Southern Company Announces Retirement of Executive Chairman Thomas Fanning

December 14, 2023

🌥️Trending News

Southern Company ($NYSE:SO) is an energy company based in Atlanta, Georgia. It is one of the largest producers of electricity in the United States and serves customers in Alabama, Georgia, Florida, Mississippi, and Tennessee. It operates a diverse portfolio of businesses, including traditional electric and natural gas utilities, competitive generation assets, renewable energy developments, and retail energy services. It also has significant investments in infrastructure and technology related to energy efficiency and smart grid solutions.

Price History

This news caused a slight dip in stock price, with the stock opening at $71.5 and closing at $70.5, down by 1.2% from its previous closing price of 71.4. The company thanked Fanning for his dedicated service during his eight-year tenure and wished him all the best in his future endeavors. Additionally, they highlighted his leadership in advancing technological capabilities, expanding operations, and driving responsible energy production. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Southern Company. More…

| Total Revenues | Net Income | Net Margin |

| 26.25k | 3.03k | 11.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Southern Company. More…

| Operations | Investing | Financing |

| 7.03k | -9.2k | 2.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Southern Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 138.32k | 103.02k | 28.77 |

Key Ratios Snapshot

Some of the financial key ratios for Southern Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 1.2% | 21.6% |

| FCF Margin | ROE | ROA |

| -7.5% | 11.5% | 2.6% |

Analysis

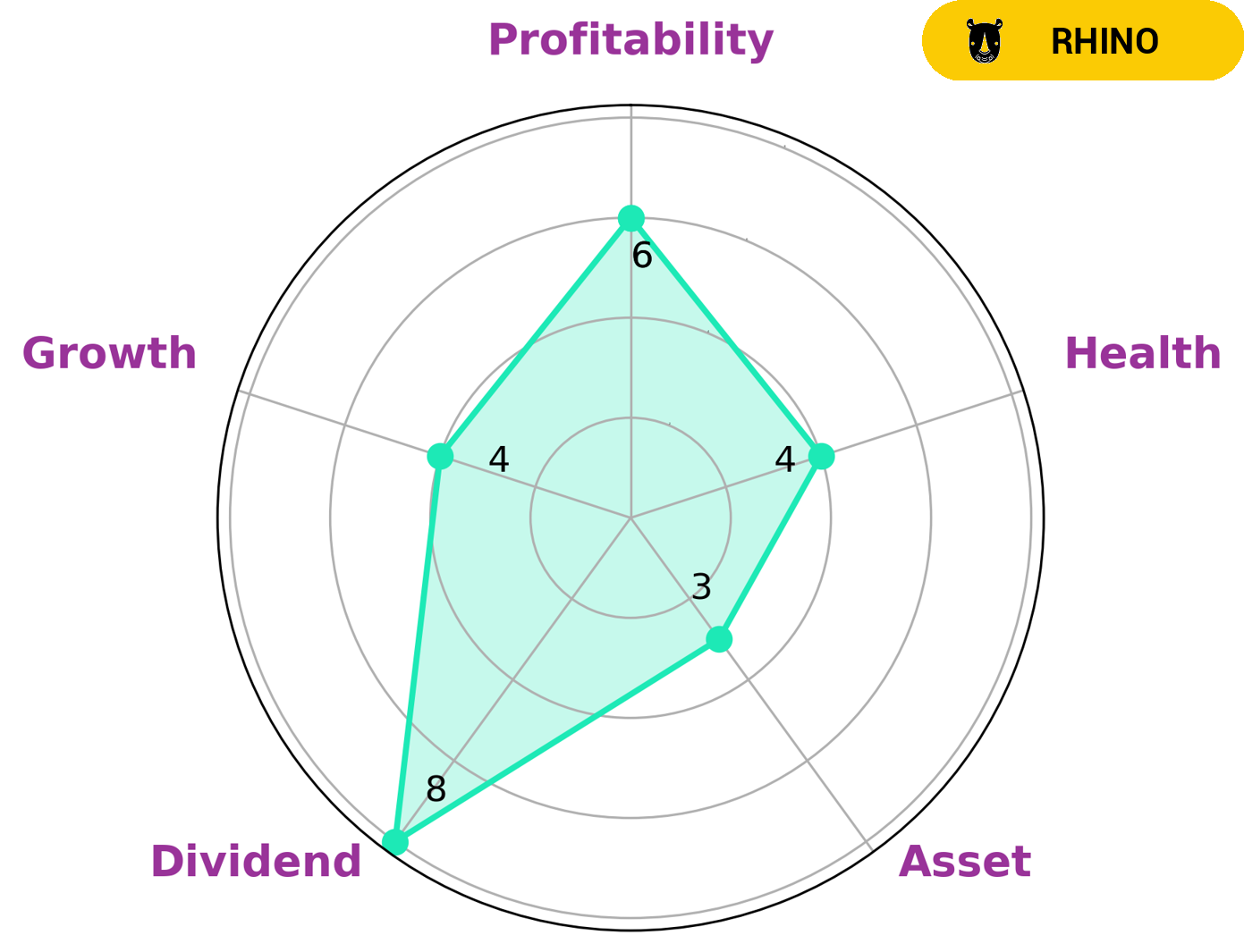

GoodWhale conducted an analysis of SOUTHERN COMPANY‘s wellbeing and based on our Star Chart classification, SOUTHERN COMPANY is classified as a ‘cow’, which is a type of company that pays out consistent and sustainable dividends. This makes SOUTHERN COMPANY an attractive investment option for investors seeking steady returns with little volatility. Our analysis found that SOUTHERN COMPANY was strong in dividend, with a medium profitability and weak asset growth rating. Additionally, the company had an intermediate health score of 4/10 due to its cashflows and debt, indicating that it is likely to sustain operations in times of crisis. As such, SOUTHERN COMPANY is a suitable investment option for investors seeking a return in the long-term. More…

Peers

In the electric utility industry, there is intense competition between Southern Co and its competitors: NextEra Energy Inc, Avangrid Inc, Entergy Corp. These companies are all vying for market share in the Southeast region of the United States.

– NextEra Energy Inc ($NYSE:NEE)

NextEra Energy Inc is a leading clean energy company with operations in 27 states and Canada. The company has a market cap of 143.98B as of 2022 and a Return on Equity of 4.45%. NextEra Energy Inc is committed to providing clean, safe and reliable energy to its customers. The company has a diversified portfolio of generation assets that includes wind, solar, nuclear and natural gas. NextEra Energy Inc is also one of the largest electric utilities in the United States.

– Avangrid Inc ($NYSE:AGR)

Avangrid Inc is a leading energy services and delivery company with operations in 26 states. It has a market cap of 15.4 billion and a return on equity of 3.84%. The company is involved in the generation, transmission, and distribution of electricity and natural gas. It also provides renewable energy solutions.

– Entergy Corp ($NYSE:ETR)

Entergy Corporation is an integrated energy company engaged primarily in electric power production and retail distribution operations. Entergy owns and operates power plants with approximately 30,000 megawatts of electric generating capacity, including nearly 10,000 megawatts of nuclear power. Entergy delivers electricity to 2.9 million utility customers in Arkansas, Louisiana, Mississippi, and Texas.

Summary

He has been an integral part of the company’s success over the years and is credited with leading the company through many successful strategic initiatives. Investors should take notice of this news and consider how the retirement of such a well-respected leader may affect SOU’s future performance. Analysts have suggested that SOU’s earnings could be negatively impacted going forward due to the loss of Fanning’s leadership, but they believe the company is well-positioned to continue to grow and perform well over the long-term.

Recent Posts