Truist Financial Initiates Coverage on Republic Services with Positive Outlook

April 19, 2023

Trending News ☀️

Republic Services ($NYSE:RSG), one of the largest providers of non-hazardous solid waste collection, transfer, disposal, recycling, and energy services in the United States, has recently been the focus of a positive analyst report. On Monday, The Fly reported that analysts from Truist Financial have initiated coverage of Republic Services with a positive outlook. The company’s services are designed to help customers reduce the environmental impacts of the waste they generate and create a cleaner, healthier and safer world. Their offerings include collection and disposal services, recycling services, and organics services, as well as energy-from-waste facilities. The report from Truist Financial highlighted Republic Services’ strong financial position, with consistent cash flow.

This has allowed the company to invest in organic and strategic initiatives that have resulted in a record-high number of customers year over year. The analysts also praised the company’s strong management team for its ability to effectively manage costs and capitalize on growth opportunities. Overall, the positive outlook from Truist Financial for Republic Services reflects its strong financial position and potential for continued growth in the near future. With its commitment to providing sustainable waste solutions, Republic Services is well-positioned to continue to be a leader in the industry.

Stock Price

Opening at $138.8, Republic Services‘ stock closed the day at $137.6. The slight decline in stock price is most likely a result of investors taking profits and selling their shares following Truist’s announcement. Despite the slight dip in stock price, the overall outlook for Republic Services remains positive as Truist expects the company to continue to perform strongly in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Republic Services. More…

| Total Revenues | Net Income | Net Margin |

| 13.51k | 1.49k | 11.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Republic Services. More…

| Operations | Investing | Financing |

| 3.19k | -4.42k | 1.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Republic Services. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.05k | 19.37k | 30.64 |

Key Ratios Snapshot

Some of the financial key ratios for Republic Services are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.5% | 11.4% | 16.5% |

| FCF Margin | ROE | ROA |

| 12.8% | 14.5% | 4.8% |

Analysis

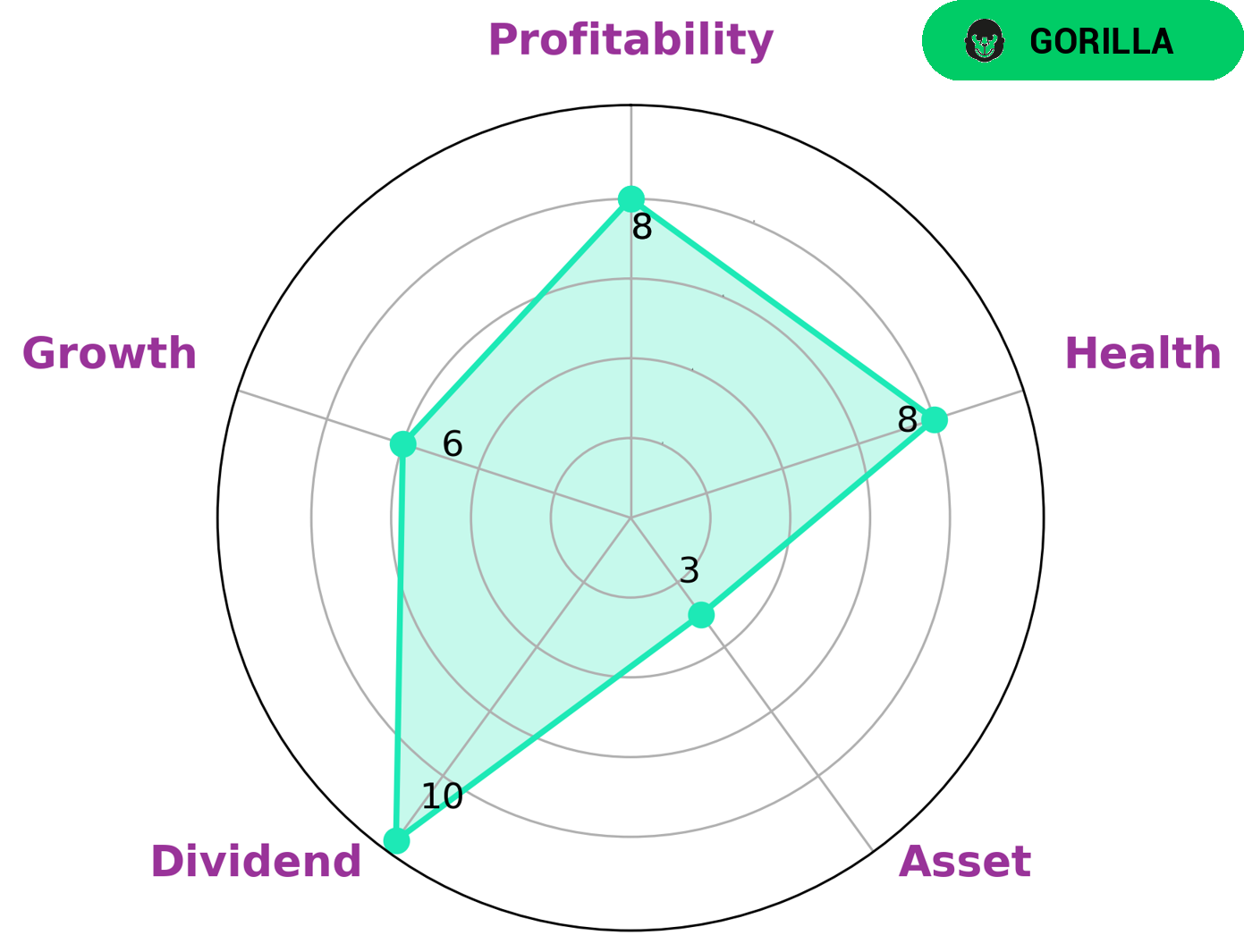

After analyzing REPUBLIC SERVICES’ financials, we at GoodWhale have classified it as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company typically attracts investors that are looking for long-term growth potential. REPUBLIC SERVICES also has a high health score of 8/10, which indicates that it is well-equipped to survive market downturns without the risk of bankruptcy. Specifically, our analysis reveals that it is strong in dividend, profitability, and medium in growth. However, its assets are relatively weak compared to the other metrics. These strong and weak points can be useful for investors looking for risk-adjusted returns. More…

Peers

Founded in 1998, Republic Services, Inc. is an industry leader in U.S. non-hazardous solid waste. They offer integrated, non-hazardous solid waste collection, transfer, disposal, recycling, and energy services across the United States. Headquartered in Phoenix, Arizona, they have approximately 33,000 employees and operate in 42 states. Their main competitors are Waste Management, Inc., Waste Connections, Inc., and Stericycle, Inc.

– Waste Management Inc ($NYSE:WM)

Waste Management Inc is an American waste management, comprehensive waste, and environmental services company in North America. The company is headquartered in Houston, Texas. It was founded in 1971.

Waste Management Inc has a market cap of 66.75B as of 2022. The company has a Return on Equity of 27.41%. Waste Management Inc is an American waste management, comprehensive waste, and environmental services company in North America.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a waste management company that has a market cap of 33.98B as of 2022. The company has a return on equity of 9.38%. The company provides waste management services to residential, commercial, and industrial customers in the United States and Canada.

– Stericycle Inc ($NASDAQ:SRCL)

Stericycle Inc is a provider of medical waste management services. The company has a market cap of 3.81B as of 2022 and a Return on Equity of 0.01%. Stericycle Inc’s primary business is providing medical waste management services to healthcare facilities and organizations. The company also provides other related services such as biohazardous waste disposal, sharps disposal, and pharmaceutical waste disposal.

Summary

Investing analysts at Truist Financial have recently released a report covering Republic Services. According to their analysis, the company is a sound investment opportunity, citing its strong and consistent financial performance, as well as its solid track record of delivering on strategic initiatives and growth opportunities. Truist Financial believes that Republic Services is well positioned to capitalize on the changing market dynamics and strong economic fundamentals over the coming years. Investors looking to add Republic Services to their portfolios are recommended to do so in order to benefit from the company’s long-term growth prospects.

Recent Posts