ABERCROMBIE & FITCH Reports 41.5% Decrease in Fourth Quarter Revenue for FY2023

March 17, 2023

Earnings Overview

ABERCROMBIE ($NYSE:ANF): For the 4th quarter of FY2023 ending on January 31 2023, A&F reported total revenue of $38.3 million, a decrease of 41.5% from the same period in FY2022. Net income for the same period was $1199.8 million, a 3.3% increase compared to the same period of the previous year.

Share Price

On Thursday, ABERCROMBIE & FITCH reported a 41.5% decrease in fourth quarter revenue for fiscal year 2023. The news had a direct effect on their stock price, which opened at $29.1 and closed at $28.3, down 3.0% from the previous day’s closing price of $29.2. The decline in revenue came as a shock to many analysts and investors alike, as the company had been experiencing a period of sustained growth up until this point. The decrease was largely attributed to a decline in foot traffic and sales in stores, as well as an overall slowdown in consumer spending due to the ongoing economic recession. Despite the decline in revenue, ABERCROMBIE & FITCH remains bullish about their future prospects and are confident that their strategies will pay off in the long run.

They are aiming to focus on their digital presence and plan to continue opening new stores in strategic locations around the world. Going forward, ABERCROMBIE & FITCH will need to find innovative ways to increase sales and generate revenue, as the current market conditions remain unpredictable. They will also have to remain vigilant in monitoring consumer trends and adapting their business model accordingly if they are to emerge from the current downturn successful. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ANF. More…

| Total Revenues | Net Income | Net Margin |

| 3.7k | 2.82 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ANF. More…

| Operations | Investing | Financing |

| -2.34 | -140.68 | -155.33 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ANF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.71k | 2.01k | 14.18 |

Key Ratios Snapshot

Some of the financial key ratios for ANF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.7% | 6.1% | 2.5% |

| FCF Margin | ROE | ROA |

| -4.5% | 8.6% | 2.1% |

Analysis

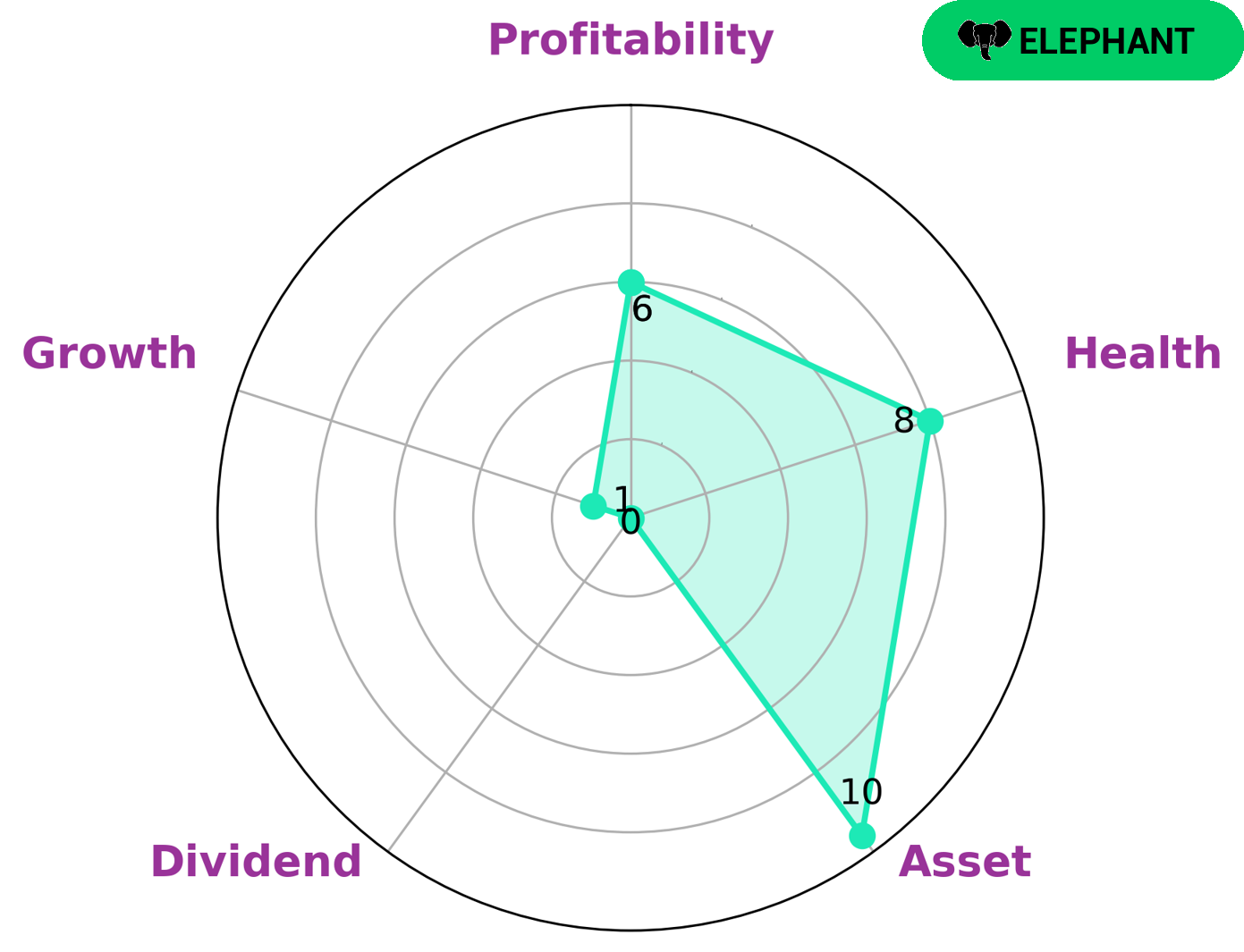

GoodWhale has conducted an analysis of ABERCROMBIE & FITCH’s financials. Based on our Star Chart, ABERCROMBIE & FITCH is classified as an ‘elephant’, which indicates the company is rich in assets after deducting off liabilities. Investors who are looking for a more secure investment and a steady income may be interested in companies such as ABERCROMBIE & FITCH. Though it is strong in assets, it is only medium in profitability and weak in dividend and growth. Nevertheless, ABERCROMBIE & FITCH has a relatively high health score of 8/10 after taking into consideration its cashflows and debt, thus making it capable of sustaining future operations in times of crisis. More…

Peers

Competition between Abercrombie & Fitch Co and its competitors, Gap Inc, Children’s Place Inc, and Ross Stores Inc, is fierce. All four companies specialize in retail apparel and strive to offer their customers the best products and services. As a result, each company constantly works to outpace the others in terms of product offerings, store locations, and customer service.

– Gap Inc ($NYSE:GPS)

Gap Inc is a leading apparel retail company based in San Francisco, California. The company offers apparel, accessories, and personal care products for men, women, and children through its brands, which include Gap, Old Navy, Banana Republic, Athleta, and Intermix. As of 2022, Gap Inc. has a market capitalization of 4.4 billion dollars and a return on equity of -0.62%. This is lower than the industry average for apparel retail companies, indicating that the company has not been able to generate a satisfactory return on its equity investments. However, the company’s market capitalization of 4.4 billion dollars suggests that investors are still confident in the company’s future prospects.

– Children’s Place Inc ($NASDAQ:PLCE)

Children’s Place Inc is a popular children’s apparel retailer with a market cap of 461.48M as of 2022. The company offers a variety of clothing, accessories, and footwear for kids ranging from newborn to age 14. They have an impressive Return on Equity of 41.18%, which is a measure of the company’s ability to generate income from shareholders’ investments. This is a strong indicator of the company’s financial health and its ability to make efficient use of capital. The Children’s Place Inc is well-positioned to continue to provide great products and services to its customers in the years to come.

– Ross Stores Inc ($NASDAQ:ROST)

Ross Stores Inc is a leading off-price retailer in the United States. It operates 1,400 stores in 39 states, the District of Columbia, and Guam. The company offers apparel, accessories, footwear, and home fashions at discounts of 20% to 60% below department and specialty store regular prices. As of 2022, Ross Stores Inc has a market capitalization of 39.77B and a Return on Equity (ROE) of 29.12%. This reflects the company’s strong financial performance and ability to generate significant returns for its shareholders. Ross Stores has consistently recorded positive earnings growth for over 10 years and is well positioned for future growth.

Summary

ABERCROMBIE & FITCH reported a decrease in total revenue of 41.5% for the fourth quarter of FY2023 ending January 31 2023, compared to the same period last year. Net income, however, saw a 3.3% increase during the same period. Following the announcement, stock price moved down.

Investors should take into consideration the company’s overall performance in the fourth quarter of FY2023 when making decisions about investing in ABERCROMBIE & FITCH, as it may indicate possible challenges in the future. It is important to also look at the company’s long-term performance and any other factors that may affect its stock price such as economic conditions and industry competition.

Recent Posts