Mosaic Company Stock Fair Value Calculation – JPMorgan Cuts Mosaic Rating to Neutral Amid Concerns of Profitability

April 8, 2023

Trending News 🌥️

JPMorgan recently downgraded the rating of Mosaic Company ($NYSE:MOS) from Outperform to Neutral due to concerns about their profitability. Mosaic Company is a leading global provider of crop nutrients and animal nutrition products. JPMorgan’s decision to downgrade Mosaic’s stock symbol comes after the company posted weaker-than-expected earnings and a decline in gross margins. The dip in profits was due to higher costs from their nitrate production and distribution operations, as well as increased competition from their rivals. Furthermore, JPMorgan expressed their concern that Mosaic may struggle to expand into new markets, as well as maintain their market share in existing ones.

With Mosaic’s rating downgraded to Neutral, analysts are advising investors to take a wait-and-see approach on the company. While there is some potential for the stock to bounce back, JPMorgan cautions that there is no guarantee of future success. As such, investors would be wise to keep an eye on Mosaic’s performance and adjust their portfolios accordingly.

Stock Price

On Thursday, JPMorgan downgraded their rating of MOSAIC COMPANY from Overweight to Neutral, citing concerns that the company’s profitability may be at risk. The news resulted in the company’s stock price dropping 5.7%, from its last closing price of 46.3 to 44.6 at opening and 43.7 at closing. This news put a damper on the company’s stock performance, as investors have become increasingly wary of the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mosaic Company. More…

| Total Revenues | Net Income | Net Margin |

| 19.13k | 3.58k | 18.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mosaic Company. More…

| Operations | Investing | Financing |

| 3.94k | -1.26k | -2.68k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mosaic Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.39k | 11.19k | 35.55 |

Key Ratios Snapshot

Some of the financial key ratios for Mosaic Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.0% | 135.3% | 25.2% |

| FCF Margin | ROE | ROA |

| 14.1% | 25.4% | 12.9% |

Analysis – Mosaic Company Stock Fair Value Calculation

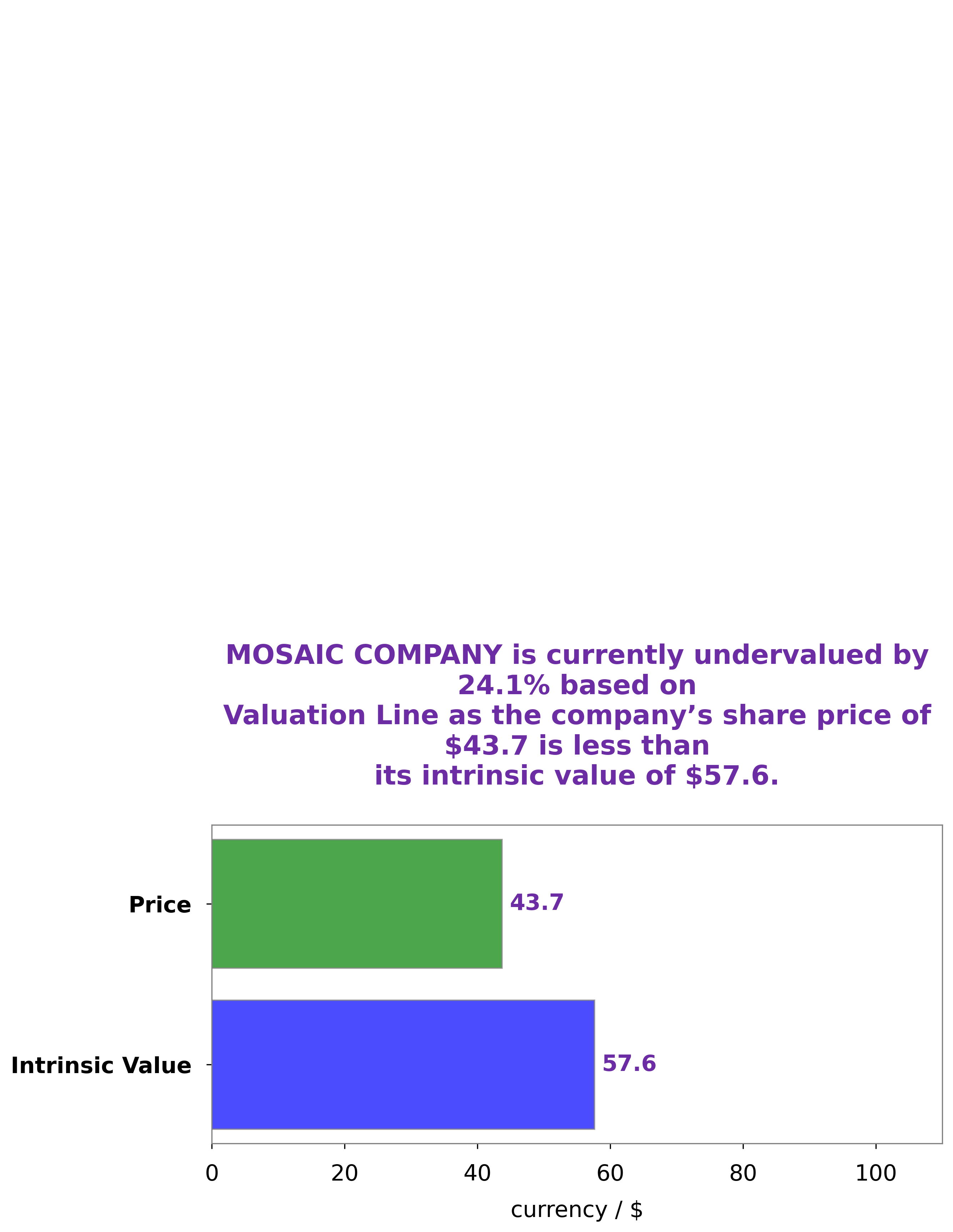

GoodWhale has studied the financials of MOSAIC COMPANY and conducted a financial analysis to determine the intrinsic value of their stock. Our proprietary Valuation Line Indicator shows that the intrinsic value of a MOSAIC COMPANY share is around $57.6. Currently, MOSAIC COMPANY stock is trading at $43.7, which means that it is undervalued by 24.1%. This could be a great opportunity for investors who are looking to benefit from potential upside in the stock price. More…

Peers

The company operates mines, production facilities, and distribution centers in the United States, Canada, and South America. The Mosaic Co’s competitors include CF Industries Holdings Inc, Nutrien Ltd, Corteva Inc.

– CF Industries Holdings Inc ($NYSE:CF)

CF Industries Holdings, Inc. is a holding company. The Company, through its subsidiaries, is engaged in the manufacture and distribution of nitrogen fertilizers. It operates through two segments: Nitrogen Fertilizers and Nitrogen Fertilizer Intermediates. The Company’s nitrogen fertilizers include ammonia, granular urea, urea ammonium nitrate and ammonium nitrate. The Company produces nitrogen fertilizer intermediates, including nitric acid and soda ash. It also owns and operates a natural gas liquids (NGL) business, which consists of its equity investment in Grande Prairie Pipelines Limited Partnership (GPP), which owns and operates a 1,912-mile pipeline system that transports NGLs from western Canada to the United States Gulf Coast.

– Nutrien Ltd ($TSX:NTR)

Nutrien Ltd is a Canadian agricultural company that produces and distributes crop nutrients. It is the largest fertilizer company in the world with a market cap of 60.94B as of 2022. The company has a strong focus on sustainable agriculture and has a return on equity of 23.76%.

– Corteva Inc ($NYSE:CTVA)

Corteva Inc is a publicly traded company with a market capitalization of $45.19 billion as of 2022. The company has a return on equity of 5.63%. Corteva Inc is a leading provider of crop protection and seed products. The company’s products are used by farmers to improve crop yields and protect against pests and diseases. Corteva’s products are sold in more than 130 countries around the world.

Summary

Mosaic Company is a multinational fertilizer producer and distributor. In recent news, JPMorgan downgraded the stock’s rating from “overweight” to “neutral”, citing a less optimistic outlook on profits. This caused the stock price to fall the same day, making it a volatile investment opportunity. Analysts suggest that investors should wait to see if the company can improve its outlook by taking proactive steps to increase efficiency and reduce costs. With a dividend yield of more than 4%, investors may also be interested in the potential for income growth over time. In the likely event that Mosaic Company can improve its profitability, the stock price could potentially rebound.

However, investors should keep a close eye on the company’s news and performance before making any long-term decisions.

Recent Posts