Edison International Reports Non-GAAP EPS of $1.09, Revenue of $3.97B Misses by $30M

May 3, 2023

Trending News 🌧️

The total revenue of $3.97B fell short of analyst predictions by $30M. Edison International ($NYSE:EIX) is a holding company whose subsidiaries are involved in the generation, transmission, and distribution of electricity and energy services. Based in Rosemead, California, it is the parent corporation of Southern California Edison and Edison Energy. Edison International has become a recognized leader in delivering clean energy solutions and services to its customers. They have created a suite of innovative products that help customers save money on their energy bills as well as achieve their sustainability goals.

Price History

The company also reported total revenue of $3.97 billion for the quarter, missing estimates by $30 million. On Tuesday, EDISON INTERNATIONAL stock opened at $74.0 and closed at $73.3, down by 0.9% from the previous closing price of 74.0. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Edison International. More…

| Total Revenues | Net Income | Net Margin |

| 17.22k | 612 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Edison International. More…

| Operations | Investing | Financing |

| 3.22k | -5.57k | 2.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Edison International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 78.04k | 60.52k | 40.87 |

Key Ratios Snapshot

Some of the financial key ratios for Edison International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | -7.9% | 10.6% |

| FCF Margin | ROE | ROA |

| -14.9% | 7.4% | 1.5% |

Analysis

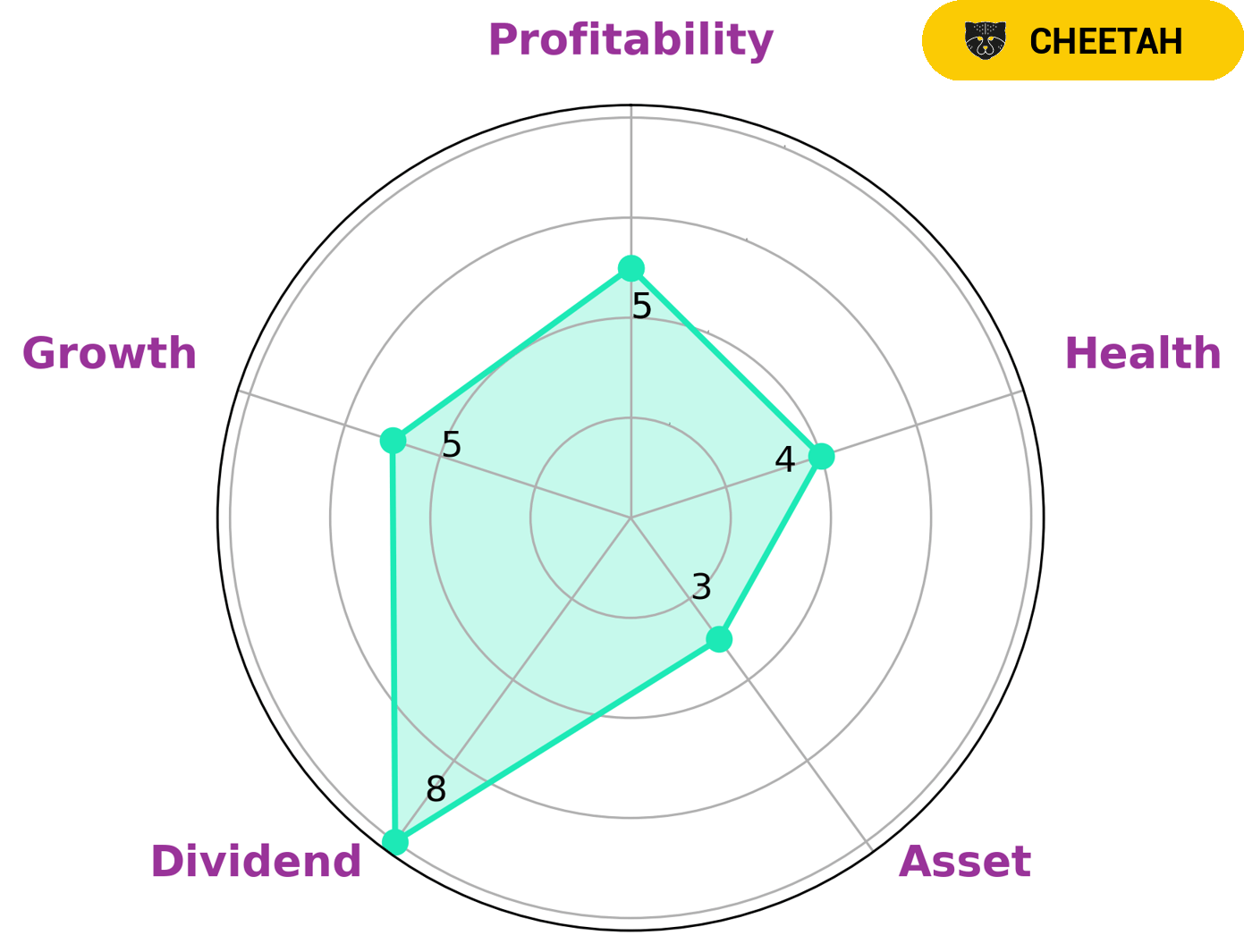

GoodWhale has conducted an analysis of EDISON INTERNATIONAL‘s wellbeing, and based on the Star Chart it is clear that the company is strong in dividend, but only medium in growth, profitability, and asset. As such, we classify EDISON INTERNATIONAL as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth, but is considered to be less stable due to lower profitability. Investors who are interested in EDISON INTERNATIONAL should be aware that although it has achieved high revenue growth, this may not be sustainable due to its lower profitability. However, GoodWhale’s analysis has also shown that EDISON INTERNATIONAL has an intermediate health score of 4/10 considering its cashflows and debt, and is likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

Edison International is one of the largest investor-owned electric utilities in the United States and is one of the largest electric utility companies in the world. Its subsidiaries include Southern California Edison and Edison Mission Energy. It is headquartered in Rosemead, California. Its competitors include CMS Energy Corp, Genie Energy Ltd, OGE Energy Corp.

– CMS Energy Corp ($NYSE:CMS)

CMS Energy Corporation is an energy company operating primarily in the state of Michigan. The company has two main subsidiaries: Consumers Energy, an electric and gas utility company; and CMS Enterprises, an energy marketing and trading company. CMS Energy is headquartered in Jackson, Michigan.

As of 2022, CMS Energy Corporation had a market capitalization of 16.14 billion dollars and a return on equity of 12.15%. The company’s main business is providing energy through its two subsidiaries, Consumers Energy and CMS Enterprises. Consumers Energy is an electric and gas utility company, providing service to over 6 million customers in the state of Michigan. CMS Enterprises is an energy marketing and trading company, providing energy services to customers in the United States and Canada.

– Genie Energy Ltd ($NYSE:GNE)

Genie Energy Ltd. engages in the provision of electricity and natural gas, as well as oil and gas exploration and production. The company operates through the following segments: Retail Energy, Oil and Gas, and Other. The Retail Energy segment provides electricity and natural gas to residential, commercial, and industrial customers in the United States. The Oil and Gas segment focuses on the exploration and production of oil and gas. The Other segment includes corporate overhead and other investments. Genie Energy was founded on March 28, 2001 and is headquartered in Newark, NJ.

– OGE Energy Corp ($NYSE:OGE)

DOE Energy Corp is an energy company that focuses on the development and production of natural gas and oil. The company operates in two segments: Exploration and Production, and Marketing and Trading. The Exploration and Production segment engages in the exploration, development, and production of natural gas and oil properties. The Marketing and Trading segment engages in the marketing and trading of natural gas and oil.

Summary

Analysts are hopeful that the strong EPS result indicates that the company’s long-term growth prospects remain positive, despite the slight miss on revenue. Investors should keep an eye on the company’s future performance in order to determine its true potential.

Recent Posts