The Southern Company [NYSE: SO] Market Cap Reaches 68.86B – Analyzing the Impact of the Recent Price Decrease.

March 4, 2023

Trending News ☀️

Tuesday saw The Southern Company ($NYSE:SO) NYSE: SO stock take a downward trajectory, with a one-week price decrease of -3.80%. Despite this slight dip in stock prices, the market cap for the company reached an impressive 68.86B. This figure immediately highlights the importance of The Southern Company in the energy sector and their current status as a well-established cornerstone of the industry. Now more than ever, investors are looking to The Southern Company as a safe and reliable source of energy. The company has a long history of providing high quality services and products and their impressive market cap is a testament to the trust that consumers have towards them. Furthermore, their diverse portfolio of offerings, ranging from electricity to natural gas, allows them to remain competitive in a rapidly changing environment.

The Southern Company has also recently made a series of strategic investments in new technologies such as solar, wind and battery storage. This move highlights their commitment to becoming a sustainable and environmentally conscious energy provider. These investments are also likely to lead to further success for the company in terms of increasing their market cap and gaining a larger customer base. Overall, the recent dip in stock prices may have caused a bit of hesitation among investors, however the long-term implications of The Southern Company’s impressive market cap of 68.86B should not be overlooked. With a strong position in the energy sector and an eye towards sustainability, The Southern Company is well-positioned to carry on their success for years to come.

Stock Price

The Southern Company NYSE: SO is experiencing a recent decrease in share price, and the market cap has reached 68.86B. Despite this, the media sentiment for the company remains mostly positive. On Thursday, SO opened at $62.4 and closed at $63.7, an increase of 2.2% from the previous closing price of 62.3. It is yet to be seen whether the current trend of positivity will remain and how exactly the decrease in price will affect Southern Company’s future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Southern Company. More…

| Total Revenues | Net Income | Net Margin |

| 29.28k | 3.52k | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Southern Company. More…

| Operations | Investing | Financing |

| 6.3k | -8.43k | 2.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Southern Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 134.89k | 100.36k | 28.92 |

Key Ratios Snapshot

Some of the financial key ratios for Southern Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.0% | 1.4% | 21.3% |

| FCF Margin | ROE | ROA |

| -5.5% | 12.6% | 2.9% |

Analysis

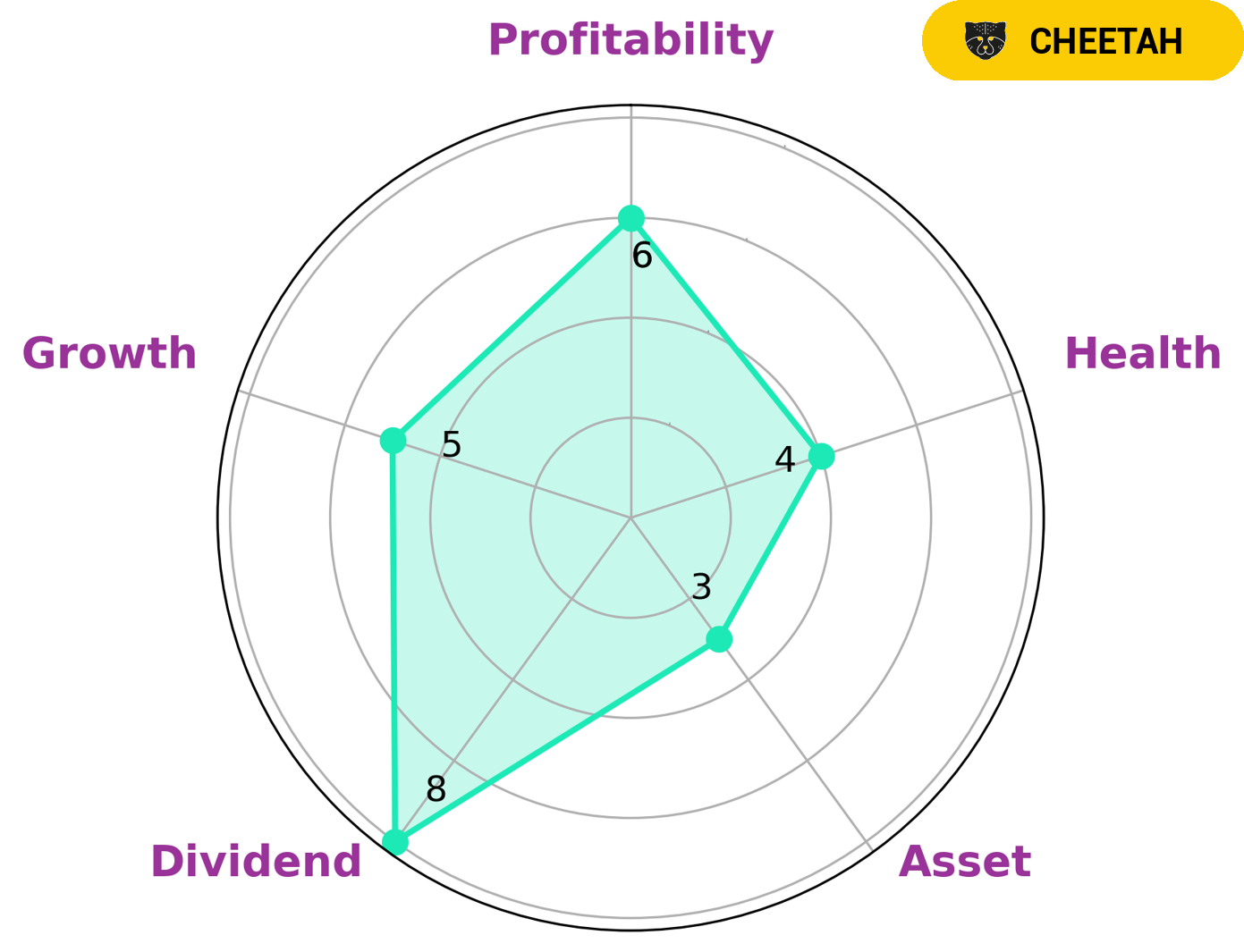

As an analysis conducted by GoodWhale, SOUTHERN COMPANY had a strong dividend, medium growth, and weak assets but is still considered to be in an intermediate health. This can be seen on the Star Chart, where they are rated at 4/10 on their cashflows and debt. SOUTHERN COMPANY has been classified as a ‘cheetah’, meaning it achieved high revenue or earnings growth, but due to lower profitability, it can considered to be less stable. This kind of company could be interesting to some type of investors, such as those with a high risk tolerance and are looking for short-term gains. Such investors may also be motivated by the potential for high returns, meaning that SOUTHERN COMPANY could be seen as an attractive prospect. More…

Peers

In the electric utility industry, there is intense competition between Southern Co and its competitors: NextEra Energy Inc, Avangrid Inc, Entergy Corp. These companies are all vying for market share in the Southeast region of the United States.

– NextEra Energy Inc ($NYSE:NEE)

NextEra Energy Inc is a leading clean energy company with operations in 27 states and Canada. The company has a market cap of 143.98B as of 2022 and a Return on Equity of 4.45%. NextEra Energy Inc is committed to providing clean, safe and reliable energy to its customers. The company has a diversified portfolio of generation assets that includes wind, solar, nuclear and natural gas. NextEra Energy Inc is also one of the largest electric utilities in the United States.

– Avangrid Inc ($NYSE:AGR)

Avangrid Inc is a leading energy services and delivery company with operations in 26 states. It has a market cap of 15.4 billion and a return on equity of 3.84%. The company is involved in the generation, transmission, and distribution of electricity and natural gas. It also provides renewable energy solutions.

– Entergy Corp ($NYSE:ETR)

Entergy Corporation is an integrated energy company engaged primarily in electric power production and retail distribution operations. Entergy owns and operates power plants with approximately 30,000 megawatts of electric generating capacity, including nearly 10,000 megawatts of nuclear power. Entergy delivers electricity to 2.9 million utility customers in Arkansas, Louisiana, Mississippi, and Texas.

Summary

Southern Company (NYSE: SO) is a major energy provider headquartered in Atlanta, Georgia. With a market capitalization of 68.86 billion, the company has seen its stock price dip recently. Despite this, the overall sentiment around the stock is generally positive due to its strong long-term prospects. Analysts point to Southern’s large customer base, established financials, and diverse portfolio of services as reasons to invest.

Its focus on renewables and clean energy sources, along with cost-saving measures and efficiency gains, has also attracted significant investor interest. Southern Company is an appealing stock for investors looking for a steady income from dividends and long-term growth potential.

Recent Posts