York Water Upgraded to ‘Buy’ Rating, Showing Slow But Steady Improvement

May 17, 2023

Trending News ☀️

York Water ($NASDAQ:YORW) is making steady improvements, prompting us to upgrade our rating to ‘Buy’. YORK WATER is an American water utility company headquartered in Pennsylvania. The company owns and operates regulated water, wastewater, and wastewater treatment facilities that supply drinking water, wastewater services, and wastewater treatment services to residential, commercial, and industrial customers in York and Adams counties.

YORK WATER’s improved financial performance is also reflected in its share price, which has risen steadily over the last year and is currently trading near its all-time high. This, combined with YORK WATER’s strong fundamentals and attractive dividend yield, has made the stock increasingly attractive for investors.

Price History

On Tuesday, YORK WATER stock opened at $43.6 and closed at $43.5 after gaining a ‘buy’ rating from analysts. The company provides services to residential, commercial, and industrial customers, using an extensive network of pipes and pumps to deliver fresh water to its customers. YORK WATER’s stock has been gradually increasing over the past few months, driven by strong operational performance and cost-cutting initiatives. Investors are optimistic about the company’s future potential and have been pleased with the steady progress it has made in recent months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for York Water. More…

| Total Revenues | Net Income | Net Margin |

| 61.22 | 19.37 | 28.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for York Water. More…

| Operations | Investing | Financing |

| 22.91 | -57 | 34.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for York Water. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 524.5 | 316.1 | 14.59 |

Key Ratios Snapshot

Some of the financial key ratios for York Water are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | 0.7% | 41.6% |

| FCF Margin | ROE | ROA |

| -55.7% | 7.7% | 3.0% |

Analysis

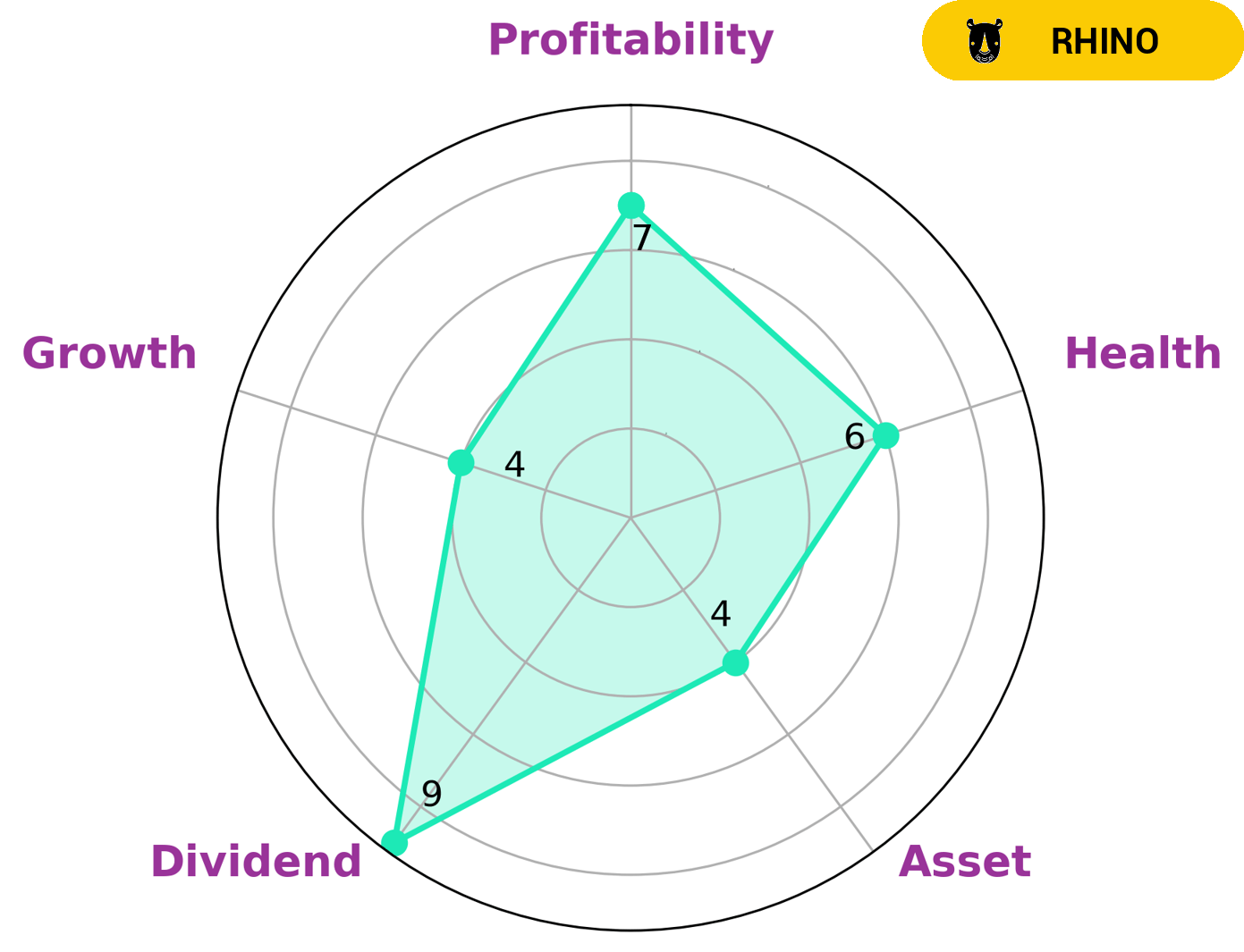

At GoodWhale, we recently conducted an analysis of YORK WATER to evaluate the company’s wellbeing. Our Star Chart placed YORK WATER in the ‘rhino’ category, which we deem as a company that has achieved moderate revenue or earnings growth. We found YORK WATER to be strong in dividend and profitability, and medium in asset and growth. Considering YORK WATER’s cashflows and debt, our assessment places the company at an intermediate health score of 6/10. This suggests YORK WATER is likely to safely ride out any crisis without the risk of bankruptcy. The type of investors that may be interested in YORK WATER would be those who are looking for a stable stock with moderate earnings growth. Investors that are looking for higher returns from their investments should look elsewhere. More…

Peers

The company operates in Pennsylvania, Maryland, and Virginia. As of December 31, 2018, the company owned and operated seven water treatment plants, seven wastewater treatment plants, 2,200 miles of water mains, and 1,700 miles of sewer lines. The company’s stock is traded on the Nasdaq Global Select Market under the ticker symbol YORW. The York Water Co’s competitors include Thu Duc Water, Pure Cycle Corp, Global Water Resources Inc.

– Thu Duc Water ($HOSE:TDW)

As of 2022, Pure Cycle Corp has a market cap of 196.16M and a Return on Equity of -9.74%. The company is engaged in the business of water treatment, including the treatment and re-use of wastewater.

– Pure Cycle Corp ($NASDAQ:PCYO)

Global Water Resources, Inc. is a water resource management company that owns, operates, and manages water and wastewater utilities in the state of Arizona. The company’s mission is to provide safe, reliable, and sustainable water resources to the communities it serves. Global Water Resources is committed to providing its customers with high-quality water and wastewater services at an affordable price. The company’s philosophy is to operate its utilities in a manner that is financially, environmentally, and socially responsible. Global Water Resources has a market capitalization of $283.77 million and a return on equity of 30.2%.

Summary

YORK WATER is an attractive investment opportunity, as analysts have recently upgraded their rating from hold to buy. The company has a strong balance sheet and has been able to weather downturns in the market. YORK WATER’s experienced management team has also improved the company’s efficiency and profitability. The company has also made several strategic acquisitions in recent years, which have helped fuel growth.

Analysts believe that YORK WATER’s long-term outlook is positive and that the company’s stock is undervalued. As such, YORK WATER is thought to be a great option for investors looking for good long-term returns.

Recent Posts