Tesla Stock Fair Value – Tesla’s China EV Sales Up 2.44% in May, CPCA Reports

June 12, 2023

🌥️Trending News

Tesla ($NASDAQ:TSLA) is an American automaker and energy storage company that designs, manufactures, and sells electric vehicles, solar panels, home batteries, and other energy storage products. In recent news, the China Passenger Car Association (CPCA) reported that Tesla’s sales of electric vehicles manufactured in China increased by 2.44% month-on-month in May. Nonetheless, the CPCA report serves as another sign of Tesla’s strength in China, which is one of the largest EV markets in the world.

Analysis – Tesla Stock Fair Value

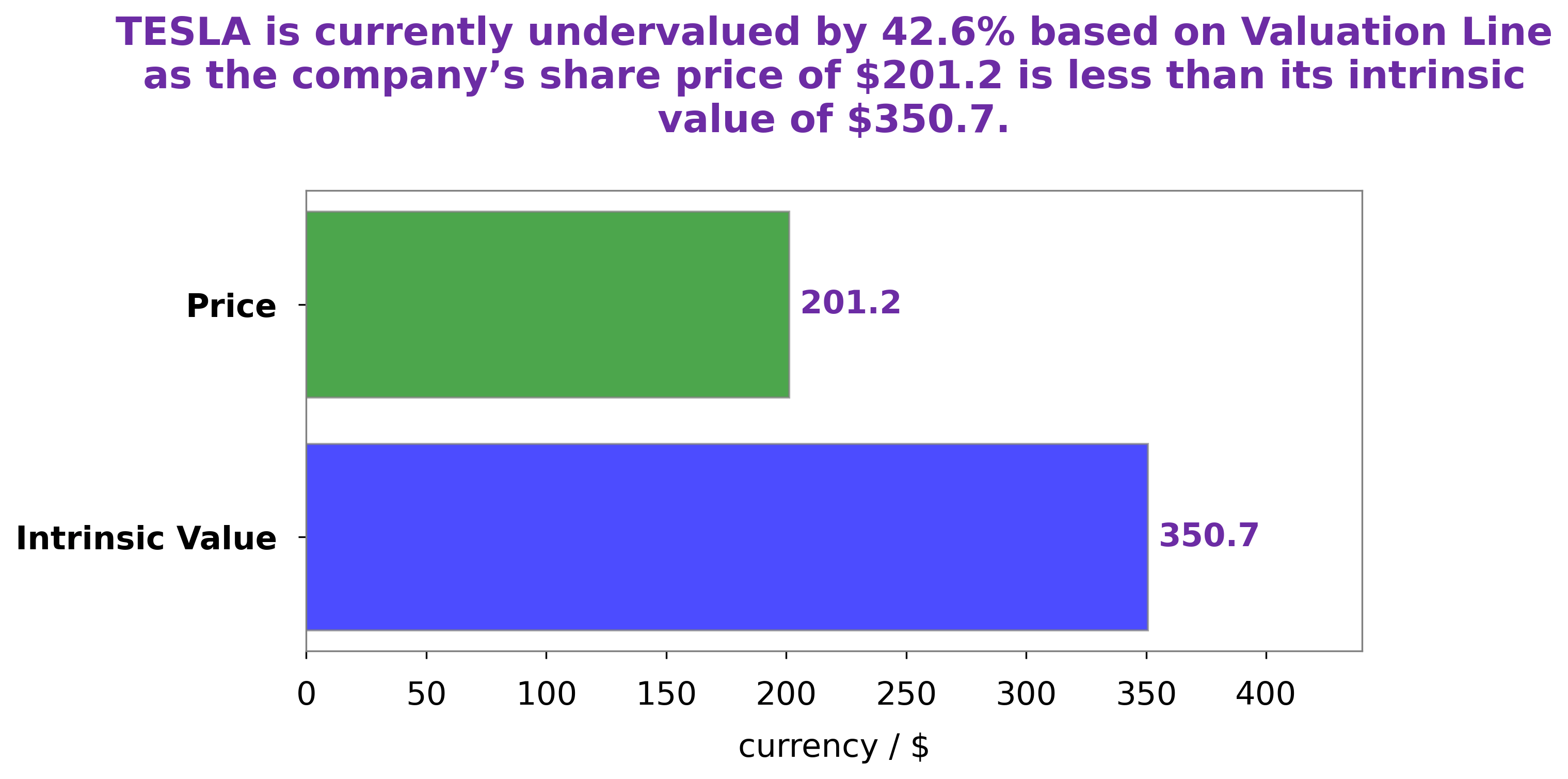

At GoodWhale, we have conducted an analysis of TESLA‘s wellbeing. After running our proprietary Valuation Line, we have determined that the intrinsic value of TESLA’s share is approximately $350.7. Currently, TESLA’s stock is trading at $217.6 – significantly undervalued by 38.0%. This provides investors with the opportunity to purchase shares at a discount. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tesla. More…

| Total Revenues | Net Income | Net Margin |

| 86.03k | 11.78k | 13.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tesla. More…

| Operations | Investing | Financing |

| 13.24k | -12.29k | -1.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tesla. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 86.83k | 37.6k | 15.16 |

Key Ratios Snapshot

Some of the financial key ratios for Tesla are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 49.0% | 148.4% | 15.2% |

| FCF Margin | ROE | ROA |

| 6.7% | 17.6% | 9.4% |

Peers

Tesla Inc is an American electric vehicle and clean energy company based in Palo Alto, California. Tesla’s current products include electric cars, battery energy storage from home to grid scale, solar panels and solar roof tiles, and related products and services. Some of Tesla’s notable competitors in the electric vehicle space include NIO Inc, XPeng Inc, and Li Auto Inc.

– NIO Inc ($SEHK:09866)

NIO Inc. is a Chinese electric vehicle manufacturer headquartered in Shanghai. The company was founded in 2014 and has since become one of the leading EV manufacturers in China. NIO produces a range of electric vehicles, including the ES8 SUV, the ES6 SUV, and the EC6 sedan. The company also offers a range of services, including the NIO Power battery-swapping service and the NIO Pilot autonomous driving system. NIO Inc. has a market cap of 154.77B as of 2022 and a Return on Equity of -13.53%. The company is one of the leading EV manufacturers in China and offers a range of electric vehicles and services.

– XPeng Inc ($SEHK:09868)

As of 2022, YPeng Inc has a market capitalization of 54.52 billion dollars and a return on equity of -11.13%. YPeng Inc is a Chinese multinational conglomerate holding company headquartered in Beijing. The company was founded in 1988 and has since grown to become one of the largest companies in China. YPeng Inc is involved in a wide variety of businesses, including but not limited to: e-commerce, retail, transportation, logistics, and financial services.

– Li Auto Inc ($SEHK:02015)

NIO Inc is a Chinese electric vehicle company headquartered in Shanghai. The company was founded in 2014 and is listed on the New York Stock Exchange. NIO Inc designs, manufactures, and sells electric vehicles in China, the United States, and Europe. The company has a market cap of 140.12B as of 2022 and a return on equity of -0.27%.

Summary

Investor sentiment for Tesla appears to remain strong, as the company continues to develop its presence in the Chinese EV market. Over the past several quarters, Tesla has taken steps to strengthen its competitive position in China, such as expanding its Supercharger network, forming strategic partnerships with local organizations, and upgrading its manufacturing processes. The firm’s plans for further expansion in the Chinese market, such as the upcoming launch of its Shanghai-made Model Y SUV, could provide a boost to future sales. Investors should watch out for any developments that could impact the demand for Tesla’s EVs in China, and consider the potential impacts of the US-China trade war on Tesla’s operations there.

Recent Posts