ALUMINA LIMITED Reports 8.8% Decrease in Revenue for FY2022, Net Income Unchanged YOY.

March 5, 2023

Earnings report

ALUMINA LIMITED ($ASX:AWC) reported its earnings results for the fourth quarter of FY2022 (ending December 31 2022) on February 21 2023. Total revenue for the quarter was USD 104.0 million, an 8.8% decrease compared to the same period last year. This decrease in revenue was primarily driven by lower sales volumes due to global market conditions. According to the company, it was also impacted by higher costs associated with raw materials and labor. Despite the decrease in revenue, net income for ALUMINA LIMITED remained stable year over year at USD 0.7 million.

Management attributed this to the company’s ability to maximize efficiency, reduce expenses and focus on cost containment initiatives. Looking ahead, ALUMINA LIMITED is hopeful of improving its performance in FY2023 as markets rebound and demand increases. The company is focused on executing its long-term growth and sustainability plans as it strives to drive positive outcomes for shareholders, customers and other stakeholders.

Price History

Despite this decrease in revenue, the company’s net income remained unchanged year-over-year. In trading, ALUMINA LIMITED stock opened at AU$1.4 and closed at AU$1.5. Despite these headwinds, ALUMINA LIMITED’s cost-cutting measures and efforts to increase efficiency enabled the company to maintain its net income.

ALUMINA LIMITED’s management team has stated that they remain committed to pursuing growth opportunities and cost containment in order to further increase the company’s profitability. They also indicated that they plan to continue their investments in research and development in order to stay ahead of the competition and bring new products to market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alumina Limited. More…

| Total Revenues | Net Income | Net Margin |

| – | 271.9 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alumina Limited. More…

| Operations | Investing | Financing |

| 567.4 | -259.2 | -304.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alumina Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.66k | 113.3 | 0.53 |

Key Ratios Snapshot

Some of the financial key ratios for Alumina Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | 0.0% | – |

| FCF Margin | ROE | ROA |

| – | 10.5% | 10.4% |

Analysis

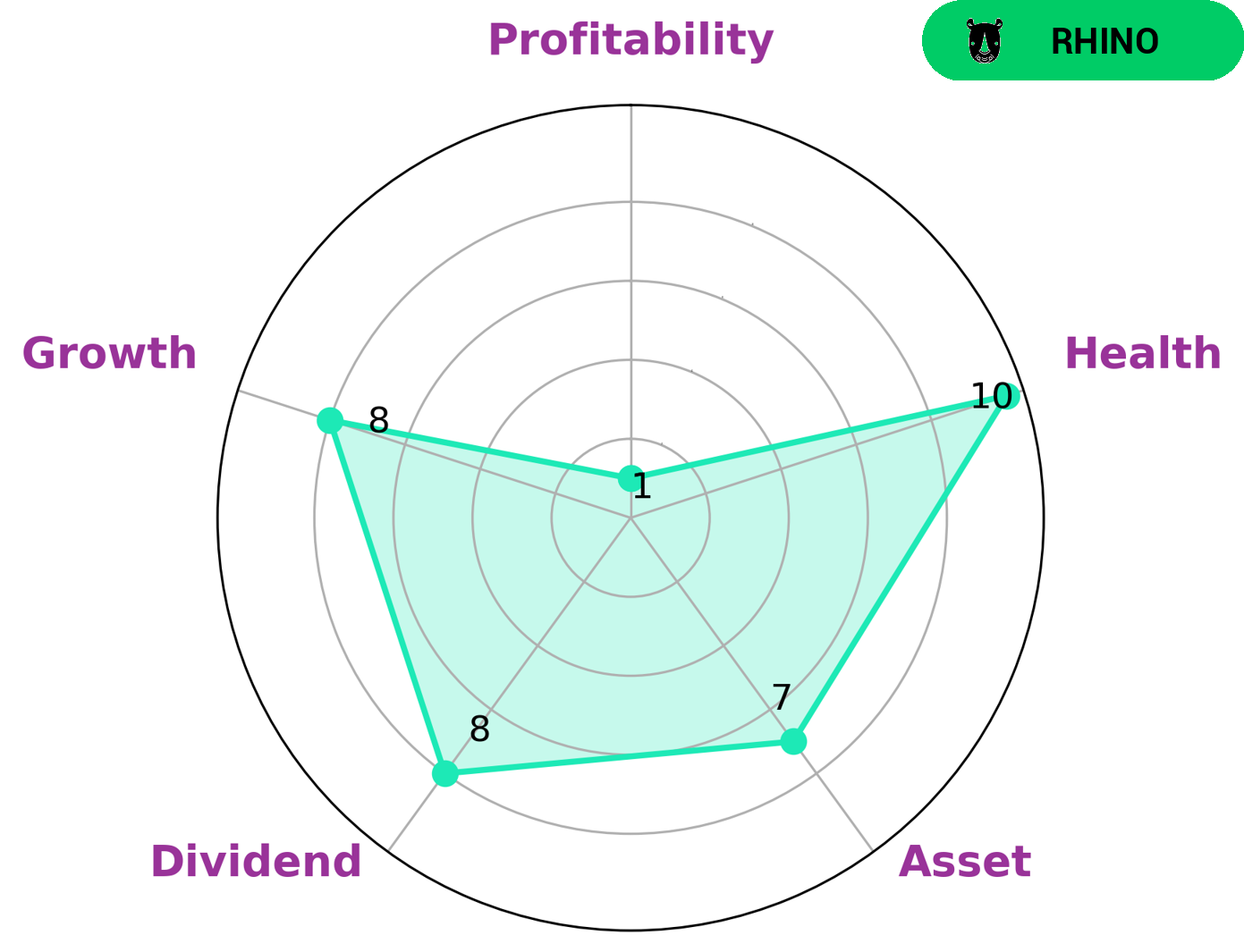

GoodWhale has conducted an analysis of ALUMINA LIMITED‘s wellbeing and we are pleased to report that the company has scored a high health score of 10/10 according to our Star Chart. This score indicates that the company is in a strong financial health and is able to safely ride out any crisis without the risk of bankruptcy. Further analysis indicates that ALUMINA LIMITED is strong in asset, dividend, and growth. However, the company’s profitability is somewhat weak which holds them back from being classified as ‘gazelle’ i.e. a company that has achieved high revenue or earnings growth. Instead, ALUMINA LIMITED has achieved moderate revenue or earnings growth, which classifies them as ‘rhino’. Investors who are interested in a company that has achieved moderate growth, but is financially stable and strong in asset, dividend and growth may be interested in investing in ALUMINA LIMITED. More…

Peers

Alumina Ltd is one of the leading players in the global aluminium industry, competing with major industry players such as Alcoa Corp, MLG Oz Ltd, and Norsk Hydro ASA. Alumina Ltd strives to provide quality products and services to its customers, while maintaining its competitive edge in the industry.

– Alcoa Corp ($NYSE:AA)

Alcoa Corporation is a leading global producer of aluminum and aluminum products. Founded in 1888, the company has operations in countries around the world, including the United States, Canada, Australia, and Brazil. As of 2022, Alcoa Corp has a market capitalization of 8.05 billion dollars. This indicates the company’s size and scale of operations in the global aluminum industry. Furthermore, its Return on Equity (ROE) stands at 11.09%, showing that Alcoa’s management is making efficient use of shareholder funds.

– MLG Oz Ltd ($ASX:MLG)

MLG Oz Ltd is an Australian publicly-traded company that provides a range of services in the media and entertainment industries. The company’s market cap currently stands at 56.81M as of 2022, with a Return on Equity (ROE) of 3.46%. This market cap is relatively small compared to other public companies, but its ROE indicates that the company has been able to generate a moderate amount of income from the equity it has invested in its businesses. The company has been able to maintain a positive return on its investments, making it an attractive investment for those looking to diversify their portfolios.

– Norsk Hydro ASA ($OTCPK:NHYDY)

Norsk Hydro ASA is a Norwegian aluminum and renewable energy company. It is one of the largest aluminum companies in the world and is active in the production and sale of primary aluminum, rolled and extruded aluminum products, and energy products. As of 2022, Norsk Hydro ASA had a market capitalization of 14.38B, making it one of the largest publicly traded companies in Norway. Furthermore, its Return on Equity (ROE) was 23.31%, indicating that Norsk Hydro ASA was able to generate a high return on its shareholders’ investments.

Summary

Alumina Limited is an aluminium producer headquartered in Australia. Its stock performance over the last year has seen mixed results, with a slight decrease in market value. The company reported a net income of USD 0.7 million for both the current and prior year, remaining unchanged. Overall, Alumina Limited appears to be a safe investment for investors looking for steady returns and minimal risk.

Recent Posts