Schneider National Posts Solid Earnings Despite Missed Revenue Goal

April 28, 2023

Trending News ☀️

Schneider National ($NYSE:SNDR), Inc. is a large North American transportation and logistics services provider. The company reported its second quarter earnings this week, with Non-GAAP EPS of $0.55, surpassing estimates by $0.10. Despite this, total revenue of $1.4B fell short of projections by $90M. Despite the missed revenue goal, the company’s balance sheet was still strong.

While the company failed to meet its goals for revenue, its earnings report showed that it had a solid quarter overall. The company is continuing to focus on cost control and expanding its operations in order to drive long-term growth.

Stock Price

On Thursday, SCHNEIDER NATIONAL stock opened at $25.3 and closed at $25.8, up by 1.1% from the last closing price of 25.6. Despite missing its revenue goal, the company posted solid earnings and revenue growth. Despite falling slightly short of its target, SCHNEIDER NATIONAL still managed to deliver strong earnings growth and positive returns for investors. The company attributed its strong performance to a focus on cost control, increased operating efficiency, and investments in technology to improve customer experience.

The company also noted that its expansion into new markets and its ongoing focus on offering quality services have helped boost sales. Despite some challenges in the current economic landscape, SCHNEIDER NATIONAL is well-positioned for continued growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Schneider National. More…

| Total Revenues | Net Income | Net Margin |

| 6.6k | 457.8 | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Schneider National. More…

| Operations | Investing | Financing |

| 856.4 | -598.8 | -116.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Schneider National. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.32k | 1.48k | 15.94 |

Key Ratios Snapshot

Some of the financial key ratios for Schneider National are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 25.2% | 9.3% |

| FCF Margin | ROE | ROA |

| 2.5% | 13.8% | 8.9% |

Analysis

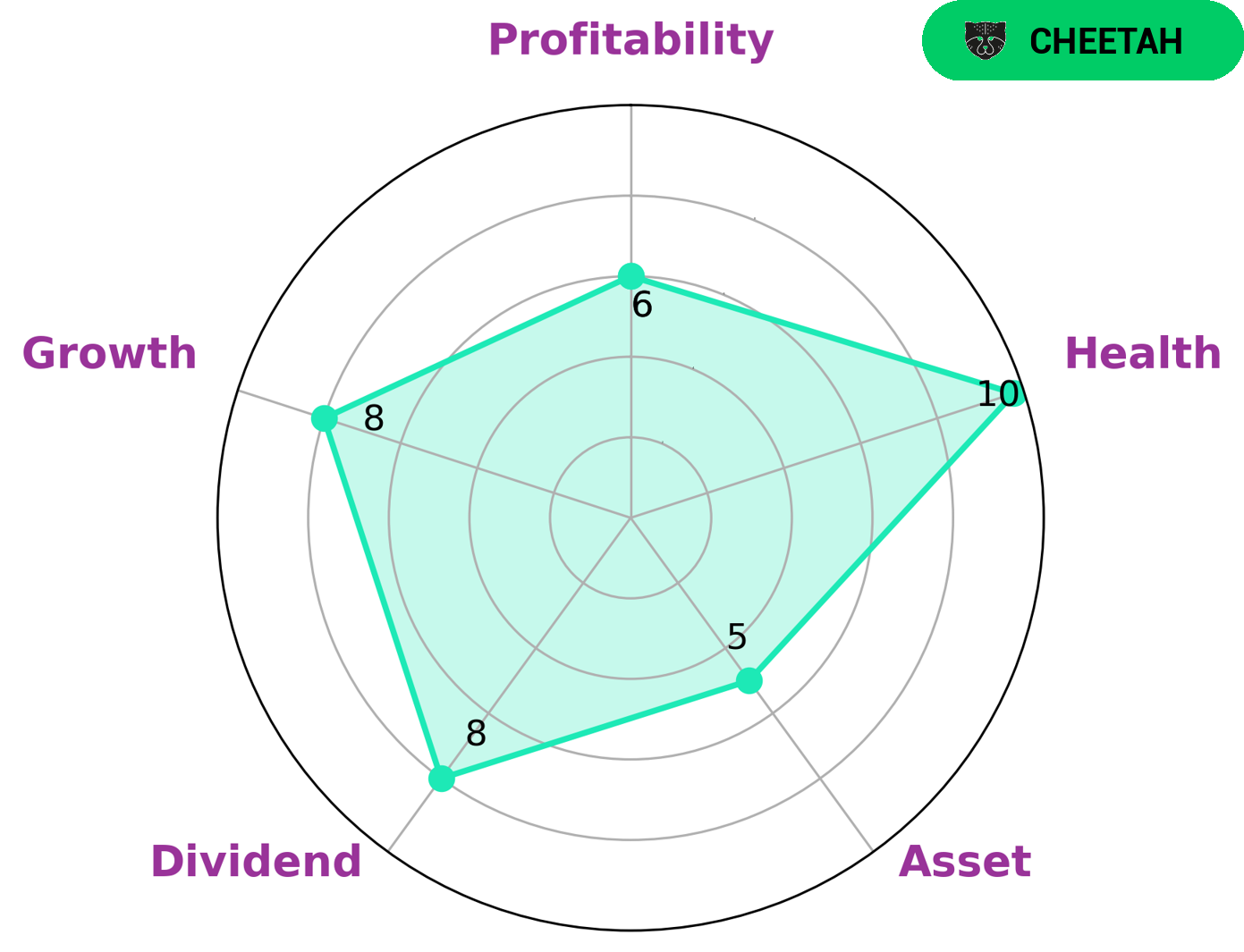

GoodWhale has completed an analysis of SCHNEIDER NATIONAL‘s financials. According to our Star Chart classification, SCHNEIDER NATIONAL is classified as a ‘cheetah’ type of company. We determine that this type of company has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. In terms of investor interest, SCHNEIDER NATIONAL is strong in dividend and growth. It is also medium in terms of asset and profitability. Additionally, SCHNEIDER NATIONAL has a health score of 10/10 with regard to its cashflows and debt, indicating that the company is well-positioned to pay off debt and fund future operations. As such, investors who prioritize growth and dividend yields may be interested in investing in SCHNEIDER NATIONAL. More…

Peers

It has a wide variety of competitors, including Xinjiang Tianshun Supply Chain Co Ltd, Shanghai Ace Investment & Development Co Ltd, and Deppon Logistics Co Ltd.

– Xinjiang Tianshun Supply Chain Co Ltd ($SZSE:002800)

Xinjiang Tianshun Supply Chain Co Ltd is a company that operates in the supply chain industry. The company has a market cap of 2.48B as of 2022 and a return on equity of 8.22%. The company has a strong market position and is a well-known player in the industry. The company’s main business is the provision of supply chain services to businesses. The company has a diversified client base and a strong track record. The company is headquartered in Xinjiang, China.

– Shanghai Ace Investment & Development Co Ltd ($SHSE:603329)

Shanghai Ace Investment & Development Co Ltd is a 3B market cap company with an ROE of 18.67%. The company is involved in the development and management of real estate projects.

– Deppon Logistics Co Ltd ($SHSE:603056)

Deppon Logistics Co Ltd is a leading Chinese logistics company with a market cap of 18.11B as of 2022. The company provides comprehensive logistics services to businesses and individuals in China, including transportation, warehousing, distribution, and e-commerce logistics. The company has a strong focus on customer service and has a reputation for providing high-quality, reliable logistics services. Deppon Logistics Co Ltd has a return on equity of 4.31%. The company is well-positioned to continue its growth in the Chinese logistics market.

Summary

However, the company’s revenue of $1.4B fell short of forecasts by $90M. Despite the lower than expected revenue, investors may view the above consensus earnings per share as a positive sign for the company. Investors should carefully analyze Schneider’s financials to determine whether the stock is a good long-term investment.

Investors should also consider any changes in the company’s competitive landscape or future outlook to assess its potential upside. Overall, Schneider National’s results may be viewed as mixed, with better-than-expected EPS but lower-than-expected revenue.

Recent Posts