Magnite Intrinsic Value – Magnite to Restructure Global Workforce After SpotX Acquisition

April 26, 2023

Trending News 🌥️

MAGNITE ($NASDAQ:MGNI), a digital advertising marketplace, announced on Thursday in a regulatory filing that following its acquisition of SpotX, it will reduce its global workforce by 6% to remove any duplicate roles. The move is part of Magnite‘s overall strategy to create the world’s largest open exchange for the programmatic buying and selling of video advertising and become a leader in the digital advertising industry. With the addition of SpotX, Magnite’s inventory has grown to more than 25 billion monthly impressions across all devices, making it one of the largest exchanges in the world. In addition to reducing its global workforce, Magnite has said it plans to make other cost-cutting moves and optimize its organizational structure. The company has indicated that the restructuring should help it to maintain a strong financial footing and better position itself for future growth.

The changes should also help the company to more effectively compete in the highly competitive digital advertising industry. By restructuring its global workforce, Magnite is aiming to ensure that it has an efficient and effective organization in place to capitalize on the opportunities provided by the SpotX acquisition. In doing so, Magnite is taking a bold step to become a leader in the digital advertising space and create a one-stop-shop for companies looking to buy and sell digital ads.

Market Price

On Monday, MAGNITE announced their plans to restructure the global workforce after the acquisition of SpotX. As a result of this news, MAGNITE stock opened at $9.4 and closed at $8.9, a drop of 5.5% from its prior closing price. This restructuring is set to help MAGNITE better align with the organization’s strategy, as well as create efficiencies in their operations and cost structure. The restructuring will include the consolidation of certain positions, relocation of some job functions to a more cost-effective location, and the elimination of certain open roles.

In response to the restructuring news, MAGNITE has committed to providing impacted employees with comprehensive support throughout the transition, including severance packages and outplacement assistance. The company is confident that with these changes, they will be able to better serve their customers while also achieving long-term cost savings. Magnite_to_Restructure_Global_Workforce_After_SpotX_Acquisition”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Magnite. More…

| Total Revenues | Net Income | Net Margin |

| 577.07 | -130.32 | -21.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Magnite. More…

| Operations | Investing | Financing |

| 192.55 | -65.15 | -30.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Magnite. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.71k | 1.92k | 5.9 |

Key Ratios Snapshot

Some of the financial key ratios for Magnite are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 54.5% | – | -18.3% |

| FCF Margin | ROE | ROA |

| 25.7% | -8.2% | -2.4% |

Analysis – Magnite Intrinsic Value

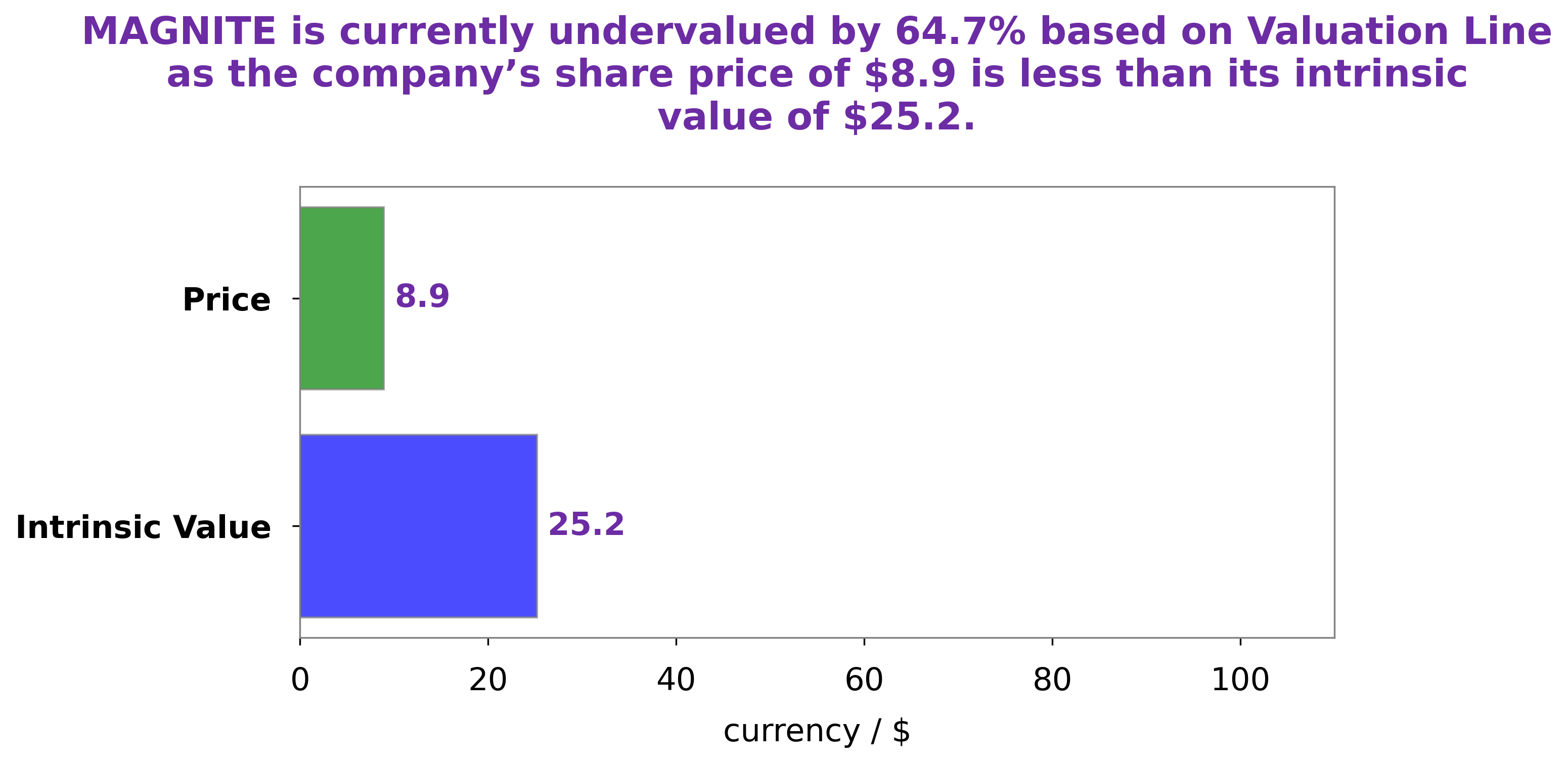

We at GoodWhale conducted an analysis of MAGNITE’s financials and have come up with a fair value of its stock of around $25.2. This figure was calculated using our proprietary Valuation Line. At the time of writing, MAGNITE’s stock is being traded at $8.9, meaning that it is undervalued by an astounding 64.7%. It’s possible to take advantage of this significant discrepancy by buying into the stock while it’s still trading at its current low price. Magnite_to_Restructure_Global_Workforce_After_SpotX_Acquisition”>More…

Peers

Headquartered in San Francisco, California, United States, the company was founded in 2006. Magnite is a leading independent technology platform for buyers and sellers of digital advertising. The company’s mission is to power the ecosystem of digital advertising with innovative technology that makes transactions more efficient, effective, and valuable for all participants. Magnite’s competitors include Direct Digital Holdings Inc, Integral Ad Science Holding Corp, and Quotient Technology Inc.

– Direct Digital Holdings Inc ($NASDAQ:DRCT)

As of 2022, Direct Digital Holdings Inc has a market cap of 8.19M and a Return on Equity of 49.62%. The company is a provider of digital direct-to-consumer products and services. Its products and services include online marketing, e-commerce, and software-as-a-service solutions. The company’s customers are located in the United States, Canada, Europe, Asia, Australia, and South America.

– Integral Ad Science Holding Corp ($NASDAQ:IAS)

Integral Ad Science Holding Corp. is a technology company that provides data and analytics to the global online advertising industry. The company’s technology platform enables its customers to optimize their advertising campaigns and to measure their return on investment. The company was founded in 2009 and is headquartered in New York, New York.

– Quotient Technology Inc ($NYSE:QUOT)

Quotient Technology Inc is a provider of digital coupons and advertising solutions. Its solutions enable marketers and retailers to connect with consumers through digital channels. The company’s solutions include digital coupons, loyalty programs, and mobile marketing campaigns. Quotient Technology Inc has a market cap of 311.33M as of 2022, a Return on Equity of -22.8%. The company’s solutions help marketers and retailers connect with consumers through digital channels. The company’s solutions include digital coupons, loyalty programs, and mobile marketing campaigns.

Summary

Magnite (MAGN) has recently announced a 6% reduction in its global workforce due to the acquisition of SpotX. This is expected to improve the company’s efficiency and cost structure. As a result, the stock price dropped on the news. Investors should watch for potential upside from cost savings, but also be aware of the potential negative impact on employee morale and customer service.

The duration and magnitude of these effects remain to be seen. In the short term, investors should take a wait and see approach to determine the long-term impact of this cost-cutting measure on Magnite’s profitability.

Recent Posts