a $100 million deal

April 19, 2023

Trending News 🌥️

CADIZ INC ($NASDAQ:CDZI) (CDZI) is a leading player in the Utilities – Regulated Water industry, and its stock price has skyrocketed 159.07% this year, making CDZI one of the highest performers in its sector. This success has been underpinned by an impressive overall score of 89, with the company’s business operations and market performance providing much of the upward momentum. It specializes in water resource and storage development, focusing primarily on renewable resources and sustainable technologies. The deal involves securing the right to develop three renewable energy projects on its land.

This move has significantly strengthened the company’s financial position and is expected to generate significant revenue for years to come. CADIZ INC’s impressive stock performance and promising outlook have made it a leader in the Utilities – Regulated Water industry, and its upcoming projects are likely to ensure its continued growth in the future. With its unique combination of resources and expertise, CDZI is well positioned to continue expanding in the coming years.

Stock Price

On Monday, CADIZ INC made headlines as their stock opened at $5.0 and closed at $4.7, down by 3.9% from its last closing price of 4.9. As the company continues to capitalize on its lucrative deal and expand its reach, CADIZ INC looks poised to continue its meteoric rise in the stock market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cadiz Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.5 | -29.9 | -1651.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cadiz Inc. More…

| Operations | Investing | Financing |

| -18.6 | -4.12 | 16.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cadiz Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 110.79 | 76.56 | 0.61 |

Key Ratios Snapshot

Some of the financial key ratios for Cadiz Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 50.4% | – | -1103.4% |

| FCF Margin | ROE | ROA |

| -1464.0% | -31.3% | -9.3% |

Analysis

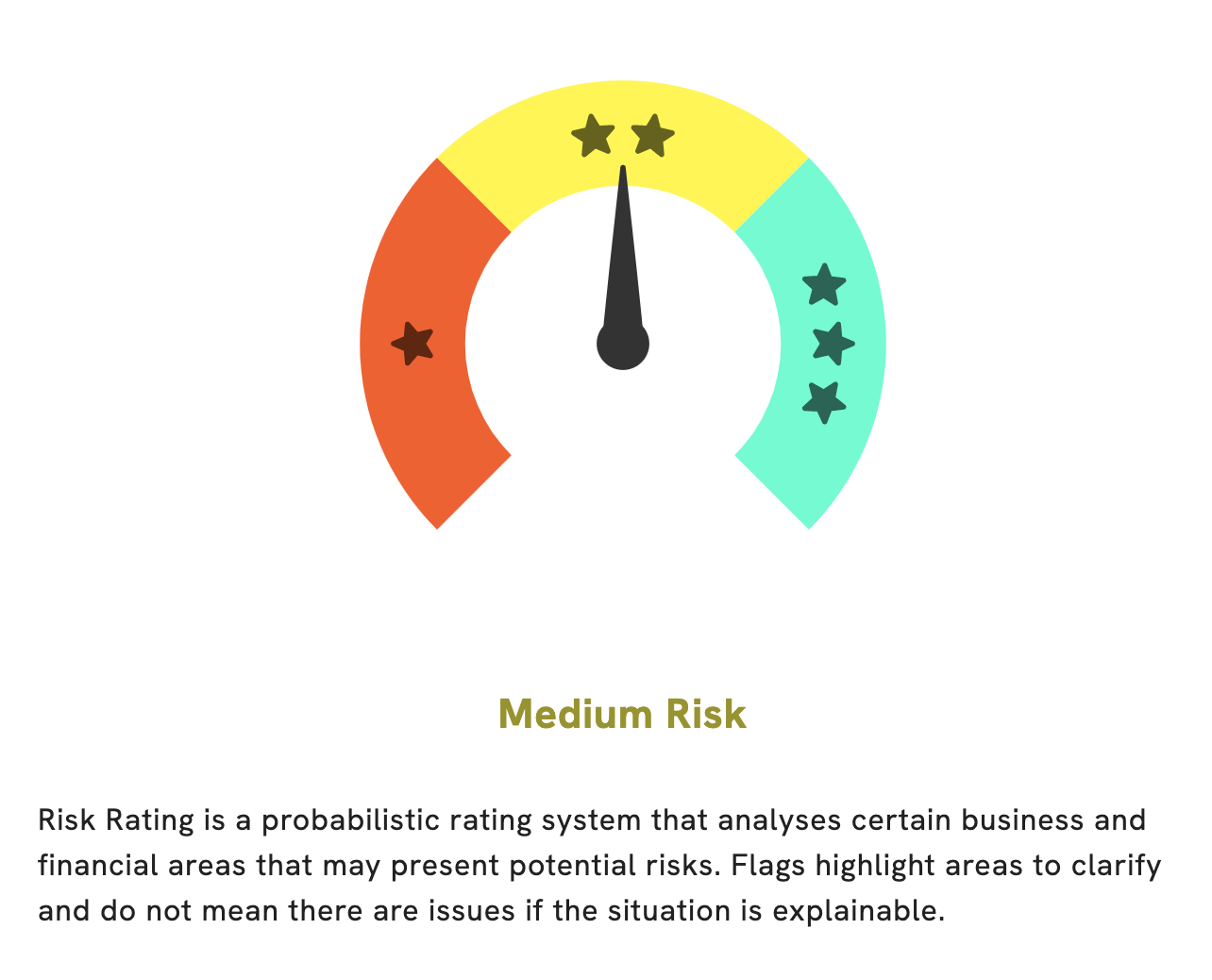

At GoodWhale, we recently conducted an analysis of CADIZ INC‘s wellbeing. Our Risk Rating indicated that it is a medium risk investment in terms of financial and business aspects. After further investigation, we detected 3 risk warnings in their income sheet, balance sheet, and cashflow statement. To gain more insights into these risks, become a registered user on our platform. We are confident that our analysis can provide you with the information necessary to make an informed decision regarding your investment. More…

Peers

In recent years, the water resources industry has seen increased competition between Cadiz Inc and its competitors. This is due to a number of factors, including the increasing global demand for water, the need for better water management, and the advancement of technology. While each company has its own strengths and weaknesses, Cadiz Inc has been able to maintain its position as one of the leading companies in the industry.

– Vidler Water Resources Inc ($NASDAQ:GWRS)

Global Water Resources Inc is a publicly traded water resource management company that owns, operates, and manages water and wastewater utilities in the state of Arizona. The company has a market cap of $309.31M as of 2022 and a Return on Equity of 21.79%. Global Water Resources Inc is headquartered in Scottsdale, Arizona.

– Global Water Resources Inc ($SHSE:688296)

Zhejiang Heda Technology Co Ltd is a Chinese company that manufactures and sells electronic cigarettes and other vaping products. The company has a market cap of 2.5 billion as of 2022 and a return on equity of 9.13%. Heda Technology was founded in 2009 and is headquartered in Hangzhou, China.

Summary

CADIZ INC (CDZI) is a leading company in the Utilities – Regulated Water industry and has seen an impressive 159.07% return this year. Analyzing the stock, there was a decrease in price on the same day as the overall score of 89 was achieved. Investors should look at the fundamentals of this stock and decide for themselves if it is an investment worth making. Factors such as financials, dividend yields, competitive advantage and management team are all important to consider.

Furthermore, many investors look to technical analysis such as trend lines, support and resistance levels, and moving averages to make an informed decision. With this in mind, investors should understand the potential risks and rewards of investing in CADIZ INC and weigh them against their own investment goals.

Recent Posts