Advent Technologies Heeds Going Concern Warning, Prepares to Raise Capital

April 4, 2023

Trending News 🌧️

Advent Technologies ($NASDAQ:ADN), a company that specializes in providing breakthrough energy solutions, has recently heeded a going concern warning and is now preparing to raise capital. In light of this warning, Advent Technologies may be looking to increase its access to capital in order to stay afloat. The going concern warning is a cautionary notice issued when a company is facing financial difficulties and may not be able to continue operations as usual. As such, Advent Technologies is taking steps to address the warning and prepare for the possibility of raising additional capital. This could be achieved through increasing their equity or debt-based funding, or even selling shares in the company. In any case, Advent Technologies is currently preparing to raise capital in order to address the current financial concerns.

Advent Technologies is committed to providing cutting edge energy solutions that are reliable and cost-effective. The company’s mission is to make energy usage more efficient and sustainable by introducing innovations that help reduce energy consumption and costs. With this in mind, Advent Technologies has been investing heavily into research and development in order to keep their products at the forefront of the industry. Despite the current warning, Advent Technologies is confident that with adequate capital, they will be able to continue providing reliable energy solutions for years to come.

Market Price

ADVENT TECHNOLOGIES, an American technology company based in California, recently issued a going concern warning as part of its quarterly filing with the Securities and Exchange Commission. According to the filing, the company is preparing to raise additional capital in order to fund its operations and establish a suitable capital structure. In response to the news, ADVENT TECHNOLOGIES’ stock price rose by 2.8% on Monday, with the stock opening at $1.0 and closing at $1.1, up from its last closing price of 1.1. This increase in stock price suggests that investors are optimistic about the company’s ability to raise the capital it needs, despite the going concern warning.

Going forward, ADVENT TECHNOLOGIES will need to carefully evaluate all available options for raising capital in order to ensure the company’s long-term viability and success. In the meantime, shareholders will be watching the company’s progress closely to see if it is able to successfully raise the necessary capital. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Advent Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 8.78 | -35.72 | -556.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Advent Technologies. More…

| Operations | Investing | Financing |

| -43.31 | -5.54 | -0.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Advent Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 127.49 | 20.1 | 2.08 |

Key Ratios Snapshot

Some of the financial key ratios for Advent Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -592.2% |

| FCF Margin | ROE | ROA |

| -552.7% | -28.8% | -25.5% |

Analysis

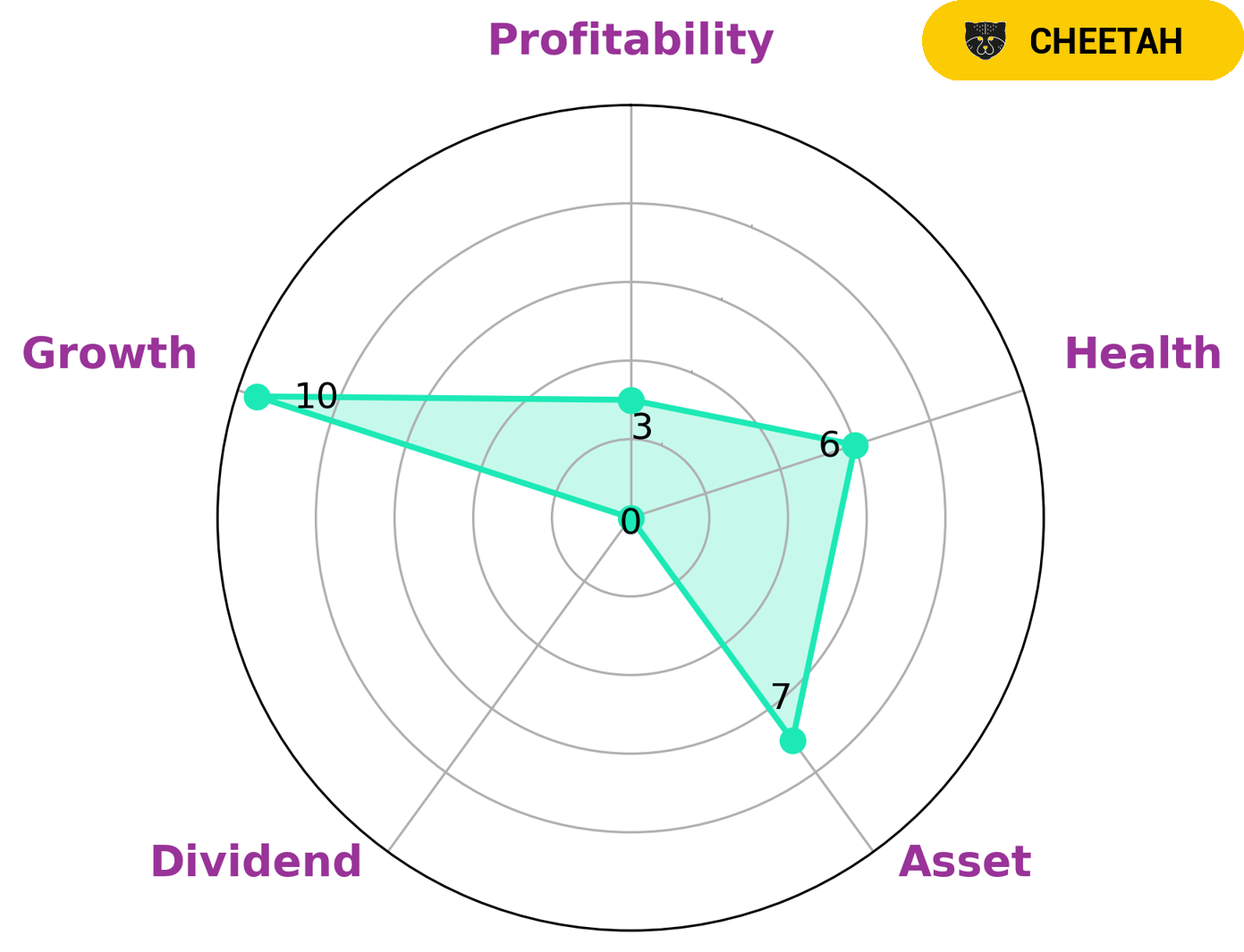

GoodWhale has conducted an analysis of ADVENT TECHNOLOGIES‘ wellbeing. According to our Star Chart assessment, ADVENT TECHNOLOGIES is strong in asset and growth, but weak in dividend and profitability. Subsequently, it has an intermediate health score of 6/10 considering its cashflows and debt, which may be enough to pay off debt and fund future operations. After further consideration, GoodWhale classified ADVENT TECHNOLOGIES as a ‘cheetah’ type of company, which we conclude achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe that such a company could be interesting for investors who are looking for dynamic growth, but have to accept some risk. More…

Peers

The company’s products are based on proprietary fuel cell and electrolysis technology, which enables them to be more efficient and durable than competing products. Advent’s products are used in a variety of applications, including automotive, marine, and stationary power. The company has a strong competitive position in the market, with a significant market share and a strong customer base.

However, Advent faces competition from a number of other companies, including Invinity Energy Systems PLC, Altus Power Inc, and Phinergy Ltd.

– Invinity Energy Systems PLC ($LSE:IES)

Infinity Energy Systems PLC is a publicly traded company with a market capitalization of 28.43 million as of 2022. The company has a return on equity of -32.9%. Infinity Energy Systems PLC is engaged in the development, manufacture, and sale of energy storage systems and related technologies. The company’s products are used in a variety of applications, including commercial and industrial buildings, telecommunication facilities, and electric utility grids.

– Altus Power Inc ($NYSE:AMPS)

Altus Power Inc is a publicly traded renewable energy company with a market capitalization of 1.45 billion as of 2022. The company has a return on equity of 18.93%. Altus Power Inc is engaged in the development, ownership, and operation of solar photovoltaic (PV) systems. The company was founded in 2010 and is based in Westport, Connecticut.

– Phinergy Ltd ($OTCPK:PHNGF)

Phinergy Ltd is an Israeli metals and mining company. The company has a market capitalization of $71.73 million and a return on equity of 144.33%. Phinergy produces aluminum alloys and other metals. The company also has interests in mining and exploration.

Summary

Advent Technologies is a publicly traded company that has recently issued a ‘going concern warning’ and is planning an imminent capital raise. Investors should approach this situation with caution as it could be a sign of financial distress. A thorough analysis should be conducted to determine whether or not the company is able to meet its commitments and whether or not the capital raise is necessary.

The company’s financial reports should be examined, including balance sheets and income statements, to determine the health of its finances. In light of the warning, it might be best for investors to wait for more information before investing in Advent Technologies.

Recent Posts