Advent Technologies Files for Relief Under 8 Del. C. § 205 in 2023.

March 21, 2023

Trending News ☀️

Advent Technologies ($NASDAQ:ADN), Inc. has recently filed for relief under 8 Delaware Code § 205 in 2023. The decision to file for such relief was made by the company’s board of directors, which is documented in Form 8-K. According to 8 Delaware Code § 205, companies can file to seek protection from creditors if they are unable to pay off their debts, and thus potentially avoid bankruptcy. The filing of Form 8-K allows Advent Technologies to take advantage of this protection and start restructuring their finances. This process is known as a “safe-harbor provision” and allows a company to restructure its debt in a way that doesn’t involve bankruptcy. By filing for relief under 8 Delaware Code § 205, Advent Technologies can continue to operate as a viable business and protect its employees and stockholders.

The process of filing Form 8-K involves providing detailed financial information necessary to review the company’s financial status. This includes information about the company’s assets, liabilities, and financial statements. Once the filing has been approved, the company can begin restructuring their debt and reorganizing their finances. This filing provides a secure path forward for the company and will enable them to remain financially solvent while restructuring their debt. This filing also provides hope for the long-term future of the company and its ability to move forward in a positive direction.

Share Price

C. § 205 in 2023, which could potentially shield the company from certain liabilities. Despite the news, media sentiment remains largely positive, with ADVENT TECHNOLOGIES‘ stock opening at $1.4 and closing at the same price, down 3.5% from its previous closing price. Although the details of their filing remain unclear, this move suggests that ADVENT TECHNOLOGIES is taking necessary steps to protect itself from potential liabilities down the road. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Advent Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 8.78 | -35.72 | -556.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Advent Technologies. More…

| Operations | Investing | Financing |

| -43.31 | -5.54 | -0.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Advent Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 127.49 | 20.1 | 2.08 |

Key Ratios Snapshot

Some of the financial key ratios for Advent Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -592.2% |

| FCF Margin | ROE | ROA |

| -552.7% | -28.8% | -25.5% |

Analysis

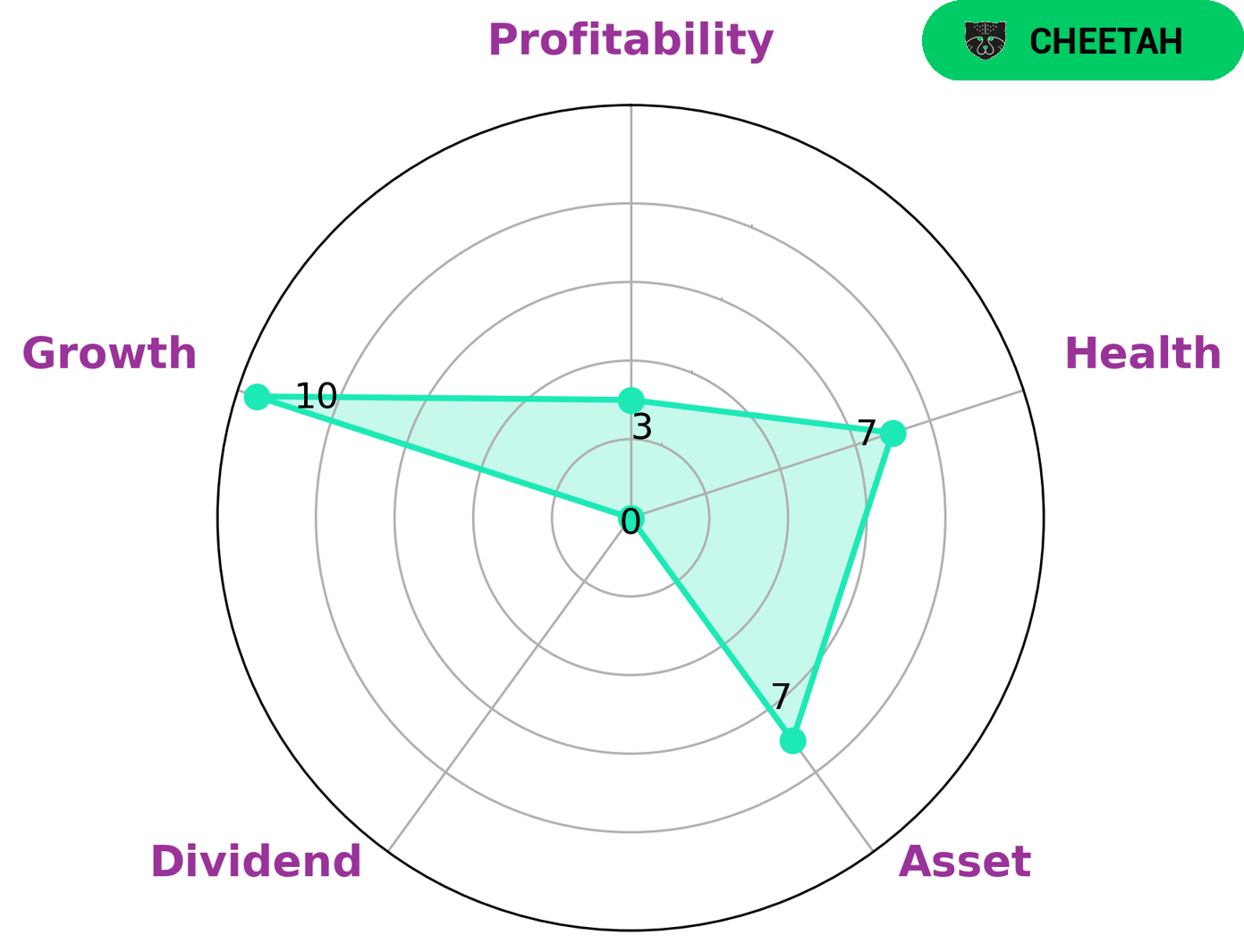

At GoodWhale, we conducted an analysis of ADVENT TECHNOLOGIES‘s wellbeing. Based on our Star Chart, ADVENT TECHNOLOGIES is strong in asset, growth, and weak in dividend and profitability. Further, ADVENT TECHNOLOGIES has a high health score of 7/10 considering its cashflows and debt, suggesting that it is capable to pay off debt and fund future operations. Based on our analysis, ADVENT TECHNOLOGIES is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. This means that investors who are looking for high growth with a certain level of risks may be attracted to investing in ADVENT TECHNOLOGIES. Investors who are looking for a safer option may be best looking into other options. More…

Peers

The company’s products are based on proprietary fuel cell and electrolysis technology, which enables them to be more efficient and durable than competing products. Advent’s products are used in a variety of applications, including automotive, marine, and stationary power. The company has a strong competitive position in the market, with a significant market share and a strong customer base.

However, Advent faces competition from a number of other companies, including Invinity Energy Systems PLC, Altus Power Inc, and Phinergy Ltd.

– Invinity Energy Systems PLC ($LSE:IES)

Infinity Energy Systems PLC is a publicly traded company with a market capitalization of 28.43 million as of 2022. The company has a return on equity of -32.9%. Infinity Energy Systems PLC is engaged in the development, manufacture, and sale of energy storage systems and related technologies. The company’s products are used in a variety of applications, including commercial and industrial buildings, telecommunication facilities, and electric utility grids.

– Altus Power Inc ($NYSE:AMPS)

Altus Power Inc is a publicly traded renewable energy company with a market capitalization of 1.45 billion as of 2022. The company has a return on equity of 18.93%. Altus Power Inc is engaged in the development, ownership, and operation of solar photovoltaic (PV) systems. The company was founded in 2010 and is based in Westport, Connecticut.

– Phinergy Ltd ($OTCPK:PHNGF)

Phinergy Ltd is an Israeli metals and mining company. The company has a market capitalization of $71.73 million and a return on equity of 144.33%. Phinergy produces aluminum alloys and other metals. The company also has interests in mining and exploration.

Summary

Advent Technologies is a technology company that recently filed for relief under Delaware’s 8 Del. Despite the filing, investor sentiment around the company has been mostly positive.

However, on the day the company announced its filing, its stock price dropped slightly. Overall, Advent Technologies appears to be a volatile stock with potential to be a good investment depending on its progress over the coming months and years. It is important that investors stay up to date with the company’s developments and performance in order to make a sound investing decision.

Recent Posts