Capral Limited Expands Presence in New South Wales with Acquisition of Allyman Aluminium

December 27, 2022

Trending News 🌧️

CAPRAL LIMITED ($ASX:CAA) is a leading Australian aluminium manufacturer and distributor, supplying customers with innovative and high-quality solutions. They are renowned for their aluminium products and services, which are used in a variety of industries across the country. The company recently announced that they have acquired Allyman Aluminium, an aluminium distribution business located in Wollongong, New South Wales. The acquisition forms part of Capral’s strategy to further expand its presence in New South Wales. This move will benefit Capral’s customers in the South Coast region of New South Wales, providing them with access to a wider range of aluminium products and services. Allyman Aluminium has a well-established customer base and is renowned for its quality products and customer service.

This is something that Capral can leverage to strengthen its presence in the region. The acquisition also allows Capral to extend its services to include the design, fabrication and installation of aluminium extrusion products, which are currently in high demand. With this added capacity, Capral can now provide a more comprehensive service that meets the needs of the local market. Capral’s Managing Director, Mark Trewin, said that the acquisition was a natural fit for the company and that they are looking forward to growing their presence in this important market. With this new acquisition, Capral has opened up a new avenue for growth in New South Wales and is well placed to leverage this new opportunity.

Market Price

The acquisition marks a significant milestone for Capral Limited as it will help the company expand its portfolio of products and services. The acquisition will also enable Capral to gain access to Allyman’s experience and expertise in aluminium fabrication, allowing the company to better serve its customers. Capral Limited’s stock opened at AU$7.5 on Tuesday and closed at AU$7.5, down by 0.1% from the prior closing price of 7.5. Despite the slight decline, investors remain confident that the acquisition will boost the company’s growth prospects in New South Wales.

The acquisition also marks an important step forward in Capral’s strategic plan to become a leading supplier of aluminium products and services in Australia. The acquisition is expected to bring significant benefits to both Capral and Allyman Aluminium in terms of increased market share, enhanced product offerings, and improved customer satisfaction. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Capral Limited. More…

| Total Revenues | Net Income | Net Margin |

| 638.7 | 49.25 | 7.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Capral Limited. More…

| Operations | Investing | Financing |

| 30.95 | -10.41 | -1.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Capral Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 500.01 | 325.81 | 9.94 |

Key Ratios Snapshot

Some of the financial key ratios for Capral Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.9% | – | 6.2% |

| FCF Margin | ROE | ROA |

| 3.2% | 14.9% | 4.9% |

VI Analysis

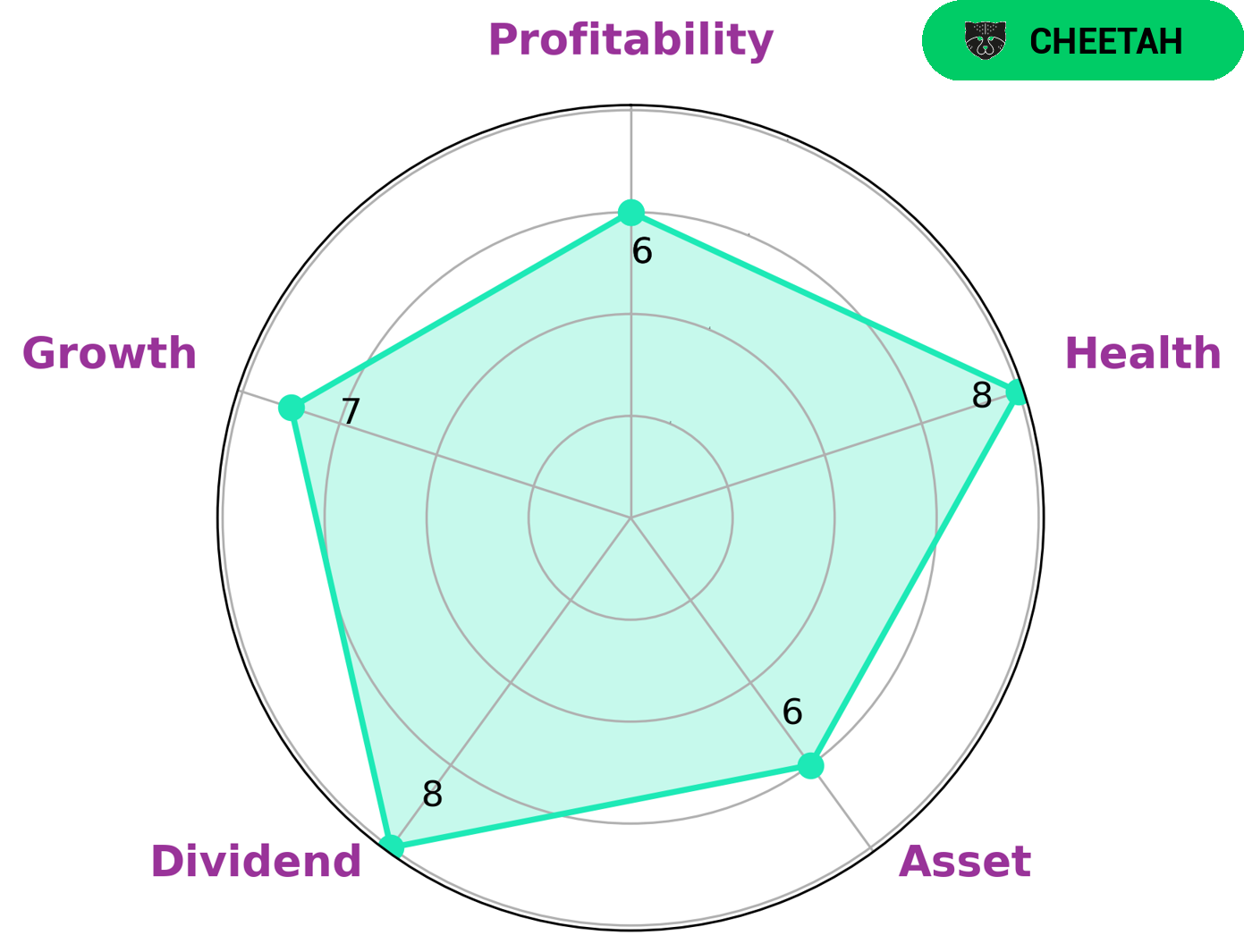

CAPRAL LIMITED is a company with strong fundamentals, which reflect its long term potential. According to the VI Star Chart, CAPRAL LIMITED has a high health score of 8 out of 10, indicating its capability to safely ride out any crisis without the risk of bankruptcy. Additionally, CAPRAL LIMITED is classified as a ‘cheetah’, meaning it achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given its solid fundamental health and cheetah-like growth potential, CAPRAL LIMITED is likely to attract a wide array of investors. Specifically, investors looking for dividend-paying stocks may be interested in CAPRAL LIMITED’s strong dividend performance. Investors seeking growth opportunities may also be interested in the company’s higher-than-average revenue or earnings growth compared to its peers. Additionally, investors looking for a balance between asset protection and profitability may find CAPRAL LIMITED’s medium ratings in both categories appealing. In conclusion, CAPRAL LIMITED is a company with strong fundamentals that indicate its long-term potential. Its dividend performance, high revenue or earnings growth, and medium ratings in asset protection and profitability make it an attractive option for a wide variety of investors. More…

VI Peers

The competition between Capral Ltd and its competitors Installux SA, New Wave Holdings Ltd, and Alumil Aluminium Industry SA is fierce, as each company strives to gain a competitive edge in the market. With innovative products, aggressive marketing strategies, and efficient production processes, these companies are constantly pushing each other to become more successful.

– Installux SA ($LTS:0FHN)

Installux SA is a French company with its headquarters in Bordeaux. It is a leading manufacturer of aluminum building materials, such as windows, doors and cladding, for both residential and commercial buildings. The company’s market cap as of 2022 is 103.83M and its Return on Equity (ROE) stands at 6.29%. This indicates that the company is able to generate a healthy return on its shareholders’ equity, making it an attractive investment option. Additionally, the market cap of Installux SA is relatively low compared to other companies in the same industry, giving it an edge in terms of cost competitiveness.

– New Wave Holdings Ltd ($SGX:5FX)

New Wave Holdings Ltd is a publicly traded company that operates in the technology industry. The company is focused on providing solutions for digital asset management and secure storage solutions for digital assets. The company has a market cap of 13.82M as of 2022, which places it as a mid-sized company. New Wave Holdings Ltd has a Return on Equity of 7.22%, which indicates that the company is generating a good return from its investment activity. This demonstrates that the company has been able to effectively utilize its resources to generate returns, and is therefore well positioned to continue to produce returns in the future.

– Alumil Aluminium Industry SA ($LTS:0KXF)

Alumil Aluminium Industry SA is a Greek aluminium manufacturer and one of the largest manufacturers in the European market. With a market cap of 67.1M as of 2022, the company is well-positioned to capitalize on the growing demand for aluminium products. The company’s Return on Equity (ROE) of 64.64% is an indication of its excellent profitability and operational efficiency. Alumil produces a wide range of aluminium products such as window and door frames, building systems, and other custom designs for its customers. The company also engages in the research and development of new technologies and processes, allowing them to remain competitive in their industry.

Summary

Capral Limited, an Australian aluminum manufacturing and distribution company, has recently announced its acquisition of Allyman Aluminium, located in New South Wales. This move is seen as a strategic investment for Capral Limited, as it will expand their presence in the region and provide them with a larger market share. Furthermore, this acquisition is expected to increase their efficiency and cost savings, providing a return on investment in the long term.

Analysts believe that this move will be beneficial for Capral Limited in terms of both growth and profitability. It will also help them remain competitive in the aluminum market, and potentially open up new opportunities in the future.

Recent Posts