Activision Blizzard’s Diablo Franchise Predicted to Drive Profits Despite Acquisition Uncertainty

June 14, 2023

☀️Trending News

Activision Blizzard ($NASDAQ:ATVI), the gaming giant behind some of the world’s most beloved game franchises, is poised to have a strong quarter despite the recent uncertainty surrounding potential acquisitions. One of the major contributors to this success is expected to be the Diablo franchise, which is one of the company’s longest-running and most popular properties. Activision Blizzard is a leading interactive entertainment company that develops and publishes video games and related content. It owns some of the world’s most recognizable franchises, including Call of Duty, World of Warcraft, and Diablo, as well as highly popular mobile titles like Candy Crush and King of Avalon. The company has dominated the industry for decades and is considered one of the best investments in gaming currently available.

The Diablo franchise is particularly well-positioned to drive profits this quarter. The franchise has an extremely strong and loyal fan base, and the recent release of Diablo Immortal – a mobile adaptation of the classic action role-playing game – has generated a great deal of excitement and anticipation. The game is expected to be a major hit in both the App Store and Google Play, and with continued updates and expansions on the horizon, it’s likely to remain a strong driver of profits for Activision Blizzard. With Diablo helping to drive profits this quarter, there’s no doubt that the gaming giant will continue to be one of the most successful companies in the industry.

Share Price

On Monday, ACTIVISION BLIZZARD‘s stock opened at $80.4 and closed at $79.8, down by 0.8% from last closing price of 80.4. Despite this slight dip, analysts are optimistic about the company’s future, citing the strength of the Diablo franchise as a key factor driving profits. Although there is some uncertainty surrounding ACTIVISION BLIZZARD due to their recent acquisition of King Digital Entertainment, it is expected that the Diablo franchise will help offset any losses from the acquisition. Overall, analysts remain confident that the Diablo franchise will continue to be a major moneymaker for ACTIVISION BLIZZARD. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Activision Blizzard. More…

| Total Revenues | Net Income | Net Margin |

| 8.14k | 1.86k | 23.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Activision Blizzard. More…

| Operations | Investing | Financing |

| 2.22k | -4.99k | -534 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Activision Blizzard. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.39k | 7.28k | 24.54 |

Key Ratios Snapshot

Some of the financial key ratios for Activision Blizzard are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.1% | 4.4% | 26.5% |

| FCF Margin | ROE | ROA |

| 26.1% | 6.9% | 4.9% |

Analysis

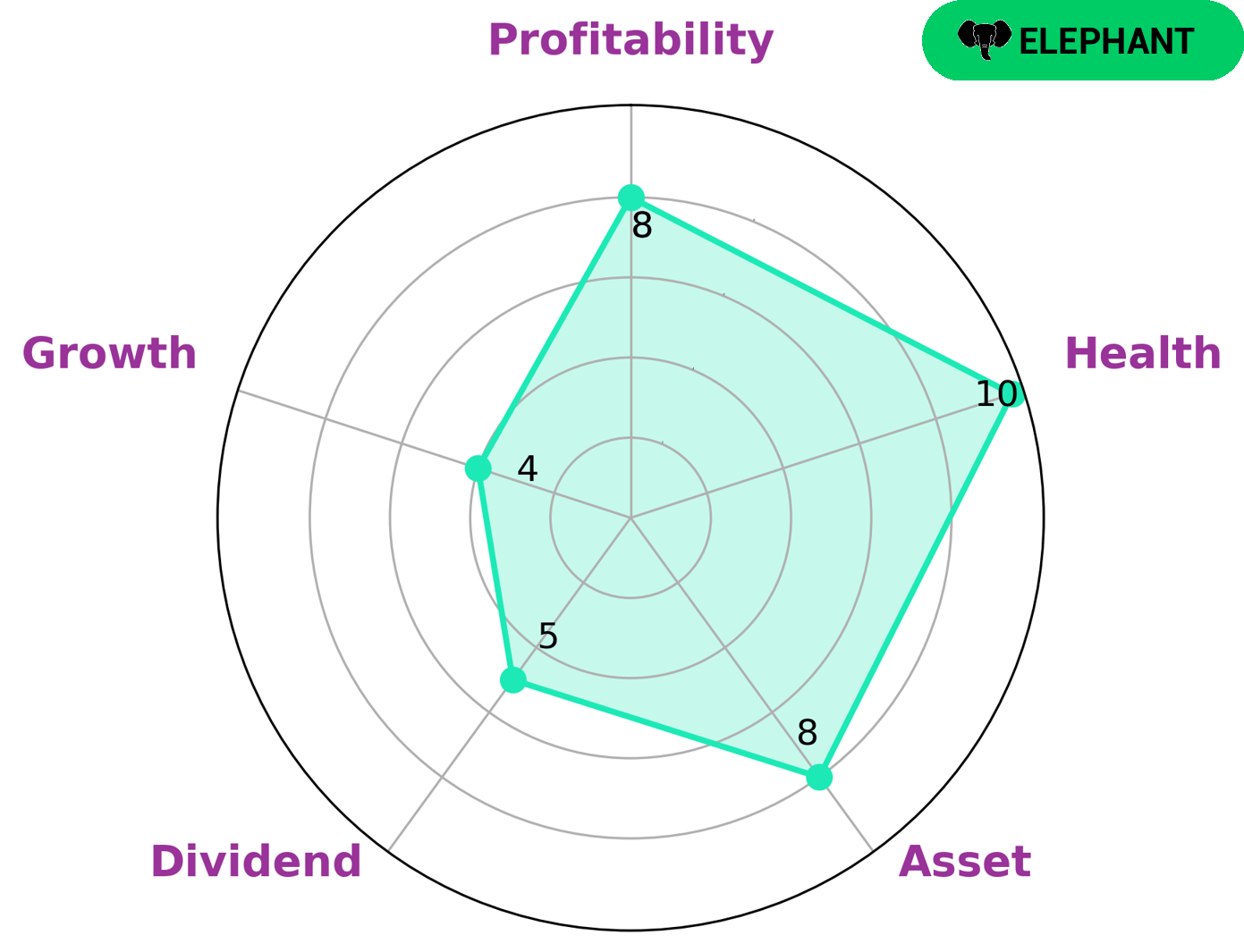

At GoodWhale we recently conducted an analysis of ACTIVISION BLIZZARD‘s wellbeing. Our Star Chart showed that ACTIVISION BLIZZARD had strong assets and profitability levels, as well as a medium dividend and growth. We classified the company as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. This type of company is likely to attract different types of investors. Those focused on the short-term may be interested in the company’s high-dividend rate and its potential for growth. Others might be more interested in the long-term potential of the company, which could be indicated by its strong assets and profitability. Finally, we also looked at ACTIVISION BLIZZARD’s health score. We gave the company a very favourable rating of 10/10 in terms of cashflows and debt, indicating that it is well positioned to sustain operations in the face of economic crisis. More…

Peers

The company has a strong portfolio of video game franchises and continues to innovate in the gaming space. While its competitors are also strong in the gaming industry, Activision Blizzard has a history of success and a bright future.

– Take-Two Interactive Software Inc ($NASDAQ:TTWO)

Take-Two Interactive Software, Inc. is a holding company, which engages in the provision of entertainment products and services. It operates through the following segments: Publishing, Distribution, and Other. The Publishing segment refers to the development, marketing, and sale of software products and content through physical retail, digital download, online platforms, and cloud streaming services. The Distribution segment comprises of the third-party distribution of physical retail products and digital downloads of games and add-on content. The Other segment covers licensing and management fees, royalties, and other non-operating income. The company was founded by Ryan Brant and Jeffrey D. Lapin on September 24, 1993 and is headquartered in New York, NY.

– Electronic Arts Inc ($NASDAQ:EA)

Electronic Arts Inc is a leading global interactive entertainment software company. The Company develops, publishes, and distributes interactive software worldwide for video game systems, personal computers, cellular handsets and the Internet.

As of 2022, Electronic Arts Inc has a market cap of 35.66B and a Return on Equity of 10.3%. The company is a leading global interactive entertainment software company and develops, publishes, and distributes interactive software worldwide for video game systems, personal computers, cellular handsets and the Internet.

Summary

However, while many anticipate a good quarter, there is some uncertainty surrounding the company’s potential acquisition by a large media conglomerate. With that said, analysts are generally feeling confident about the company’s future prospects and its ability to deliver solid returns in the short-term.

Recent Posts