NOG Intrinsic Value Calculation – Northern Oil and Gas to Invest $162M in Forge Assets, Acquiring 30% Stake

May 17, 2023

Trending News ☀️

Northern ($NYSE:NOG) Oil and Gas, a leading independent exploration and production company, has announced its agreement to invest $162 million in Forge Assets, acquiring a 30% stake in the company. The deal will give Northern Oil and Gas access to Forge’s large and diversified portfolio of production and development assets located in several of the United States’ most prolific oil and gas basins. The company has a strong history of successful investments, efficient operations and responsible resource management, enabling them to become one of the most successful exploration and production companies in the nation. The new partnership will also provide both companies with an opportunity to share expertise and capitalize on their combined strengths.

Together, Northern Oil and Gas and Forge Assets will be able to accelerate their development of the assets and maximize value from each asset’s full potential. This is the latest in a series of investments that demonstrates Northern Oil and Gas’ commitment to responsible resource management, efficient operations, and profitable long-term growth.

Analysis – NOG Intrinsic Value Calculation

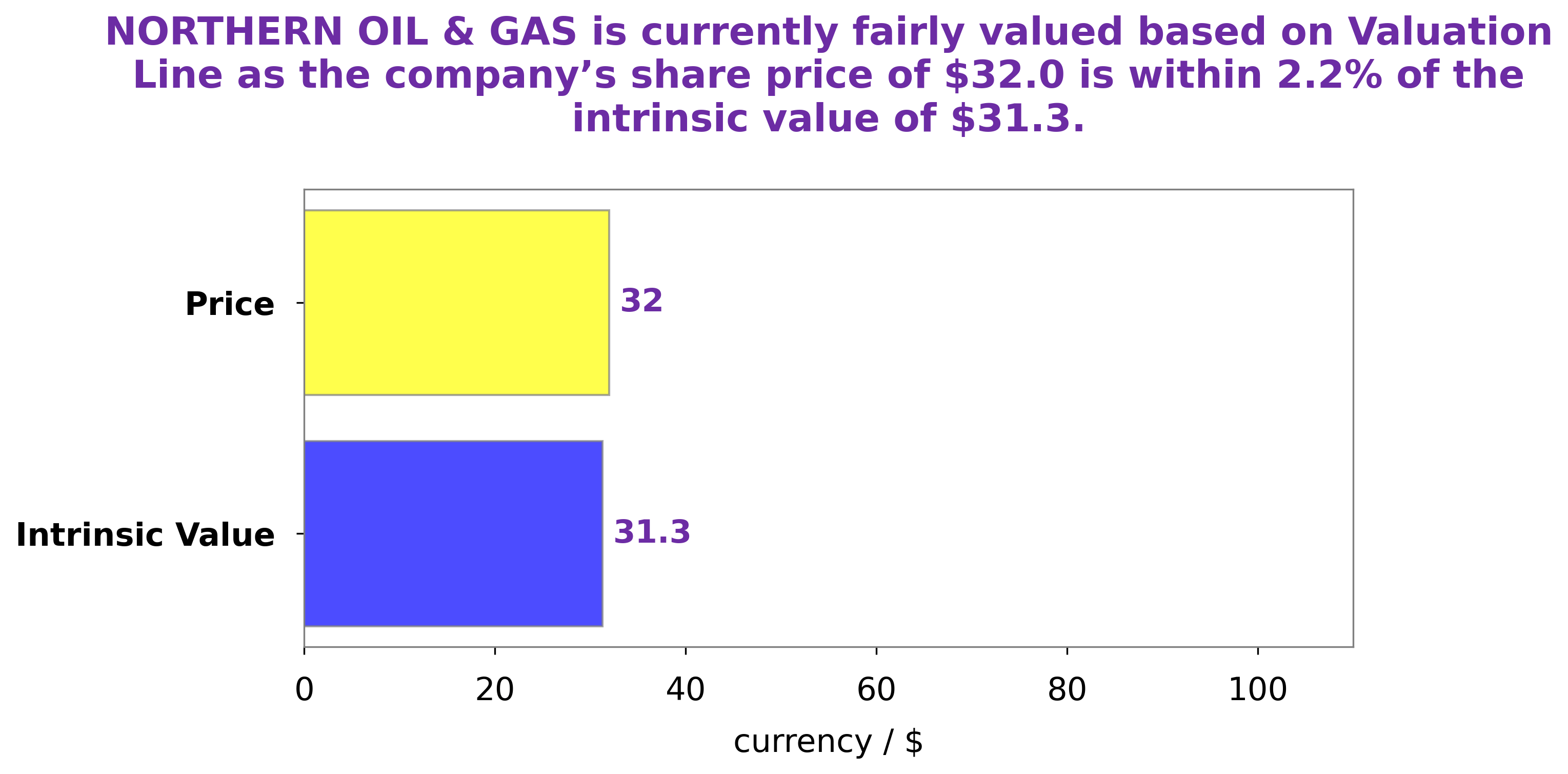

At GoodWhale, we recently conducted an analysis of NORTHERN OIL & GAS’s wellbeing. Our proprietary Valuation Line allowed us to calculate the intrinsic value of NORTHERN OIL & GAS share, which is around $31.3. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NOG. More…

| Total Revenues | Net Income | Net Margin |

| 1.96k | 1.29k | 55.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NOG. More…

| Operations | Investing | Financing |

| 928.42 | -1.4k | 467.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NOG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.34k | 2.29k | 12.28 |

Key Ratios Snapshot

Some of the financial key ratios for NOG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 48.4% | 94.1% | 72.3% |

| FCF Margin | ROE | ROA |

| -22.0% | 98.7% | 26.5% |

Peers

The company competes with Carbon Energy Corp, Earthstone Energy Inc, and Battalion Oil Corp in the highly competitive oil and gas industry.

– Carbon Energy Corp ($OTCPK:CRBO)

Carbon Energy Corp is a publicly-traded, integrated oil and gas exploration and production company headquartered in Denver, Colorado. They are focused on developing cleaner energy solutions from oil and gas resources located in the United States, Canada, and Argentina. The company has a market capitalization of 20.76k as of 2023, which represents a decrease from the previous year. Its Return on Equity (ROE) is also negative, coming in at -36.04%. This suggests that the company is not generating enough revenues to cover its costs and expenses. The company is working to improve its ROE performance by investing in more efficient and sustainable technologies and operations.

– Earthstone Energy Inc ($NYSE:ESTE)

Earthstone Energy Inc is an exploration and production company based in Texas that focuses on the development and exploitation of oil and natural gas reserves. With a market capitalisation of 1.24 billion USD as of 2023, the company has proven its resilience despite of the turbulence in the energy sector. The company has also achieved a very impressive Return on Equity of 33.04%, which is significantly higher than the industry average of 8.88%. This is a testament to the sound management employed by Earthstone Energy Inc, which has enabled it to outperform its competitors in terms of profitability.

– Battalion Oil Corp ($NYSEAM:BATL)

Battalion Oil Corp is an independent oil and natural gas company headquartered in Houston, Texas. It mainly focuses on developing and exploiting oil and natural gas properties in the Permian Basin, Mid-Continent, and Appalachian regions. Battalion Oil Corp has a market cap of 101.34M as of 2023, indicating that it is a highly valued company in the sector. Its Return on Equity (ROE) of 112.49% demonstrates that the firm is efficiently using its resources to generate profits and improve shareholder value, making it an attractive investment opportunity for investors seeking to capitalize on the favorable energy market conditions.

Summary

Northern Oil and Gas recently announced a $162 million deal to purchase a 30% stake in Forge Assets. This move signals the company’s commitment to expanding their portfolio of investments and entering new markets. It also indicates a clear shift in the company’s strategy from production-focused activities to diversification. This move could provide Northern with a reliable source of steady cash flow and new opportunities for growth.

Additionally, the deal is likely to provide investors with a more compelling long-term investment thesis. This is due to the increased diversification of the company’s assets, which could lead to more stable returns. Overall, this move is a long-term positive for Northern Oil and Gas.

Recent Posts