PNM Resources Ranking in the Utilities – Regulated Electric Field Analyzed.

March 5, 2023

Trending News 🌥️

PNM ($NYSE:PNM): P N M R e s o u r c e s I n c i s a p u b l i c l y t r a d e d c o m p a n y t h a t i s i n v o l v e d i n t h e U t i l i t i e s – R e g u l a t e d E l e c t r i c s e c t o r . T h i s s e c t o r c o n s i s t s o f c o m p a n i e s t h a t p r o v i d e e l e c t r i c , g a s a n d w a t e r u t i l i t i e s a n d r e l a t e d s e r v i c e s t o i n d i v i d u a l s , b u s i n e s s e s , a n d g o v e r n m e n t a l a g e n c i e s . T h e p e r f o r m a n c e o f t h e s e c o m p a n i e s i s i m p a c t e d b y c h a n g e s i n g o v e r n m e n t r e g u l a t i o n s , d e m a n d f o r t h e g o o d s o r s e r v i c e s p r o v i d e d , w e a t h e r , a n d t h e o v e r a l l e c o n o m y . I n t e r m s o f p e r f o r m a n c e , P N M R e s o u r c e s I n c . r a n k s h i g h l y a m o n g i t s p e e r s i n t h e U t i l i t i e s – R e g u l a t e d E l e c t r i c s e c t o r . A c c o r d i n g t o r e c e n t a n a l y s i s o f t h e s e c t o r , P N M R e s o u r c e s I n c . ‘ s s t o c k h a s a s t r o n g r a n k i n g c o m p a r e d t o o t h e r c o m p a n i e s i n t h e s a m e i n d u s t r y . T h i s s t r o n g p e r f o r m a n c e i s a t t r i b u t e d t o s t r o n g f i n a n c i a l m a n a g e m e n t a n d s o u n d o p e r a t i o n a l s t r a t e g i e s .

P N M R e s o u r c e s I n c . a l s o b e n e f i t s f r o m i t s w e l l – e s t a b l i s h e d c u s t o m e r b a s e , w h i c h h e l p s t o k e e p r e v e n u e c o n s i s t e n t . O v e r a l l , P N M R e s o u r c e s I n c . h a s s h o w n i t s e l f t o b e a n a t t r a c t i v e i n v e s t m e n t i n t h e U t i l i t i e s – R e g u l a t e d E l e c t r i c s e c t o r . T h e c o m p a n y ‘ s s t o c k h a s c o n s i s t e n t l y o u t p e r f o r m e d i t s p e e r s , m a k i n g i t a n i d e a l o p t i o n f o r i n v e s t o r s i n t e r e s t e d i n t h i s s e c t o r . W i t h a s t r o n g f i n a n c i a l s t a n d i n g a n d s o l i d o p e r a t i o n a l s t r a t e g i e s i n p l a c e , P N M R e s o u r c e s I n c . l o o k s s e t t o c o n t i n u e t o b e a l e a d e r i n t h i s s e c t o r i n t h e y e a r s a h e a d.

Stock Price

PNM Resources Inc. has been receiving mostly positive media coverage as it continues to rank in the utilities – regulated electric field. On Friday, the stock opened at $49.0 and ended the week at $48.9, a minor change in comparison to the prior week. With an innovative and forward-thinking business model, PNM Resources is well-positioned to capitalize on the growing demand for electric utilities and move up further in the rankings. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pnm Resources. More…

| Total Revenues | Net Income | Net Margin |

| 2.25k | 169.53 | 10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pnm Resources. More…

| Operations | Investing | Financing |

| 566.86 | -952.26 | 357.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pnm Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.03k | 6.76k | 25.79 |

Key Ratios Snapshot

Some of the financial key ratios for Pnm Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.6% | 10.1% | 15.1% |

| FCF Margin | ROE | ROA |

| -25.6% | 9.6% | 2.3% |

Analysis

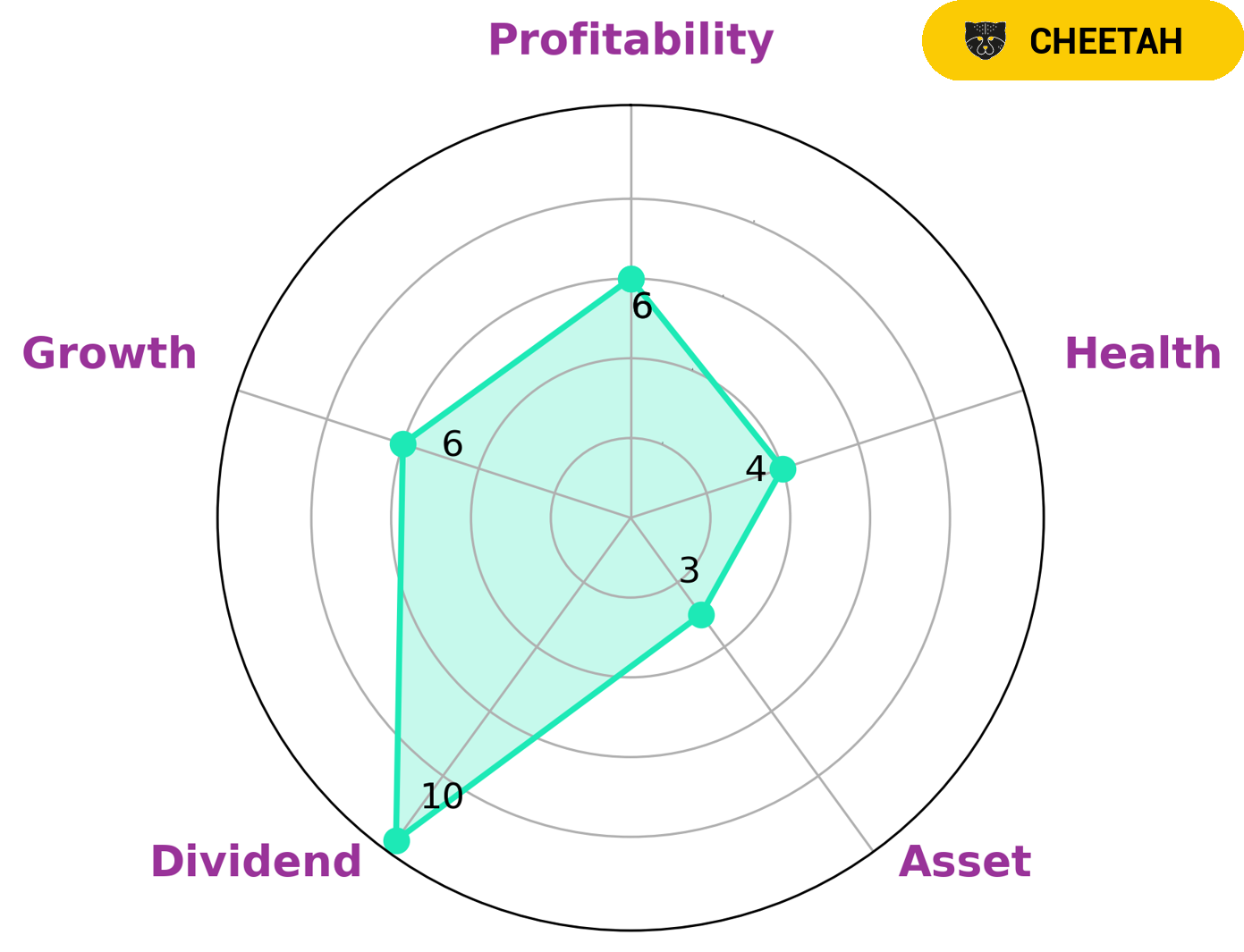

At GoodWhale, we analyze PNM RESOURCES‘s fundamentals according to the Star Chart. Our assessment reveals that PNM RESOURCES has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to pay off debt and fund future operations. PNM RESOURCES is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the specific profile of PNM RESOURCES, certain types of investors may be interested in the stock. Its dividend policy is strong, while its growth, profitability, and asset strategies are rated as medium. Investors looking for a relatively safe stock with good dividend returns may find this company to be an ideal fit for their portfolio. More…

Peers

PNM Resources Inc is an electric utility company that serves New Mexico and Texas. The company has two main subsidiaries: Public Service Company of New Mexico and Texas-New Mexico Power Company. PNM Resources is the holding company for these two subsidiaries. The company has a market capitalization of $2.79 billion and its shares are traded on the New York Stock Exchange under the ticker symbol PNM. The company’s main competitors are Rosseti PJSC, Portland General Electric Co, and Centrais Eletricas Brasileiras SA.

– Rosseti PJSC ($NYSE:POR)

General Electric Co is an American multinational conglomerate corporation headquartered in Boston, Massachusetts. As of 2018, the company operates through the following segments: Power, Renewable Energy, Oil & Gas, Aviation, Healthcare, Transportation, and Capital. The company has a market cap of 3.91B as of 2022 and a return on equity of 9.64%.

– Portland General Electric Co ($NYSE:EBR.B)

Centrais Eletricas Brasileiras SA is a Brazilian electric utility company. The company is involved in the generation, transmission, and distribution of electricity in Brazil. The company has a market cap of 23.13B as of 2022 and a Return on Equity of 9.75%. The company is headquartered in Rio de Janeiro, Brazil.

Summary

PNM Resources Inc. is a holding company that invest in the regulated electric and gas utility industries. It operates through two divisions, Public Service Company of New Mexico (PNM) and Texas-New Mexico Power Company (TNMP). Furthermore, the company has seen a general trend of positive reviews and coverage in the media, indicating a largely positive outlook for potential investors. The low-risk stability makes it especially ideal for those seeking stability over growth, making it a great option for investors who are looking for reliable performance with minimized risk.

Recent Posts