Ault Alliance Realizes Profits by Selling Prime St. Petersburg Property

June 18, 2023

☀️Trending News

Ault Alliance ($NYSEAM:AULT), a leading real estate investment firm, is realizing profits by selling prime property located in St. Petersburg, Russia. The company specializes in offering high quality and profitable properties to investors and businesses. Over the past several years, Ault Alliance has targeted the St. Petersburg area for its potential to yield excellent returns on investments, and their success has been evident. With a long-standing reputation for success in the real estate market, Ault Alliance has become a trusted name in the industry. Ault Alliance has consistently demonstrated their expertise when it comes to finding prime real estate investments. The firm has a thorough understanding of the local market and is always able to identify the areas that have the greatest potential for profit.

Ault Alliance has established relationships with several prominent developers in the area, allowing them to secure exclusive deals and make the most of their investments. The company’s success in St. Petersburg does not come as a surprise, as it is known for its vibrant culture and economic opportunities. Ault Alliance has been able to capitalize on the city’s thriving real estate market and turn it into a lucrative business opportunity. With a portfolio of prime properties, they have managed to generate significant profits for their investors. As a result, Ault Alliance has become one of the most successful real estate firms in the region.

Share Price

On Thursday, the AULT ALLIANCE stock opened at $9.3 and closed at $8.5, representing a drop of 7.0% from its previous closing price of $9.1. This was due to the company’s recent announcement that it will be selling its prime St. Petersburg property for a large profit. The property, which is estimated to yield a significant return for the company, is expected to be sold within the next few weeks. This is an important move for AULT ALLIANCE as it emphasizes its mission to grow and diversify its portfolio. The financial gains of this sale will be a welcome boost to the company’s bottom line and may lead to further investment opportunities for shareholders.

The sale of the property will also provide the company with capital to expand its operations and pursue new opportunities. Overall, the sale of the St. Petersburg property is an indication of AULT ALLIANCE’s commitment to maximizing its profits and providing value to its investors. With the expected proceeds of this sale, AULT ALLIANCE will be able to continue its growth and meet its strategic goals in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ault Alliance. More…

| Total Revenues | Net Income | Net Margin |

| 132.69 | -202.31 | -67.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ault Alliance. More…

| Operations | Investing | Financing |

| 4.79 | -132.64 | 93.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ault Alliance. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 526.91 | 217.89 | 119.84 |

Key Ratios Snapshot

Some of the financial key ratios for Ault Alliance are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 71.4% | – | -141.8% |

| FCF Margin | ROE | ROA |

| -56.7% | -63.1% | -22.3% |

Analysis

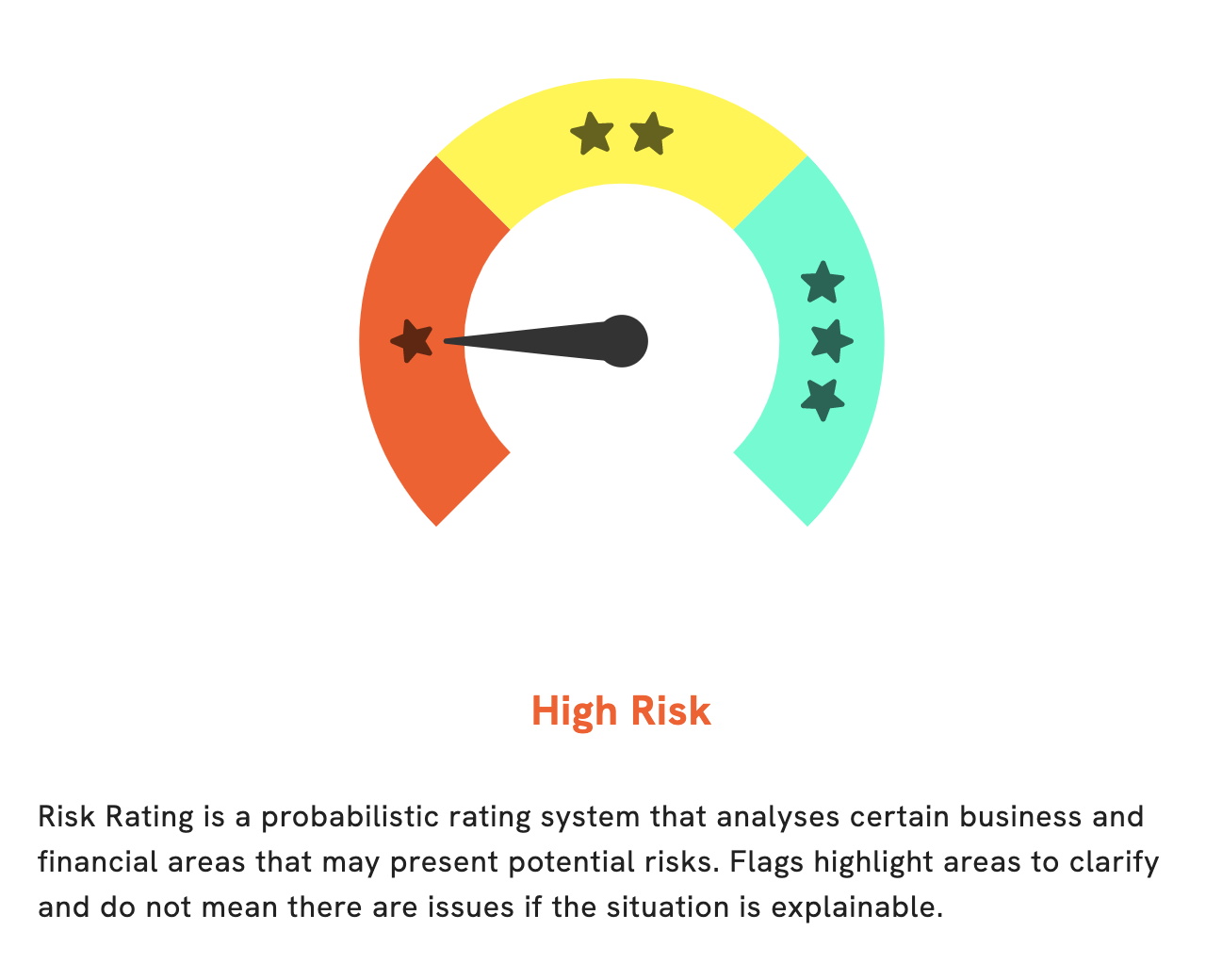

At GoodWhale, we have conducted an analysis of AULT ALLIANCE‘s financials. As part of our analysis, we have detected 2 risk warnings in the income sheet and balance sheet. If you would like to take a closer look at these risk warnings, be sure to register with us. More…

Peers

The competition between Ault Alliance Inc and its competitors, Data Patterns (India) Ltd, Kaman Corp, and Bharat Electronics Ltd, is fierce. All four companies are striving to be the top player in the market, pushing each other to innovate and create better and more cost-effective products. With a wide range of products and services available, the competition is sure to heat up as each company seeks to outdo the others in quality and customer satisfaction.

– Data Patterns (India) Ltd ($BSE:543428)

Data Patterns (India) Ltd is an Indian engineering services firm that provides product design and development, prototyping, and testing services. The company has a market capitalization of 75.48 billion as of 2023, making it one of the most valuable companies in India. In addition, the company has a strong Return on Equity of 19.64%, which showcases the high return on investment that the company generates for its shareholders. Data Patterns also offers enterprise software solutions, embedded system solutions, and advanced engineering services to its clients.

– Kaman Corp ($NYSE:KAMN)

Kaman Corp is a diversified industrial company that operates in aerospace, distribution, and industrial markets. As of 2023, Kaman Corp has a market capitalization of 676.66M. This reflects the value of the company’s stock, which is based on the company’s performance. In addition, Kaman Corp has a Return on Equity of 3.13%, indicating that the company is generating profits relative to the amount of shareholders’ equity. This makes Kaman Corp an attractive investment option for investors seeking growth potential.

– Bharat Electronics Ltd ($BSE:500049)

Bharat Electronics Ltd is an Indian state-owned aerospace and defence company headquartered in Bengaluru, India. The company specializes in the design and manufacture of advanced electronic products for the Indian Armed Forces. As of 2023, the company has a market capitalization of 700.28 billion and a return on equity of 17.83%. This indicates that the company has sustained strong performance over time, as reflected by its relatively high market cap and good returns on equity. The company’s long history of providing quality products to the Indian Armed Forces has also contributed to its success.

Summary

Investors in AULT ALLIANCE are likely to have mixed feelings about the company’s recent decision to sell prime real estate in St. Petersburg, as the stock price took a hit on the same day. To further evaluate the company’s prospects, investors should look into its overall business strategy and financial performance. This includes analyzing its current income sources and any long-term plans to focus on different business segments.

Investors should also consider the volatility of the market and the current risks that come with investing in AULT ALLIANCE. By staying informed and taking all of these factors into account, investors can make an informed decision when evaluating AULT ALLIANCE as a potential investment opportunity.

Recent Posts