“DTE Energy Co. Stock Rises Sharply in 2023, Outperforming Market”.

March 25, 2023

Trending News ☀️

On Friday, DTE ($NYSE:DTE) Energy Co. stock rose sharply in 2023 and outperformed the market. The strong performance was driven by the company’s financial results, which showed impressive growth across multiple segments. The company reported a 4% increase in revenue year-over-year due to their investments in renewable energy sources such as wind and solar. Overall, DTE Energy Co. has seen a significant uptick in its stock price due to its strong performance in 2023.

Analysts are optimistic that the company’s long-term outlook remains positive, as it continues to invest in renewable energy sources and cost-cutting efforts. This positive momentum in the stock is expected to continue, propelling the company into a brighter future.

Market Price

In 2023, DTE Energy Co. has seen a marked rise in its stock, far surpassing the performance of the overall market. So far, news about the company has been mostly positive. On Friday, the company’s stock opened at $103.0 and closed at $106.8, representing an increase of 4.0% from the previous closing price of 102.7. This sharp increase in the company’s stock is indicative of its positive outlook for the foreseeable future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dte Energy. More…

| Total Revenues | Net Income | Net Margin |

| 19.23k | 1.08k | 5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dte Energy. More…

| Operations | Investing | Financing |

| 1.98k | -3.43k | 1.46k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dte Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.68k | 32.28k | 46.35 |

Key Ratios Snapshot

Some of the financial key ratios for Dte Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.9% | 1.0% | 9.3% |

| FCF Margin | ROE | ROA |

| -7.3% | 11.5% | 2.6% |

Analysis

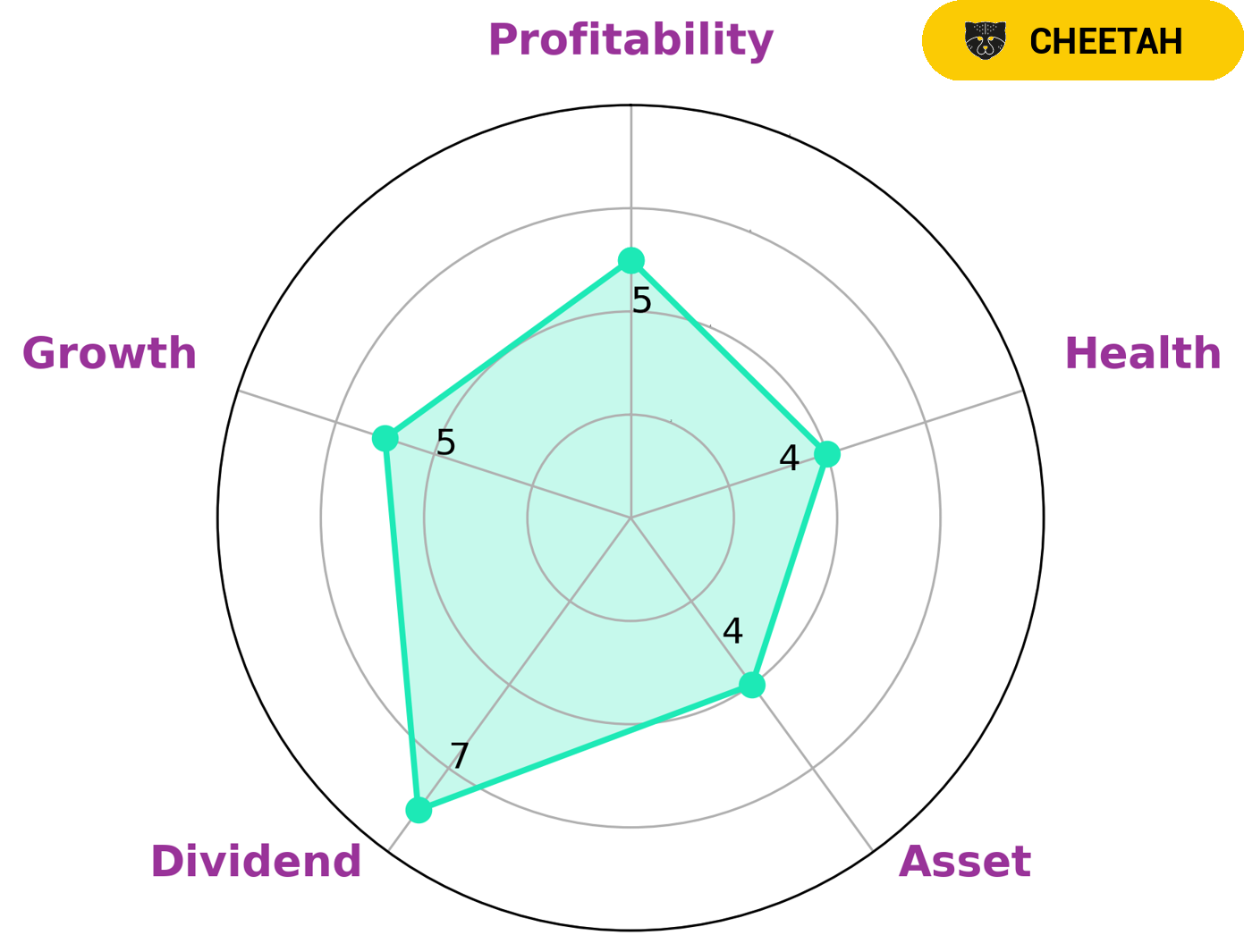

At GoodWhale, we have conducted an analysis of DTE ENERGY‘s fundamentals. According to our Star Chart, DTE ENERGY is strong in dividend and medium in asset, growth, and profitability. With an intermediate health score of 4/10 considering its cashflows and debt, we believe that DTE ENERGY is likely to safely ride out any crisis without the risk of bankruptcy. Additionally, we have classified DTE ENERGY as a ‘Cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This may be of interest to investors looking for growth opportunities that come with higher risk, such as venture capitalists or angel investors. More…

Peers

The company operates through two segments: Electric and Gas. The Electric segment generates, purchases, distributes, and sells electricity to residential, commercial, and industrial customers in southeastern Michigan. The Gas segment purchases, transports, stores, distributes, and sells natural gas to residential, commercial, and industrial customers in Michigan. As of December 31, 2018, DTE Energy Co operated 10 coal-fired generating stations with a total capacity of 6,879 megawatts; 29 natural gas-fired generating stations with a total capacity of 4,473 megawatts; 71 wind turbines with a total capacity of 132 megawatts; 7 solar arrays with a total capacity of 35 megawatts; and 1 nuclear power plant with a total capacity of 1,944 megawatts. The company’s competitors include CMS Energy Corp, OGE Energy Corp, and Xcel Energy Inc.

– CMS Energy Corp ($NYSE:CMS)

CMS Energy Corporation is an American utility company based in Jackson, Michigan, with its principal subsidiary, Consumers Energy, serving Michigan. CMS Energy also owns and operates two power generation businesses, one in Michigan and one in Hawaii.

The company has a market capitalization of $16.81 billion as of 2022 and a return on equity of 12.15%. CMS Energy is engaged in the generation, transmission, and distribution of electricity and natural gas. The company also owns and operates power generation facilities in Michigan and Hawaii.

– OGE Energy Corp ($NYSE:OGE)

Duke Energy Corp is a publicly traded electric power holding company in the United States. The company has a market capitalization of $73.9 billion as of March 2021 and a return on equity of 18.7%. Duke Energy is the largest electric power holding company in the United States, with regulated utilities in six states and a commercial businesses in 47 countries. The company’s regulated utility operations serve approximately 7.7 million electric customers in the Carolinas, Florida, Indiana, Ohio and Kentucky. Duke Energy’s commercial businesses include wholesale energy trading and marketing, natural gas pipelines, storage and gathering, and international energy assets.

– Xcel Energy Inc ($NASDAQ:XEL)

Xcel Energy Inc. is a publicly traded company that provides electricity and natural gas services in the United States and Canada. The company has a market capitalization of $35.77 billion as of 2022 and a return on equity of 9.4%. The company operates in eight states and serves more than 3.6 million customers. Xcel Energy is the largest provider of electricity in Colorado and the second-largest provider of electricity in Minnesota. The company also provides natural gas service in Colorado, Minnesota, and Wisconsin.

Summary

DTE Energy Co. stock has been outperforming the market and has seen a sharp rise in 2023. This has been reflected in the stock price, which has moved up significantly on the same day. The news surrounding the company has been mostly positive and this has been reflected in the stock’s performance.

Investors who have held onto the stock have seen a healthy return on their investment, while those who are looking to invest in the company now could see further gains if the trend continues. It is important to consider all factors when investing in any company and to do thorough research before making any decisions.

Recent Posts