Deluxe Corporation Reports USD 571.7 Million in Revenue for Second Quarter of FY2023, a 1.5% Increase from Last Year

August 27, 2023

☀️Earnings Overview

On June 30 2023, DELUXE CORPORATION ($NYSE:DLX) announced their second quarter earnings results for FY2023. Total revenue increased by 1.5% year-on-year to USD 571.7 million, although net income decreased by 25.8% to USD 16.4 million compared to the same period in the previous year.

Analysis

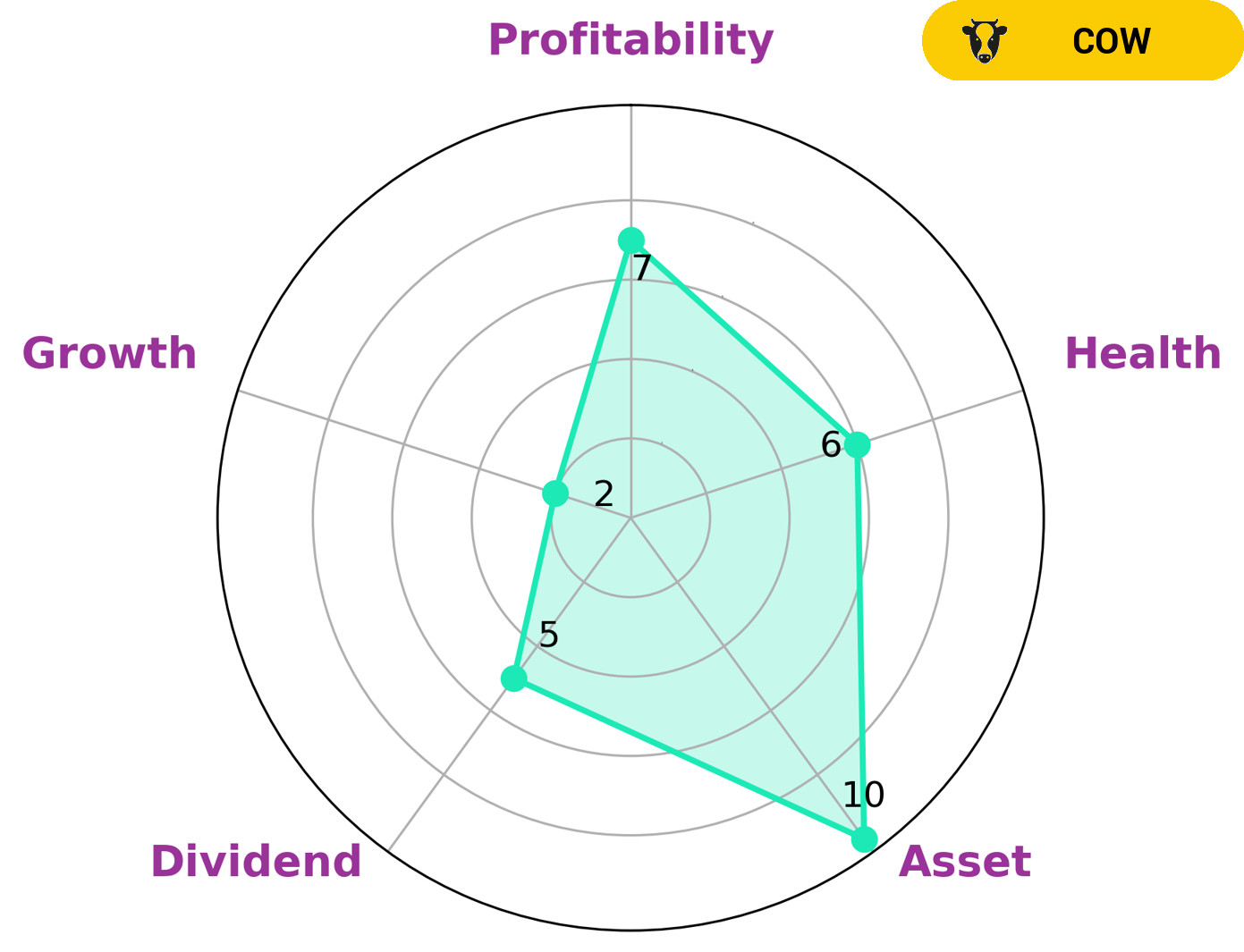

GoodWhale’s analysis of DELUXE CORPORATION‘s fundamentals shows that the company is strong in terms of assets and profitability, while being medium in terms of dividend. Its growth rate was found to be weak. The health score of DELUXE CORPORATION was 7/10, which indicates it is capable to sustain operations in times of crisis with its cash flows and debt. Based on this evaluation, DELUXE CORPORATION has been classified as a ‘cow’, a company which has the track record of paying out consistent and sustainable dividends. This type of company may be of interest to investors who are looking for steady returns and capital appreciation over time. These investors may be confident in such a company’s ability to generate a stable stream of income and maintain consistent profitability. Moreover, investors who are seeking capital appreciation would also likely be interested in DELUXE CORPORATION due to its strong assets and stability. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Deluxe Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.24k | 52.77 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Deluxe Corporation. More…

| Operations | Investing | Financing |

| 166.64 | -97.75 | -65.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Deluxe Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.92k | 2.31k | 14.12 |

Key Ratios Snapshot

Some of the financial key ratios for Deluxe Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.3% | -5.7% | 8.2% |

| FCF Margin | ROE | ROA |

| 2.1% | 19.0% | 3.9% |

Peers

Deluxe Corp is in the business of providing software solutions. Its competitors are Ilkka Oyj, Specificity Inc, and DM Solutions Co Ltd.

– Ilkka Oyj ($LTS:0IGW)

Ilkka Oyj is a Finnish company that produces and supplies wood products. It has a market cap of 110.82M as of 2022 and a Return on Equity of 2.9%. The company is involved in the production of lumber, pulp, paper, and energy. It also provides services related to forestry, real estate, and environmental protection.

– Specificity Inc ($OTCPK:SPTY)

Based in New York, Specificity Inc is a biotechnology company that focuses on the development of cancer treatments. The company has a market capitalization of 11.71 million as of 2022 and a return on equity of 189.94%. Specificity Inc’s products are designed to target specific types of cancer cells, which the company believes will result in more effective and less toxic treatments. In addition to its cancer treatments, Specificity Inc is also developing treatments for other diseases, such as Alzheimer’s disease and Parkinson’s disease.

– DM Solutions Co Ltd ($TSE:6549)

The company’s market cap as of 2022 is 2.39B, and its ROE is 5.37%. The company provides software development services and solutions.

Summary

DELUXE CORPORATION reported their second quarter earnings results for FY2023, with total revenue of USD 571.7 million, representing a 1.5% growth from the prior year. Net income was USD 16.4 million, a 25.8% decrease year-on-year. Despite the decline in net income, the stock price moved upward on the same day, indicating that investors are still confident in the company’s prospects. Investors should continue to monitor the performance of DELUXE CORPORATION to assess the potential value of their investment.

Recent Posts