Rockefeller Capital Management L.P. Increases Investment in Hawaiian Electric Industries, by 308 Shares.

February 10, 2023

Trending News ☀️

Rockefeller Capital Management L.P. has recently made a significant investment in Hawaiian Electric Industries ($NYSE:HE), Inc. (HEI) by acquiring 308 shares. It is engaged in the generation, purchase, transmission, distribution and sale of electric energy. HEI operates three electric utilities: Hawaiian Electric Company, Inc., Maui Electric Company, Ltd., and Hawaii Electric Light Company, Inc. The company also provides non-regulated services such as real estate development, telecommunications, environmental services and energy services. HEI’s revenue comes from two sources: electric revenues from utilities and non-utility investments. The electric revenue generated from its utilities is subject to regulation by the Hawaii Public Utilities Commission. Non-utility investments include subsidiaries that are either publicly held or privately held.

These subsidiaries focus on the areas of telecommunications, real estate development, energy services, and providing environmentally friendly solutions. HEI is committed to providing reliable and affordable energy to its customers. With an increasing demand for clean and renewable energy sources, HEI continues to focus on developing innovative solutions to meet the needs of its customers while driving its businesses forward. HEI has a long history of providing reliable and affordable electricity to Hawaii residents and businesses and its commitment to environmental stewardship make it an attractive investment. With its increased investment in HEI, Rockefeller Capital Management L.P. is sure to benefit from the company’s continued success.

Market Price

This news has generated mostly positive sentiment in the market. On Thursday, HAWAIIAN ELECTRIC INDUSTRIES stock opened at $42.9 and closed at $41.8, down by 2.7% from prior closing price of 43.0. The company was able to perform well in the past few quarters, with its overall stock performance being satisfactory. It also provides a range of banking and other financial services. The company is well-positioned to benefit from the growing customer demand for renewable energy in Hawaii, with its focus on the development and distribution of energy-related products and services. It has been investing heavily in renewable energy projects to meet the growing demand for green energy sources.

The company’s commitment to sustainability has enabled it to remain profitable despite the challenging market conditions. Hawaiian Electric Industries, Inc. offers a wide range of services through its subsidiaries, such as Hawaiian Electric Company, Inc., which provides electricity to residential, commercial, and industrial customers, and American Savings Bank, which provides a suite of banking services for individuals and businesses. The company has a strong customer base and a long-standing reputation for providing reliable services that have enabled it to succeed in the highly competitive market. The company’s commitment to sustainability and innovation has enabled it to remain profitable despite the challenging market conditions and position itself as a leader in the renewable energy industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HE. More…

| Total Revenues | Net Income | Net Margin |

| 3.49k | 238.31 | 8.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HE. More…

| Operations | Investing | Financing |

| 332.73 | -1.18k | 756.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16k | 13.77k | 20.4 |

Key Ratios Snapshot

Some of the financial key ratios for HE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.3% | 4.3% | 14.1% |

| FCF Margin | ROE | ROA |

| 0.5% | 11.2% | 1.6% |

Analysis

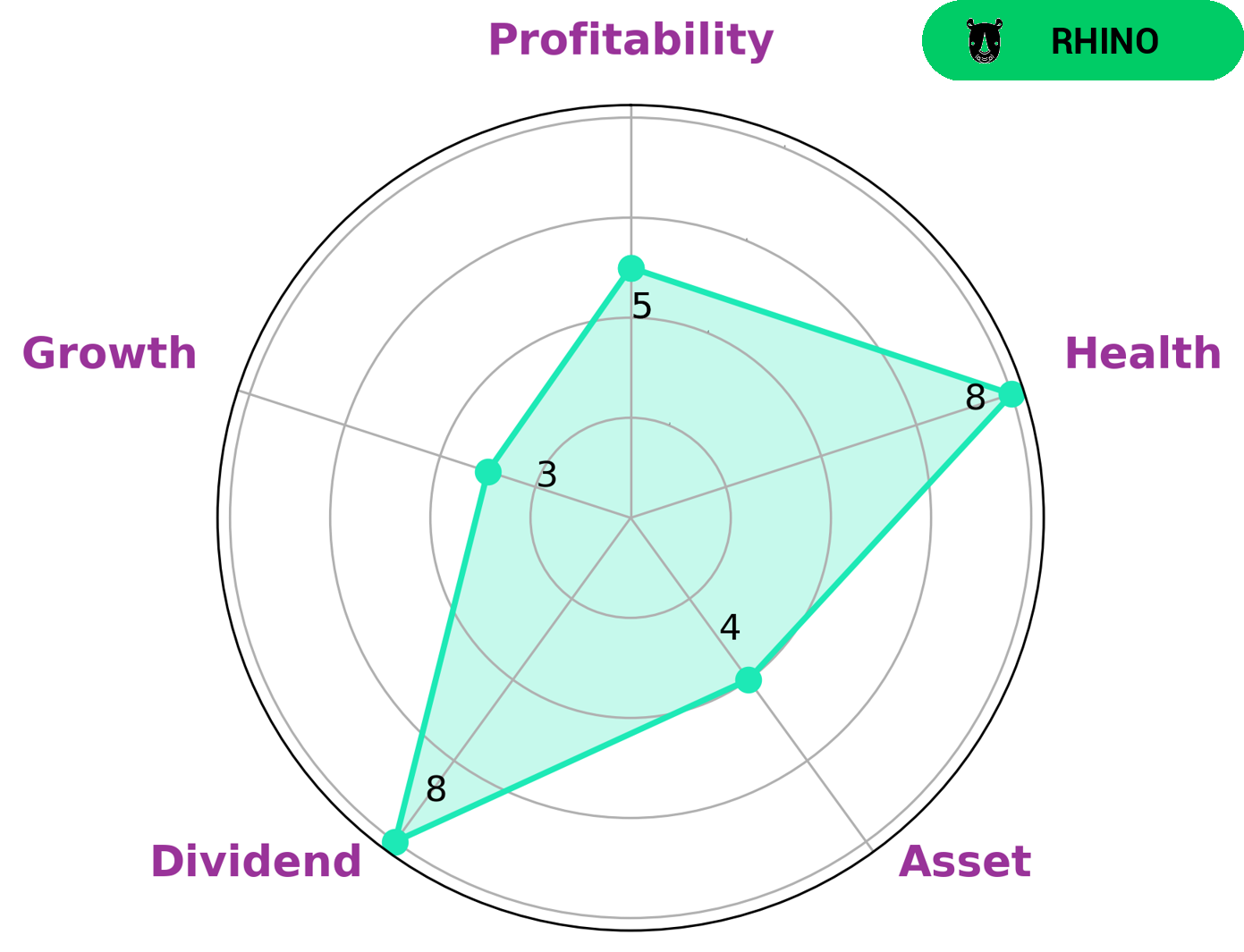

GoodWhale conducted an analysis of HAWAIIAN ELECTRIC INDUSTRIES’s wellbeing, revealing a Star Chart that showed HAWAIIAN ELECTRIC INDUSTRIES to be strong in dividend, medium in asset, profitability and weak in growth. HAWAIIAN ELECTRIC INDUSTRIES is classified as a ‘rhino’ type of company – one that has achieved moderate revenue or earnings growth. Such companies are attractive investments for investors who are looking for steady returns, rather than high-risk, high-reward strategies. HAWAIIAN ELECTRIC INDUSTRIES has a high health score of 8/10, indicating that the company has strong cashflows and is capable of riding out any crisis without the risk of bankruptcy. This makes HAWAIIAN ELECTRIC INDUSTRIES an attractive investment opportunity for investors who are looking for steady returns with minimal risk. Furthermore, the company’s strong dividend and asset base provide investors with reliable income and capital security. Overall, HAWAIIAN ELECTRIC INDUSTRIES is an attractive investment opportunity for those looking for steady returns with minimal risk. The company’s strong dividend and asset base provide reliable income and capital security, while its moderate revenue and earnings growth offer a balance between risk and reward. The company’s healthy financials indicate that it can weather any crisis without the risk of bankruptcy, making it an ideal long-term investment for those seeking stability. More…

Peers

Its competitors in the electric power industry include Pinnacle West Capital Corp, Evergy Inc, Federal Grid Co of Unified Energy System PJSC. HEI has a long history dating back to its founding in 1881 and is the largest electric utility in Hawaii, with over 400,000 customers.

– Pinnacle West Capital Corp ($NYSE:PNW)

Pinnacle West is an electric utility company headquartered in Phoenix, Arizona. It is the parent company of Arizona Public Service, the state’s largest electric utility. The company serves more than two million customers in Arizona.

Pinnacle West has a market capitalization of $7.61 billion as of 2022 and a return on equity of 9.57%. The company is the largest electric utility in Arizona and serves more than two million customers.

– Evergy Inc ($NYSE:EVRG)

Evergy Inc is a holding company that engages in the generation, transmission, and distribution of electricity in the United States. It operates through two segments: Kansas Operations and Missouri Operations. The company has a market cap of 13.95B as of 2022 and a ROE of 8.82%. Evergy Inc was founded in 1925 and is headquartered in Kansas City, Missouri.

Summary

Rockefeller Capital Management L.P. recently increased their investment in Hawaiian Electric Industries, Inc. (HEI) by 308 shares. This move is seen as a sign of confidence in the company and its future prospects. Analysts are generally positive on the outlook for HEI, citing its strong financial position, reliable customer base, and potential for future growth. The company has made strategic investments in renewable energy, infrastructure, and technology, positioning it well for the future.

Investors should consider the potential returns that could be achieved by investing in HEI. With its strong fundamentals and promising outlook, HEI remains an attractive investment opportunity.

Recent Posts