Northwest Natural Holding: The Slow and Steady Approach to Success

April 1, 2023

Trending News ☀️

When it comes to investing, many turn to a fast-paced approach.

However, Northwest Natural Holding ($NYSE:NWN) is proof that slow and steady progress can lead to success. The company has been around for over a century and is still going strong today. Northwest Natural Holding has been a leader in providing clean and reliable energy to its customers. They are committed to sustainability and have invested heavily in renewable energy sources such as solar and wind. Their commitment to sustainability and environmental stewardship has made them a leader in the industry. Their stock has also seen steady growth over the past few years. They have increased their dividend and share price over the past 10 years, showing that slow and steady progress can lead to success in the long term. They also have a strong balance sheet and are well-positioned to continue providing reliable and clean energy to their customers. Their commitment to sustainability and environmental stewardship, along with their strong balance sheet, shows that they are a solid investment for any investor looking to take a slow and steady approach to success.

Share Price

On Friday, its stock opened at $47.7 and closed at $47.6, a slight increase of 0.2% from its last closing price of $47.5. This small gain shows that the company is performing well and is on a steady upward trend. It is a testament to their slow and steady approach to success that they are able to sustain such small but consistent gains in the stock market. Though their growth may be slow, it is clear that Northwest Natural Holding is taking the right steps to ensure their continued success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NWN. More…

| Total Revenues | Net Income | Net Margin |

| 1.04k | 86.3 | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NWN. More…

| Operations | Investing | Financing |

| 147.67 | -435.46 | 301.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NWN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.75k | 3.57k | 33.09 |

Key Ratios Snapshot

Some of the financial key ratios for NWN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 5.3% | 16.3% |

| FCF Margin | ROE | ROA |

| -18.5% | 9.2% | 2.2% |

Analysis

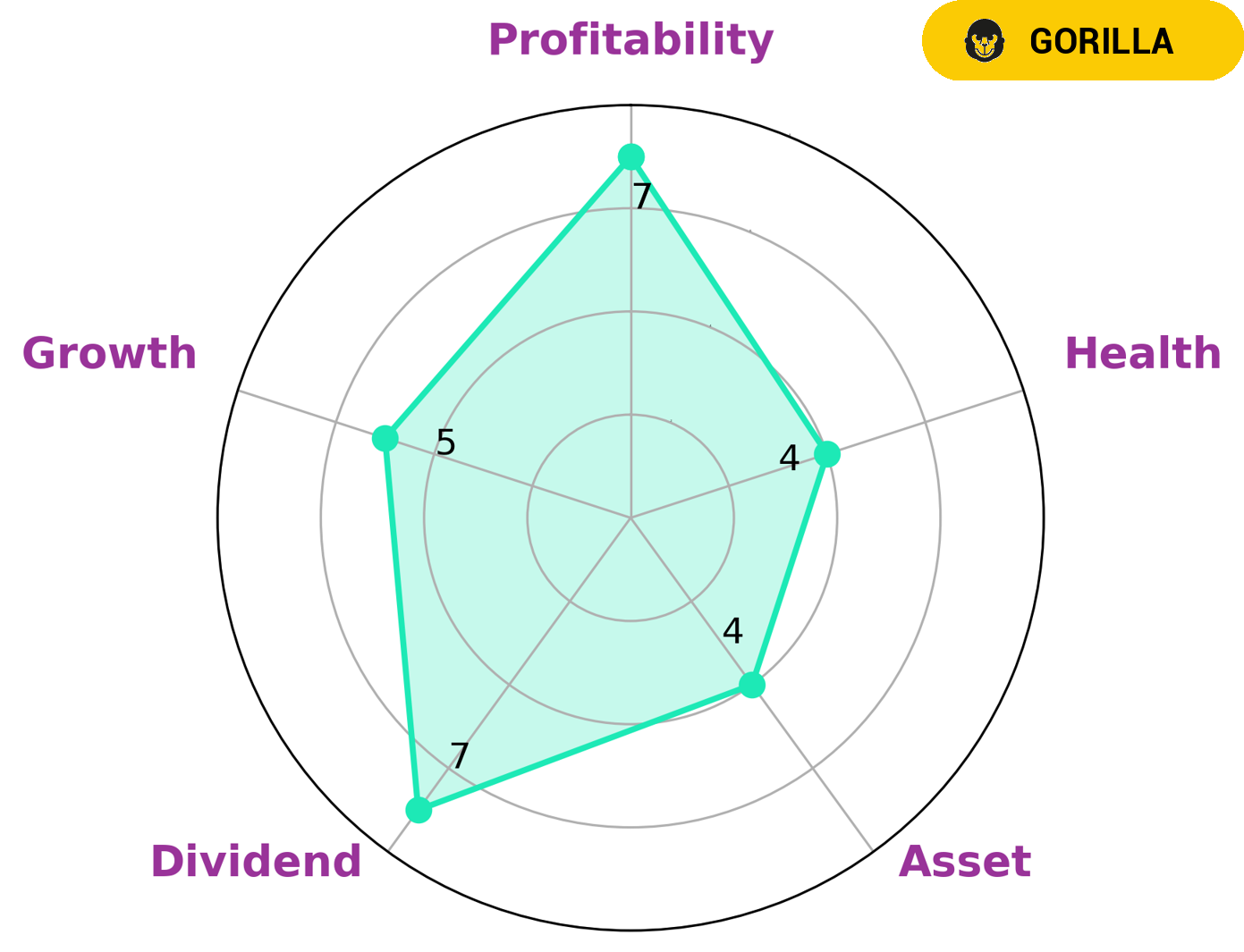

GoodWhale has analyzed NORTHWEST NATURAL HOLDING’s financials and found that the company is classified as a ‘gorilla’ – meaning it has achieved stable and high revenue or earning growth due to its strong competitive advantage. With regard to dividend and profitability, the company performed strongly, while its asset and growth were rated as medium. Furthermore, GoodWhale found that NORTHWEST NATURAL HOLDING has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to pay off debt and fund future operations. This makes NORTHWEST NATURAL HOLDING an attractive investment option for long-term investors who seek stability in their portfolio. More…

Peers

Its competitors include RGC Resources Inc, ONE Gas Inc, and Indraprastha Gas Ltd. The company has a strong market position and is well-positioned to continue its growth.

– RGC Resources Inc ($NASDAQ:RGCO)

RGC Resources is a diversified energy services company that provides natural gas and electricity to residential, commercial, and industrial customers in Virginia, North Carolina, and South Carolina. The company also provides energy-related products and services to customers in Virginia and North Carolina. RGC Resources has a market cap of 206.32M as of 2022, a Return on Equity of -13.92%. The company has been in operation for over 100 years and is headquartered in Roanoke, Virginia.

– ONE Gas Inc ($NYSE:OGS)

Natl Gas Co is a holding company, which engages in the distribution of natural gas. It operates through the following segments: Natural Gas and Others. The Natural Gas segment offers natural gas to residential, commercial and industrial customers. The Others segment includes activities of the Company’s subsidiaries in the electricity, water and waste industries. The company was founded on December 28, 1922 and is headquartered in Buenos Aires, Argentina.

– Indraprastha Gas Ltd ($BSE:532514)

Indraprastha Gas Ltd (IGL) is an Indian natural gas distribution company. It is engaged in the business of marketing and distributing natural gas in the National Capital Region of India. IGL also has a city gas distribution network in the cities of Agra and Kanpur. The company has a customer base of over 2.6 million customers.

IGL has a market capitalization of Rs 296.1 billion as of March 31, 2022. The company has a return on equity of 17.79%. IGL is a leading player in the city gas distribution market in India. The company has a strong presence in the National Capital Region of India, with a customer base of over 2.6 million customers.

Summary

Northwest Natural Holding is a publicly-traded natural gas and electric utility company headquartered in Portland, Oregon. Recent investment analysis suggests that, when it comes to the stock of Northwest Natural Holding, slow and steady wins the race. With a strong balance sheet and a history of dividend increases, the company has been able to weather economic downturns better than most. Analysts predict that the company’s continued focus on efficiency, customer service, and safety will help it remain profitable in the long run.

In addition, its commitment to clean energy and sustainability initiatives could provide long-term growth potential. For investors looking for a safe and reliable utility stock, Northwest Natural Holding is an excellent option.

Recent Posts