Independent Advisor Alliance Decreases Stake in PPL Corporation.

February 2, 2023

Trending News 🌥️

PPL ($NYSE:PPL) Corporation is one of the largest publicly traded utilities companies in the United States and provides energy to over 10 million customers in the United States and the United Kingdom. It has a diverse portfolio of energy production that includes nuclear, hydroelectric, coal, solar, and wind power. The company has a long history of providing reliable and affordable electricity and natural gas to its customers. Recently, the Independent Advisor Alliance (IAA) has decreased its stake in PPL Corporation. The IAA is an independent financial advisory firm that works with individuals, families, and businesses to provide advice on investing and retirement planning. The IAA has a long history of successful investing and financial advice. As such, their decision to decrease their stake in PPL Corporation is significant. The IAA’s decision to reduce its stake in PPL Corporation could be a sign of concern about the company’s future. The utility sector has been facing a number of challenges in recent years, including increased competition, rising costs, and regulatory changes. PPL Corporation has been able to remain profitable despite these challenges, but there could be signs that the company is headed for trouble.

In addition, the IAA may have decided to reduce its stake in PPL Corporation in order to invest in other companies or industries. As the company’s stock price has remained relatively stable in recent years, the IAA may have decided that there are better opportunities for investment elsewhere. The IAA’s decision to decrease its stake in PPL Corporation will be closely monitored by investors and analysts. If the IAA’s decision proves to be a wise one, then other investors may follow suit. On the other hand, if PPL Corporation is able to overcome its current challenges and continue to deliver strong performance, then the IAA’s decision may turn out to be a mistake. Either way, the IAA’s decision is sure to have an impact on the stock price of PPL Corporation.

Market Price

On Monday, PPL Corporation saw a slight decline in their stock price. The stock opened at $29.5 and closed at $29.4, down by 0.6% from the previous closing price of 29.6. This decline was largely due to the reduction of stake in the company by Independent Advisor Alliance. Independent Advisor Alliance is a financial services firm that provides investment advice to clients. They had previously held a significant stake in PPL Corporation but announced their decision to decrease their stake, leading to the decline in stock price. This news had an immediate effect on the stock market, as investors reacted to the announcement. Many investors saw this as an opportunity to capitalize on the decline, with some buying shares in the company at the lower price.

Others, however, were concerned about the future of the company and decided to sell their shares. Although the stock market was initially shaken by this news, analysts believe that the decline in stock price is not likely to be a long-term trend. They point to the strong fundamentals of the company and its strong performance over the past few years as reasons to remain confident in the future of PPL Corporation. Overall, this news had a short-term impact on the stock market but is unlikely to have a lasting effect on the company. Investors should consider all relevant information before making any decisions regarding their investments in PPL Corporation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ppl Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 7.1k | 700 | 9.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ppl Corporation. More…

| Operations | Investing | Financing |

| 1.8k | -5.7k | -567 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ppl Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 37.38k | 23.49k | 18.85 |

Key Ratios Snapshot

Some of the financial key ratios for Ppl Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.9% | -21.7% | 19.4% |

| FCF Margin | ROE | ROA |

| -3.2% | 6.2% | 2.3% |

Analysis

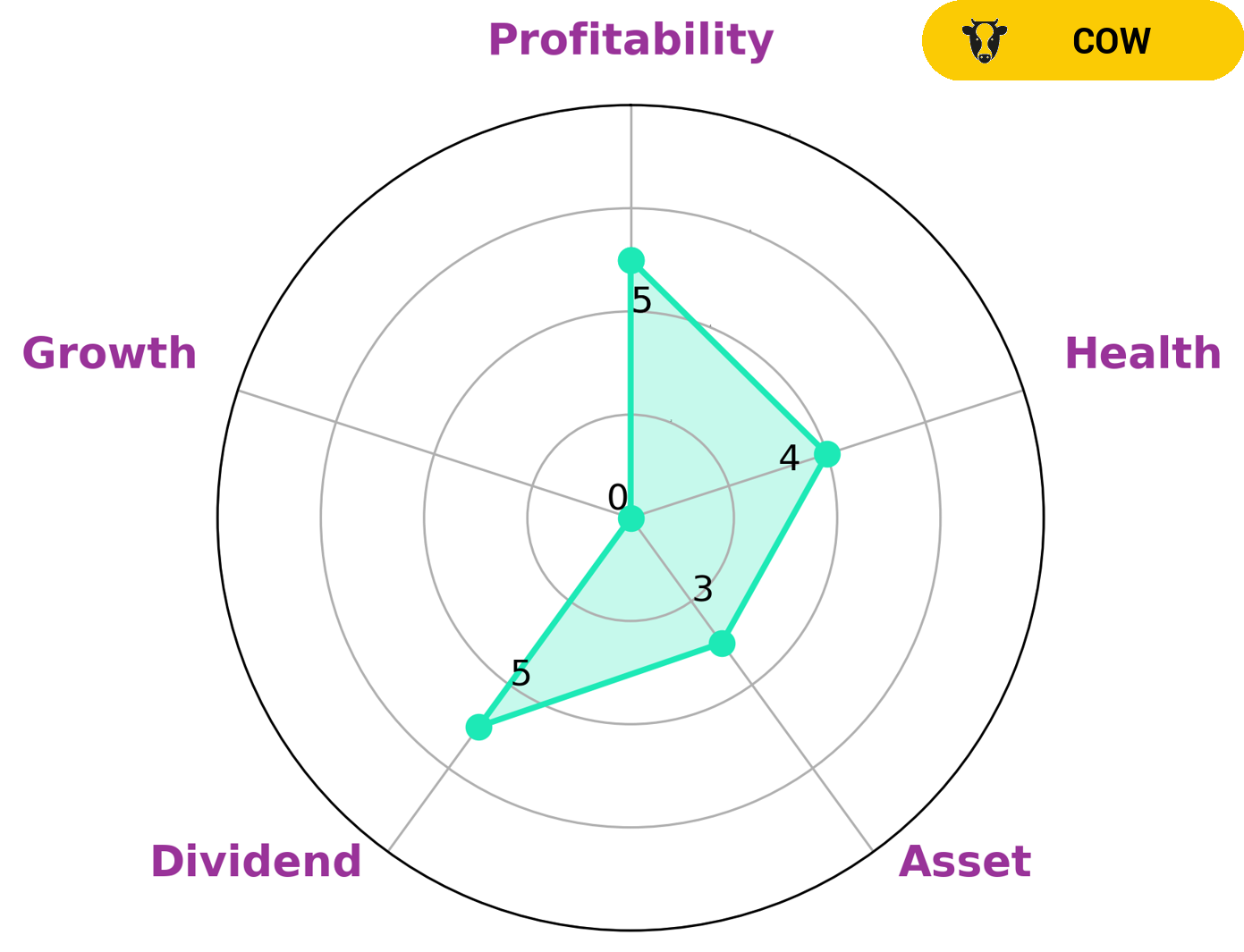

This makes it attractive to investors who are looking for reliable income streams. GoodWhale performed an analysis of PPL Corporation‘s fundamentals and determined that the company is strong in medium in dividend, profitability and weak in asset, growth. The health score of the company is 4/10, which suggests that it could withstand any crisis without the risk of bankruptcy. This makes it a good option for those investors who are looking for steady returns over a long period of time. In terms of its fundamentals, PPL Corporation is a relatively strong company. Its dividend yield is higher than the industry average, and its profitability metrics are also above average. However, its asset base and growth prospects are weaker than its peers. This means that investors need to weigh the pros and cons carefully before investing in PPL Corporation. Overall, PPL Corporation is a good option for investors who are looking for consistent returns over a long period of time. Its health score is intermediate, which suggests that it is able to withstand any crisis without the risk of bankruptcy. Moreover, its dividend yield is higher than the industry average, while its profitability metrics are also above average. Investors should consider these factors carefully before investing in PPL Corporation. More…

Peers

PPL Corp. is an electricity and gas company that operates in the United Kingdom, the United States, and Chile. The company is headquartered in London, England. The company’s main competitors are Enel Chile SA, Societatea Energetica Electrica SA, and Rosseti PJSC.

– Enel Chile SA ($NYSE:ENIC)

Enel Chile is a Chilean electricity company that is part of the Italian energy company Enel. It is the largest electricity generator in Chile and the second largest in South America. The company has a market cap of 2.43B as of 2022 and a Return on Equity of 4.84%. Enel Chile is a leading electricity company in Chile and South America, and is committed to providing clean and sustainable energy to its customers.

– Societatea Energetica Electrica SA ($LSE:ELSA)

Electrica SA is a Romania-based company engaged in the electricity sector. The Company’s activity is divided into three segments: Distribution, Supply and Services. The Distribution segment manages the low and medium voltage networks, while the Supply segment focuses on the sale of electricity to final consumers. The Services segment provides metering, grid connection, technical assistance, project management and other services. Electrica SA operates through a network of over 70 subsidiaries.

Summary

PPL Corporation, a diversified energy company, has had its stake decreased by Independent Advisor Alliance (IAA). Investors are encouraged to conduct their own research and seek professional advice before making any investments decisions in PPL Corporation.

Recent Posts