Shares of Brookfield Infrastructure Partners L.P. Rally 1.96% on Favorable Trading Session

June 4, 2023

☀️Trending News

Shares of Brookfield Infrastructure ($TSX:BIPC) Partners L.P. (BIP.UN) experienced a positive trading session on Friday, with the share price rising 1.96% to close at C$49.38. This was a significant jump for the stock, which has seen its price fluctuate during the past several weeks. Brookfield Infrastructure Partners is one of the leading global infrastructure companies, operating in North and South America, Europe, Asia Pacific, and India. The company is focused on providing long-term investors with a stable and growing stream of cash flows from its diversified portfolio of core infrastructure businesses in the Utilities, Transport, Energy, and Data Infrastructure sectors. The company has grown its asset base significantly over the years, resulting in a robust portfolio of high-quality businesses that generate strong cash flows and provide essential services to their customers.

Additionally, Brookfield Infrastructure’s ownership structure provides investors with a unique opportunity to participate in the growth of infrastructure assets around the world. With its strong presence in global markets and a commitment to providing investors with attractive returns, Brookfield Infrastructure is well-positioned for future growth.

Analysis

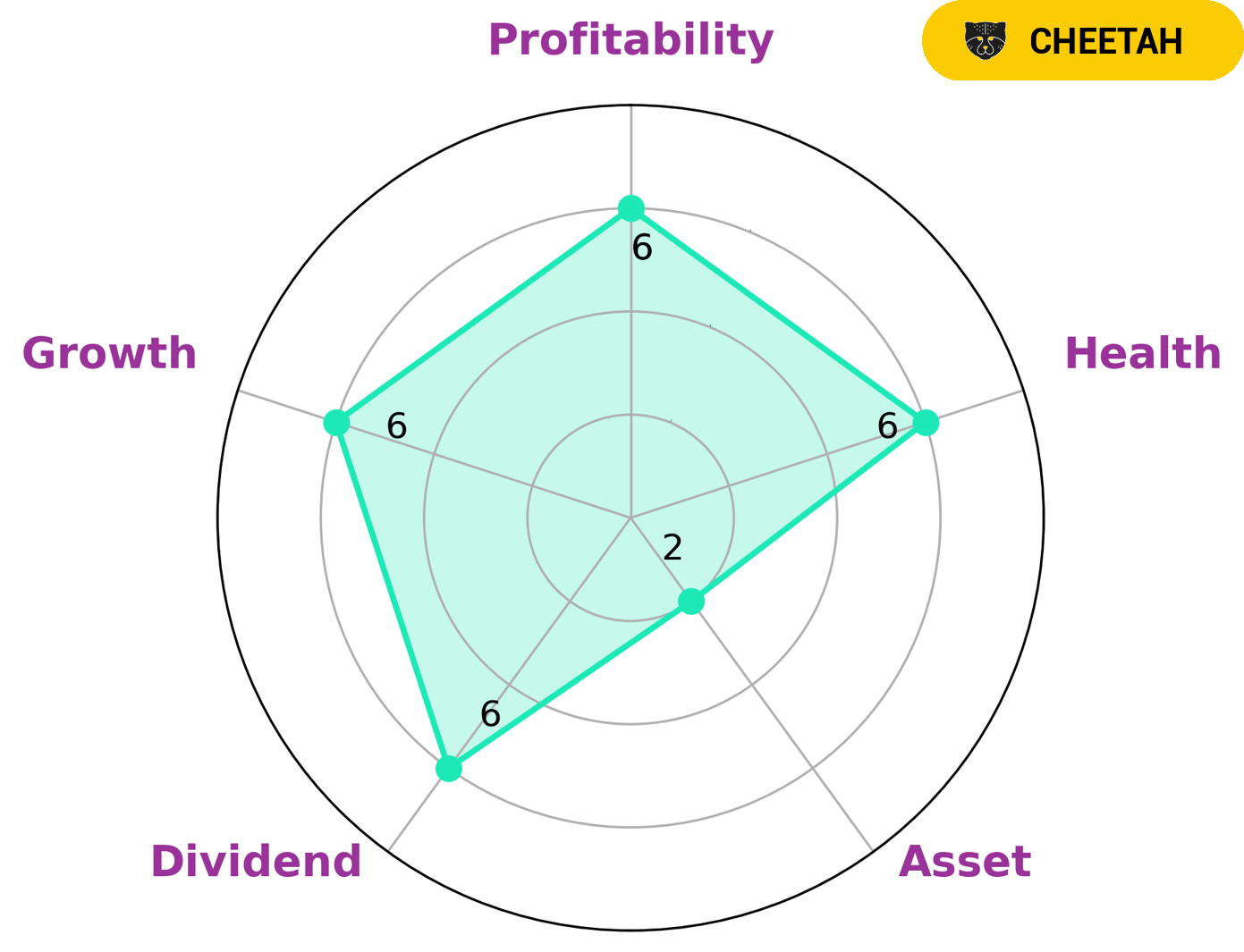

GoodWhale’s analysis of BROOKFIELD INFRASTRUCTURE shows that it is classified as a ‘cheetah’ company according to our Star Chart. This means that it has achieved high revenue or earnings growth, but is considered to be less stable due to lower profitability. As a result, investors that are looking for rapid growth and don’t mind taking on a bit more risk may be interested in this type of company. When it comes to financial fundamentals, BROOKFIELD INFRASTRUCTURE has an intermediate health score of 6/10. This is mainly due to its good cashflows and debt management, indicating that the company is likely to be able to pay off its debt and fund its future operations. In terms of specific metrics, BROOKFIELD INFRASTRUCTURE is strong in dividends, medium in growth, profitability and weak in assets. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brookfield Infrastructure. More…

| Total Revenues | Net Income | Net Margin |

| 1.92k | 1.17k | 62.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brookfield Infrastructure. More…

| Operations | Investing | Financing |

| 760 | -537 | -1.13k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brookfield Infrastructure. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.46k | 11.11k | -10.12 |

Key Ratios Snapshot

Some of the financial key ratios for Brookfield Infrastructure are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | 7.1% | 127.9% |

| FCF Margin | ROE | ROA |

| 11.6% | -121.4% | 14.7% |

Peers

Its competitors include Interconexion Electrica SA ESP, Brookfield Infrastructure Partners LP, and New Fortress Energy Inc.

– Interconexion Electrica SA ESP ($OTCPK:IESFY)

The company has a market cap of 3.9B as of 2022 and a ROE of 28.84%. The company is engaged in the business of electricity transmission in Spain.

– Brookfield Infrastructure Partners LP ($TSX:BIP.UN)

As of 2022, Brookfield Infrastructure Partners LP has a market cap of 21.31B and a Return on Equity of 34.5%. Brookfield Infrastructure Partners LP is a leading global infrastructure company that owns and operates a diversified portfolio of critical infrastructure assets in North and South America, Asia Pacific, Europe and Africa. The company’s assets include electric transmission and distribution networks, natural gas pipelines and storage facilities, seaports, toll roads, railways, airports and data centers.

– New Fortress Energy Inc ($NASDAQ:NFE)

As of 2022, New Fortress Energy Inc has a market cap of 10.22B and a Return on Equity of 7.4%. The company is engaged in the business of providing natural gas-fired power generation and related services to utility, industrial and commercial customers.

Summary

Investors have been bullish on Brookfield Infrastructure Partners L.P. (BRK.UN) recently. On Friday, the company’s share price rose 1.96% to C$49.38, showing that investors remain confident in the company’s long-term prospects. With its strong balance sheet and experienced management team, Brookfield Infrastructure Partners L.P. appears to be well-positioned for future growth.

Recent Posts