Severn Trent Shares Climb 0.75% to £26.84 on Positive Trading Day.

March 4, 2023

Trending News ☀️

Trading in Severn Trent ($LSE:SVT) PLC shares on Thursday saw a slight increase of 0.75% to close at £26.84, well outperforming the broader market which also had a positive trading day. The uptick in Severn Trent’s share price came as investor confidence in the company’s future strategic prospects increased due to recent announcements and solid financial results. These figures have been well received by the investment community, with many investors expecting further positive performance in the long term.

Overall, the positive trading session for Severn Trent is a sign of investor confidence in the company’s long-term prospects and its ability to meet short-term targets. As such, with further announcements and developments on the horizon, Severn Trent’s share price is expected to continue its upward trend.

Share Price

On Thursday, SEVERN TRENT shares traded positively, opening at £26.6 and closing at £26.8, up by 0.75%. This was an increase from the previous day’s closing price of £26.6. At the time of writing, the media sentiment from most investors and traders was mostly positive.

SEVERN TRENT has seen a strong performance on the stock market for the past few months, with increasing shares prices and a positive outlook from investors. With Thursday’s positive trading day, the shares have kept climbing, indicating that investors remain positive about the company’s performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Severn Trent. More…

| Total Revenues | Net Income | Net Margin |

| 2.05k | 171.6 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Severn Trent. More…

| Operations | Investing | Financing |

| 905.5 | -680.6 | 108.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Severn Trent. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.08k | 10.87k | 4.81 |

Key Ratios Snapshot

Some of the financial key ratios for Severn Trent are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.5% | -4.7% | 30.9% |

| FCF Margin | ROE | ROA |

| 10.7% | 32.0% | 3.3% |

Analysis

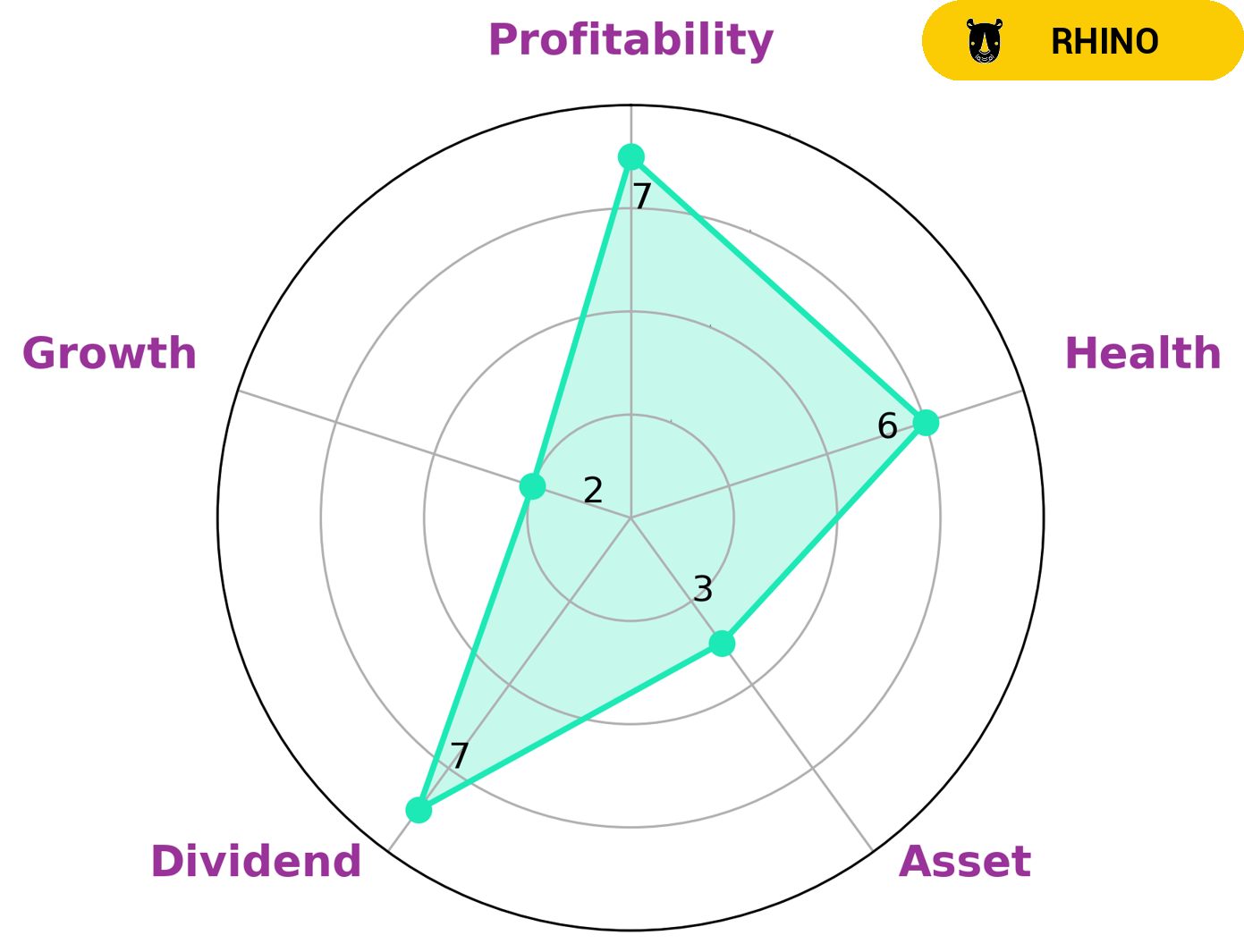

GoodWhale conducted an analysis of SEVERN TRENT‘s wellbeing, and the Star Chart shows that the company is strong in dividend, profitability and weak in asset, growth. This makes it likely that long-term investors or investment funds looking for a steady income and capital appreciation would be interested in this type of company. In terms of its financial health, SEVERN TRENT has an intermediate health score of 6/10 with regard to its cashflows and debt; these are good indications that the company might be able to pay off debt and fund future operations. More…

Peers

In the water utility industry, Severn Trent PLC faces stiff competition from American States Water Co, Kangda International Environmental Co Ltd, and Athens Water Supply & Sewerage Co. These companies are all large, well-established players in the industry, and they each have a significant market share. Severn Trent PLC must continually innovate and provide high-quality service in order to stay ahead of its competitors.

– American States Water Co ($NYSE:AWR)

American States Water Company is a publicly traded water and wastewater utility company. The Company provides water service to approximately 26,000 customers in the cities of Big Bear Lake, California and San Bernardino, California. American States Water Company also provides wastewater service to approximately 20,000 customers in the city of San Bernardino. In addition, the Company’s subsidiaries, Golden State Water Company and American States Utility Services, Inc., provide water service to approximately 248,000 customers in 36 counties in California.

– Kangda International Environmental Co Ltd ($SEHK:06136)

Kangda International Environmental Co Ltd has a market capitalization of 1.22 billion as of 2022 and a return on equity of 12.47%. The company is engaged in the business of environmental protection and provides environmental protection services in China.

– Athens Water Supply & Sewerage Co ($OTCPK:AHWSF)

Athens Water Supply & Sewerage Co. is a water utility company that provides water and wastewater services to the city of Athens, Greece. The company has a market cap of 748.86M as of 2022 and a Return on Equity of 4.35%. Athens Water Supply & Sewerage Co. is the largest water utility in Greece and one of the largest in Europe. The company serves a population of approximately 3.5 million people.

Summary

Severn Trent (SVT.L) is up 0.75% today as it trades at £26.84. This marks a positive day for the company, and media sentiment surrounding the company has been mostly positive. Analysts have recommended investors buy into Severn Trent as it currently offers good long-term value. Analysts have also highlighted the company’s strong cash flow and balance sheet which makes them optimistic about Severn Trent’s future prospects.

The company also offers regular dividend payments, making it a great choice for those looking for income assets. Overall, Severn Trent seems to be a smart and attractive investment choice in the current market.

Recent Posts