Rxo Inc Intrinsic Value Calculation – RXO INC Reports $0.11 Non-GAAP EPS, Revenue of $1.01B Misses by $60M

May 4, 2023

Trending News 🌧️

RXO ($NYSE:RXO) Inc, a company specializing in the development and distribution of medical products, has recently reported its non-GAAP earnings per share (EPS) to come in at $0.11. This is an increase of $0.04 more than the expected results, giving investors cause for optimism. Despite this positive result, the revenue of $1.01B fell short of expectations by $60M, resulting in a moderate overall reaction from the market. RXO Inc is a publicly traded company based in the United States, with its stock trading on the NASDAQ exchange.

The company operates in both the domestic and international markets, and its products are used by hospitals, clinics, and other medical establishments around the world. RXO Inc continually strives to bring new technologies and products to the market in order to streamline medical processes and increase patient care.

Earnings

RXO INC has reported its financial results for the fourth quarter of FY2022, ending December 31, 2022. This was a 15.6% decrease from the same period last year. Net income for the quarter was reported at a loss of $4.0 million.

This is an impressive 109.5% decrease when compared to the same period last year. The company reported non-GAAP earnings per share of $0.11, in line with analyst expectations.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rxo Inc. More…

| Total Revenues | Net Income | Net Margin |

| 4.8k | 92 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rxo Inc. More…

| Operations | Investing | Financing |

| 310 | -56 | -183 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rxo Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.03k | 1.44k | 5.04 |

Key Ratios Snapshot

Some of the financial key ratios for Rxo Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | 14.3% | 2.6% |

| FCF Margin | ROE | ROA |

| 5.3% | 8.9% | 3.8% |

Price History

The stock opened at $19.0 and closed at $19.5, rising 6.0% from the prior closing price of 18.4. Despite the positive stock performance, the company’s revenue was still lower than expected and led to a decrease in the stock price. Live Quote…

Analysis – Rxo Inc Intrinsic Value Calculation

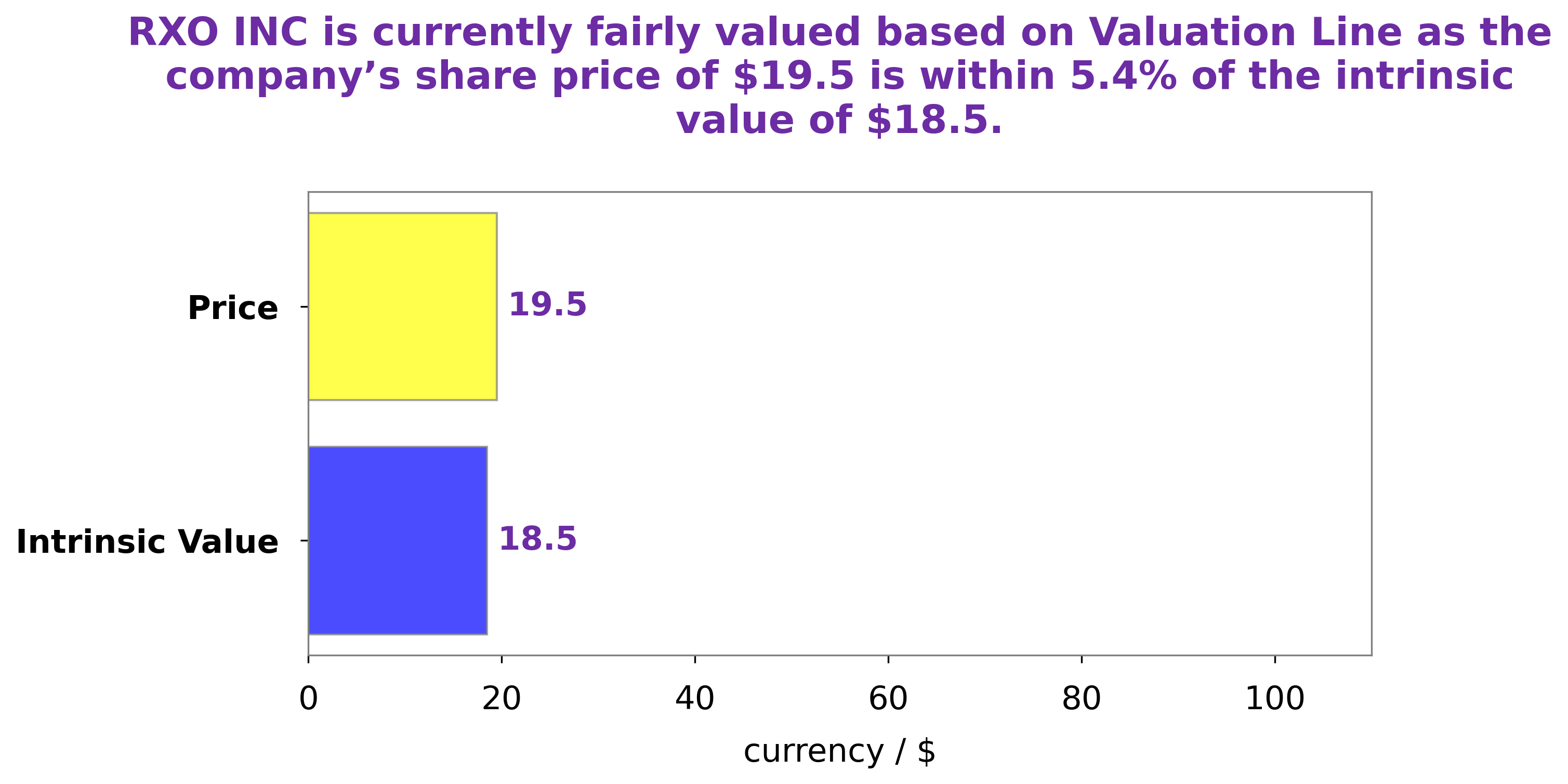

At GoodWhale, we have performed an analysis of RXO INC‘s wellbeing and compiled our findings. Our proprietary Valuation Line has calculated an intrinsic value of the RXO INC share at around $18.5. Currently, the RXO INC stock is being traded at $19.5, which is a fair price, though it is slightly overvalued by 5.4%. More…

Peers

The company has a broad portfolio of services and capabilities, including truckload and intermodal, dedicated truckload services, ocean and air cargo, temperature-controlled freight, and customs brokerage. RXO Inc is a major player in the transportation and logistics industry, competing against JB Hunt Transport Services Inc, ArcBest Corp, and Ultrapetrol (Bahamas) Ltd.

– JB Hunt Transport Services Inc ($NASDAQ:JBHT)

J.B. Hunt Transport Services, Inc. is a leading national transportation and logistics company headquartered in Arkansas. As of 2023, the company has a market cap of 19.77 billion and a Return on Equity (ROE) of 26.69%. The company provides transportation and delivery services for customers across the United States, Canada, and Mexico, and is one of the largest transportation companies in North America. J.B. Hunt offers a variety of services including intermodal, truckload, dedicated, and final mile, as well as integrated services that combine multiple service offerings. The company’s strong market position and excellent customer service have allowed it to maintain a healthy ROE, reflecting its success in producing consistent profits for shareholders.

– ArcBest Corp ($NASDAQ:ARCB)

ArcBest Corp is a leading provider of integrated logistics solutions. Founded in 1923, ArcBest has grown to become a Fortune 500 company and one of the largest transportation companies in North America. As of 2023, ArcBest has a market cap of 2.44 billion dollars, indicating its strong market presence and potential for growth. Additionally, ArcBest has a Return on Equity of 22.0%, indicating that it is successfully reinvesting its profits back into the business and maximizing its returns.

– Ultrapetrol (Bahamas) Ltd ($OTCPK:ULTRF)

Ultrapetrol (Bahamas) Ltd is a publicly traded marine transportation company that provides services to the oil, gas, and bulk liquid industry. The company has a market cap of 1.13M as of 2023 and a Return on Equity of -10.92%. The market cap is a measure of the company’s value and is calculated by taking the total number of outstanding shares multiplied by the current share price. A negative return on equity indicates that the company has not been able to generate enough profit from its assets to cover its liabilities and equity obligations.

Summary

RXO Inc is a financial technology company that recently reported their Non-GAAP EPS at $0.11, which beat analysts’ expectations by $0.04.

However, their revenue of $1.01B missed expectations by $60M. Despite this miss, the stock price of RXO Inc moved up the same day, indicating to investors that the market is optimistic about the company’s future prospects. Moving forward, it will be important for investors to closely monitor the company’s financial performance and any changes in their business strategy. It will also be important to remain aware of any potential market changes that could affect the company’s performance.

Recent Posts