Sono Group’s Sion Passenger Car Program Shuts Down, Cantor Fitzgerald Downgrades Rating to Neutral, COO Thomas Hausch Steps Down.

February 28, 2023

Trending News 🌥️

The news of the closure of Sono Group ($NASDAQ:SEV)’s Sion Passenger Car Program has sent shockwaves throughout the industry, with over 300 employees now facing potential redundancy. On Friday, COO Thomas Hausch announced his resignation, and Cantor Fitzgerald has responded by downgrading its rating on Sono Group to Neutral from Overweight. The Sion Passenger Car Program was expected to be the cornerstone of Sono Group’s future growth, but the company’s failure to meet its targets meant that the project had to be shut down and the 300 employees sadly let go. As a result of this, Cantor Fitzgerald has downgraded its rating on Sono Group and also expects that Thomas Hausch’s departure could further hit the group’s long-term growth prospects.

The effects of Sono Group’s decision to close the Sion Passenger Car Program are already being felt throughout the industry, with Thomas Hausch’s resignation having a potentially damaging effect on the group’s future. Unfortunately, it looks like the closure of the program could be the end of the road for Sono Group, and Cantor Fitzgerald may have made the right decision in downgrading its rating to Neutral.

Stock Price

Additionally, Chief Operating Officer Thomas Hausch announced his stepping down from the company. As a result of these events, SONO GROUP stock opened at $0.6 and closed at $0.6, representing a plunge of 11.3% from its prior closing price of 0.6. Investors took the news poorly, driving down share prices and rating of the company. It will remain to be seen how the company will fare in the coming weeks in light of these new developments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sono Group. More…

| Total Revenues | Net Income | Net Margin |

| 0.2 | -125.94 | -63254.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sono Group. More…

| Operations | Investing | Financing |

| -125.68 | -40.25 | 185.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sono Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 103.87 | 75.11 | 0.33 |

Key Ratios Snapshot

Some of the financial key ratios for Sono Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -62829.1% |

| FCF Margin | ROE | ROA |

| -84658.2% | -169.3% | -74.1% |

Analysis

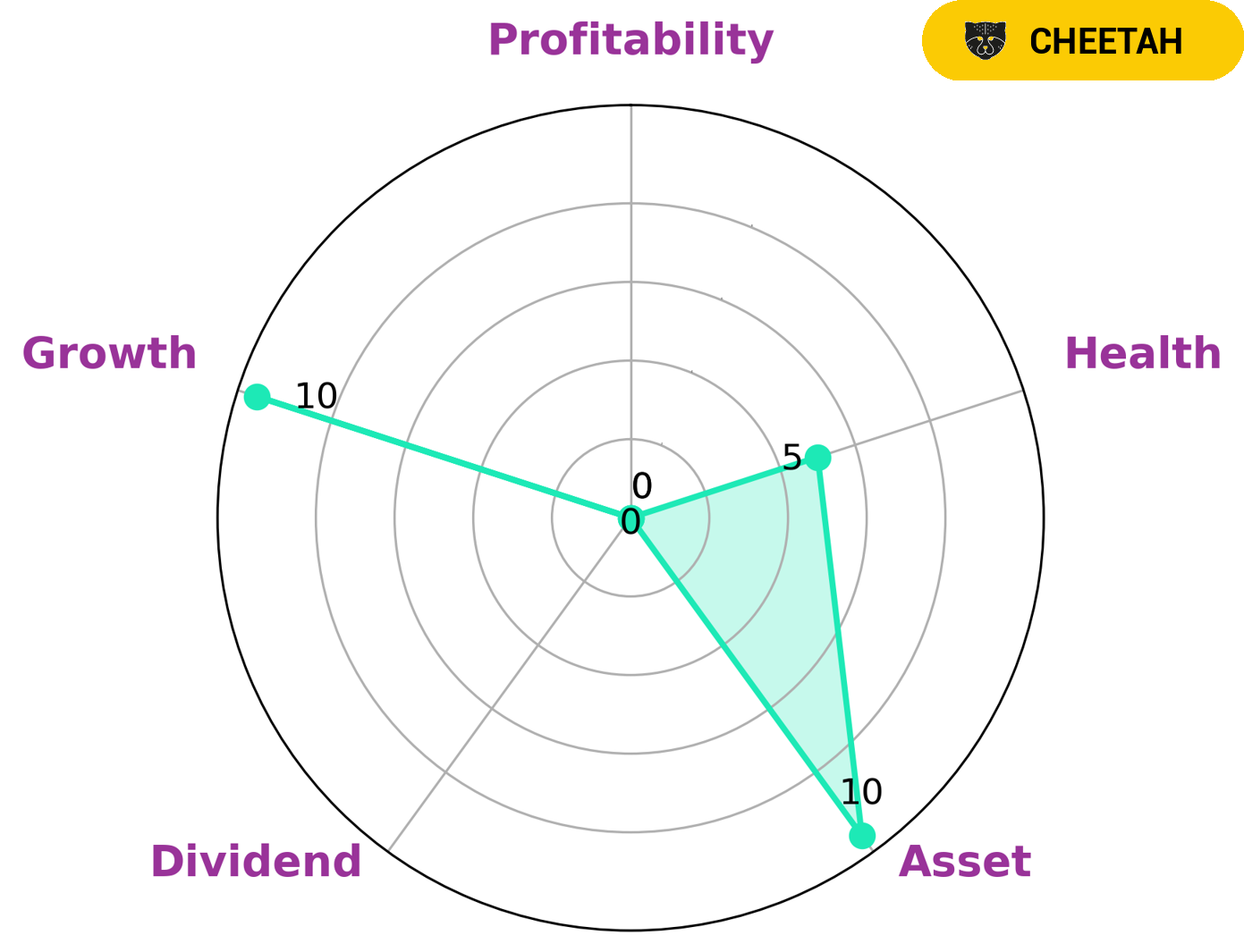

GoodWhale has conducted an analysis of the fundamentals of SONO GROUP, and classified them as a ‘cheetah’ according to the Star Chart. Cheetahs are companies that have achieved high revenue or earnings growth but are considered less stable due to their lower profitability. Given its intermediate health score of 5/10, which takes into account its cashflows and debt, SONO GROUP is likely to safely ride out any crisis without the risk of bankruptcy. Therefore, investors looking for an opportunity to invest in a company with a high potential for growth may be interested in SONO GROUP. The company is strong in asset and growth, and weak in dividend and profitability. This makes it an attractive option for investors who are looking to tap into the potential of the company’s future performance, while also being able to take advantage of the lower dividend yields and low risks associated with such investments. More…

Peers

Sono Group NV is a company that manufactures and sells electric vehicles. The company competes with Tesla Inc, Tek Seng Holdings Bhd, and Shanghai Aerospace Automobile Electromechanical Co Ltd.

– Tesla Inc ($NASDAQ:TSLA)

Tesla Inc is an American electric vehicle and clean energy company based in Palo Alto, California. The company specializes in electric vehicle manufacturing, battery energy storage from home to grid scale, solar panel manufacturing, and solar roofing tiles. Tesla is one of the world’s leading clean energy companies and has a market cap of $687.33B as of 2022. The company has a Return on Equity of 27.88%, which is higher than the average for the S&P 500. Tesla’s products are helping to accelerate the world’s transition to sustainable energy and its mission is to accelerate the world’s transition to sustainable energy.

– Tek Seng Holdings Bhd ($KLSE:7200)

Tek Seng Holdings Bhd is a company that manufactures and sells electronic and electrical products. The company has a market cap of 108.2M as of 2022 and a Return on Equity of 5.82%. The company’s products include mobile phones, digital cameras, LCD TVs, and other consumer electronics.

– Shanghai Aerospace Automobile Electromechanical Co Ltd ($SHSE:600151)

Shanghai Aerospace Automobile Electromechanical Co Ltd is a leading manufacturer of automotive parts and components in China. The company has a market cap of 13.4 billion as of 2022 and a return on equity of 2.14%. The company’s products include engines, transmissions, suspension systems, brakes, and steering systems. Shanghai Aerospace Automobile Electromechanical Co Ltd is headquartered in Shanghai, China.

Summary

Investors in Sono Group are advised to pay close attention to the recent news of the company’s Sion Passenger Car Program shutting down, with a resulting downgrade of its rating to Neutral by Cantor Fitzgerald. This comes in light of Thomas Hausch, COO of Sono Group, stepping down. As a result, the stock price has decreased, leaving investors with a nervous outlook on their investments, uncertain of the potential risks involved. As such, it is recommended that investors use caution when considering Sono Group as an investment, keeping an eye on the stock performance and a close watch on any further news and developments coming out of the company.

Recent Posts