2023: ARKO Corp. Sees Record Results Thanks to Growth Strategy and Acquisition Pipeline.

March 27, 2023

Trending News ☀️

ARKO ($NASDAQ:ARKO) Corp. made history in 2023, as the company reported record results. This success was the result of a strategic growth plan that included three main pillars: operational excellence, customer experience, and innovation. The company implemented a number of initiatives that strengthened their core processes and operations, improved customer satisfaction, and developed new products and services.

Additionally, ARKO Corp. has been at the forefront of the acquisition pipeline, increasing their portfolio of companies and expanding their reach. The results were impressive. These record results are a testament to ARKO Corp.’s innovative strategy and its commitment to make a positive impact on the world. The company is now well-positioned to continue its success into 2023 and beyond.

Price History

ARKO CORP is enjoying record results in 2023, thanks to an effective growth strategy and a robust acquisition pipeline. According to news sentiment, investors are responding positively to the company’s performance. On Thursday, ARKO CORP stock opened at $8.4 and closed at $8.6, representing a 2.0% increase from its prior closing price of 8.5. This marks an all-time high for the company, indicating investor confidence in its proposed strategies. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arko Corp. More…

| Total Revenues | Net Income | Net Margin |

| 9.14k | 66 | 0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arko Corp. More…

| Operations | Investing | Financing |

| 209.26 | -175.49 | 10.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arko Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.26k | 2.87k | 3.17 |

Key Ratios Snapshot

Some of the financial key ratios for Arko Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.3% | 401.5% | 1.9% |

| FCF Margin | ROE | ROA |

| 1.2% | 28.3% | 3.3% |

Analysis

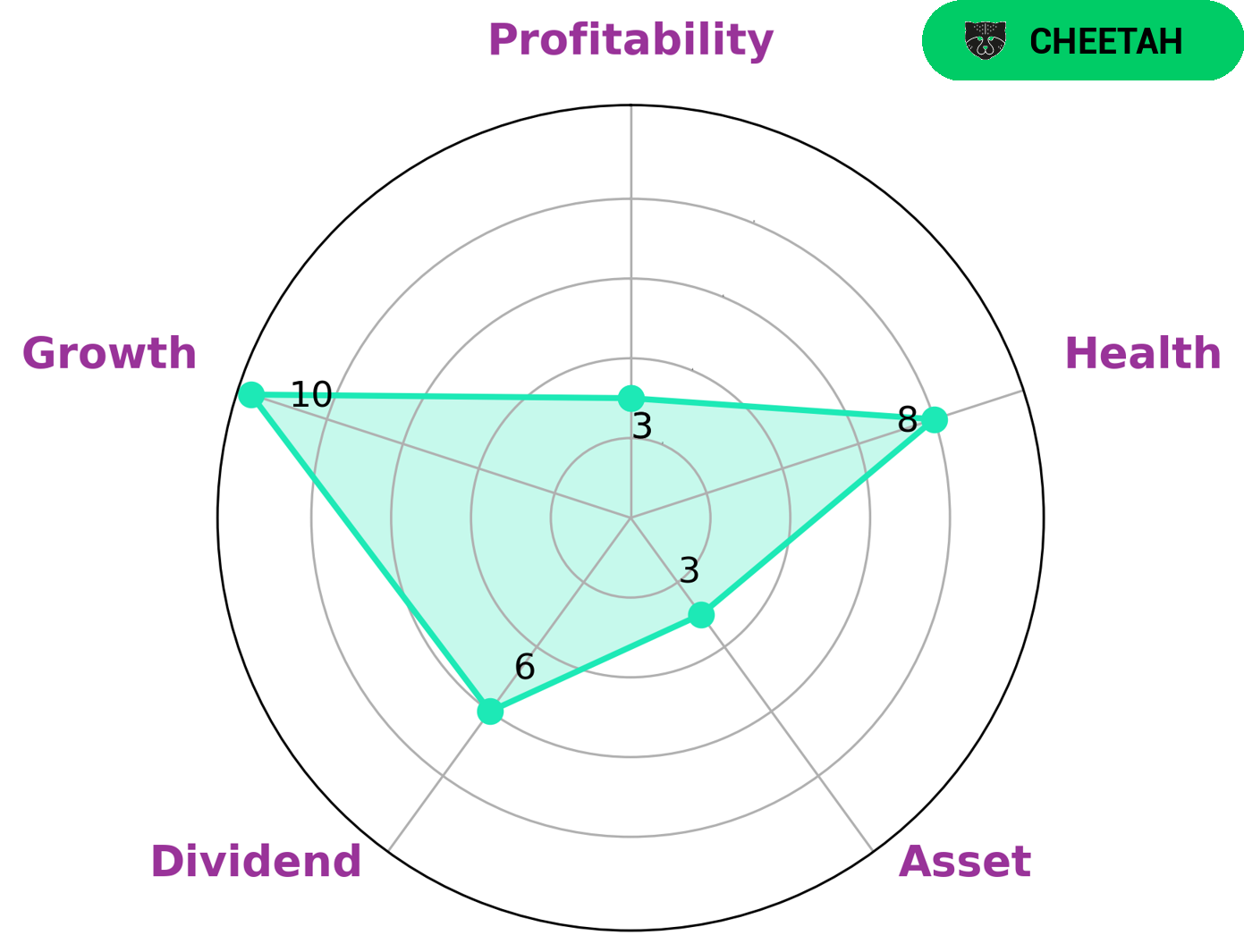

GoodWhale has conducted an analysis of ARKO CORP‘s fundamentals and found that the company is strong in growth, medium in dividend, and weak in asset, profitability. Our Star Chart shows that ARKO CORP has a high health score of 8/10, indicating that the company is capable of paying off debt and funding future operations. We have classified ARKO CORP as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Potential investors who may be interested in such a company could include those who seek higher returns with greater risk tolerance. They must assess their own risk appetite and analyze the company further to ensure it meets their specific goals and objectives. More…

Peers

It has several competitors in the industry, such as Com7 PCL, Valora Holding AG, and Central Retail Corp PCL. Each of these companies is striving to offer the most efficient and cost-effective solutions to its customers. Despite the competition, ARKO Corp remains at the forefront of the industry, offering quality solutions and services.

– Com7 PCL ($SET:COM7)

PCL is a diversified conglomerate with operations in the construction, engineering, real estate, energy and environmental services, forestry and manufacturing sectors. Founded in 1925, the company has grown to become Canada’s largest owner of office and retail space, with a market cap of 81.09 billion dollars as of 2023. PCL’s strong financial performance is reflected in its Return on Equity (ROE). PCL holds a 41.93% ROE as of 2023, indicating that it has been successful in generating returns for its shareholders. With its strong balance sheet, PCL is well-positioned to continue to expand and deliver value for its shareholders over the long-term.

– Valora Holding AG ($LTS:0QLE)

Valora Holding AG is a Swiss-based company that specializes in the retail, food, and beverage industries. With a market cap of 1.12B as of 2023, Valora Holding AG is a well-established company that has been in the industry for many years. Its Return on Equity (ROE) of 2.94% shows that the company is making good use of its equity to generate profits. The company is well-positioned in the market and continues to grow with its presence in more than 2,000 locations across Europe.

– Central Retail Corp PCL ($SET:CRC)

Central Retail Corporation Public Company Limited (CRC) is a leading retail conglomerate in Thailand and Southeast Asia. Founded in 1979, the company operates a multi-format retail network comprising of department stores, specialty stores, supermarkets, convenience stores, and online stores. As of 2023, the company has a market capitalization of 278.93 billion baht and an impressive Return on Equity (ROE) of 11.38%. This is a clear indication of the company’s strength in terms of profitability and efficiency. The company’s diversified portfolio of retail businesses, combined with its strong financial performance, has enabled CRC to remain competitive and successful in the retail industry.

Summary

ARKO Corp. has reported record results this year, due to their successful growth strategy and noteworthy acquisition pipeline. Investors have responded positively to the news, as stock prices have risen following the announcement. Analysts have praised ARKO’s performance, citing their effective mergers and acquisitions as a contributing factor to their success.

The company’s diversified portfolio has led to increased revenue and market share, while strategic partnerships have enabled them to expand their customer base. With their focus on innovation and a strong management team in place, ARKO is well positioned for continued growth.

Recent Posts