Great Valley Advisor Group Increases Stake in American Water Works Company,

January 9, 2023

Trending News ☀️

It is the largest publicly traded U.S. water and wastewater utility company and has been providing quality water services for over a century. Recently, Great Valley Advisor Group Inc. has increased its stake in American Water Works ($NYSE:AWK) Company, Inc. Great Valley Advisor Group Inc. is an investment firm based in Pennsylvania that provides investment advice to institutional investors across the United States. The firm specializes in managing long-term investments for its clients with a focus on risk management and portfolio diversification. American Water Works Company, Inc. is well-positioned to continue providing reliable and high-quality water services and maintaining its position as one of the largest publicly traded U.S. water and wastewater utility companies.

The increased stake also serves as a testament to the strength of the company’s management team and their ability to successfully navigate the ever-changing landscape of the water industry. With its strong management team and long track record of success, American Water Works Company, Inc. is well-positioned to continue providing excellent water services for many years to come.

Market Price

Till now, the media coverage of this move has been mostly positive, with many analysts seeing it as a sign of investor confidence in the company. On Tuesday, American Water Works opened at $153.8 and closed at $154.1, up by 1.1% from the previous closing price of 152.4. This increase in stock price is indicative of the confidence that investors have in the company’s ability to deliver value to shareholders. The company’s products and services include water treatment, wastewater treatment, water distribution, wastewater collection, and water reuse. The company has a strong focus on sustainability and has invested heavily in projects to reduce its environmental footprint.

American Water Works has also taken proactive steps to ensure that its customers have access to safe, clean and reliable water services. The company is committed to investing in technological advancements such as smart meters, remote sensing technologies and digital analytics to improve customer service. With its commitment to customer service and environmental stewardship, American Water Works is well-positioned to capitalize on future growth opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AWK. More…

| Total Revenues | Net Income | Net Margin |

| 3.81k | 1.32k | 19.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AWK. More…

| Operations | Investing | Financing |

| 1.18k | -1.54k | 373 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AWK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.13k | 19.37k | 42.67 |

Key Ratios Snapshot

Some of the financial key ratios for AWK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.3% | 1.3% | 56.2% |

| FCF Margin | ROE | ROA |

| -29.0% | 17.5% | 4.9% |

VI Analysis

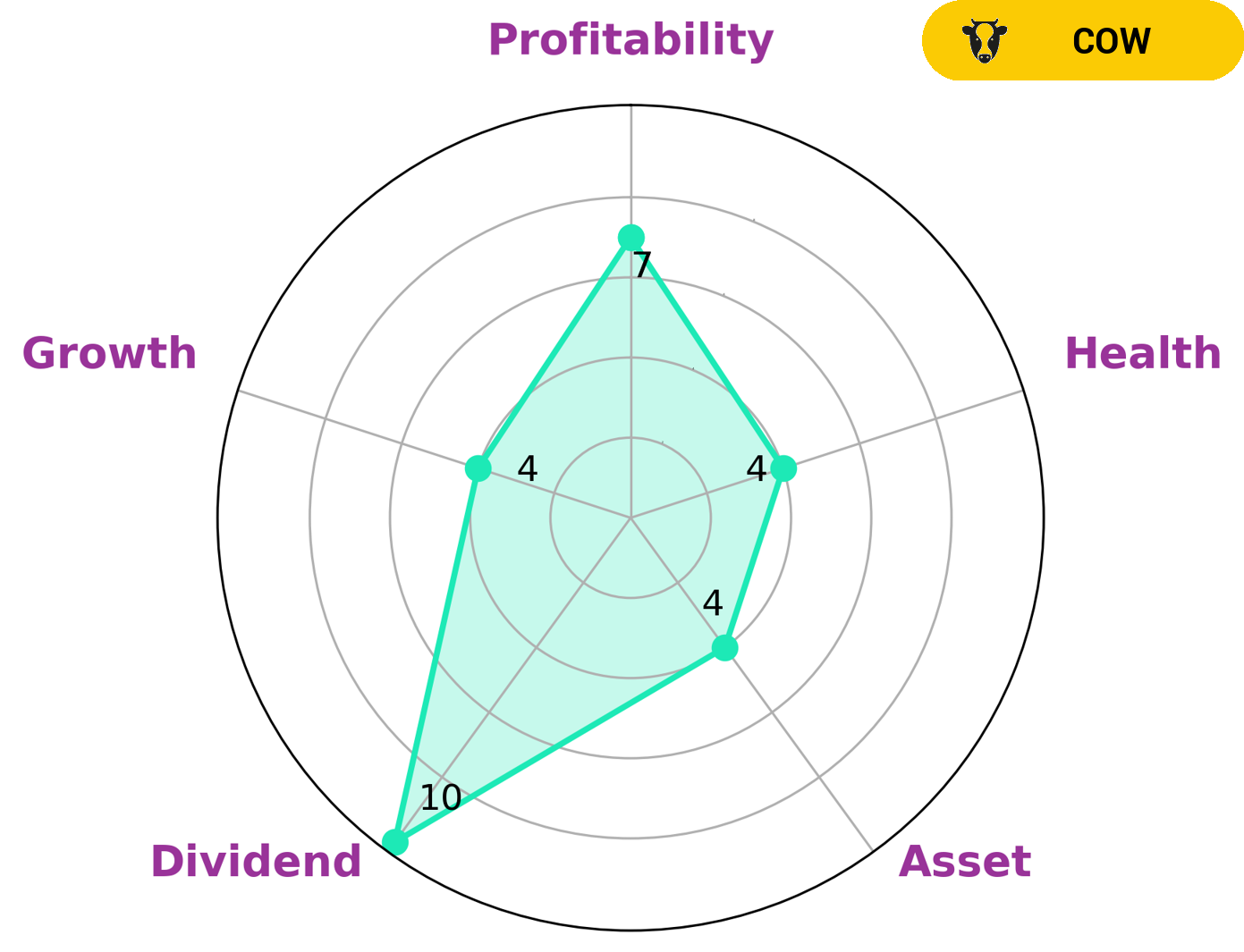

Investors seeking a stable dividend stock may be interested in American Water Works, which has an intermediate health score of 4/10 according to the VI Star Chart. This score is based on its cashflows and debt, indicating that the company may be able to sustain future operations in times of crisis. The company also boasts strong dividend and profitability ratings, as well as a medium asset and growth rating. In addition, American Water Works is classified as a ‘cow’, suggesting that it has a history of paying out consistent and sustainable dividends. American Water Works’ fundamentals reflect its long-term potential and make it an attractive investment opportunity for those who are looking for a stable stock. Its intermediate health score demonstrates that the company has the financial resources and stability to meet its financial obligations. Its strong dividend and profitability ratings indicate that the company has a reliable source of income from its operations, while its medium asset and growth ratings suggest that American Water Works is on a positive trajectory for future growth. Furthermore, its ‘cow’ classification indicates that the company has a track record of consistently paying out dividends. More…

VI Peers

American Water Works Co Inc, American States Water Co, Global Water Resources Inc, and Artesian Resources Corp are all water utilities companies. They are all in the business of providing water and wastewater services to residential, commercial, and industrial customers.

– American States Water Co ($NYSE:AWR)

American States Water Co is a water and wastewater utility company that serves nearly million people in the United States. The company has a market cap of 3.22B as of 2022 and a ROE of 12.01%. American States Water Co is the largest water utility company in California and the fourth largest in the United States. The company also provides wastewater services to approximately 700,000 people in Arizona, Illinois, New Mexico, and Texas.

– Global Water Resources Inc ($NASDAQ:GWRS)

Global Water Resources, Inc. is a water resource management company that provides water and wastewater services to residential and commercial customers in the Phoenix metropolitan area. The company has a market cap of $296.66 million and a return on equity of 21.79%. Global Water Resources is headquartered in Scottsdale, Arizona.

– Artesian Resources Corp ($NASDAQ:ARTNA)

Artesian Resources Corp is a water utility company that serves the metropolitan area of Wilmington, Delaware. It is the largest provider of water and wastewater services in the state of Delaware, and is the 8th largest provider of water and wastewater services in the United States. The company has a market cap of 496.24M as of 2022 and a Return on Equity of 10.87%.

Summary

American Water Works Company, Inc. is a publicly traded company that provides water and wastewater services to residential, commercial, and industrial customers in the United States and Canada. Recently, Great Valley Advisor Group Inc. increased its stake in American Water Works Company, Inc. Over the past few months, the company’s stock has risen significantly due to positive investor sentiment. Analysts believe that American Water Works is well-positioned to benefit from increasing demand for water services and infrastructure investment in the United States. Furthermore, their strong balance sheet and high dividend yield make it an attractive stock for investors looking for long-term returns.

Recent Posts