Edison International Stock Dips 0.74%, Still Outperforms Market.

February 9, 2023

Trending News 🌥️

Edison International ($NYSE:EIX), a publicly traded energy company, saw its stock dip by 0.74% on Wednesday, closing at $66.81. Despite this decrease in stock price, Edison International still outperformed the market as a whole, which had an overall dismal trading session. Edison International is an American publicly traded energy holding company headquartered in Rosemead, California. It is the parent company of Southern California Edison and Edison Energy, is one of the largest investor-owned electric utilities in the United States, and is currently the largest subsidiary of parent company Edison International. The company’s stock has been fairly stable over the last few years, and it has performed well in comparison to the overall market.

Edison International’s stock price may have dipped slightly on Wednesday, but it is still outperforming the market as a whole. The company is well positioned to continue to have strong performance in the years ahead. It has a strong balance sheet and its fundamentals remain solid, making it a good option for investors looking for a secure long-term investment.

Share Price

On Wednesday, Edison International stock opened at $67.0 and closed at $66.8, down by 0.7% from previous closing price of 67.3. Despite this slight dip in the stock price, Edison International still outperformed the market as a whole. The dip in Edison International stock came after the company reported its third quarter financial results that missed expectations. The dip in stock price could be attributed to overall market sentiment, as investors are now preparing for a potential economic slowdown amid rising geopolitical tensions and global economic uncertainty. As a result, many investors have been taking a more conservative approach to their investments, leading to a decrease in stock prices across the board.

Despite this short-term dip, Edison International stock still looks to be a good long-term investment given its current performance and potential for growth. The company is expected to benefit from strong demand for its services and steady growth in its core markets. It also plans to increase its investments in renewable energy sources, which could provide further upside for investors over time. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Edison International. More…

| Total Revenues | Net Income | Net Margin |

| 16.54k | 720 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Edison International. More…

| Operations | Investing | Financing |

| 2.61k | -5.6k | 2.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Edison International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 76.71k | 59.42k | 41.36 |

Key Ratios Snapshot

Some of the financial key ratios for Edison International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.1% | -23.9% | 11.5% |

| FCF Margin | ROE | ROA |

| -19.1% | 6.4% | 1.3% |

Analysis

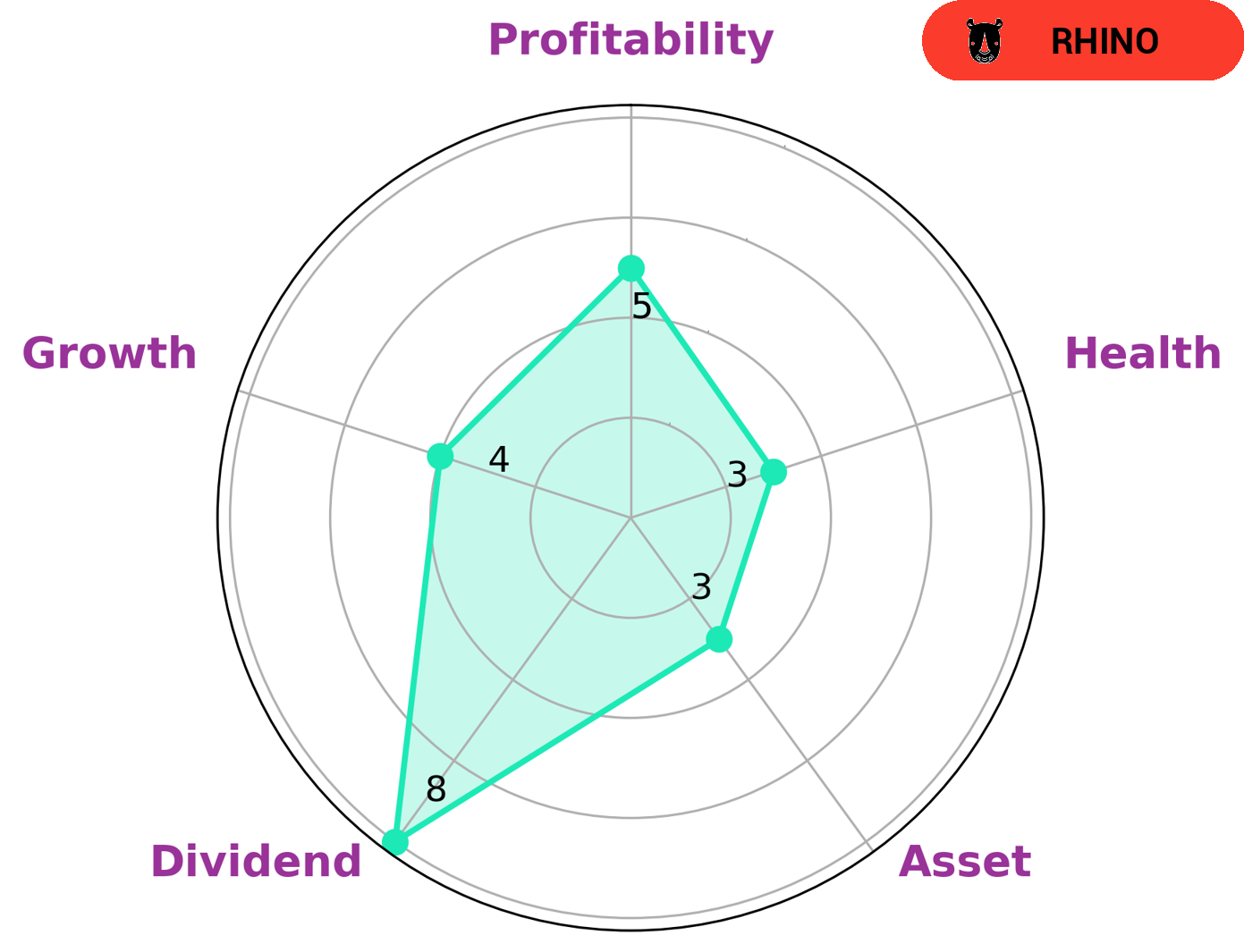

EDISON INTERNATIONAL is a company with a strong dividend, medium growth, and profitability. According to the Star Chart, it is weak when it comes to assets. This places it in the ‘rhino’ category, which are companies that have achieved moderate revenue or earnings growth. Investors who are attracted to such a company may be looking for a steady stream of income from dividends, and may not be as concerned about capital appreciation. Those who are looking for a more aggressive growth strategy might be better served by investing in other companies. The company has a low health score of 3/10 with regard to its cashflows and debt, which could make investors wary of investing in it. With this in mind, it is less likely that EDISON INTERNATIONAL can safely ride out any crisis without the risk of bankruptcy. Investors should take this into consideration before investing in the company. Overall, EDISON INTERNATIONAL may be an attractive option for those looking for an income stream from dividends, but investors should also be aware of its low health score when making their decision. Those seeking more aggressive growth strategies may be better served by looking elsewhere. More…

Peers

Edison International is one of the largest investor-owned electric utilities in the United States and is one of the largest electric utility companies in the world. Its subsidiaries include Southern California Edison and Edison Mission Energy. It is headquartered in Rosemead, California. Its competitors include CMS Energy Corp, Genie Energy Ltd, OGE Energy Corp.

– CMS Energy Corp ($NYSE:CMS)

CMS Energy Corporation is an energy company operating primarily in the state of Michigan. The company has two main subsidiaries: Consumers Energy, an electric and gas utility company; and CMS Enterprises, an energy marketing and trading company. CMS Energy is headquartered in Jackson, Michigan.

As of 2022, CMS Energy Corporation had a market capitalization of 16.14 billion dollars and a return on equity of 12.15%. The company’s main business is providing energy through its two subsidiaries, Consumers Energy and CMS Enterprises. Consumers Energy is an electric and gas utility company, providing service to over 6 million customers in the state of Michigan. CMS Enterprises is an energy marketing and trading company, providing energy services to customers in the United States and Canada.

– Genie Energy Ltd ($NYSE:GNE)

Genie Energy Ltd. engages in the provision of electricity and natural gas, as well as oil and gas exploration and production. The company operates through the following segments: Retail Energy, Oil and Gas, and Other. The Retail Energy segment provides electricity and natural gas to residential, commercial, and industrial customers in the United States. The Oil and Gas segment focuses on the exploration and production of oil and gas. The Other segment includes corporate overhead and other investments. Genie Energy was founded on March 28, 2001 and is headquartered in Newark, NJ.

– OGE Energy Corp ($NYSE:OGE)

DOE Energy Corp is an energy company that focuses on the development and production of natural gas and oil. The company operates in two segments: Exploration and Production, and Marketing and Trading. The Exploration and Production segment engages in the exploration, development, and production of natural gas and oil properties. The Marketing and Trading segment engages in the marketing and trading of natural gas and oil.

Summary

Edison International is a publicly traded company that provides electric power and energy services to Southern California. Recently, its stock dipped 0.74%, however it still outperformed the overall market. When investing in Edison International, it is important to consider a few key points.

First, consider the company’s financials. Analyze the balance sheet and income statement to determine the financial health of the company. Second, look at the company’s competitive advantage. Consider the industry trends, customer base and business model. Third, examine the management team. Analyze the past performance of the management team and their strategic vision for the future. Finally, analyze the stock’s performance over time. Look at its past performance, price-to-earnings ratio and other key metrics. By using these methods, investors can gain a better understanding of Edison International and make informed decisions when investing in the company.

Recent Posts