STERICYCLE Offers Effective Solutions for Sustainable Healthcare Waste Disposal in the Medical Waste Management Market

May 17, 2023

Trending News 🌧️

STERICYCLE ($NASDAQ:SRCL) is a leader in the medical waste management market, providing effective solutions for sustainable healthcare waste disposal. Their mission is to help healthcare facilities reduce their environmental impact while still meeting the needs of their patients and communities. These products are designed to reduce the amount of hazardous waste that is generated and prevent contamination from entering the environment. By using Stericycle‘s solutions, healthcare organizations can reduce their environmental footprint while still meeting the needs of their patients and communities. In addition to their medical waste management services, Stericycle also provides a range of other services such as sharps disposal systems, pharmaceutical waste management, and hazardous waste collection and transport.

With their comprehensive approach, Stericycle helps healthcare organizations meet all of their environmental obligations while continuing to provide exceptional patient care. Stericycle is also a publicly traded company on the Nasdaq exchange under the symbol SRCL. This allows investors to purchase shares of the company and benefit from the success of its products and services.

Price History

On Monday, STERICYCLE stock opened at $43.6 and closed at $43.7, up by 0.9% from prior closing price of 43.3, reflecting the company’s place in the medical waste management market. STERICYCLE provides effective solutions to help healthcare organizations and facilities reduce their environmental impact and improve patient safety. The company offers a range of products, such as hazardous waste containers, sharps disposal systems, and biomedical waste containers that are designed to simplify and standardize the collection, segregation, and storage of medical waste.

In addition, STERICYCLE provides services that include regulatory compliance consulting, medical waste tracking and reporting, and waste stream audits. The company’s comprehensive solutions ensure that healthcare facilities can effectively manage their healthcare waste in a safe, cost-effective, and sustainable way. The company is committed to providing innovative solutions to help healthcare organizations improve their sustainability practices and protect patient safety. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stericycle. More…

| Total Revenues | Net Income | Net Margin |

| 2.72k | 81.4 | 2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stericycle. More…

| Operations | Investing | Financing |

| 288.5 | -82.3 | -202 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stericycle. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.33k | 2.89k | 26.47 |

Key Ratios Snapshot

Some of the financial key ratios for Stericycle are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.8% | 9.2% | 7.0% |

| FCF Margin | ROE | ROA |

| 5.8% | 4.9% | 2.2% |

Analysis

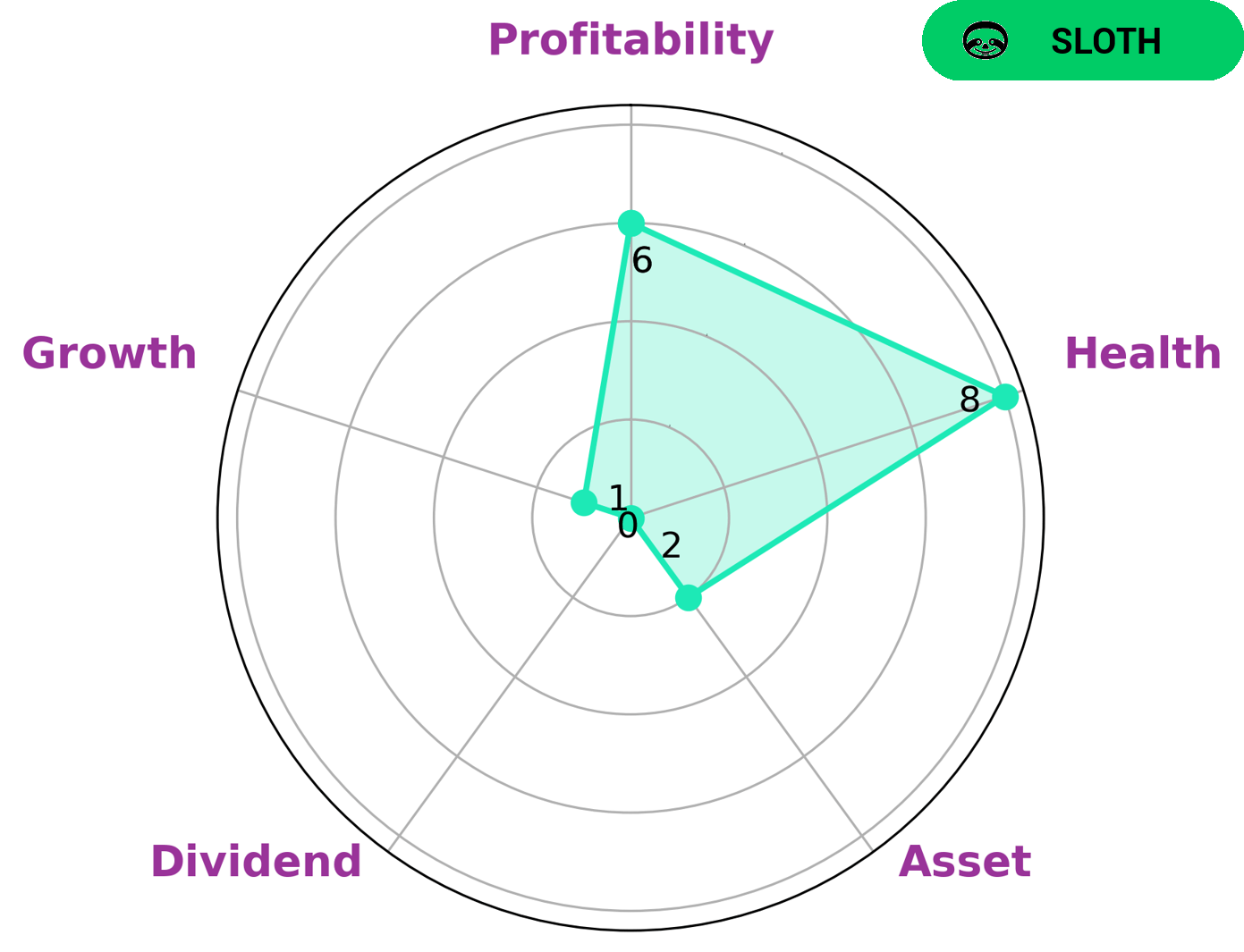

GoodWhale has conducted an analysis of STERICYCLE‘s wellbeing. According to their Star Chart, STERICYCLE is strong in their operations, medium in profitability, and weak in asset, dividend, and growth. Despite this, they have a high health score of 8/10 with regard to their cashflows and debt, indicating they are capable to sustain future operations even in times of crisis. Based on this analysis, we classify STERICYCLE as a ‘sloth’, a company which has achieved revenue or earnings growth slower than the overall economy. Investors looking for a slow but steady growth in the medium-term may be interested in investing in such companies. More…

Peers

Its competitors are Sunny Friend Environmental Technology Co, Waste Connections Inc, Waste Management Inc.

– Sunny Friend Environmental Technology Co ($TWSE:8341)

Sunny Friend Environmental Technology Co is a company that specializes in environmental technology. They have a market cap of 14.83B as of 2022 and a ROE of 25.67%. The company does research and development in the field of environmental technology in order to help preserve the environment.

– Waste Connections Inc ($NYSE:WCN)

Waste Connections Inc is a publicly traded company that provides waste management and environmental services in the United States, Canada, and Mexico. The company has a market capitalization of $33.42 billion as of April 2021 and a return on equity of 9.38%. Waste Connections Inc is the third largest waste management company in North America by revenue. The company’s main services include residential, commercial, and industrial waste collection; landfill operations; and recycling and resource recovery.

– Waste Management Inc ($NYSE:WM)

Waste Management Inc is a leading provider of comprehensive waste management services in North America. The company’s operations include solid waste collection, transfer, disposal, and recycling. Waste Management serves residential, commercial, industrial, and municipal customers in the United States and Canada.

Waste Management has a market capitalization of $63.71 billion as of 2022 and a return on equity of 28.78%. The company’s strong financial performance is driven by its diversified business model, which provides a stable stream of revenue and earnings. Waste Management’s diversified operations also provide a buffer against economic cycles. The company’s strong market position and financial stability have allowed it to weather the COVID-19 pandemic relatively well.

Summary

STERICYCLE is a leader in Healthcare Waste Management Solutions. Their investment analysis looks attractive with a strong position in the market and a wide range of services across different locations. The company has secured partnerships with local, state, and federal governments, and they are well positioned to continue to increase their market share. Their portfolio of advanced waste management solutions include on-site treatment, collection, transportation, reprocessing, and disposal services.

The company’s public offerings have been highly successful and offer investors an opportunity to benefit from their positive growth story. The company has a strong reputation for quality and reliability, which has enabled them to continue to develop new products and services that meet customer needs. Investors can take advantage of the company’s sound financials and competitive advantages to benefit from the continued growth in the sector.

Recent Posts