Waste Management Q4 Non-GAAP EPS Misses $0.12 in 2023

February 2, 2023

Trending News 🌧️

Waste Management ($NYSE:WM) is a publicly traded company based in Houston, Texas. It is one of the world’s largest integrated waste management companies, providing collection, recycling and disposal services to residential, commercial, industrial and municipal customers. In the fourth quarter of 2023, Waste Management reported a Non-GAAP Earnings Per Share (EPS) of $1.30, which fell short of expectations by $0.12. This missed EPS was due to several factors.

First, the company faced higher costs for fuel and other operating expenses. Second, the amount of recycled materials sold was lower than expected. Finally, there were higher costs associated with fleet and equipment maintenance and repairs. Waste Management is working hard to reduce these costs and improve their bottom line. They are increasing their recycling efforts by collecting more materials and finding new markets for them. They are also investing in technology to increase efficiency and reduce costs.

Additionally, they are expanding their fleet of trucks to keep up with customer demand. Despite the disappointing Q4 Non-GAAP EPS numbers, Waste Management is continuing to grow its business. They are making smart investments in technology and expanding their customer base. As a result, they are well-positioned for long-term success. With these strategies in place, Waste Management should be able to meet or exceed their earnings expectations in the future.

Market Price

Waste Management’s Q4 Non-GAAP earnings per share (EPS) fell short of the $0.12 expected in 2023, giving rise to mostly negative media exposure. On Wednesday, WASTE MANAGEMENT‘s stock opened at $150.1 and closed at $154.4, down by 0.2% from the previous closing price of 154.7. This was an unexpected setback for the company, as analysts had anticipated a positive performance. Waste Management’s stock has been on a rollercoaster ride since then, with investors uncertain as to what direction the company will take next. The company has been under pressure to make changes to its business model and improve its financial performance.

In addition, the company has recently invested heavily in new technologies and strategies to reduce waste and improve efficiency. Despite the current slump, Waste Management remains well-positioned in the global market for waste management services and products. Its strong market presence and robust portfolio of services and products are expected to drive long-term growth.

Additionally, its ongoing investments in advanced technologies and strategies to enhance sustainability are expected to contribute to future growth. As Waste Management continues to make changes and invest in new technologies and strategies, investors should continue to watch for signs of improvement in the company’s performance. In the meantime, analysts have advised caution when investing in Waste Management stocks, citing the uncertain market conditions and the company’s failure to meet expectations in Q4. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Waste Management. More…

| Total Revenues | Net Income | Net Margin |

| 19.44k | 2.25k | 11.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Waste Management. More…

| Operations | Investing | Financing |

| 4.48k | -2.82k | -1.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Waste Management. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.84k | 22.83k | 17.08 |

Key Ratios Snapshot

Some of the financial key ratios for Waste Management are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.0% | 6.2% | 16.8% |

| FCF Margin | ROE | ROA |

| 10.2% | 28.8% | 6.8% |

Analysis

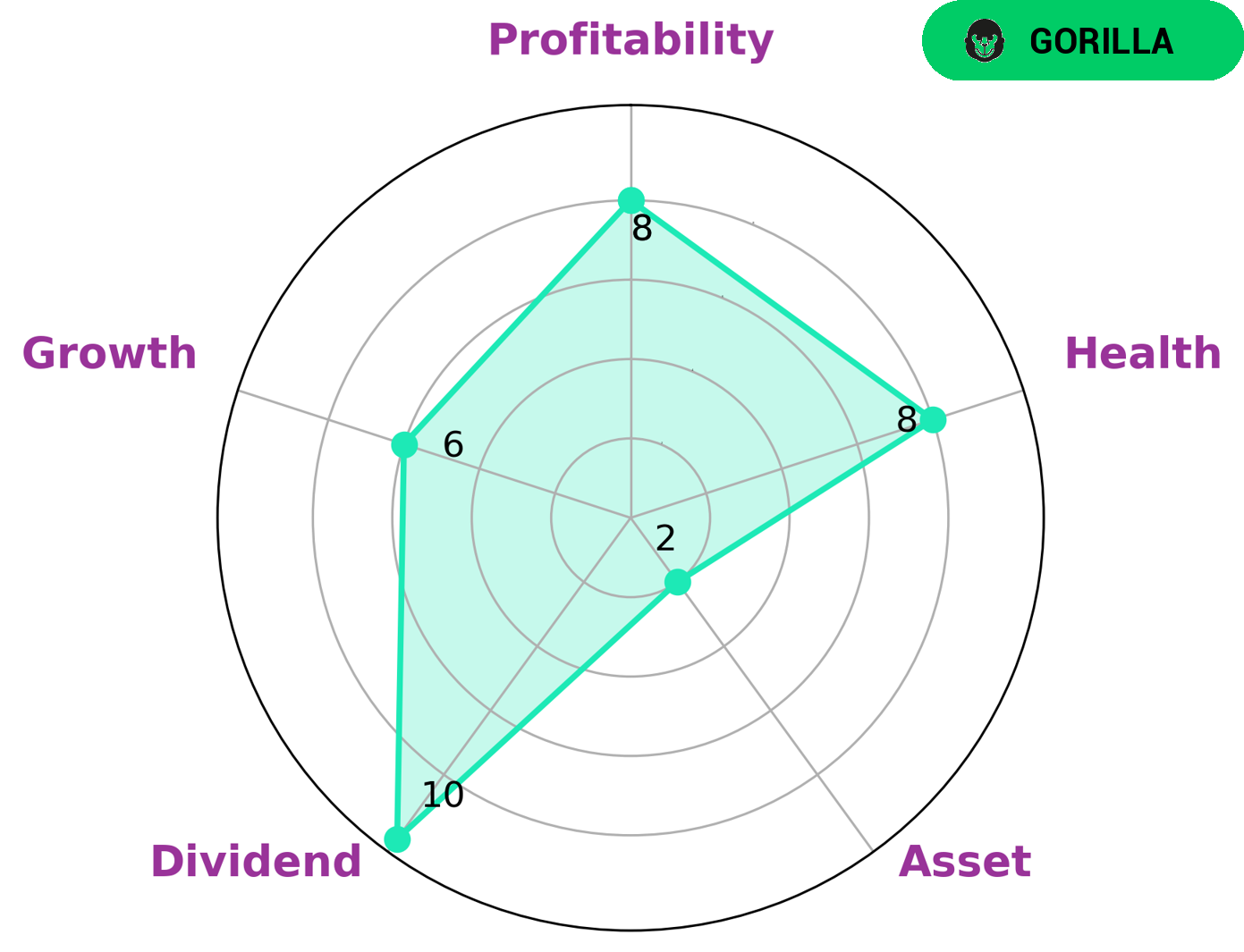

GoodWhale has conducted an analysis of WASTE MANAGEMENT‘s financials and based on Star Chart, the company has a high health score of 8/10 in terms of their cashflows and debt. This indicates that WASTE MANAGEMENT is capable to pay off their debt and fund future operations. This type of company may be attractive to investors who are looking for dividend income, steady profitability, and medium-level growth. However, it may not be suitable for investors looking for companies with high levels of asset growth. Overall, WASTE MANAGEMENT is a strong choice for investors who are looking for steady dividend income, high profitability, and medium-level growth. It may not be suitable for investors looking for high levels of asset growth. More…

Peers

It has many competitors, including Republic Services Inc, Waste Connections Inc, and Macau Capital Investments Inc.

– Republic Services Inc ($NYSE:RSG)

Republic Services is an American trash and recycling company. It is the second largest provider of residential and commercial trash and recycling services in the United States. The company’s revenue for 2020 was $9.75 billion. The company’s ROE for 2020 was 13.97%.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a provider of waste management services in North America. The company has a market cap of 34.1B as of 2022 and a return on equity of 9.38%. Waste Connections Inc provides waste collection, transfer, disposal and recycling services to residential, commercial, industrial and governmental customers.

Summary

Waste Management is a provider of waste management services and solutions. Recently, the company reported a Q4 Non-GAAP EPS miss of $0.12 in 2023. This news has caused negative sentiment among investors. Despite the recent news, Waste Management is still a solid investment opportunity. The company has a strong history of generating consistent returns, with a diversified portfolio of business lines across the waste management industry. Furthermore, Waste Management also offers attractive dividend yields and has a track record of raising its dividend payments, which should provide investors with long-term capital appreciation.

Additionally, the company boasts a relatively low debt-to-equity ratio, which reduces its risk profile and makes it appealing to investors looking to diversify their portfolios. Investing in Waste Management is a great way to diversify your portfolio and benefit from its long-term capital appreciation potential.

Recent Posts