Middlesex Water Short Interest Decreases 11.6% in February 2023

March 17, 2023

Trending News ☀️

Middlesex Water ($NASDAQ:MSEX) has seen a significant decrease in short interest this February. According to the latest figures, there were 518300 shares in short as of February 28th, which is a drop of 11.6% compared to the previous month. This decline could be attributed to investors having less pessimistic sentiment toward the company, or it could be due to bearish traders closing their positions as prices have risen over the past few weeks. It is worth noting that short interest in Middlesex Water remains higher than it was at the start of the year.

While the February decrease is certainly positive news for shareholders, there is still considerable bearish sentiment around the stock. With new developments, such as potential debt refinancing, and potential investments in the company’s infrastructure, investors may be encouraged to move out of their bearish positions in the near future.

Market Price

Middlesex Water has been experiencing largely positive news coverage recently. On Tuesday, the company’s stock opened at $74.7 and closed at $75.3, representing an increase of 2.6% from the prior closing price of $73.4. This could be an indication that investors are becoming more bullish on the stock, as a decrease in short interest can indicate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Middlesex Water. More…

| Total Revenues | Net Income | Net Margin |

| 162.43 | 42.31 | 23.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Middlesex Water. More…

| Operations | Investing | Financing |

| 61.36 | -88.21 | 27.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Middlesex Water. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.07k | 672.04 | 22.81 |

Key Ratios Snapshot

Some of the financial key ratios for Middlesex Water are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.5% | 4.7% | 33.9% |

| FCF Margin | ROE | ROA |

| -18.5% | 8.6% | 3.2% |

Analysis

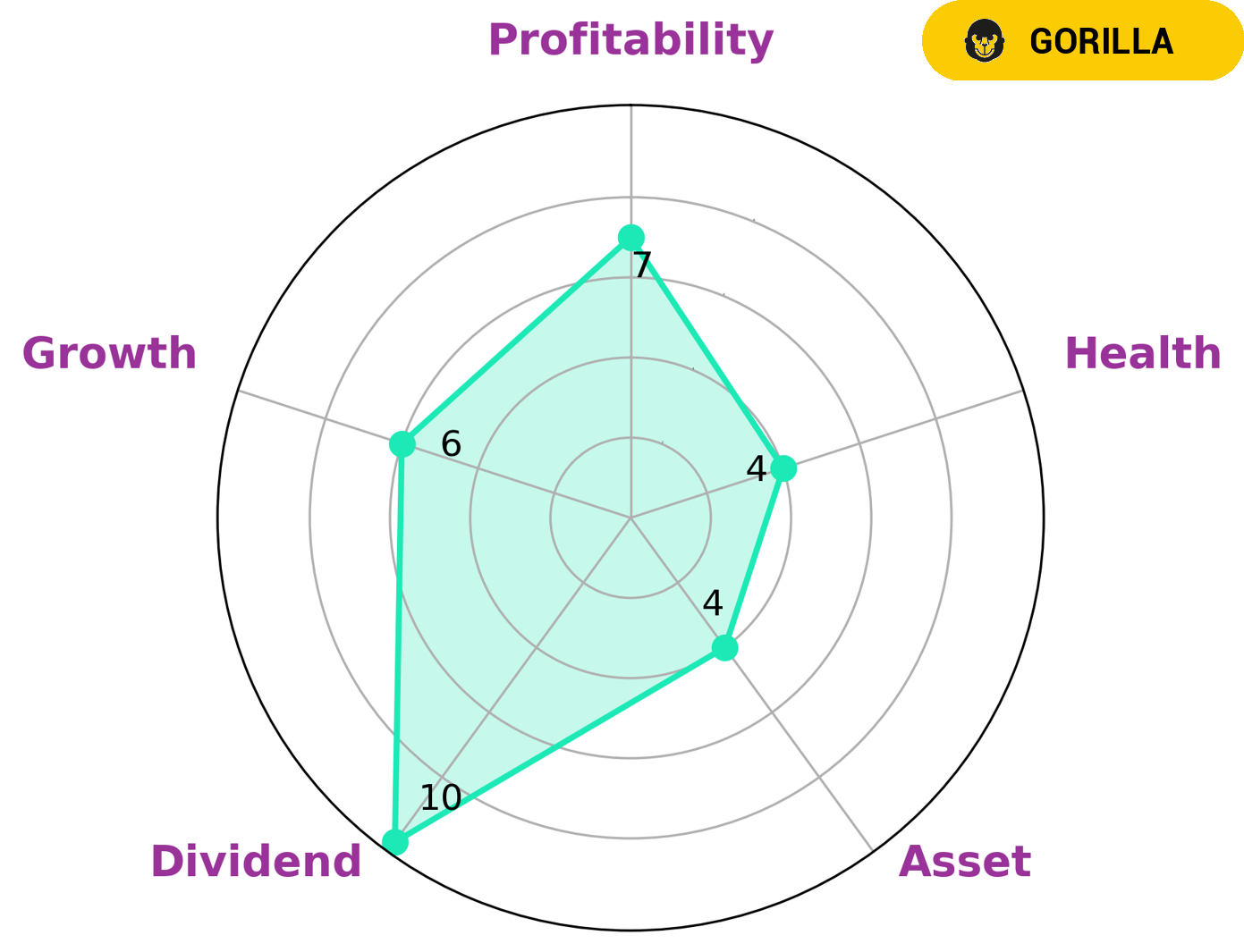

GoodWhale conducted an analysis of MIDDLESEX WATER‘s wellbeing and found that the company scored a 4/10 on its intermediate health score, which means it could be able to sustain future operations in times of crisis. Furthermore, MIDDLESEX WATER scored high in dividends and profitability, and medium in asset growth. We classified MIDDLESEX WATER as a ‘gorilla’ company, which means it has a strong competitive advantage and is able to achieve stable and high revenue or earnings growth. Given MIDDLESEX WATER’s strong financial position and competitive advantage, investors interested in steady returns over a long-term period are likely to be attracted to the company’s stock. Similarly, investors who are looking for capital appreciation and dividend income may also be interested in this stock. More…

Peers

The company’s competitors include Artesian Resources Corp, The York Water Co, and American Water Works Co Inc.

– Artesian Resources Corp ($NASDAQ:ARTNA)

Artesian Resources Corp is a water utility company that serves the greater Baltimore and Wilmington areas. The company has a market cap of 494.09M as of 2022 and a Return on Equity of 10.87%. The company is engaged in the business of providing water and wastewater services to residential, commercial, and industrial customers.

– The York Water Co ($NASDAQ:YORW)

The York Water Company, founded in 1816, is the oldest investor-owned water utility in the United States. It is a water and wastewater utility company that serves approximately 70,000 customers in south central Pennsylvania. The company’s market capitalization is $634.16 million as of 2022, and its return on equity is 8.18%. The York Water Company is committed to providing safe, reliable, and affordable water and wastewater services to its customers.

– American Water Works Co Inc ($NYSE:AWK)

American Water Works Company, Inc. is the largest investor-owned water and wastewater utility company in the United States, based on operated revenue. The company provides water and wastewater services to an estimated 14 million people in 46 states. It has approximately 7,100 employees and operates 86 utility subsidiaries. The company’s headquarters is in Camden, New Jersey.

American Water Works Company’s market capitalization is $25.28 billion as of 2022. The company’s return on equity is 17.48%.

American Water Works Company provides water and wastewater services to residential, commercial, and industrial customers in the United States. The company also supplies water to public utilities and municipalities. In addition, it engages in the wastewater treatment, desalination, and water reuse businesses.

Summary

Middlesex Water is a water and wastewater utility company in New Jersey and Delaware. In February 2023, the company’s short interest decreased 11.6%, compared to the previous month. This could be a sign of investors becoming more confident in the company, as a decrease in short interest usually signals an increase in long-term investment. Furthermore, current news coverage has been mostly positive, suggesting that investors are optimistic about the future of Middlesex Water.

The company continues to make strategic decisions, such as investing in infrastructure and expanding services, to provide clean and reliable water to customers. Overall, Middlesex Water appears to be a strong investment option and is likely to experience further growth in the near future.

Recent Posts