Li-cycle Holdings Stock Fair Value – Li-Cycle Holdings Reports Miss on Both Earnings and Revenue

May 16, 2023

Trending News 🌧️

LI-CYCLE ($NYSE:LICY): Li-Cycle Holdings (LICY), a leading global provider of sustainable technology-enabled recycling solutions, recently reported its fourth quarter financials and delivered a miss on both earnings and revenue. Li-Cycle Holdings reported a GAAP EPS of -$0.22, which was $0.05 lower than expected, and revenue of $3.6M, which was $2.73M lower than anticipated. Li-Cycle Holdings leverages its proprietary technology and established network of global partners to deliver sustainable recycling solutions that enable the recovery of critical materials and reduce reliance on virgin materials. The company operates across three distinct business units, including Lithium-ion Battery Recycling, Electronics Recycling and industrial Recycling.

Investors were particularly disappointed with the low earnings and revenue figures, as the company’s stock had been steadily rising prior to the announcement. Despite the poor performance in the fourth quarter, Li-Cycle Holdings remains one of the leading players in the sustainable technology-enabled recycling solutions space and is well-positioned to capitalize on the growth potential of the sector.

Earnings

In its earning report of FY2022 Q4 as of October 31 2022, LI-CYCLE HOLDINGS reported a miss on both earnings and revenue. The company earned 3.0M USD in total revenue and lost 33.9M USD in net income. This marks a 31.7% decrease in total revenue compared to the previous year.

Over the last three years, LI-CYCLE HOLDINGS’s total revenue increased significantly from 0.47M USD to 3.0M USD. Despite this, the company failed to meet analyst expectations for both earnings and revenue in the reported quarter.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Li-cycle Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 13.4 | -53.7 | -907.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Li-cycle Holdings. More…

| Operations | Investing | Financing |

| -72.6 | -190.1 | 244.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Li-cycle Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 882.3 | 388.2 | 2.81 |

Key Ratios Snapshot

Some of the financial key ratios for Li-cycle Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 552.8% | – | -272.4% |

| FCF Margin | ROE | ROA |

| -1960.4% | -4.5% | -2.6% |

Stock Price

The company’s stock opened at $4.8 and closed at $4.6, a drop of 7.9% from its prior closing price of $4.9. The company attributed this to increased costs associated with their expansion plans and lower-than-expected sales in some markets. Investors were disappointed by the results, and the company’s stock price fell sharply in response. Live Quote…

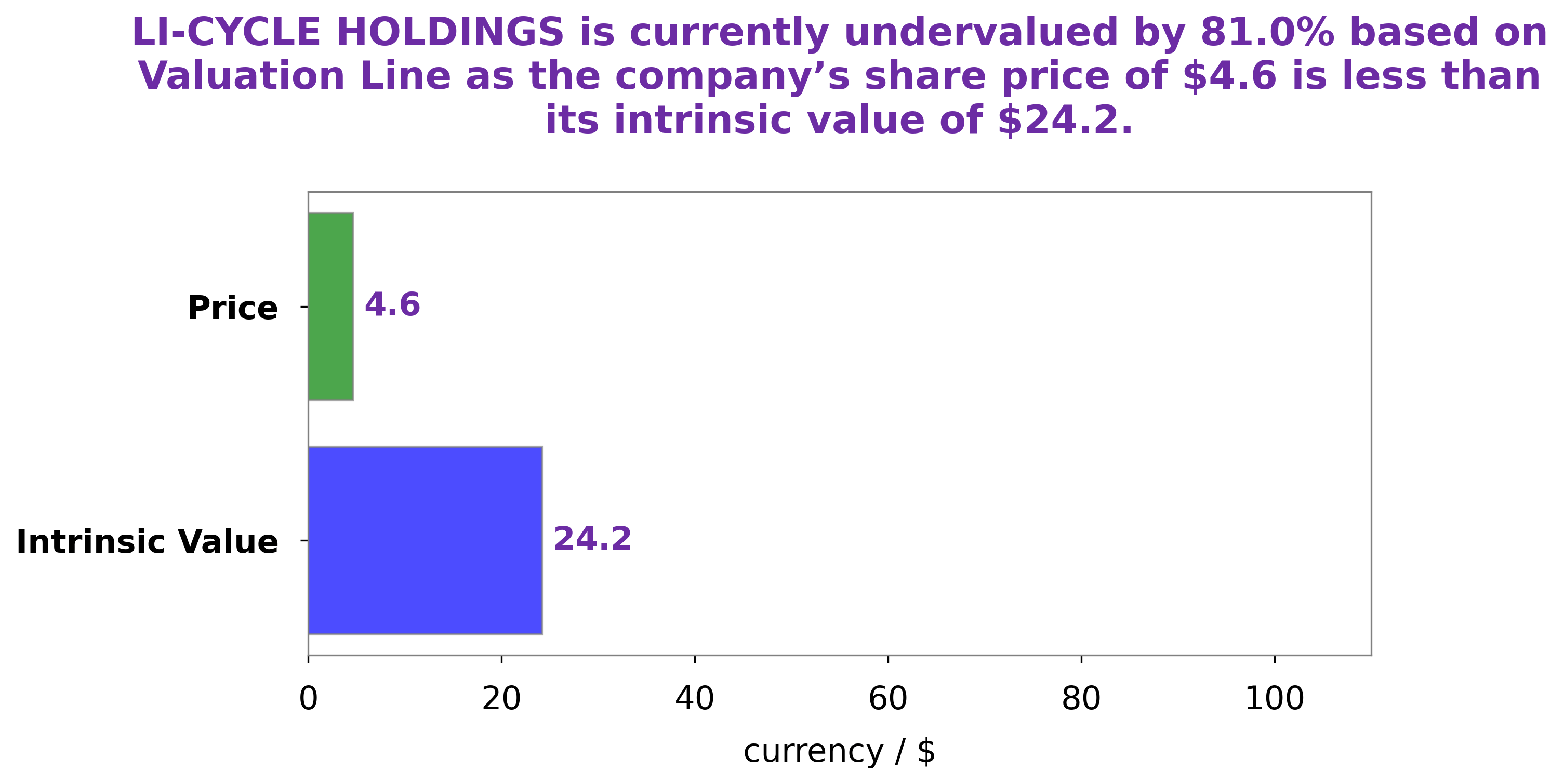

Analysis – Li-cycle Holdings Stock Fair Value

At GoodWhale, we have conducted a thorough analysis of LI-CYCLE HOLDINGS‘ financials. After carefully considering various metrics, our proprietary Valuation Line has determined that the fair value of LI-CYCLE HOLDINGS’ shares is around $24.2. However, the stock is currently traded at a price of $4.6, representing a discount of 81.0%. This indicates that LI-CYCLE HOLDINGS is currently significantly undervalued and presents an attractive long-term investment opportunity for investors. More…

Peers

In recent years, the competition between Li-Cycle Holdings Corp and its competitors has intensified. Guangzhou Great Power Energy&Technology Co Ltd, Flux Power Holdings Inc, and Beijing Easpring Material Technology Co Ltd have all been striving to gain market share in the lithium-ion battery recycling industry. While each company has its own strengths and weaknesses, Li-Cycle Holdings Corp has emerged as the clear leader in terms of market share and profitability.

– Guangzhou Great Power Energy&Technology Co Ltd ($SZSE:300438)

The company’s market capitalization is 31.9 billion as of 2022, and its return on equity is 7.8%. The company is engaged in the development, manufacture and sale of batteries, energy storage systems and other related products.

– Flux Power Holdings Inc ($NASDAQ:FLUX)

Founded in 2006, Flux Power Holdings, Inc. is a developer, manufacturer and marketer of advanced battery solutions for industrial applications, including electric forklifts, airport ground support equipment and other commercial electric vehicles. The company’s lithium-ion batteries are designed to provide safer and longer lasting performance than lead-acid batteries, as well as a lower total cost of ownership. Flux Power’s products are sold through a network of industrial equipment dealers and battery distributors.

As of 2022, Flux Power Holdings Inc had a market cap of 49.59M and a return on equity of -63.65%.

– Beijing Easpring Material Technology Co Ltd ($SZSE:300073)

Beijing Easpring Material Technology Co Ltd is a Chinese company that produces and sells materials for use in the semiconductor industry. The company has a market capitalization of $33.32 billion as of 2022 and a return on equity of 11.52%. Beijing Easpring is a leading supplier of silicon wafers, epitaxial wafers, and other semiconductor materials. The company’s products are used in the manufacture of integrated circuits, optoelectronic devices, and other semiconductor products.

Summary

The reported GAAP earnings per share (EPS) of -$0.22 missed analyst estimates by $0.05 and revenue of $3.6M missed estimates by $2.73M. As a result of this news, the stock price moved down the same day. Investors should take a deeper look into the company’s fundamentals to develop a more informed opinion about its future prospects. Furthermore, analyzing the company’s financial performance over time, competition, and industry trends should be reviewed to determine if it is a good long-term investment.

Additionally, investors should pay close attention to any future news that could affect the stock price in the short-term.

Recent Posts