EEKA FASHION Experiences Revenue Decline for 2022

January 30, 2023

Trending News 🌥️

EEKA FASHION ($SEHK:03709) is a well-known fashion retail company that has been around for over fifteen years. The company has had a successful track record of providing customers with quality apparel and accessories at an affordable price. Unfortunately, EEKA FASHION has recently experienced a decline in revenue for the year 2022. The company has attributed this revenue decline to a number of factors including an overall decrease in consumer spending due to the ongoing pandemic.

Additionally, EEKA FASHION has faced stiff competition from other fashion retailers who have been able to offer lower prices and better quality products. This has resulted in fewer customers choosing EEKA FASHION for their apparel needs. In response to this revenue decline, the company has implemented a number of strategies to improve their sales. This includes introducing new product lines to appeal to a wider range of customers. Furthermore, EEKA FASHION has also implemented an aggressive marketing campaign to boost visibility and brand awareness. Finally, the company has also focused on providing excellent customer service in order to retain its existing customers. Despite the revenue decline for 2022, EEKA FASHION remains optimistic that it can turn its fortunes around with the implementation of these strategies. The company is confident that by continuing to provide quality products at competitive prices, they can regain their market share and experience growth in the future. Overall, EEKA FASHION remains committed to its customers and is confident that it can recover from this difficult period. With the right strategies in place, the company is sure to experience a successful comeback in the years ahead.

Market Price

EEKA FASHION recently experienced a revenue decline for 2022, which has caused concern amongst shareholders and investors. On Friday, EEKA FASHION stock opened at HK$10.0 and closed at HK$10.1, up by 0.4% from prior closing price of 10.1. This modest increase did not provide enough reassurance to shareholders, who are worried about the company’s future prospects. The revenue decline has been attributed to a variety of factors, including a decrease in demand for EEKA FASHION products, increased competition from other fashion brands, and rising costs of production. The company has also been impacted by the current economic climate, with the pandemic causing significant disruption to the global retail industry. To address these issues, EEKA FASHION has taken a number of steps to reduce costs and increase efficiency. It has implemented cost-cutting measures such as reducing staff and marketing budgets, and investing in more efficient production processes.

Additionally, the company has shifted its focus to online sales, which has enabled it to reach a wider customer base and remain competitive in a crowded marketplace. Despite these efforts, EEKA FASHION still faces an uphill battle in terms of recovering from its revenue decline. In order to restore its previous level of success, the company must continue to invest in innovation and developing new products that appeal to customers. Additionally, EEKA FASHION must find ways to differentiate itself from its competitors and build a loyal customer base. If these measures are not taken, the company could face further losses in the years ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eeka Fashion. More…

| Total Revenues | Net Income | Net Margin |

| 6.17k | 544.99 | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eeka Fashion. More…

| Operations | Investing | Financing |

| 1.41k | -357.82 | -1.38k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eeka Fashion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.06k | 2.15k | 5.56 |

Key Ratios Snapshot

Some of the financial key ratios for Eeka Fashion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.6% | 32.5% | 11.8% |

| FCF Margin | ROE | ROA |

| 19.8% | 11.6% | 7.5% |

VI Analysis

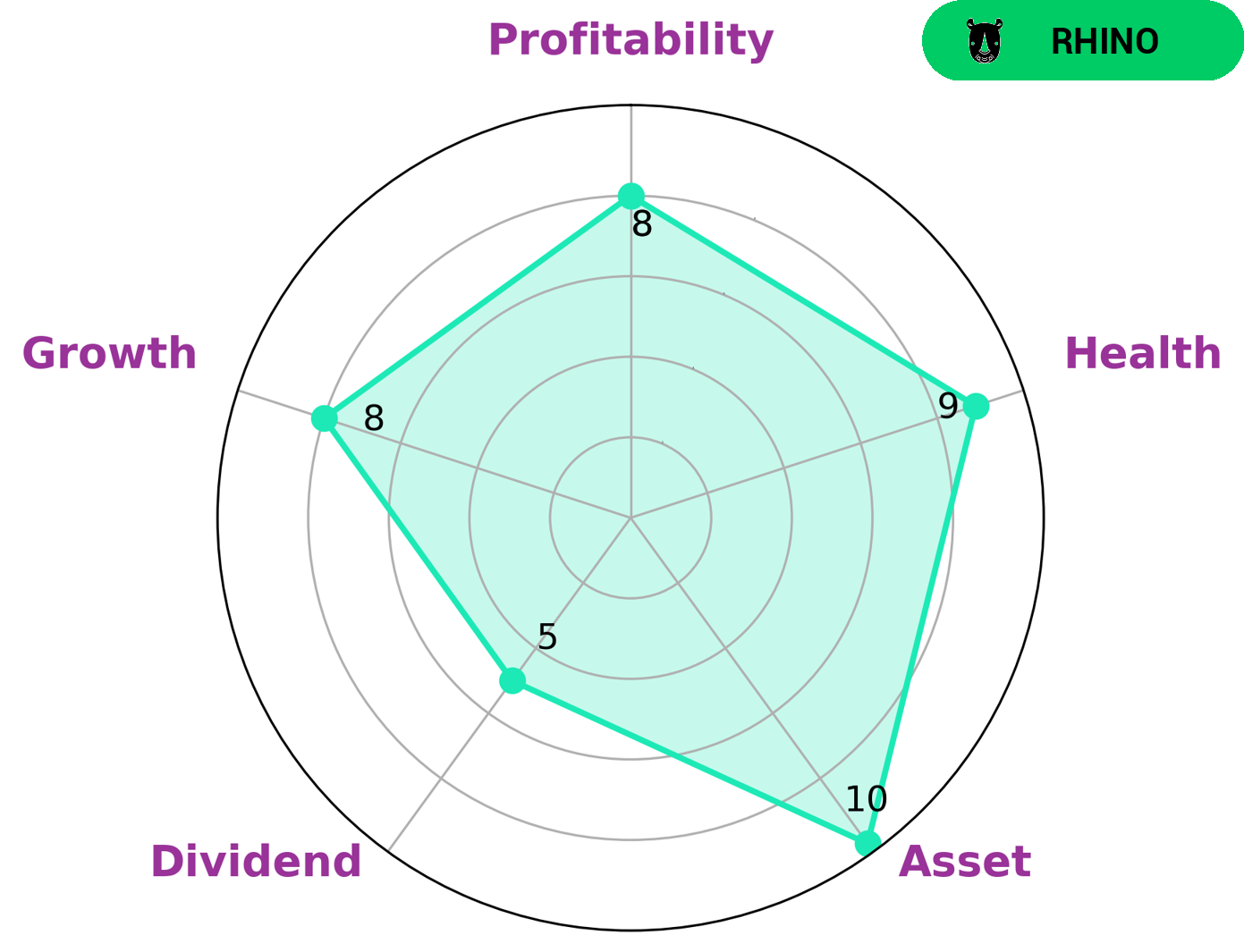

EEKA FASHION is classified as a ‘rhino’ company, indicating it has achieved moderate growth in revenue or earnings. Such companies are often attractive to investors who look for steady, reliable returns. The VI app provides a simplified analysis of the fundamentals of EEKA FASHION, which reveal it is strong in terms of asset growth, profitability, and medium in dividend. Moreover, the company has a high health score of 9/10 due to its cash flows and debt, making it capable of sustaining future operations even in times of crisis. Investors interested in EEKA FASHION may be confident that the company can provide stable returns and long-term growth potential. The VI app also provides an overview of EEKA FASHION’s financial performance, along with key financial metrics such as gross profit margin, return on equity, and return on assets. This data allows investors to accurately assess the company’s financial health and make informed decisions about whether to invest. In addition, investors can use the app to gain insights into EEKA FASHION’s competitive landscape and market trends to better understand how the company is positioned in relation to its competitors. Overall, EEKA FASHION is an attractive investment option due to its strong fundamentals and financial health. The VI app offers investors a comprehensive overview of the company’s performance and fundamentals, allowing them to make informed decisions about where to invest their capital. With its moderate growth rate, strong financials, and high health score, EEKA FASHION is well-positioned for continued success. More…

VI Peers

The company’s main competitors are China Lilang Ltd, C Banner International Holdings Ltd, and TSI Holdings Co Ltd. All of these companies are based in China and have a significant market share in the country. EEKA Fashion Holdings Ltd has a competitive advantage over its competitors due to its strong brand recognition, innovative designs, and efficient manufacturing and distribution capabilities. The company is also expanding its reach into other markets, such as the United States and Europe.

– China Lilang Ltd ($SEHK:01234)

Lilang Ltd is a Chinese company with a market cap of 4.43B as of 2022. The company’s return on equity is 9.38%. Lilang Ltd is engaged in the design, manufacture, and sale of men’s, women’s, and children’s apparel. The company offers a wide range of products, including shirts, jackets, pants, and suits.

– C Banner International Holdings Ltd ($SEHK:01028)

Banner International Holdings Ltd is a Hong Kong-based investment holding company principally engaged in the provision of management services. The Company operates its business through five segments. The Investment Properties segment is engaged in the investment in properties. The Corporate Finance segment is engaged in the provision of corporate finance services. The Asset Management segment is engaged in the provision of asset management services. The Property Development and Construction segment is engaged in the development and sale of properties, as well as the contracting of construction projects. The Corporate Investments segment is engaged in the investments in shares, as well as the provision of loans.

– TSI Holdings Co Ltd ($TSE:3608)

TSI Holdings Co Ltd is a Japanese holding company that operates in the following segments: air transportation, food and beverage, ground transportation, and other businesses. The company was founded in 1947 and is headquartered in Tokyo, Japan.

The company has a market capitalization of 41.15 billion as of 2022 and a return on equity of 1.85%. The company’s main business is in air transportation, and it also has businesses in food and beverage, ground transportation, and other areas. The company is headquartered in Tokyo, Japan.

Summary

EEKA FASHION has seen a decrease in revenue for 2022. This can be attributed to a number of factors such as the current economic climate, competition, and changes in consumer behaviour. Investors should be aware of the potential impact of these factors on the company’s financial performance. They should also be aware of the company’s strategies for mitigating risks and increasing revenue.

Additionally, investors should monitor the company’s financial performance over time to determine if it is providing a good return on their investment.

Recent Posts