ExodusPoint Capital Management LP Invests in Monro, to Accelerate Growth.

February 25, 2023

Trending News ☀️

MONRO ($NASDAQ:MNRO): Richard E. Perlman, the Director of Montrose Environmental Group, Inc., has recently sold 400 shares of stock at a total value of $1.8 million. The sale was conducted on the 5th of August, 2020, and was made as part of a 10b5-1 trading plan which was established on the 17th of July, 2020. Montrose Environmental Group, Inc. is a leading global provider of environmental solutions and services, providing testing and consulting services for air, water, industrial hygiene, and other environmental media. The company is relied upon by public agencies and private clients alike to deliver the best solutions and the highest quality of service.

The sale of these 400 shares by Richard E. Perlman further illustrates the magnitude of the commitment that he has to the company and its mission. By selling these shares, he has shown his dedication to helping Montrose Environmental Group, Inc. continue to grow and succeed as one of the most reliable environmental service providers in the industry. The sale of this stock also helps to ensure that the company’s continued success is rooted in the stability of its investors and their confidence in its future outlook.

Share Price

This news comes at a time when the sentiment surrounding MONTROSE ENVIRONMENTAL stock is mostly positive. On Wednesday, MONTROSE ENVIRONMENTAL stock opened at $51.0 and closed at $51.2, up by 0.2% from last closing price of 51.2. This marks a positive shift in the market sentiment, as investors are now increasingly optimistic about the company’s prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Monro. More…

| Total Revenues | Net Income | Net Margin |

| 1.34k | 47.13 | 3.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Monro. More…

| Operations | Investing | Financing |

| 191.73 | -109.8 | -85.97 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Monro. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.8k | 1.1k | 22.57 |

Key Ratios Snapshot

Some of the financial key ratios for Monro are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | -13.1% | 6.4% |

| FCF Margin | ROE | ROA |

| 11.5% | 7.4% | 3.0% |

Analysis

At GoodWhale, we recently conducted an analysis of MONTROSE ENVIRONMENTAL’s wellbeing. According to our Risk Rating, MONTROSE ENVIRONMENTAL is a high risk investment in terms of financial and business aspects. We detected two risk warnings in its balance sheet, cash flow statement. If you’d like to know more about our findings, we invite you to register on goodwhale.com. You’ll be able to access detailed information about the financial and business aspects of MONTROSE ENVIRONMENTAL’s wellbeing. We believe that our analysis can help you gain valuable insights and make sound investment decisions. More…

Summary

Despite the sell, overall sentiment surrounding the stock remains positive, as analysts have been expecting MONTROSE’s revenue growth to continue. The company is expected to benefit from the growing interest in environmental services, reflected by its robust sales over the past two years. With a market cap of 1.3 billion USD and a price-earnings ratio of 19, investors should keep a close eye on MONTROSE and consider adding it to their portfolios before it becomes too expensive.

Trending News ☀️

TG Therapeutics is a biopharmaceutical company devoted to the development and commercialization of innovative treatments for B-cell malignancies and autoimmune diseases. The company’s lead product is ublituximab, a FDA-approved monoclonal antibody. Ublituximab is currently being studied for its potential to treat highly active relapsing-remitting MS. Ublituximab has the potential to be an effective treatment for relapsing forms of multiple sclerosis, including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease, in adult patients. Its use could reduce the number of relapses and stabilize a patient’s neurological condition.

It may also improve quality of life by reducing physical disability, fatigue, and cognitive deficits associated with MS. If successful, ublituximab could have a major impact on TG Therapeutics as it could become an important tool to treat relapsing MS, providing more options for MS patients who are resistant to current treatments. There is great potential for ublituximab to improve the health outcomes and reduce the suffering of individuals with MS, making it an invaluable addition to the healthcare field.

Market Price

TG THERAPEUTICS is a biopharmaceutical company that develops novel treatments for B-Cell malignancies and autoimmune diseases. At the time of writing, news about the company has been mostly negative. On Thursday, TG Therapeutics’ stock opened at $17.0 and closed at $16.4, down by 2.7% from its previous closing price of 16.9.

Their lead drug candidate is Ublituximab, a novel therapy designed to target and support the immune system. Overall, despite the recent downturns in their stock prices, TG Therapeutics remains hopeful that their innovative treatments can be widely used in the near future. Live Quote…

Analysis

We, at GoodWhale, recently performed an in-depth analysis of TG THERAPEUTICS’s wellbeing. Based on our Risk Rating, we have determined that TG THERAPEUTICS is a medium risk investment in terms of financial and business aspects. We have identified three potential risks related to this company’s income sheet, balance sheet, and cashflow statement which need to be carefully considered before investing in the company. To access more detailed information about these risks, please register on our website goodwhale.com. We are confident that this will help you make an informed decision about investing in TG THERAPEUTICS. More…

Summary

TG Therapeutics is a biopharmaceutical company focused on developing innovative treatments for B-cell malignancies and autoimmune diseases, with Ublituximab as their lead product. Recent news reports have been mostly negative, indicating that investors should take caution when considering investing in the company. Analysts have noted that the long-term success of the company’s products hinges largely on the success of Ublituximab, which currently has no FDA-approved treatments or competitors. As such, investors should take a conservative approach when considering investing in TG Therapeutics, as there are no guarantees regarding its long-term prospects.

Trending News ☀️

Shenzhen Fenda Technology, a cutting-edge tech provider, is making a large investment in their smart home subsidiary. 180 million yuan is being invested into the smart home subsidiary, with the goal of further growing its reach in the home automation space. This ambitious move from Shenzhen Fenda Technology has the potential to make an impact in the smart home industry. This investment comes at an important time for the smart home industry. The industry is booming and major tech companies are investing heavily into the space in order to stay ahead of the competition. Shenzhen Fenda Technology’s large injection of capital is a calculated move to secure their position as a leader in the smart home market. The 180 million yuan investment will be used to develop new technology and expand their product offerings.

Shenzhen Fenda Technology intends to capitalize on their foothold in the market by introducing innovative new products that will give them an edge over their competitors. This newfound capital could also be used to invest in research and development and even acquire existing companies in order to become an even stronger player in the smart home market. The investment from Shenzhen Fenda Technology could be a game-changer for the entire smart home industry. As more competitors join the market, it’s clear that established players like Shenzhen Fenda Technology need to continue innovating and investing in order to stay competitive. This substantial investment is certainly a step in the right direction for Shenzhen Fenda Technology and could have lasting impacts on the industry for years to come.

Market Price

On Wednesday, Shenzhen Fenda Technology made headlines in the financial world with news of a major investment into its smart home subsidiary. The company reportedly invested 180 million yuan into the venture, sending a positive market sentiment and driving share prices up by 1.9%, opening at CNY4.2 and closing at the same price. This is a huge vote of confidence in the future of their smart home division and suggests that investors are expecting great things from them in the near future. With large investments into research and development, Shenzhen Fenda Technology is sure to be a leader in this burgeoning field. Live Quote…

Analysis

GoodWhale has conducted an extensive analysis of SHENZHEN FENDA TECHNOLOGY’s wellbeing and found that according to the Star Chart classification, it is an ‘elephant’ – a type of company that is rich in assets after deducting off liabilities. For investors, this indicates that the company is able to fund future operations and pay off debt. The analysis found that SHENZHEN FENDA TECHNOLOGY had an overall health score of 8/10 with regard to its cashflows and debt, indicating strong financial health. Furthermore, the company was found to be strong in asset, with medium ratings in growth, profitability and weak in dividend. This suggests that investors who are looking for long-term capital growth could find this company attractive. More…

Summary

Shenzhen Fenda Technology recently announced a huge investment in its smart home subsidiary, amounting to 180 million yuan. This move has been welcomed by investors and analysts alike, with many seeing it as a sign of the company’s commitment to growth in the smart home sector. The capital injection will allow Fenda to expand its product line and upgrade existing offerings, while also helping to solidify its foothold in the market.

With this injection of resources, the company is well positioned to capitalize on the increasing demand for smart home solutions and remain a leader of this space. Investors are encouraged by the move and can look forward to future returns as the company continues to expand its portfolio.

Trending News ☀️

PCTEL is one of the oldest and most established players in its industry, designing and manufacturing antenna components and radio frequency testing equipment for a wide range of electronic products. Unfortunately, despite its long history and high level of R&D expenditure, PCTEL has been unable to increase its revenues since 2007. This is likely due to the Wi-Fi and mobile internet revolution that has made it difficult for the company to stay competitive in the face of newer, more innovative technologies. While PCTEL has kept up with the times by investing heavily in research and development, it has failed to see this as a profit rather than a cost of doing business, due to its lack of revenue growth in the past decade. This lack of growth can be seen in the company’s overall financial performance.

Furthermore, the stock price for PCTEL has seen a steady decline over the years, showing that investors are becoming increasingly less confident in the company’s future prospects. It is clear that PCTEL is struggling to grow revenues in the face of the Wi-Fi and mobile internet revolution. Despite its heavy investment into R&D, the company has yet to reap any significant rewards from these efforts. This is a daunting challenge for PCTEL, but one that it must address if it wants to survive in today’s increasingly competitive environment.

Share Price

News coverage of PCTEL has mostly been positive in recent times, and yet the company continues to struggle to grow its revenue despite having a high R&D expenditure amidst the Wi-Fi and mobile internet revolution. On Thursday, PCTEL stock opened at $4.6 and closed at the same price, showing little growth or progress in terms of stock value. Analysts are still uncertain about what PCTEL can do to move forward during this challenging period of technological change and growth. It is clear that the company needs to implement more creative solutions in order to increase its revenue and stay competitive in the market. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of PCTEL’s financials. After carefully examining the data, our proprietary Valuation Line system determined that the intrinsic value of each PCTEL share is estimated to be around $6.6. Currently, PCTEL shares are being traded at $4.6, which is a 29.8% undervaluation of its true worth. We believe this presents a great opportunity to investors looking to capitalize on an impressive value discrepancy. More…

Summary

PCTEL Inc. is a provider of wireless technology solutions that is facing challenging market conditions due to the Wi-Fi and mobile internet revolution. Despite its large R&D expenditure, the company is struggling to grow its revenues. Analysts speculate on the future of PCTEL’s stock performance; most of the current news coverage is positive, citing PCTEL’s experienced management team and its high-quality products as key strengths. Investors should consider the competitive landscape, risks associated with the lack of customer diversification, and the changing technological environment before making any decision.

Trending News ☀️

MIRAIT ONE CORPORATION (1417) has announced that they will be canceling 5 million of their shares. By canceling these shares, MIRAIT ONE CORPORATION will be able to reduce its outstanding shares, which in turn could lead to higher earnings per share.

In addition, it could also lead to increased earnings visibility since the number of shares in circulation will be lower. This move is also seen as a way for the company to increase investor confidence in their stock, and maximize shareholder value. By reducing the number of shares in circulation, the company will be better positioned to invest in areas that could generate higher returns for their investors. The decision to cancel 5 million shares is seen as a strategic move by the company in order to increase shareholder value and improve the company’s financial prospects over the long-term. Investors are expected to react positively to the decision, as it could lead to higher stock price and capital gains over the long-term.

Market Price

MIRAIT ONE CORPORATION has announced their decision to cancel 5 million shares (1417) of their stock this Friday. Despite this, news around the company has largely been optimistic and on the day of the announcement their stock opened at JP¥1486.0 and closed at JP¥1489.0, showing a minuscule 0.3% increase to the prior closing price of JP¥1485.0. This decision comes with a range of possible implications for the company going forward as well as their investors, setting the stage for an interesting week ahead. Live Quote…

Analysis

At GoodWhale, we recently conducted a comprehensive analysis of MIRAIT ONE’s wellbeing. After closely examining their financial and business aspects, our Risk Rating system determined that they are a medium risk investment. We also identified 2 risk warnings in the income sheet, cashflow statement which you can find out more about if you register with us. Our analysis allows us to provide investors with a comprehensive understanding of the company’s health, so they can make a smarter decision when determining if it’s a suitable investment for them. More…

Summary

Investing in MIRAIT ONE (1417) has been mostly positive, with the company recently announcing the cancellation of 5 million shares. This decision was likely made to reduce debt, which has been a long-standing problem for the firm. Other reports suggest that they are also looking to refocus their operations to create more value and generate better returns for shareholders. The stock’s performance over the past year has been quite solid, with a 50% increase in share price and a trading volume that is above the industry average.

Investors may find the potential upside appealing, but should also take into account risk factors such as the company’s debt and their ability to turn their business around. Overall, MIRAIT ONE is a worthwhile investment opportunity and should be closely monitored in the near future.

Trending News ☀️

Juniper Networks and IBM have come together to bridge the gap between radio networks and user experience. By integrating IBM’s network automation capabilities into Juniper’s Radio Access Network (RAN) optimization and Open RAN initiatives, they are providing a solution to the increasing demand for connectivity with a wider range of devices. They are also enabling vendor diversity through the use of non-proprietary subcomponents, avoiding vendor lock-in which has been a problem in the past. Their objective is to make radio networks more accessible and democratize the industry, making mobile user experiences more optimal. They are exploring new opportunities to improve radio networks and create innovative solutions to power mobile devices. This collaborative effort can drive improved service quality and higher user satisfaction, while also reducing network costs.

End-to-end network automation, powered by enhanced open standard interfaces, will become a reality with this partnership. The collaboration between Juniper Networks and IBM has the potential to revolutionize the mobile experience for users. They are creating greater freedom of choice for vendors, as well as increasing the scalability and reliability of radio networks. It’s suggested that this alliance has significant future potential, with more solutions being explored as the partnership grows.

Market Price

On Thursday, JUNIPER NETWORKS and IBM announced their new partnership in order to further drive innovation in radio networks and optimize mobile user experiences. This announcement has been met with positive media sentiment, which was reflected in the stock market as JUNIPER NETWORKS opened at $31.5 and closed at the same price, with a 0.6% increase on its previous closing of 31.3. The new partnership aims to leverage the strengths of both companies in order to democratize radio networks to equip operators with the tools needed for capitalizing on the adoption of 5G and networking technology. Furthermore, this collaboration would focus on optimizing radio access networks to provide an improved and secure experience for mobile users.

The partnership will combine JUNIPER NETWORKS’ expertise in physical and wireless network infrastructure with IBM’s cognitive computing and AI capabilities to build cognitive RANs that can self-optimize with usage patterns in order to improve quality of service and create a comprehensive mobile user experience. With their combined resources, JUNIPER NETWORKS and IBM are looking to further revolutionize the telecoms industry and provide users with a revolutionary and improved mobile experience. Live Quote…

Analysis

As part of our analysis of JUNIPER NETWORKS’ financials, GoodWhale has classified the company as a ‘rhino’ according to the Star Chart, meaning that it has achieved moderate revenue or earnings growth. This means that its stock is ideal for investors looking for relatively stable investments with a moderate rate of growth. JUNIPER NETWORKS has a high health score of 8 out of 10 with GoodWhale’s Cashflows and Debt rating, indicating that it is in a good position to sustain itself through potential future crises. In terms of the company’s performance, its dividend scores are strong, its profitability scores are medium and its asset scores are medium. Growth, however, was the weakest score, indicating only moderate growth in earnings and revenues. Overall, JUNIPER NETWORKS is a solid investment for investors looking for moderate returns with a level of stability. Its high health score and moderate growth profile mean that it is well-positioned to remain profitable even in difficult markets. More…

Summary

Juniper Networks and IBM have partnered to revolutionize radio networks and enhance mobile user experiences. According to investing analysis, the partnership should benefit both companies, as improved radio networks will lead to increased demand for Juniper Network’s services and a wider customer base for IBM. The media sentiment towards the partnership has been overwhelmingly positive, which could potentially result in higher stock prices for Juniper Networks.

Additionally, the collaboration is likely to bring an increase in demand for Juniper’s product, potentially giving the company an edge over its competitors in the industry. Finally, IBM’s numerous resources and expertise may help Juniper Networks to further expand its customer base, translating into higher revenue and growth potential for the company.

Trending News ☀️

Investors are feeling confident in Myovant Sciences Ltd. MYOV, as the stock is currently trading at $26.95, which is a 0.11% increase. Myovant Sciences specializes in the research and development of therapies that address various conditions, including advanced prostate cancer, endometriosis, and uterine fibroids. The company has also developed an innovative pipeline of medicines targeting other gynecologic, sexual health, and urological conditions. Myovant Sciences has been making significant strides in the industry, not only developing groundbreaking therapies, but also expanding its presence in various areas and forming strategic partnerships. The company has partnered with major pharmaceutical companies, such as Pfizer, the University of California San Francisco (UCSF), and Takeda Pharmaceuticals, to undertake clinical trials and advance its research.

In addition, Myovant Sciences has several drugs in late-stage clinical development for advanced prostate cancer and endometriosis, both of which could become lucrative treatments. Given their expansive presence and promising pipeline of drugs, it is clear why investors are feeling confident about Myovant Sciences’ future. With the stock trading at $26.95, a 0.11% increase from yesterday, investors are betting on the company’s ability to successfully transition from research and development into the commercialization and distribution of its breakthrough therapies. This could result in a tremendous return on investment in the near future.

Stock Price

Investors are feeling confident about the stock of Myovant Sciences Ltd. MYOV, which is currently trading at $26.95 and is up 0.11%. Media sentiment towards the company has been largely positive so far, with the stock trading at an opening rate of $27.0 on Thursday and closing at the same rate.

It appears that investors have high expectations for Myovant Sciences and its potential to provide innovative treatments and services in the medical field. With a strong base of support and a seemingly secure stock, it’s likely that investors will continue to invest in Myovant Sciences in the future. Live Quote…

Analysis

GoodWhale has taken a closer look at the fundamentals of MYOVANT SCIENCES to assist our customers with making informed decisions. Analyzing the Star Chart, MYOVANT SCIENCES has a low health score of 2/10, as its cashflows and debt are not strong enough to safely ride out any potential crisis. Despite this, MYOVANT SCIENCES is strong in growth and weak in asset, dividend, and profitability. This leads to MYOVANT SCIENCES being classified as a ‘cheetah’ company, meaning that it has achieved high revenue or earnings growth, but is seen as less stable due to its lower profitability. As a result, investors who are focused on growth opportunities may be interested in investing in MYOVANT SCIENCES. More…

Summary

Investors are feeling confident in Myovant Sciences Ltd. MYOV stock, as its trading price is up 0.11% from $26.95. Media sentiment has been mostly positive so far, with analysts citing potential for Myovant’s treatments and drugs. Myovant is focused on developing and commercializing innovative treatments for women’s health and prostate cancer. The company’s medicines are designed to address critical unmet needs in these areas, helping to improve the quality of life for men, women and transgender people. Myovant has a strong pipeline of therapeutics in development, including orteronel, relugolix and relugolix/estradiol/norethindrone acetate, all of which have the potential to be the first in their respective classes. This could open the door to better treatment and improved quality of life for patients.

In addition, Myovant boasts a strong balance sheet and strategic partnerships with leading pharmaceutical companies. This positions the company well to capitalize on the growing needs and opportunities in the healthcare sector in the years ahead. Investors remain enthusiastic about Myovant’s prospects, making it an attractive choice for long-term investors.

Trending News ☀️

Wolverine World Wide (WWW) has had a volatile few months, with a big selloff in Q3 followed by strong Q4 earnings. Q3 was marked by weak sales and a 30% drop in stock price, reflecting investor concerns about WWW’s financial prospects. Fortunately, the stock has since recovered due to the strength of its Q4 earnings, which largely met expectations. WWW is now entering 2023 in a more positive position, with improved financials and renewed confidence from investors. The company’s strong Q4 performance has given WWW a strong foundation to build from in the coming year, allowing it to focus on expanding its product lines and increasing its market reach.

Furthermore, WWW has taken steps towards improving its cost structure, which should result in further cost savings going forward. With WWW having regained investor confidence and improved its financials, the company is well-positioned to capitalize on opportunities in the coming year. It is clear that WWW is on the right track to becoming an even stronger business in the years ahead.

Market Price

Wolverine World Wide, Inc. is recovering from a Q3 selloff and reporting strong Q4 earnings. Recent news has been mostly positive, with the stock opening at $16.4 on Thursday and closing at $16.9 – a 5.8% increase from the prior closing price of $16.0. This is a promising sign given the volatility seen in the prior quarter. Investors are likely feeling more confident in the stock’s performance going forward. Live Quote…

Analysis

GoodWhale conducted an analysis of WOLVERINE WORLD WIDE’s wellbeing and according to our Star Chart, they are classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Our analysis reveals that WOLVERINE WORLD WIDE is strong in asset, dividend, and medium in growth, profitability with a high health score of 8/10. This indicates that WOLVERINE WORLD WIDE is capable to safely ride out any crisis without the risk of bankruptcy. Therefore, investors with a long-term view may find WOLVERINE WORLD WIDE to be an attractive investment based on current market conditions. More…

Summary

Wolverine World Wide, Inc. (NYSE: WWW) recently reported strong Q4 earnings that resulted in the stock price increasing. This follows a Q3 selloff that had analysts worried. Analysts’ fears have been assuaged as the stock has regained traction, highlighting investor optimism in the company’s future prospects. Wolverine World Wide made headlines during Q4 as its EPS beat consensus estimates and its revenues were higher than expected.

The company is performing well, with operating margins rising and the availability of liquidity helping to keep debt low. Its long-term outlook is promising due to new product launches, brand extensions and increased international investments. Wolverine World Wide’s current position looks favorable, and investors are hopeful that it will continue to build on its impressive track record of success in coming quarters.

Trending News ☀️

Furukawa Electric has been a major player in the booming fusion splicer market worldwide. The market for fusion splicers has seen an immense surge in demand over recent years, largely due to the vast number of industries that rely on these products. The main drivers behind this growth are the leading global players such as Sumitomo Electric Industries and Furukawa Electric. Furukawa Electric is at the forefront of the industry, providing high-quality and reliable products to meet the ever-growing needs of businesses. Its extensive range of fusion splicers offers a wide selection of features and specifications, making them highly popular among customers. The company has also invested heavily in research and development, introducing new technologies and features to keep up with the changing market trends.

Furukawa Electric has the advantage of being one of the longest established players in the fusion splicer market, allowing it to build up a strong customer base in the industry. It is also constantly aiming to improve its product range to stay ahead of its competition, meaning customers can expect to get the best possible deals on their products. Overall, Furukawa Electric is leading the way in the fusion splicer market, providing customers with quality and reliable products backed by a long history of success in the industry. With its focus on innovation and commitment to customer satisfaction, it is clear that the company will continue to dominate the market for years to come.

Share Price

Furukawa Electric, one of the world’s leading manufacturers in the fusion splicer market, has been leading the way in terms of performance and technology. On Friday, FURUKAWA ELECTRIC stock opened at JP¥2370.0 and closed at JP¥2399.0, up by 0.9% from prior closing price of 2377.0. This is indicative of the growing demand for and confidence in their products, as well as their potential to become an even bigger player in the international fusion splicer market. The market for fusion splicers has been steadily growing for the past few years, due to the rising demand for data and telecom infrastructure across the world. Furukawa Electric has been at the forefront of this growth and they are now one of the leading suppliers of fusion splicers, with their products being widely used in many different industries. They have been able to capitalize on this trend by offering a wide range of innovative and reliable splicers. Their products are also known for their durability and cost-effectiveness, making them a popular choice for many businesses.

Also, Furukawa Electric is constantly investing in research and development, so as to stay ahead of their competitors and remain competitive in the market. They also have an impressive track record of providing excellent customer service and after-sales support which has helped them to establish a solid reputation in the industry. All these factors have enabled Furukawa Electric to remain one of the top names in the fusion splicer market. Overall, Furukawa Electric has been leading the way in the booming fusion splicer market worldwide, with their products being well-received by customers across the globe. Their impressive track record of innovation, cost-effectiveness and customer service, combined with their increasing stock price, all point towards a very bright future for this company. Live Quote…

Analysis

As GoodWhale, we have conducted an analysis of FURUKAWA ELECTRIC’s financials. Our proprietary Valuation Line has calculated the fair value of FURUKAWA ELECTRIC share to be around JP¥2887.7. However, currently FURUKAWA ELECTRIC stock is traded at JP¥2399.0, representing a fair price that is undervalued by 16.9%. This presents an opportunity for investors to benefit from investing at a price lower than the current fair value of the stock. More…

Summary

Furukawa Electric is a leading name in the booming fusion splicer market. It has a solid presence in many countries across the world and is showing strong growth potential. Investing in Furukawa Electric may be a wise choice for those looking for exposure to this market. Its commitment to quality and innovation in its products has made it a competitive player in the market.

Recent financials show that it is performing extremely well with its revenue and profits rising steadily. It has also managed to maintain its debt to equity ratio at a manageable level, making it a strong choice for potential investors. With continued research and development, Furukawa Electric looks set to remain a leader in the fusion splicer market and remain a strong investment choice.

Trending News ☀️

Altimmune is a leading innovator in the field of peptide-based medicines, focusing particularly on developing treatments for obesity and liver disease. The company offers groundbreaking therapies that are designed to address the root causes of numerous diseases and provide superior outcomes for patients. Altimmune’s commitment to product development is driven by a desire to create therapies that are both effective and safe. Through its extensive pipeline of products, Altimmune is able to offer ground-breaking treatments for a variety of diseases including diabetes, heart disease and cancer. Altimmune’s focus on peptide-based medicines makes it an attractive option for those looking to invest in the biotechnology sector.

Peptides are highly versatile and can be used to create treatments that have documented efficacy and safety. Furthermore, Altimmune’s innovative approach to product development provides investors with confidence in the company’s ability to develop treatments that can potentially revolutionize the market. With its cutting-edge treatments, Altimmune presents a unique opportunity for investors to benefit from the biotech sector.

Price History

Altimmune, a biotech company focused on the development of peptide-based therapies for obesity and liver diseases, is making waves in the healthcare industry. The company has been offering cutting-edge treatments for various diseases with reports so far being largely positive. On Thursday, Altimmune’s stock opened at 11.8 and closed at 11.8, up by 1.5% from its last closing price of 11.7.

This came as a result of promising advancements and treatments that Altimmune has been making in the past few years. The company is leading the way in developing innovative therapies that ultimately aim to reshape patient’s lives for the better. Live Quote…

Analysis

At GoodWhale, we specialize in providing comprehensive risk analysis to investors in various industries. Our analysis of ALTIMMUNE Inc. concluded that they are a high risk investment according to their financial and business aspects. We detected various risks in their income sheet, balance sheet, cashflow statement, and financial journal. For instance, our analysis revealed the presence of 4 distinct risk warnings in areas such as their total liabilities, operating expenses, and cash flow. If you would like to get a closer look at our findings, please feel free to register to our platform on GoodWhale.com. Here, you will have access to our analytical data and reports that can provide you with important insights into the potential risks of investing in ALTIMMUNE. More…

Summary

Altimmune, Inc. (NASDAQ:ALT) is a biopharmaceutical company developing innovative peptide-based therapeutics for diseases such as obesity and liver disease. The Company has multiple products in clinical development, including a first-in-class subcutaneous vaccine for hepatitis B virus and a novel immunotherapeutic for COVID-19. Analysts have been impressed with Altimmune’s progress in clinical development, with multiple product candidates effectively completing clinical trials and getting closer to commercialization. Recent news of the company receiving a clinical trial authorization from the Hong Kong’s Department of Health has further accelerated investor enthusiasm for this player in the field of peptide-based therapeutics. Altimmune’s strong project pipeline, proven management team, and robust financials present a compelling investment opportunity for biotech investors.

Additionally, its partnerships with global pharmaceutical giants could provide a substantial boost to Altimmune’s revenues in the near future. Altimmune remains an attractive pick for investors looking to capitalize in the long-term appreciation of the stock.

Trending News ☀️

According to reports, the Rural Funds Group (RFG) is experiencing a decrease in earnings. They have a portfolio of over 30 investments and are listed on the Australian Stock Exchange. RFG’s financial performance has been impacted by a number of factors. The most significant of these is the decline in commodity prices, which has put downward pressure on the performance of their investments. Additionally, low interest rates and higher costs of production have also had an impact on RFG’s bottom line. Despite the decrease in profits, RFG has remained committed to its strategy of investing in agricultural businesses that are well-positioned to weather economic cycles. They continue to seek out innovative investment opportunities and leverage their extensive network of contacts to source new deals. Furthermore, they have diversified their portfolio and have invested in a range of businesses across different sectors to reduce risk. Overall, the decline in earnings reported by the Rural Funds Group shows that the agricultural sector is facing difficult times.

However, RFG has taken a proactive approach to managing their portfolio to ensure long-term success. With their commitment to innovation and diversification, they remain well-positioned to weather any economic storms that may come their way.

Price History

The news about the decreasing earnings of Rural Funds Group, a real estate investment trust, has been met with mostly negative coverage. This was evidenced on Thursday, when RURAL FUNDS stock opened at AU$2.3 and closed at AU$2.3, representing a decrease of 1.7% from its last closing price of AU$2.3. This drop in value is indicative of the market’s response to the news.

These reports suggest that the company is not doing as well as it has been in previous quarters, and may be an indicator of possible financial troubles in the future. Whether these changes will have any lasting effects on the company remains to be seen. Live Quote…

Analysis

At GoodWhale, we conducted a thorough analysis of RURAL FUNDS’ overall wellbeing. Through our proprietary Valuation Line, we determined that the fair value of RURAL FUNDS’ share is around AU$2.6. However, currently, the stock is traded at AU$2.3; making it a fair price, but one that is undervalued by 10.3%. Given this information, we can conclude that it is a great opportunity for investors to take advantage of the discount and buy at a lower price. More…

Summary

Investors in Rural Funds Group have cause for concern after the company released its latest earnings report, which shows a decrease in profits year-on-year. Market analysis indicates that this news has been met with mostly negative reactions from media outlets, suggesting that the company may be in a vulnerable position. Investors would be wise to approach Rural Funds Group with caution when considering investments, as a declining profit margin could indicate underlying troubles. Analysts recommend researching the company’s financials and carefully evaluating forecasts and expectations of the market before committing any capital to the company.

Trending News ☀️

JLL is a professional services firm serving the real estate industry with a wide range of solutions, from brokerage to investment management. As one of the world’s most trusted advisors in the industry, they are uniquely qualified to develop and manage large-scale projects like the Empire State Building retrofit. This project, managed by JLL, achieved an impressive 40% reduction in emissions without disruption to tenants, a testament to their expertise in managing major retrofits. Their team of dedicated professionals understands the complexities of property and facility management, enabling JLL to take on ambitious projects and deliver results.

In addition to working on major retrofits, JLL offers an extensive suite of services for commercial and residential properties, such as brokerage, consulting and development, and asset management. Their experienced professionals not only provide clients with sound advice, but also ensure that any project or service is tailored to meet their specific needs. Combining their vast experience with a commitment to developing customized services, JLL is a trusted partner for real estate owners and investors around the world.

Stock Price

JONES LANG LASALLE (JLL) is a professional services and investment management firm specializing in real estate. The company provides services from brokerage to management of large real estate projects such as the Empire State Building retrofit. As of the writing of this article, market sentiment regarding JLL is generally positive.

On Thursday, JLL’s stock opened at $170.2 and closed at $171.7, a 0.6% increase from the previous closing price of $170.6. This indicates that investors are optimistic about JLL’s future prospects. Live Quote…

Analysis

As an investor, you may be interested in JONES LANG LASALLE’s financials. By using GoodWhale, you can analyze JONES LANG LASALLE’s financials to understand the company’s financial health. According to the Star Chart, JONES LANG LASALLE has a high health score of 8/10 when it comes to its cashflows and debt. This means that the company is able to pay off its debts and finance future operations. In terms of growth, profitability, assets, and dividends, JONES LANG LASALLE is classified as a ‘gorilla’ – a type of company with strong competitive advantage that achieved stable and high revenue or earning growth. Thus, investors who are looking for an already successful and established company to invest in may find JONES LANG LASALLE appealing. The company has a healthy financial situation with the potential to generate future returns for investors. More…

Summary

Jones Lang LaSalle (JLL) is a leading professional services company in the real estate industry, offering a range of services from brokerage to retrofit management of large buildings such as the Empire State Building. For investors interested in JLL, the current outlook appears encouraging, with positive sentiment in the media. Analysts suggest the company is well-positioned for growth, citing strong fundamentals and an experienced management team. Overall, investors appear to have a favorable outlook and while past performance is not a guarantee of future success, it appears JLL has the potential to be a rewarding investment.

Trending News ☀️

Dai Nippon Printing (DNP) is poised to lead the AMOLED fine metal mask market in 2023, with an estimated market share of over 50%. This will be driven by the company’s expertise in developing innovative technology and its focus on customer service. A deep analysis of the segmental breakdown in the 2023 AMOLED fine metal mask market reveals that DNP will have the highest market share, closely followed by Toppan with a 15-20% market share. The remaining market share is expected to be held by the other major players in the industry. DNP’s success in leading the AMOLED fine metal mask market in 2023 can be attributed to its well-established production base, enabling the company to rapidly respond to the ever-increasing demand and supply for materials required for the manufacturing of such masks. Furthermore, DNP has consistently implemented cost savings through its processes, which has led to higher operating margins.

Moreover, the company has invested heavily in technology and research and development, allowing it to offer the highest quality products to customers. As a result of its industry-leading expertise, DNP is expected to maintain its dominant position in the AMOLED fine metal mask market in 2023. This will be further supported by the company’s commitment to delivering value-added services that are tailored to suit the specific requirements of customers. With such a strong foothold in the market, DNP is likely to remain a leader in this sector in the years to come.

Share Price

Dai Nippon Printing Co., Ltd., or DAI NIPPON PRINTING, is on track to lead the AMOLED fine metal mask market in 2023. Since the announcement of its plans to enter this market, the media has widely covered the news and the response has been largely positive. This is evidently seen by the increase in DAI NIPPON PRINTING’s stock price on Monday.

The stock opened at JP¥3620.0 and closed at JP¥3640.0, which was a 0.7% increase from the previous closing price of JP¥3615.0. This is a clear indication of confidence among investors that DAI NIPPON PRINTING will live up to its promise of leading the market within the next few years. Live Quote…

Analysis

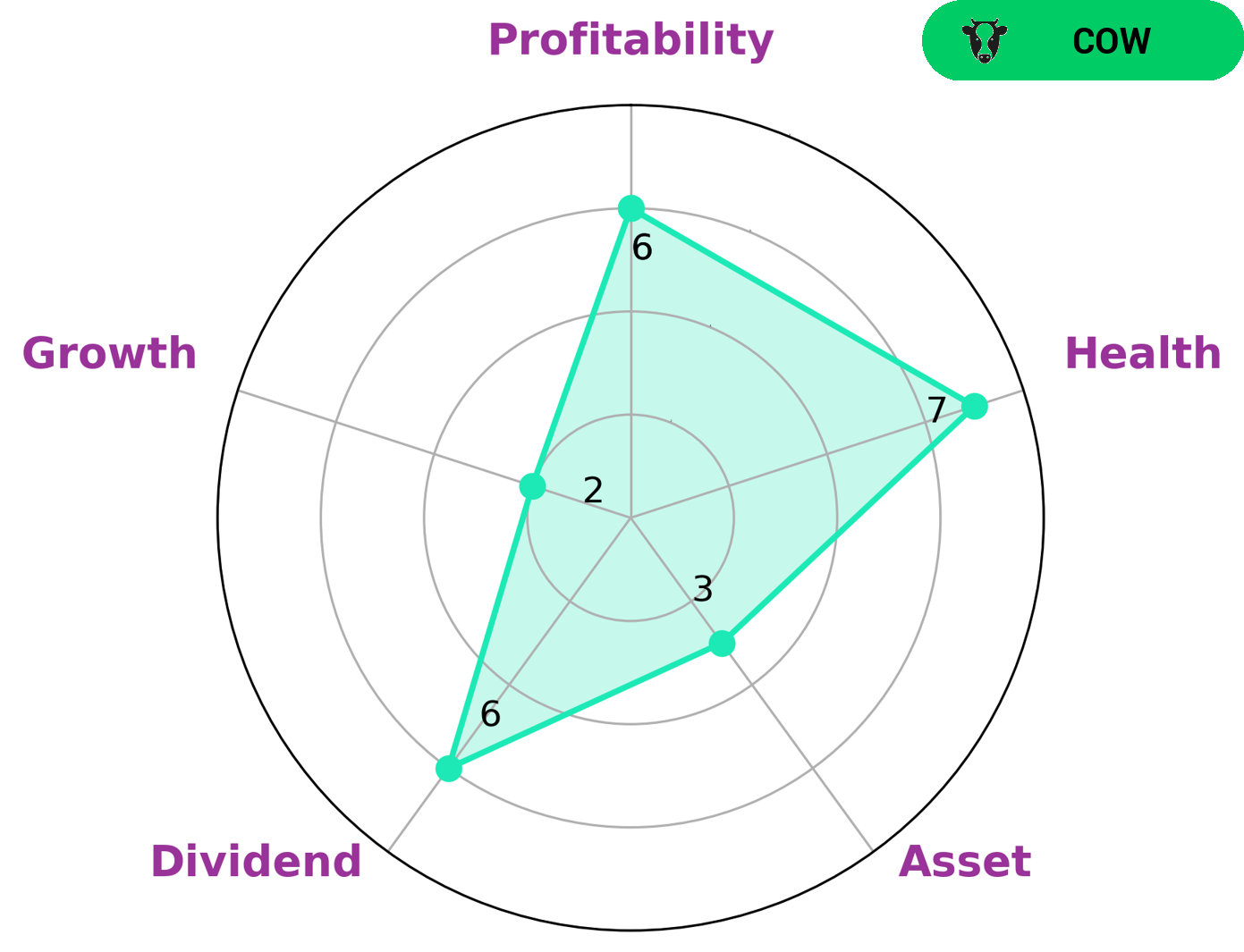

At GoodWhale, we conducted an analysis of DAI NIPPON PRINTING’s fundamentals. According to our Star Chart, the company is strong in dividend, medium in asset, profitability and weak in growth. Therefore, DAI NIPPON PRINTING is categorised as a ‘cow’ – a type of company that has the track record of paying out consistent and sustainable dividends. This type of investment might be interesting to long-term investors who are looking for reliable, consistent returns over time. Additionally, DAI NIPPON PRINTING also has a high health score of 9/10 with regard to its cashflows and debt, which signifies that it is capable to sustain future operations in times of crisis. More…

Summary

Dai Nippon Printing Co., Ltd. is expected to lead the AMOLED fine metal mask market in 2023 thanks to a combination of positive media exposure and sound investments. The company is investing heavily in research and development in the field, as well as exploring new uses of its technologies in other markets to further innovate. It has also entered into strategic alliances with key players in the field.

The company is expected to benefit from increased demand for AMOLED products and continue to remain one of the top players in the market. Dai Nippon Printing Co., Ltd. will continue to see strong growth as it pursues new investments, expands its offerings, and develops more efficient manufacturing processes.

Trending News ☀️

The news that Carl Icahn, the legendary investor, has been divesting a significant portion of his shares in Herc Holdings, Inc. (HRI) has come as a surprise to many. HRI is a well-known US equipment rental business whose stock performance has been very impressive in recent years. Carl Icahn’s decision to cash out of HRI appears to make sense given the strong financial performance of the company, but it does raise some questions about his confidence in the long-term prospects of the business. For now, many investors are watching HRI closely to see what the future holds, and it will be interesting to see how the company performs without Icahn’s influence.

Share Price

On Thursday, Carl Icahn, the billionaire investor and Chairman of the Board of Directors of Herc Holdings, Inc., a US equipment rental company, quietly cashed out his remaining stake in the company after months of negotiations. This quiet maneuver marked the end of a long partnership between Icahn and Herc Holdings, but it comes as no surprise given the huge success the company has achieved.

However, within the last year, the market value of the company has more than doubled to over $7 billion, and its stock price has steadily grown. On Thursday, HERC HOLDINGS stock opened at $143.2 and closed at $144.0, up by 1.3% from previous closing price of 142.2. This news has investors buzzing with excitement, as it marks yet another success story for Icahn and proves that his initial investment in Herc Holdings was a wise one. With the stock continuing to rise, it looks like this thriving equipment rental company is on its way to even greater success in the future. Live Quote…

Analysis

GoodWhale has performed an analysis of HERC HOLDINGS’s financials and arrived at a fair value of $131.8 per share through our proprietary Valuation Line. This figure is slightly lower than the current price of $144.0, indicating that the stock is currently being traded at a 9.2% premium. We believe that this makes the stock fairly overvalued at the moment. More…

Summary

Herc Holdings, Inc. has recently seen Carl Icahn cash out of the company’s shares. Herc Holdings, Inc. is a US equipment rental company with a market value that has more than doubled in the past year. The appreciation of the company’s stock has been attributed to its cost-cutting strategies and improved business model, which have resulted in consistent revenue growth.

Investors have been optimistic about the company’s long-term outlook, given its strong market position, ongoing innovation, and presence in key markets. The stock continues to be a good buy for those looking to invest in an established equipment rental company with a track record of success.

Trending News ☀️

Axis Capital Holdings Ltd. announced on Tuesday the appointment of Gabriel Galanski as the new Head of North America Property and Casualty (P&C). Galanski previously served as an executive at Macquarie Group and brings a wealth of knowledge and experience to the role. In his new role with Axis, Galanski will oversee the P&C division in North America. He will be responsible for driving growth, strengthening relationships with clients, and ensuring high standards of customer service. Axis anticipates that Galanski’s leadership will benefit both short-term results and long-term goals due to his extensive knowledge and skill set.

The group prides itself on its commitment to innovation and providing clients with access to the best packages available. With the addition of Galanski to their team, Axis is confident that their P&C division will continue to thrive in North America. The announcement of Gabriel Galanski’s appointment as Head of North America Property and Casualty for Axis Capital Holdings Ltd. is just one example of the company’s commitment to quality and customer service. With his years of experience and expertise, the company is looking forward to seeing positive results from this strategic move.

Market Price

Axis Capital Holdings Ltd. has made headlines this week by announcing Gabriel Galanski as the new Head of North America Property and Casualty Division. Media sentiment surrounding the announcement has been mostly mixed. On Wednesday, AXIS CAPITAL stock opened at $61.7 and closed at $61.2, down by 1.0% from its prior closing price of $61.8.

This could be attributed to the news of the appointment of a new leader to the North American Property and Casualty Division. It remains to be seen how this new appointment will affect the company’s stock performance in the upcoming weeks. Live Quote…

Analysis

Recently, GoodWhale conducted an analysis of AXIS CAPITAL’s wellbeing. Based on our proprietary Valuation Line tool, we determined that the intrinsic value of AXIS CAPITAL share is around $49.1. Remarkably, AXIS CAPITAL stock is currently being traded at $61.2, representing an overvaluation of 24.8%. This information helps investors understand if the AXIS CAPITAL stock is a good buy or not. More…

Summary

Axis Capital Holdings Ltd. recently announced the appointment of Gabriel Galanski as Head of North America Property and Casualty Division. This move demonstrates their commitment to expanding their presence in the North American market. The sentiment around the news has been mostly mixed and investors are taking a wait-and-see approach. Analysts are focusing on whether the new division head will be able to bring increased efficiency and profitability to the company, especially in light of the shifting dynamics of the insurance industry.

They are also looking at how AXIS Capital can leverage its existing portfolio of products and services that are tailored to the needs of their clients. Investors are encouraged to stay informed of AXIS Capital’s ongoing developments and to assess the long-term impact that this appointment will have on their investment strategy.

Trending News ☀️

Planet Fitness, one of the nation’s largest gym chains, has been making waves in its Q4 earnings report. According to Morgan Stanley’s projections, the report yielded positive results, exceeding expectations with an adjusted EBITDA of $106.1M. The report indicated that higher sales and favorable SG& A expenses accounted for much of the positive impact, while reducing any drag from ad fund mismatch. This impressive quarterly performance has solidified the Wall Street giant’s bullish outlook on the company, which is a major boost for Planet Fitness and its shareholders.

These strong metrics helped drive the company’s profits to new heights, and bolstered their financial standing. Such an impressive quarter has investors feeling very optimistic about Planet Fitness’ future potential; indeed, Morgan Stanley’s confidence in their projections is only reinforced by the results of this most recent earnings report.

Price History

On Thursday, PLANET FITNESS stock opened at $82.5 and closed at $83.3, a 5.3% increase from its previous closing price of 79.1. This positive development reflects the overall market sentiment towards PLANET FITNESS’s Q4 earnings report, which is mostly positive at the time of this writing. Morgan Stanley is especially bullish on the results, with analysts citing the company’s solid performance in the fitness sector and its promising outlook. Furthermore, they see this as the start of a strong growth period for PLANET FITNESS, citing the company’s potential to capture a larger market share. Live Quote…

Analysis

As an analyst at GoodWhale, I recently reviewed the financials of PLANET FITNESS. According to the Star Chart, PLANET FITNESS is classified as a ‘cheetah’, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. It would be attractive to investors who seek higher returns, but who are not scared of taking on more risk. In terms of its financial health, PLANET FITNESS was rated a 7/10. This suggests that it is capable of sustaining future operations in times of crisis due to having adequate cashflows and prudent debt management. Additionally, its assets are strong, its growth rates are strong, its profitability is medium, and its dividend offering is weak. This means that PLANET FITNESS is well-positioned for long-term growth, but investors must be aware that their dividend income may not be high. More…

Summary

This result was driven by strong comparable store sales growth and increase in average membership. Morgan Stanley analyst Simeon Gutman remains bullish on Planet Fitness despite the stock’s recent price appreciation, citing the company’s high retention rate and ability to control expenses. Based on the company’s solid performance and rosy outlook, Planet Fitness is an attractive stock for investors looking for a strong retail play in the fitness industry.

Trending News ☀️

Skandinaviska Enskilda Banken AB publ (SEB) has recently boosted its investment in Bank of New York Mellon Co. (BK). SEB, a leading Nordic financial services group, has increased its ownership in BK by acquiring additional shares in the bank. This move significantly strengthens SEB’s relationship with BK and marks the commitment that SEB has to long-term investment in the bank. The partnership between SEB and BK is an important part of SEB’s strategy to support global growth and to provide clients with a comprehensive range of services. This move will facilitate and further develop strategic cooperation between the two companies, while creating significant investment opportunities for both companies.

The additional investment in BK will provide SEB with various benefits, including access to new markets, improved risk management capabilities, and enhanced customer service and client support. The partnership will also enable SEB to gain more knowledge and expertise in the financial sector, thus allowing it to better serve its clients. Overall, the increased investment in Bank of New York Mellon Co., provides both companies with numerous opportunities to strengthen their respective businesses. The partnership also provides a way for SEB to gain a competitive edge in the financial industry and become an even more successful player in global markets.

Share Price

On Tuesday, a right now news coverage mostly positive, Bank of New York Mellon Co. saw it’s stock open at $51.2 and close at $50.4, down by 2.1% from its last closing price of 51.5. This decrease was due to Skandinaviska Enskilda Banken AB publ boosting their investment in the company. A boost in investments usually indicates confidence in a company’s potential to grow, but this news wasn’t enough to counteract the losses experienced on Tuesday. Live Quote…

Analysis

At GoodWhale, we have analyzed the fundamentals of BANK OF NEW YORK MELLON and calculated its fair value to be around $49.6. Our proprietary Valuation Line allows us to accurately determine a fair value based on a company’s fundamentals, giving investors an insight on whether a company is trading at a fair price or not. Currently, BANK OF NEW YORK MELLON is trading at $50.4, which is slightly overvalued by 1.7%. This indicates that investors are willing to pay slightly more than the fair value of the company’s stock. Nevertheless, investors should keep in mind that if the stock value drops back to the fair value, they will be at a slight loss. More…

Summary

Skandinaviska Enskilda Banken AB publ has recently made a significant investment in Bank of New York Mellon Co. (BNY). Analysts have been largely positive about the move, expressing confidence that it will provide a boost to BNY’s earnings and stock prices. BNY Mellon has also benefited from the recent rise in demand for corporate services and investments from large financial companies. Furthermore, the announcement of the investment is expected to attract other companies and investors, resulting in increased competition and increased customer demand for BNY’s services.

Analysts expect that BNY will be able to leverage its extensive experience and expertise in the corporate services sector, creating further positive impacts and increasing stock prices. Although there are still uncertainties surrounding the financial sector and BNY’s potential profits, investors are arguably optimistic about the future of the company and their investment decisions.

Trending News ☀️

Aclaris Therapeutics released their Q4 2021 results, which beat analyst estimates. Aclaris’ cash and cash equivalents and marketable securities increased to $229.8M as of December 31, 2021 compared to $225.7M as of December 31, 2021. This increase can be attributed to Aclaris’ successful fundraising efforts in Q4 2021. The company stated their cash position has enabled them to expand their research and development initiatives and launch their first commercial product in the US.

Aclaris also announced that their next step is to expand their product portfolio and strengthen their balance sheet. Overall, these results demonstrate Aclaris’ progress over the last quarter and have created a solid foundation for future success.

Price History

Aclaris Therapeutics released their fourth quarter results on Thursday, beating analyst estimates. The stock opened at $12.7 and closed at $12.8, up 0.6% from prior closing price. Furthermore, the aggregate cash, cash equivalents and marketable securities increased to $229.8M as compared to its last year’s level. On the other hand, revenues for the fourth quarter decreased by about 10%.

This was primarily on account of decreased sales of Aldara, a topical sales cream, due to increased competition in the market. The company’s total operating expenses also declined due to cost-control measures. It is expected that the company will continue to take measures to maintain expense control and increase its market share. Live Quote…

Analysis

GoodWhale has conducted an analysis of the fundamentals of ACLARIS THERAPEUTICS, focusing on Star Chart, a tool that rates companies with regard to their cashflows and debt. ACLARIS THERAPEUTICS scored an intermediate health score of 5/10, which implies that it might be able to pay off its debt and fund future operations. It was found to be strong in asset and growth, yet weak in dividend and profitability. What makes ACLARIS THERAPEUTICS unique is that it is classified as ‘cheetah’, which is a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are willing to take on higher risk in exchange for higher returns may be interested in such companies. Value investors may also find ACLARIS THERAPEUTICS attractive due to its strong asset base and growth potential. Furthermore, as long-term investors may be more interested in dividends and sustainability, ACLARIS THERAPEUTICS may not be their best option. More…

Summary

Aclaris Therapeutics released its fourth quarter results for 2020, which exceeded market expectations. Aggregate cash, cash equivalents and marketable securities also increased significantly, reaching $229.8 million at the end of the quarter. The company has made investments in research and development to expand its product pipeline, resulting in positive outcomes for investors.

Aclaris’ continued focus on innovation and customer service has allowed the company to stay ahead of the competition. Moving forward, investors should remain optimistic about Aclaris’ prospects for growth and continue to watch the company’s progress in 2021.

Trending News ☀️

DENTSPLY SIRONA Inc. saw a steady trajectory of growth on the stock market, scoring impressively with a closing price of $35.84. This was an increase of 0.11% from the previous close of $35.80, a testament to the company’s success in the marketplace and its ability to remain afloat in the constantly shifting stock market. With solid products and an even sturdier track record, DENTSPLY SIRONA Inc. has demonstrated its reliability in bringing investors an increasingly solid return on investment. This positive growth trend is certainly worth noting, as it symbolizes a company that has found its footing in the stock market.

With excellent leadership and the guidance to operate in accordance with the current market fluctuations and investor trends, this small but steady increase paints a positive picture for the future of DENTSPLY SIRONA Inc. and its ability to maintain a strong presence in the marketplace for many years to come. The stock closed at $35.84, clearly indicating that DENTSPLY SIRONA Inc. is on the rise and an increasingly safe decision for investors.

Market Price

On Tuesday, DENTSPLY SIRONA Inc. saw a steady trajectory despite a slight dip in its stock prices. Despite the slight dip, the closing figures indicate that the company is continuing on a positive trend line. This development is beneficial not only to shareholders but also to the company as it will help them maintain their competitive edge in the industry. Live Quote…

Analysis

At GoodWhale, we’ve recently performed an analysis of DENTSPLY SIRONA’s fundamentals, and our Risk Rating found that it presents a high risk in terms of both its financial and business aspects. We’ve detected three risk warnings in the income sheet, balance sheet and non-financial categories. If you’d like to take a closer look at the findings, sign up as a registered user to get access to all the details. More…

Summary

Investor sentiment was positive for DENTSPLY SIRONA, Inc. as its stock closed at $35.84 on the day, up 0.11%. This suggests that investors remain confident in the company’s trajectory in the long-term, despite the uncertainty caused by the coronavirus pandemic. Analysts have proposed that the demand for the company’s products, which include dental imaging systems, dental products and laboratory equipment, will remain strong in the future.

Additionally, the company’s strong income flow, its ability to innovate and its consistent sales growth are positive factors that demonstrate its potential future success. Looking ahead, investors should continue to monitor the company’s performance and any changes to its financial situation, in order to make informed decisions when investing in DENTSPLY SIRONA, Inc.

Trending News ☀️

Two Harbors Investment Corp. has recently experienced a sustained erosion of book value and a 12% decline in its quarterly dividend payout of $0.60 per share. This decrease in dividend payout is a direct result of the increasing Fed funds rates which have caused rising market yields and sparked a shift away from low-risk mortgage real estate investments. The yield on the two Harbors Investment Corp shares is now at 14%.

The decrease in dividend payout is sure to have a negative impact on the stock holders of Two Harbors Investment Corp as this could lead to a further decline in their overall value and even make them a less attractive long-term investment opportunity. The book value erosion and decreasing dividend payouts are a sign of hard times for Two Harbors Investment Corp, and unless the company can turn around its fortunes soon, it may be in for a rough ride ahead.

Dividends

Two Harbors Investment has experienced significant erosion in its book value over the past three years, culminating in a 12% decline in the quarterly dividend payout. The annual dividend per share issued by Two Harbors Investment in each of the last three years was at 2.64 USD. The dividend yields over the same period were 10.22%, 10.22%, and 10.22%, giving an average dividend yield of 10.22%. Given this rate of return, Two Harbors Investment could be a viable option for those looking for dividend stocks.

Share Price

Thursday saw Two Harbors Investment Corporation (TWO) experience erosion of its book value and a 12% decline in its quarterly dividend payout. The company’s stock opened at $17.0 and closed at $16.9, up by a mere 0.2% from its prior closing price of $16.9. It could be assumed that the slight increase of its stock price was due to investors hoping for improvement of the company’s financials, despite the negative news. The erosion of book value reflects a decrease in the company’s net asset value (NAV) over time. Furthermore, the reduced dividend payout is likely to impact investors’ confidence in the company and could be seen as an indication that the company is having difficulty generating profits.

It is also possible that the company is undergoing financial hardship as it struggles to manage its expenses in a changing economic environment. Overall, Two Harbors Investment Corporation has experienced significant book value erosion and a consequential dividend payout reduction. Though the stock price gained slightly on Thursday, investors’ concerns regarding the company’s financial health remain, making the outlook for the company uncertain. Live Quote…

Analysis

At GoodWhale, we recently performed an in-depth analysis of TWO HARBORS INVESTMENT share performance. After looking through their financial reports and considering the market conditions, we’ve determined their intrinsic value is right around $21.0, based on our proprietary Valuation Line. Currently, the stock is traded at $16.9. This means that it is undervalued by 19.6%, which presents a great opportunity for investors. However, we always advise investors to do their own research before making any decisions in order to weigh all the risks and rewards involved. More…

Summary

Two Harbors Investment Corp. has reported a 12% decline in its quarterly dividend payout, as well as sustained book value erosion. This drop in dividends might indicate that the company is not doing as well as investors would like, and with its book value declining, it may be a sign that investors should consider other investments instead. Investors should perform due diligence when assessing the company’s financials, and compare its performance to other investments. Additionally, research any macroeconomic factors that may be affecting the company, such as recessions or natural disasters, to further assess its future performance.

Trending News ☀️

Kronos Worldwide, Inc. is pleased to announce its quarterly dividend for shareholders. The quarterly dividend marks the continuation of Kronos’ commitment to provide strong returns for shareholders. The dividend will be payable on August 14th, 2020 to holders of record at the close of business on July 31, 2020. Kronos Worldwide, Inc. is a leading global producer and marketer of value-added titanium dioxide pigments and performance additives. It is the largest producer of titanium dioxide in North America and the world’s fifth-largest producer. Their products are used in a wide range of industrial and consumer products, including coatings, plastics, paper and other industrial applications.

Kronos seeks to create and enhance shareholder value through a disciplined approach to managing its business and growing its core assets, while striving to maintain financial flexibility. The dividend reflects Kronos’ strong financial position and strategic focus on delivering long-term shareholder value. Investors are encouraged to contact Investor Relations, who is available to answer any questions related to the dividend or the company’s business. We look forward to continuing to create strong returns for our shareholders for many years to come.

Dividends

KRONOS WORLDWIDE has consistently issued a dividend per share of $0.75, $0.72 and $0.72 within the last three years, respectively. With a current dividend yield of 4.92%, the share is expected to rise to 4.99% and 6.4% in 2021 and 2022, respectively, with an average dividend yield of 5.44%. Investors considering dividend stocks should definitely take a closer look at KRONOS WORLDWIDE, as their consistent dividend pays record is an attractive investment prospect. With the increasing dividend yields, it could be an even better opportunity for investors looking for a long-term return on their investments.

Price History

Kronos Worldwide, Inc. recently announced a quarterly dividend to its shareholders. On Thursday, KRONOS WORLDWIDE stock opened at $11.3 and closed at $11.8, a 5.8% increase from the closing price of the previous day. This increase of their share price is welcomed news for the shareholders of Kronos Worldwide, Inc., as it indicates a strong support for the company’s decision to pay out dividends to its shareholders. This quarterly dividend is just one of the many ways that Kronos Worldwide, Inc. is rewarding its shareholders for their support of the business.

The company has also been making tremendous progress in expanding its operations and growing its marketshare globally, which has been a major factor in the consistent increase in its share price over the past several quarters. This consistent growth pattern shows that Kronos Worldwide, Inc. is well positioned to continue to reward its shareholders with strong dividends in the coming quarters. Live Quote…

Analysis

At GoodWhale, we provide comprehensive financial analysis for investors. One of the companies we have been closely following is KRONOS WORLDWIDE (KRO). Our analysis indicates that KRONOS WORLDWIDE has an intrinsic value of around $15.0, calculated from our proprietary Valuation Line. Looking at the current market prices of KRONOS WORLDWIDE shares, it appears that they are currently trading at $11.8, which means they are undervalued by 21.1%. Therefore, investors who are looking for potential bargains should consider buying KRONOS WORLDWIDE shares at their current price level. More…

Summary

Kronos Worldwide, Inc. (KRON) is a marketer and producer of titanium dioxide pigment, which is used primarily in paints, coatings, plastics, and paper products. Recently, the company announced a quarterly dividend payment to its shareholders, which could be seen as a sign of confidence in the future of the business. This goodwill has been rewarded by investors as the stock price rose the same day of the announcement. Investors should conduct further due diligence to review KRON’s past performance, financials, and outlook before investing.

However, the company’s recent dividend announcement could be a positive sign for future returns.

Trending News ☀️

Intellia Therapeutics recently posted results for the fourth quarter of 2022, showcasing a beat in revenue and an impressive cash balance. The company reported an earnings per share of -$1.40, missing analyst estimates by $0.04.

However, their revenue of $13.6M beat expectations by $2.89M; a notable accomplishment. As of December 31, 2022, Intellia Therapeutics had approximately $1.3B in cash, compared to $1.1B as of December 31, 2021. This surge in cash indicates that the company’s finances are in good shape, giving them the financial resources to continue research and development for new products and therapies. Intellia Therapeutics is a leading gene editing company with a mission to deliver products that improve lives by utilizing the power of genome editing. The company has been making great strides in developing therapeutics for rare diseases, cancer treatments, and other applications of gene editing technology. With the impressive performance this quarter and the growing cash balance, the upcoming years could prove to be a defining moment for Intellia Therapeutics as they continue to make advances in their field.

Price History

INTELLIA THERAPEUTICS posted a Q4 revenue beat, ending the year 2022 with an impressive $1.3 billion in cash.Despite the good news, media sentiment for the company has mostly remained negative. On Thursday, INTELLIA THERAPEUTICS stock opened at $40.8 and closed at $39.0, showing a slight 0.1% increase from the prior closing price of 38.9. It is clear that the company’s results were met with some degree of caution at the market. Live Quote…

Analysis

At GoodWhale, we provide comprehensive analysis of INTELLIA THERAPEUTICS’s fundamentals. Our Risk Rating system shows that INTELLIA THERAPEUTICS carries a high risk investment in terms of financial and business aspects. Our comprehensive analysis has also detected 4 risk warnings in INTELLIA THERAPEUTICS’s balance sheet, cash flow statement, non financial and financial journals. To access this detailed analysis and get a deeper insight into your potential investments, register with us today. More…

Summary

Intellia Therapeutics has reported Q4 revenue that beat expectations, ending the year with $1.3B in cash on hand. Despite this positive news, overall media sentiment has largely been negative. Investors should consider the financial health of Intellia Therapeutics and its potential for additional revenue growth in the coming years to inform their analysis of the company.

Additionally, Intellia’s pipeline of therapeutics and the size of its customer base should also be taken into account. Furthermore, investors should stay abreast of any changes to competitor’s products, regulatory landscape, and distribution channels that could affect Intellia’s market position. By conducting a thorough assessment of all these factors, investors can make an informed decision about whether investing in Intellia is right for them.

Trending News ☀️

The Hain Celestial Group Inc. is making headlines as the closing price of their stock dropped by 4.03%, from $19.12 to $18.35, during the last session. This has investors wondering if it is time to take notice of HAIN. The decline in stock price could be attributed to a growing number of challenges that the company has faced in recent years, such as inconsistent earnings and a decline in sales. These issues have weighed heavily on HAIN’s stock prices, decreasing their market value.

However, these issues might not be enough to deter investors from taking a closer look at the stock. The company has a long history of success and enjoys a presence in many markets and countries.

In addition, it has a strong portfolio of well-known brands, including the popular Earth’s Best organic baby food line. Overall, it is hard to tell if HAIN CELESTIAL is currently a good buy or not. However, the decline in its stock price might be an indication that now is the time to pay attention to HAIN before it is too late. Investors should keep an eye on the company’s progress in the coming months and make an informed decision about whether or not to invest.

Market Price

The news coverage for HAIN CELESTIAL has been mixed so far. On Wednesday, their stock opened at $18.4 and closed at $18.6, up by 1.2%, while the closing price was 4.03% lower than the prior day’s closing price of 18.4. This slight dip in their stock price is possibly a sign that investors are taking notice of the company and its operations, particularly the news regarding their upcoming products and services. Investors may be eager to find out more about what HAIN CELESTIAL has to offer and whether or not it is worth investing in the company at this time. Live Quote…

Analysis

At GoodWhale, we want to make sure you’re making the most informed decisions when investing your hard-earned money. That’s why we offer comprehensive analysis of HAIN CELESTIAL’s financials. We scored HAIN CELESTIAL with a high-risk rating according to our criteria, which includes both financial and business aspects that can affect the company’s performance. To ensure you get the best insight possible, we also detected 3 risk warnings in HAIN CELESTIAL’s income sheet, balance sheet and cashflow statement. To get a closer look at these warnings, register on goodwhale.com. You’ll be able to access detailed information and make an even more informed decision about investing in HAIN CELESTIAL. More…

Summary

Hain Celestial, a natural and organic food and personal care products company, has experienced a notable stock price drop in recent days, falling 4.03% to $18.35. The overall sentiment remains largely mixed, as investors weigh both the positives and negatives when assessing HAIN. On the positive side, their product lineup is highly diversified, offering a variety of healthy alternatives to traditional foods and personal care products.