Directors of Cano Health Push for CEO Ouster and Asset Sales, Company Sees Surge in Performance

April 10, 2023

Trending News ☀️

Cano Health ($NYSE:CANO), a healthcare provider, has recently seen a tremendous surge in its stock performance as a result of the efforts of its former directors to oust the company’s CEO and sell assets. The former directors have been pushing for these actions for months, and the stock has responded positively to the news. Their services include primary and preventive care for adults and children, as well as specialty services such as imaging, laboratory tests, and vaccinations. With the former board of directors leading the charge for asset sales and CEO removal, investors have begun to take notice. The stock price has surged since the announcement, and many analysts believe that the rise is indicative of a long-term trend.

If the former directors’ plans come to fruition, Cano Health could be in for an even bigger market surge in the future. Overall, the stock performance of Cano Health has seen a dramatic improvement over the past few months due to the efforts of the former board of directors. Investors appear to be pleased with this development and are expecting even more gains in the future if the former directors’ plans are successful.

Market Price

On Monday, directors of CANO HEALTH initiated a movement to oust current CEO and propose asset sales that could potentially help the company’s financial position. The decision sent shares of the health services provider soaring by 47.3% from their previous close. The stock opened at $1.1 and closed at $1.3, indicating a surge in performance for the company. It remains to be seen whether the proposed changes will be realized and how it will affect the company’s overall performance in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cano Health. More…

| Total Revenues | Net Income | Net Margin |

| 2.74k | -207.27 | -1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cano Health. More…

| Operations | Investing | Financing |

| -146.34 | -64.16 | 74.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cano Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.93k | 1.43k | 1.68 |

Key Ratios Snapshot

Some of the financial key ratios for Cano Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 96.4% | – | -13.3% |

| FCF Margin | ROE | ROA |

| -7.2% | -68.7% | -11.8% |

Analysis

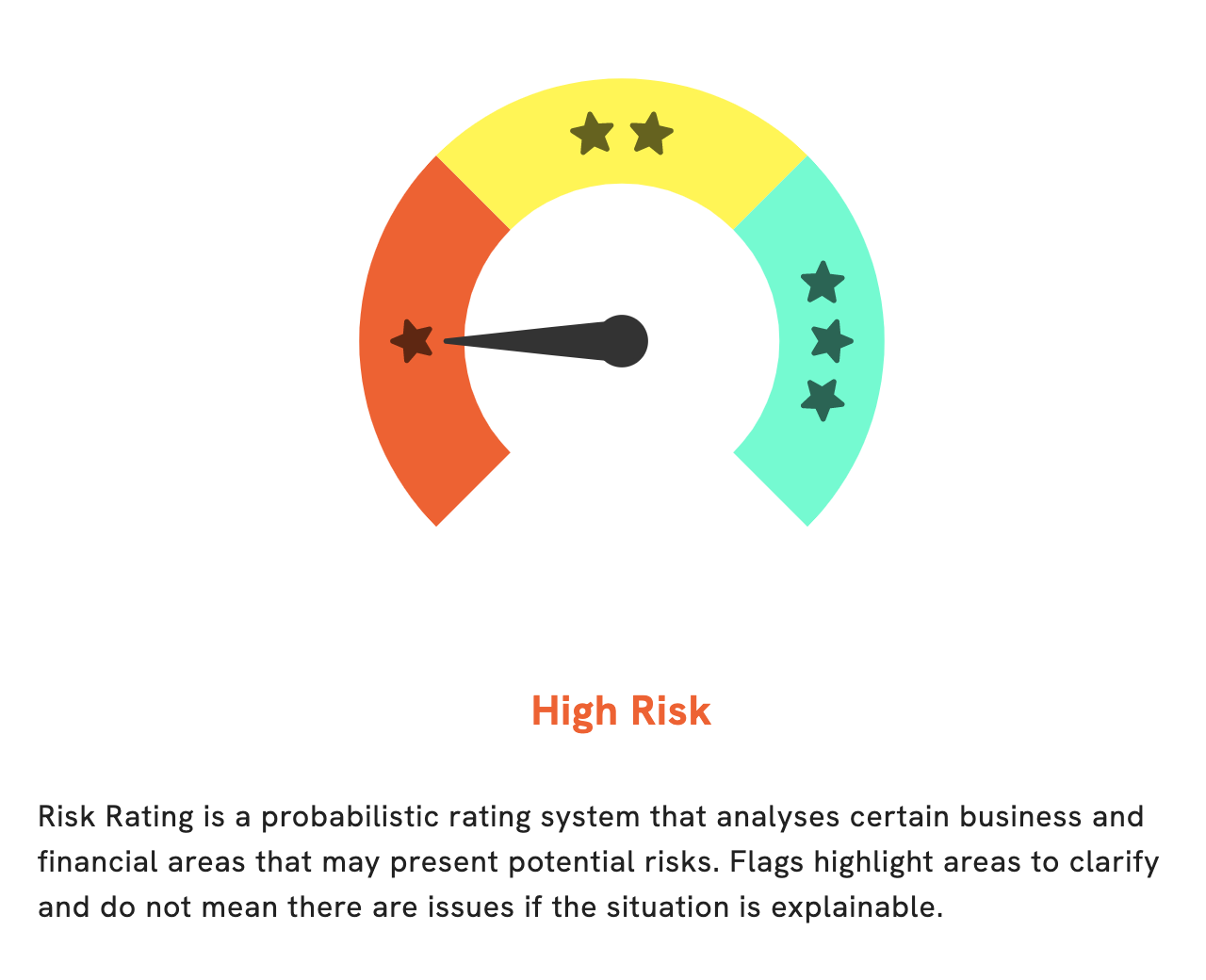

At GoodWhale, we recently conducted an analysis of CANO HEALTH‘s financials to assess their risk rating. We identified three risk warnings in their income sheet, balance sheet, and cashflow statement. To find out more about these risk warnings, register on goodwhale.com. We hope that this analysis helps our customers make informed decisions when it comes to their investments. More…

Peers

Attendo AB is a provider of healthcare services, while Universal Health Services Inc is a provider of both healthcare services and products.

– EMC Instytut Medyczny SA ($LTS:0LTC)

EMC Instytut Medyczny SA is a Polish company that provides medical diagnostic services. The company has a market capitalization of 472.49 million as of 2022 and a return on equity of 2.52%. EMC Instytut Medyczny SA provides medical diagnostic services including blood tests, X-rays, and ultrasounds. The company also offers laboratory services such as genetic testing and IVF.

– Attendo AB ($LTS:0RCY)

Attendo AB is a Swedish company that provides healthcare and social services. The company has a market cap of 4.03B as of 2022 and a Return on Equity of 8.28%. Attendo AB provides services to municipalities, county councils, and the private sector in Sweden, Finland, Norway, Denmark, Poland, and Austria. The company offers a range of services, including primary healthcare, specialist healthcare, social services, and elderly care.

– Universal Health Services Inc ($NYSE:UHS)

Universal Health Services, Inc. is one of the largest healthcare management companies in the United States. It owns and operates hospitals, outpatient facilities, and behavioral health and addiction treatment centers. As of 2022, the company’s market capitalization was 7.97 billion and its return on equity was 11.27%. Universal Health Services, Inc. is headquartered in King of Prussia, Pennsylvania.

Summary

Cano Health has seen its stock price surge recently after two former directors of the company initiated a campaign to remove the current CEO and sell some of the company’s assets. Investors have responded positively to this news, causing the stock price to move up significantly. Analysts have suggested that any potential asset sales could provide a boost to the company’s bottom line and improve its financial health.

Furthermore, they are optimistic that a new CEO, who is likely to bring fresh ideas to the company, could result in an improved performance in the future. Therefore, it might be a good idea for investors to consider investing in Cano Health at this time.

Recent Posts