Ziff Davis Aims for Slight Growth by 2023

May 16, 2023

Trending News ☀️

Over the years, Ziff Davis ($NASDAQ:ZD) has become one of the largest digital media, eCommerce, and technology companies in the world. Recently, the company has set its sights on a modest growth rate in the next few years. The goal of Ziff Davis is to see a slight increase in its current performance by 2023. The company is focusing on multiple strategies to do this. Ziff Davis is investing in new technology and also looking for ways to monetize its content.

In addition, it is actively exploring new opportunities for growth, such as expanding its eCommerce offerings and finding new ways to engage with customers. The company’s focus on growth is a reflection of its commitment to innovation and success. It is aiming to become a leader in the digital media, eCommerce, and technology space and is taking steps to ensure that it can reach its goals. With its ambitious plans for the future, Ziff Davis is sure to continue to make an impact in the industry for years to come.

Share Price

On Monday, Ziff Davis opened its stock at $62.9 and closed at $63.8, representing a 1.8% increase from its last closing price of $62.7. This slight growth is indicative of Ziff Davis’ ambitious goal of achieving more substantial growth by 2023. The company is expecting to capitalize on their industry-leading solutions to increase their market share and grow their revenue by the end of the next three years.

Ziff Davis has committed to investing heavily in research and development, as well as expanding its customer base through strategic partnerships to ensure that their goals are met. They are confident that the strategies they plan to implement will result in greater success for the company in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ziff Davis. More…

| Total Revenues | Net Income | Net Margin |

| 1.38k | 31.58 | 6.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ziff Davis. More…

| Operations | Investing | Financing |

| 335.24 | -200.92 | -29.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ziff Davis. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.53k | 1.63k | 40.07 |

Key Ratios Snapshot

Some of the financial key ratios for Ziff Davis are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.5% | -7.6% | 9.4% |

| FCF Margin | ROE | ROA |

| 16.6% | 4.3% | 2.3% |

Analysis

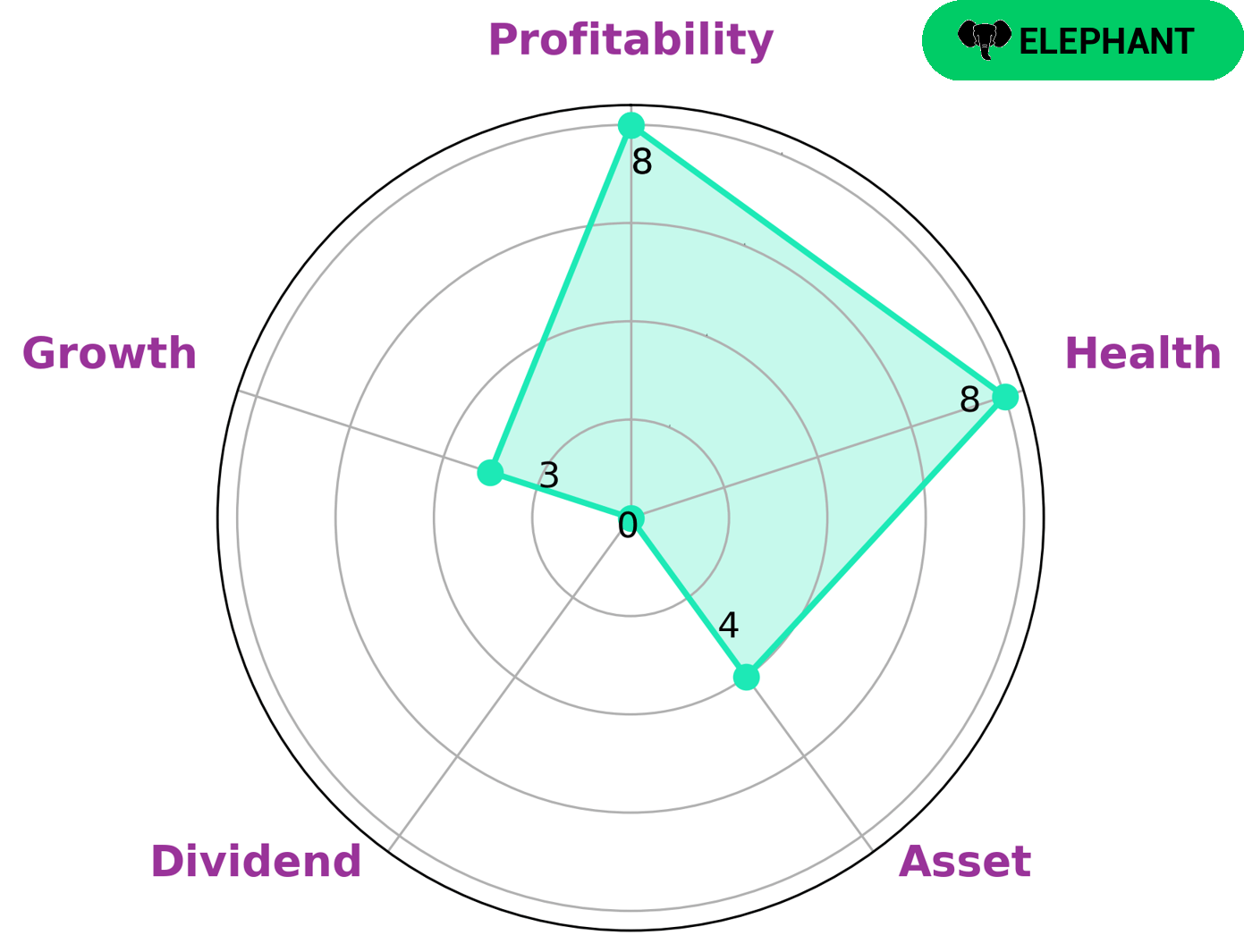

At GoodWhale, we conducted an analysis of ZIFF DAVIS‘s financials and classified the company as an ‘elephant’ – a type of company that is rich in assets after deducting off liabilities. This indicates that ZIFF DAVIS has a strong financial health and thus makes it attractive to various types of investors. Our assessment of ZIFF DAVIS further states that the company has a high health score of 8/10 with regard to its cashflows and debt. This demonstrates that ZIFF DAVIS is capable to sustain future operations in times of crisis. Additionally, our analysis reveals that the company is strong in profitability and medium in asset, but relatively weak in dividend and growth. All in all, these findings indicate that ZIFF DAVIS is a reliable and attractive investment opportunity for those looking to invest in a financially stable company. More…

Peers

In the world of publishing and media, there is intense competition between companies to maintain the highest levels of quality and profitability. One such company is Ziff Davis Inc, which faces stiff competition from the likes of Salem Media Group Inc, Fame Productions Inc, and PT Media Nusantara Citra Tbk. While each company has its own unique strengths and weaknesses, all are striving to be the best in the business.

– Salem Media Group Inc ($NASDAQ:SALM)

Salem Media Group is a publicly traded radio broadcasting company in the United States. The company owns and operates radio stations in small and mid-sized markets. Salem Media Group also owns and operates Salem Radio Network, a syndicated talk radio service. The company was founded in 1985 and is headquartered in Camarillo, California.

– Fame Productions Inc ($OTCPK:FMPR)

PT Media Nusantara Citra Tbk is one of the largest media companies in Indonesia. The company is involved in the production, distribution, and broadcasting of television programs, movies, and music. The company also owns and operates a number of radio and television stations. PT Media Nusantara Citra Tbk has a market cap of 10.52T as of 2022, a Return on Equity of 12.38%.

Summary

Ziff Davis is aiming for slight positive growth in their profits by 2023. This is based on an analysis of their financials and businesses, with the potential for stronger returns depending on future market conditions. Investments have been made in new product lines, with an emphasis on digital-first initiatives. Strategic partnerships have been formed to accelerate growth, and cost-cutting measures have been employed to maintain an efficient operation.

An increased focus has been placed on customer experience and developing innovative solutions that keep customers engaged. Overall, Ziff Davis is looking to the future with optimism, hoping to realize sustained success in the coming years.

Recent Posts