TriMas Corporation Acquires Aarts Packaging to Expand Luxury Packaging Solutions and Reach €23M in Revenue.

February 2, 2023

Trending News ☀️

TRIMAS ($NASDAQ:TRS): TriMas Corporation, a leading global designer, producer, and distributor of engineered and applied products and solutions, has just acquired Aarts Packaging. Aarts Packaging is a leader in providing innovative, premium packaging solutions for beauty, lifestyle, food and life sciences sectors. This acquisition is effective immediately, and Aarts Packaging will become part of TriMas. The acquisition of Aarts Packaging is expected to bring an additional €23M in revenue for TriMas in the fiscal year of 2022. This is due to the fact that Aarts Packaging has strong relationships with many leading brands. It offers custom-made packaging solutions that are both fashionable and functional. TriMas Corporation is a publicly traded company listed on the NASDAQ Global Select Market.

It offers a broad portfolio of products and services across multiple markets, including aerospace, automotive, industrial and consumer products. The company has made significant investments in technology and automation to ensure that its products meet the highest standards of quality and performance. Its innovative products are designed to help customers create safe, efficient and sustainable environments. This acquisition will allow TriMas to further its commitment to providing customers with high-quality, value-added solutions. The combination of Aarts Packaging’s expertise in luxury packaging solutions and TriMas’s commitment to technology and innovation will create a unique opportunity for customers to benefit from the best of both worlds.

Share Price

On Wednesday, TriMas Corporation announced that it had completed the acquisition of Aarts Packaging, a leader in luxury packaging solutions. This expansion of its product offering is expected to increase its revenue by €23 million by the end of the year. The move is seen as a strategic move to strengthen the company’s presence in the luxury packaging market, given Aarts Packaging’s reputation for providing innovative and high-quality solutions. TriMas Corporation has been focusing on expanding its product portfolio in order to meet the needs of its customers and is confident that this acquisition will help it reach its goals. The acquisition of Aarts Packaging is expected to provide TriMas Corporation with a competitive edge over its competitors, allowing it to provide the best luxury packaging solutions to its customers. This acquisition will also help the company increase its global reach and expand its customer base.

Following this announcement, TriMas Corporation’s stock opened at $30.5 and closed at $31.3, up by 1.7% from its last closing price of 30.8. This positive reaction from the market suggests that investors are confident in the company’s strategy to expand its product offering and capitalize on the growing demand for luxury packaging solutions. TriMas Corporation is looking forward to further expanding its product portfolio and increasing its global reach by leveraging Aarts Packaging’s expertise and resources. The company is confident that this acquisition will help it reach its revenue target of €23 million by the end of the year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Trimas Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 889.49 | 60.15 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Trimas Corporation. More…

| Operations | Investing | Financing |

| 103.12 | -119.02 | -40.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Trimas Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.3k | 667.32 | 15.11 |

Key Ratios Snapshot

Some of the financial key ratios for Trimas Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | -8.3% | 10.2% |

| FCF Margin | ROE | ROA |

| 6.3% | 9.0% | 4.4% |

Analysis

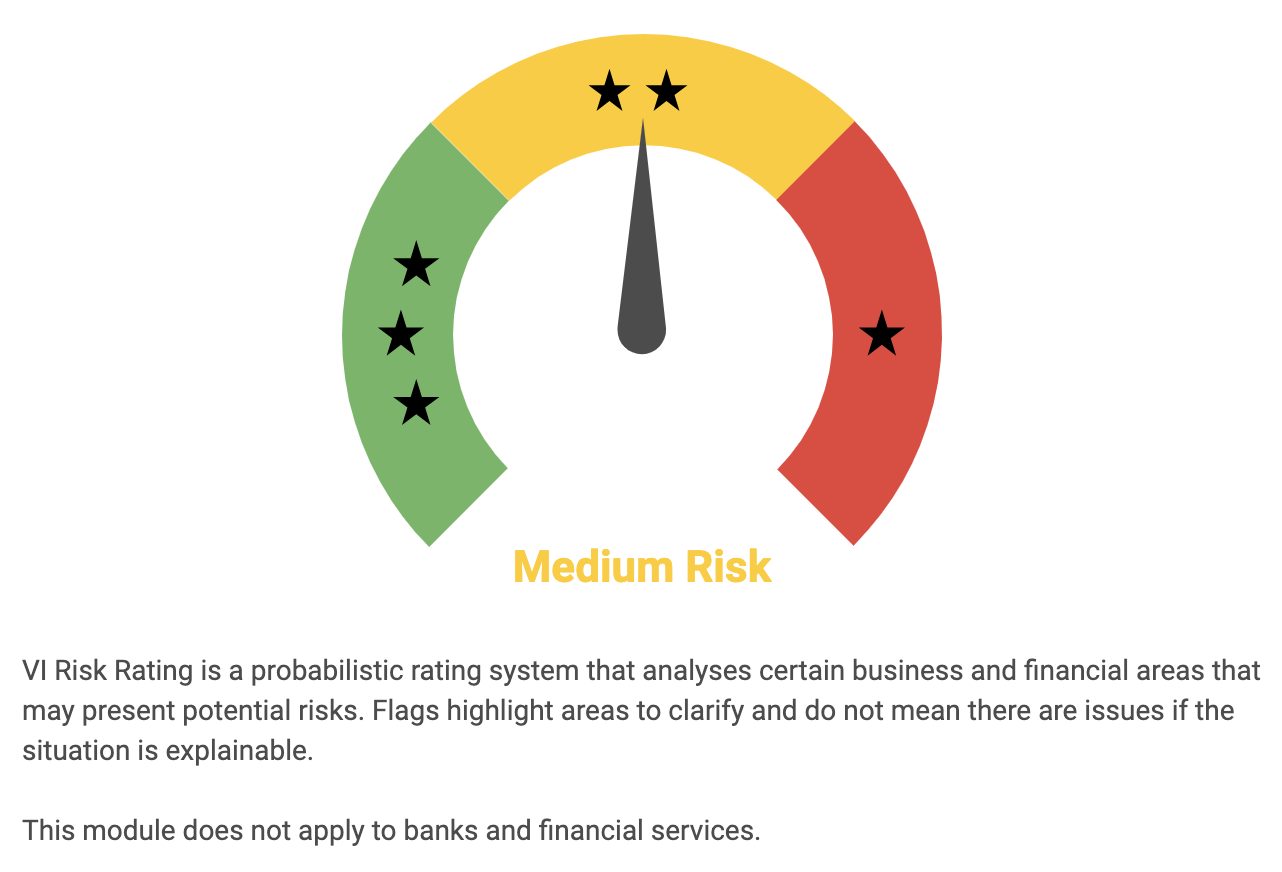

GoodWhale’s analysis of TRIMAS CORPORATION reveals a medium risk investment according to Risk Rating. This assessment takes into consideration both financial and business factors. GoodWhale has detected one risk warning in the balance sheet, which can be reviewed by registered users. Financial risk factors assessed included liquidity, debt structure, profitability, and stock price volatility. Liquidity measures how easily an investor can convert their current holdings into cash, and debt structure assesses the company’s ability to manage its debt. Profitability looks at the company’s ability to generate a return on investments, and stock price volatility assesses the level of risk associated with stock price fluctuations. Business risks include competitive landscape, reputation, management effectiveness, and market position. The competitive landscape looks at the industry the company is in and its position relative to competitors. Reputation assesses the company’s reputation with customers, suppliers, and other stakeholders. Management effectiveness looks at the ability of the senior management team to make decisions and lead the business. Finally, market position looks at the company’s standing in terms of its product offerings, pricing, and services. Overall, TRIMAS CORPORATION has been rated as a medium risk investment by GoodWhale’s Risk Rating. However, potential investors should be aware of the one risk warning in the balance sheet which can be reviewed by registered users. More…

Peers

The company competes with other companies in the same industry, such as Altra Industrial Motion Corp, Cummins Inc, and EnPro Industries Inc.

– Altra Industrial Motion Corp ($NASDAQ:AIMC)

Altra Industrial Motion Corp is a global designer, producer and marketer of a range of mechanical power transmission products. The company’s products are used in a variety of industries, including food and beverage, material handling, packaging, automotive, aerospace, construction, mining, oil and gas, and others. Altra Industrial Motion Corp has a market cap of 2.43B as of 2022 and a Return on Equity of 3.09%. The company’s products are used in a variety of industries, including food and beverage, material handling, packaging, automotive, aerospace, construction, mining, oil and gas, and others. Altra Industrial Motion Corp is headquartered in Braintree, Massachusetts, and has manufacturing facilities in the United States, Europe, Asia, and South America.

– Cummins Inc ($NYSE:CMI)

Cummins Inc is a company that manufactures engines and other power generation products. As of 2022, the company has a market capitalization of 31.69 billion dollars and a return on equity of 19.85%. The company has a long history dating back to 1919, and it is headquartered in Columbus, Indiana, in the United States. Cummins is a global leader in the design, manufacture, and distribution of engines and related technologies, including fuel systems, controls, air handling, filtration, emission solutions, and electrical power generation systems. The company operates in more than 190 countries and territories through a network of approximately 600 company-owned and independent distributors and 6,500 dealers.

– EnPro Industries Inc ($NYSE:NPO)

EnPro Industries Inc is a diversified industrial company with a focus on engineered products and industrial services. The company’s market cap as of 2022 is 2.01B, and its ROE is 11.96%. EnPro operates in three segments: sealing products, industrial products, and services. Sealing products includes gaskets, seals, and packing products for a variety of applications in the automotive, aerospace, and other industries. Industrial products includes bearings, power transmission products, and other products for the industrial and transportation markets. Services includes repair and replacement services for bearings, seals, and other products, as well as technical services.

Summary

TriMas Corporation recently acquired Aarts Packaging to expand their luxury packaging solutions and reach €23M in revenue. This acquisition marks a strong move for TriMas, as it provides further opportunity for growth and diversification. From an investing perspective, TriMas Corporation looks to be a promising investment due to its strong product portfolio, leading market share, and presence in multiple industries. The company has a solid management team in place, along with a healthy balance sheet and cash flow.

Furthermore, its new acquisition should provide meaningful cost savings and help to extend its global reach. All in all, TriMas Corporation is a great option for investors looking to capitalize on a reliable company with promising growth potential.

Recent Posts