HE Intrinsic Value Calculator – Hawaiian Electric Industries Reports Missed Earnings, Record Revenue

May 10, 2023

Trending News 🌧️

HAWAIIAN ($NYSE:HE): HEI is a publicly traded holding company, headquartered in Honolulu, Hawaii, with subsidiaries providing electric and energy services to the island of Oahu. HEI reported that their GAAP earnings per share (EPS) was $0.50, falling short of expectations by $0.03. Despite this, their revenue of $928.24M exceeded forecasts by $172.42M.

The company attributed this discrepancy to strong performances in their power supply and banking segments. Overall, HEI missed their earnings expectations but recorded record revenue, demonstrating the company’s resilience and optimism for the future.

Earnings

Hawaiian Electric Industries (HEI) has recently released its Q4 earnings report for Fiscal Year 2022 as of December 31, 2022. The impressive financial performance of HEI highlights its commitment to success in the electric industry. As the largest provider of electrical services in the state of Hawaii, HEI has proved itself as a reliable and profitable business model. With continued commitment to serving its customers and investing in its infrastructure, HEI is well poised for further success in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HE. More…

| Total Revenues | Net Income | Net Margin |

| 3.74k | 241.14 | 6.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HE. More…

| Operations | Investing | Financing |

| 327.93 | -324.08 | -19.86 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.28k | 14.08k | 20.12 |

Key Ratios Snapshot

Some of the financial key ratios for HE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 3.0% | 10.8% |

| FCF Margin | ROE | ROA |

| -0.0% | 11.5% | 1.6% |

Share Price

Hawaiian Electric Industries (HEI) reported on Tuesday that their earnings had missed expectations by a small margin, though revenue was at a record high. HEI stock opened at $38.0 and closed at $37.6, down by 2.5% from the previous closing price of 38.5. This marked a sharp contrast to the initial jump of the stock after the announcement of the quarterly results. Despite recording a higher revenue than ever before, the net income of HEI was slightly lower than analysts’ predictions.

The company’s Chairman, President and CEO Connie Lau attributed the missed earnings to higher operating expenses, which offset the gains from higher revenue. Despite the missed earnings, HEI’s stock still showed some resilience, indicating investor confidence in the prospects for the company in the future. Live Quote…

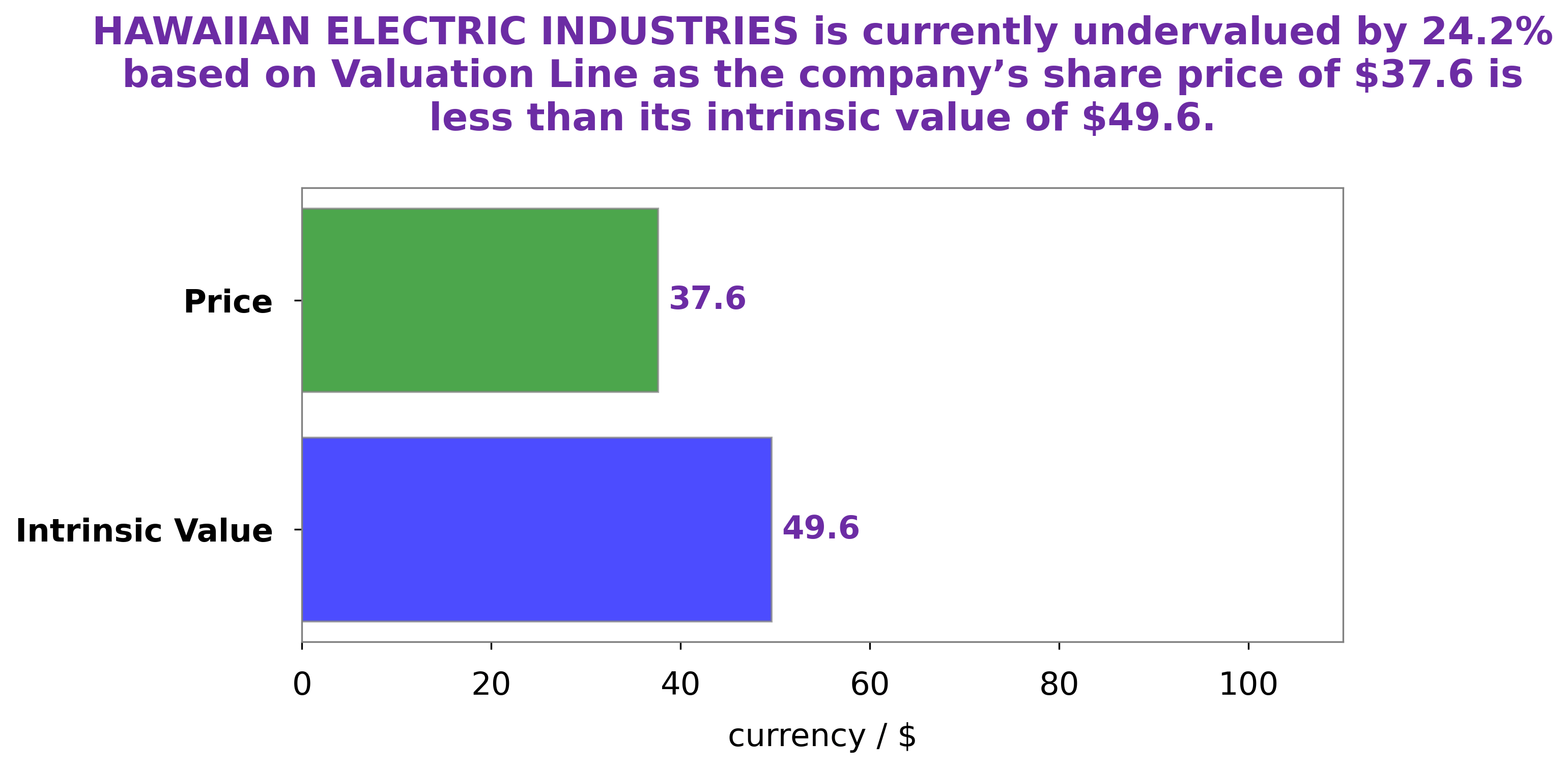

Analysis – HE Intrinsic Value Calculator

GoodWhale has conducted an analysis of HAWAIIAN ELECTRIC INDUSTRIES, and our proprietary Valuation Line reveals that the intrinsic value of HAWAIIAN ELECTRIC INDUSTRIES share is around $49.6. Currently, HAWAIIAN ELECTRIC INDUSTRIES stock is traded at $37.6, which is undervalued by 24.2%. This presents a great opportunity for investors to purchase HAWAIIAN ELECTRIC INDUSTRIES stocks at a discount. More…

Peers

Its competitors in the electric power industry include Pinnacle West Capital Corp, Evergy Inc, Federal Grid Co of Unified Energy System PJSC. HEI has a long history dating back to its founding in 1881 and is the largest electric utility in Hawaii, with over 400,000 customers.

– Pinnacle West Capital Corp ($NYSE:PNW)

Pinnacle West is an electric utility company headquartered in Phoenix, Arizona. It is the parent company of Arizona Public Service, the state’s largest electric utility. The company serves more than two million customers in Arizona.

Pinnacle West has a market capitalization of $7.61 billion as of 2022 and a return on equity of 9.57%. The company is the largest electric utility in Arizona and serves more than two million customers.

– Evergy Inc ($NYSE:EVRG)

Evergy Inc is a holding company that engages in the generation, transmission, and distribution of electricity in the United States. It operates through two segments: Kansas Operations and Missouri Operations. The company has a market cap of 13.95B as of 2022 and a ROE of 8.82%. Evergy Inc was founded in 1925 and is headquartered in Kansas City, Missouri.

Summary

Hawaiian Electric Industries (HEI) is a publicly-traded company that provides energy-related products and services in the state of Hawaii. Revenue totaled $928.24 million, surpassing estimates by $172.42 million, while earnings per share came in at $0.50, missing expectations by $0.03. Despite the miss on earnings, investors seemed pleased with the results, sending shares up over 3% in pre-market trading.

Analysts are optimistic about HEI’s future prospects, citing the company’s strong balance sheet and diverse sources of revenue. HEI stands to benefit from continued growth in the Hawaiian economy, as well as potential gains from its investments in renewables.

Recent Posts