Sei Investments Co. Decreases Holdings in American Water Works Company, Inc

June 12, 2023

🌥️Trending News

Sei Investments Co. recently announced that it had decreased its holdings of American Water Works ($NYSE:AWK) Company, Inc. (AWW). AWW is an industry leader in water infrastructure, providing reliable, safe and affordable water services to residential, commercial and industrial customers. The company also offers a variety of customer-focused services, from maintenance and repair to full-scale water resource management. Sei Investments Co.’s sale of shares in AWW marks a significant move in the financial markets, as the company had previously held a large stake in the company’s stock.

The sale follows a period of solid performance for AWW, as the company’s stock price has increased significantly over the past year. The sale of shares shows that Sei Investments Co. is confident in the future of the water utility, but is looking to diversify its portfolio.

Share Price

The stock opened at $145.4 and closed at $145.9, up by 0.1% from the prior closing price of $145.8. This marks a decrease in AWW shares held by Sei Investments Co. from the previous quarter. The sale of AWW shares by Sei Investments Co. came amidst a general uptrend in the share price of the company.

After opening at $145.4 on Monday, the stock closed at $145.9, representing a 0.1% increase from the prior closing price of $145.8. Investors remain generally optimistic about the long-term prospects of the company and are confident that American Water Works Company, Inc. will continue to perform successfully in the industry going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AWK. More…

| Total Revenues | Net Income | Net Margin |

| 3.89k | 832 | 21.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AWK. More…

| Operations | Investing | Financing |

| 1.24k | -2.85k | 1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AWK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.29k | 18.74k | 49.05 |

Key Ratios Snapshot

Some of the financial key ratios for AWK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | 3.1% | 38.0% |

| FCF Margin | ROE | ROA |

| -33.3% | 10.7% | 3.3% |

Analysis

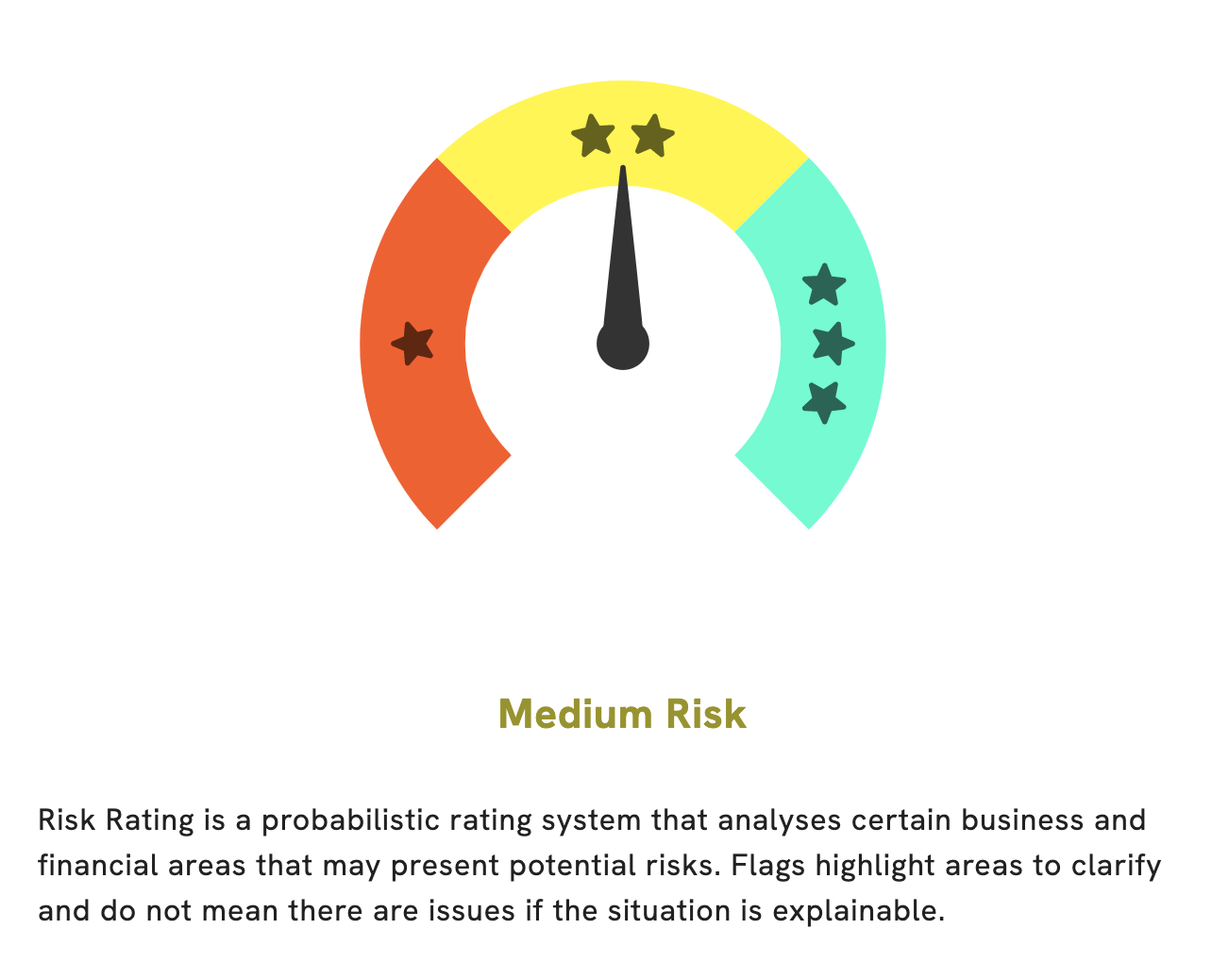

At GoodWhale, we have conducted an analysis of AMERICAN WATER WORKS’ fundamentals. After taking into account the financial and business aspects, we have determined that AMERICAN WATER WORKS is a medium risk investment. We have also identified two risk warnings in the income sheet and cashflow statement. To learn more about these risk warnings, we encourage you to register with us and see our analysis for yourself. More…

Peers

American Water Works Co Inc, American States Water Co, Global Water Resources Inc, and Artesian Resources Corp are all water utilities companies. They are all in the business of providing water and wastewater services to residential, commercial, and industrial customers.

– American States Water Co ($NYSE:AWR)

American States Water Co is a water and wastewater utility company that serves nearly million people in the United States. The company has a market cap of 3.22B as of 2022 and a ROE of 12.01%. American States Water Co is the largest water utility company in California and the fourth largest in the United States. The company also provides wastewater services to approximately 700,000 people in Arizona, Illinois, New Mexico, and Texas.

– Global Water Resources Inc ($NASDAQ:GWRS)

Global Water Resources, Inc. is a water resource management company that provides water and wastewater services to residential and commercial customers in the Phoenix metropolitan area. The company has a market cap of $296.66 million and a return on equity of 21.79%. Global Water Resources is headquartered in Scottsdale, Arizona.

– Artesian Resources Corp ($NASDAQ:ARTNA)

Artesian Resources Corp is a water utility company that serves the metropolitan area of Wilmington, Delaware. It is the largest provider of water and wastewater services in the state of Delaware, and is the 8th largest provider of water and wastewater services in the United States. The company has a market cap of 496.24M as of 2022 and a Return on Equity of 10.87%.

Summary

American Water Works Company, Inc. (AWW) is an important stock to watch for investors. The most recent news is that Sei Investments Co. has reduced its holdings in the company, likely as a result of the stock’s recent performance. This could be an opportunity to buy or sell shares in the company. Investors should pay close attention to the stock’s historical performance, as well as current events affecting AWW, such as earnings releases, industry trends, and other news or events. They should also evaluate the stock’s valuation relative to its peers and determine whether it might be undervalued or overvalued.

Additionally, investors should consider the quality of the company’s management, its financial condition, and its competitive position in the industry. By analyzing all of these factors, investors can make a more informed decision about whether or not to buy or sell shares in AWW.

Recent Posts