Upexi Accelerates Acquisition of Cygnet, Taking Full Ownership Early

April 13, 2023

Trending News 🌥️

UPEXI ($NASDAQ:UPXI) Inc., a leading technology and services provider with a focus on digital transformation, announced today that it has accelerated the acquisition of Cygnet, taking full ownership of the company earlier than expected. This move allows UPEXI to have a majority stake in Cygnet, making it the sole owner of the company. The company provides digital services to a range of industries and organizations, including healthcare, retail, financial services, and more. It specializes in digital marketing, analytics, digital payments, cloud computing, and automation. UPEXI has established itself as an innovative leader in the tech industry as well as a reliable partner for its customers.

The acquisition of Cygnet allows UPEXI to further expand its capabilities in the digital services space and to offer more comprehensive solutions to its customers. With full ownership of Cygnet, UPEXI will be able to leverage the company’s experience and expertise in mobile application development, artificial intelligence, and blockchain technology. This move also positions UPEXI to take advantage of new opportunities in the quickly growing digital market.

Market Price

On Wednesday, UPEXI INC stock opened at $4.0 and closed at $4.2, a 6.4% rise from its last closing price of $3.9. This increase was due to the announcement that UPEXI had accelerated its acquisition of Cygnet and taken full ownership of the company earlier than expected. This acquisition opens up new opportunities for UPEXI, and it is likely that the stock price will continue to increase as the company begins to benefit from the new ownership. With this move, UPEXI has positioned itself well in the industry and looks set to continue its success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Upexi Inc. More…

| Total Revenues | Net Income | Net Margin |

| 74.38 | -2.61 | -3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Upexi Inc. More…

| Operations | Investing | Financing |

| 3.72 | -0.16 | -5.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Upexi Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 76.64 | 39.89 | 2.06 |

Key Ratios Snapshot

Some of the financial key ratios for Upexi Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 172.3% | – | -5.8% |

| FCF Margin | ROE | ROA |

| 2.2% | -8.5% | -3.5% |

Analysis

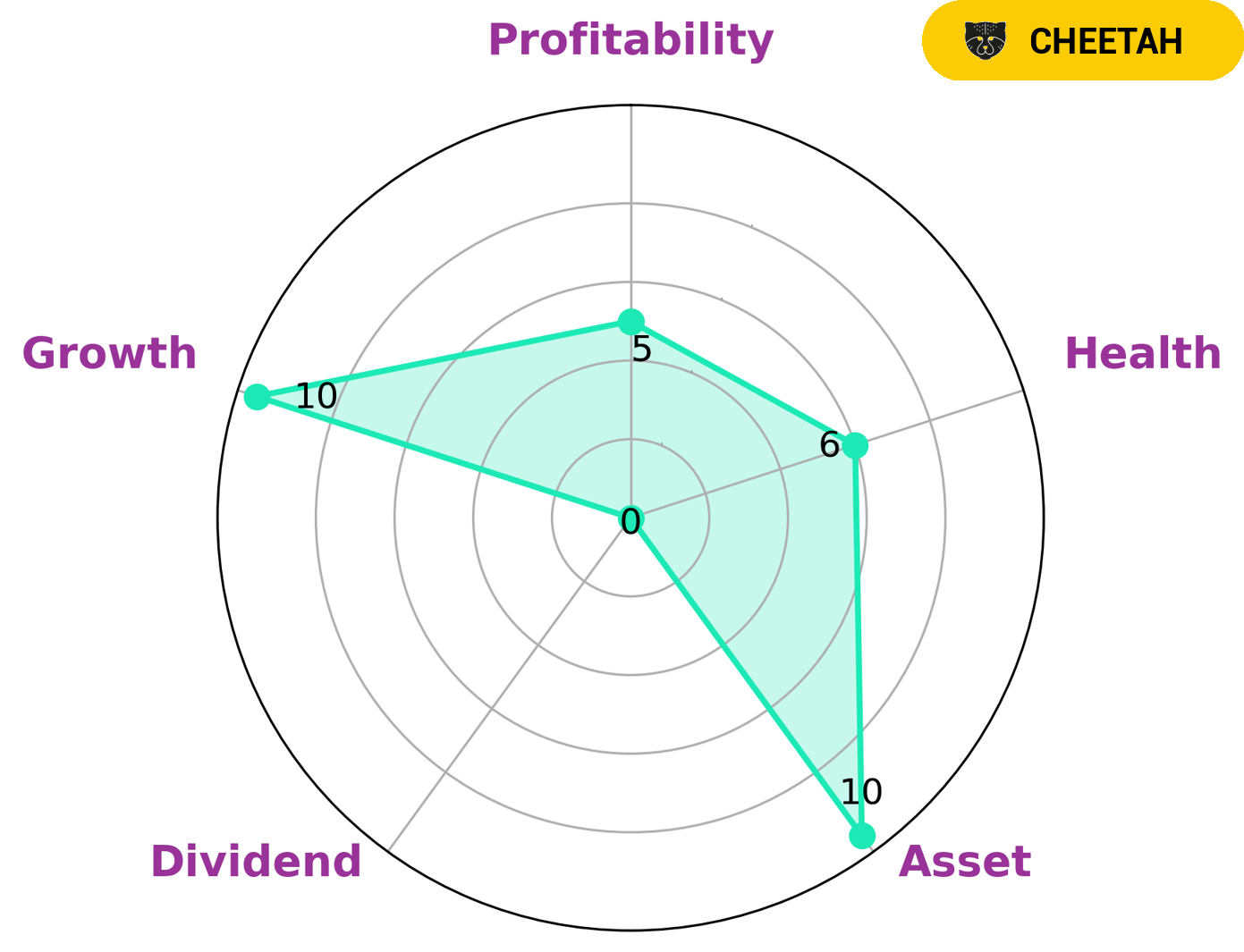

GoodWhale has conducted an analysis of UPEXI INC‘s wellbeing and determined that the company has an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it is likely to sustain future operations in times of crisis. Upon further investigation using the Star Chart, we found that UPEXI INC is strong in asset, growth, and medium in profitability, but weak in dividend. Based on this information, we have classified UPEXI INC as a ‘cheetah’ and conclude that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for companies that are growing quickly may be interested in investing in UPEXI INC. However, due to its lower stability, it is important for investors to conduct their own research and make sure that the company has sufficient resources available before investing. More…

Peers

The competition between Upexi Inc and its competitors Golden Grail Technology Corp, TrueCar Inc, and Unerry Inc is fierce in the technology industry. Each company is vying for market share and striving to be the best in the business. As the competition grows more intense, each company is continually looking for ways to stay ahead of the competition and offer the best products and services to their customers.

– Golden Grail Technology Corp ($OTCPK:GOGY)

TrueCar Inc is an American automotive pricing and information website for new and used car buyers and sellers. The company has a market capitalization of 256.41M as of 2023, and its return on equity (ROE) is -14.33%. The market cap indicates the company’s current size and reflects the total value of its outstanding shares. This can be used to measure the company’s financial performance, in comparison with other companies in the same industry. The ROE is a measure of how efficiently a company is using its equity to generate profit and is calculated by dividing net income by its total shareholders’ equity. TrueCar Inc’s negative ROE suggests that the company is not generating sufficient profit to cover its equity investments.

– TrueCar Inc ($NASDAQ:TRUE)

Unerry Inc is a technology company that specializes in providing enterprise-level software solutions for a variety of industries. As of 2023, Unerry Inc has a market capitalization of 10.32 billion, making it one of the largest tech companies in the world. Its Return on Equity (ROE) of 6.08% indicates that the company is well-positioned to continue its growth and success in the years to come. Unerry Inc is well-positioned to remain competitive as its innovative solutions continue to meet the needs of its customers in various industries.

Summary

Upexi Inc. is a publicly traded company on the stock market. It recently acquired 45% of Cygnet, a smaller company, ahead of schedule. This move gave the stock price a boost, making it a potentially attractive investment opportunity. Analysts point out that Upexi’s diversification strategy, combined with its solid financials, makes it an appealing investment with a low risk profile.

They also note that its strong balance sheet and competitive advantages should provide additional upside potential. Investors should keep an eye on Upexi’s progress and how the new acquisition impacts its bottom line and strategic positioning. Overall, Upexi is an attractive stock with the potential for continued growth and returns.

Recent Posts