Norwegian Cruise Line Holdings Reports Surprising Earnings and Revenue Growth

May 2, 2023

Trending News ☀️

The company reported Non-GAAP EPS of -$0.30, which beat expectations by $0.13, and revenue of $1.82B, beating estimates by $80M. They offer a wide variety of cruises for travelers of all ages, from family vacations to luxury cruises. In addition to their cruise operations, the company also owns and operates several resorts in the Caribbean and Europe. Their vision is to provide guests with the best possible vacations, while at the same time contributing to the local communities they visit.

Despite this, the company has managed to not only remain afloat but to grow and expand its services. With continued efforts to innovate their offerings and provide customers with amazing experiences, Norwegian Cruise Line ($NYSE:NCLH) Holdings is well-positioned for future success.

Market Price

This significant rise in stock value is indicative of the strong financial performance that Norwegian Cruise Line Holdings is currently enjoying. Meanwhile, rival cruise lines have also experienced similar success, further demonstrating that the cruise industry is healthy and prosperous. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NCLH. More…

| Total Revenues | Net Income | Net Margin |

| 4.84k | -2.27k | -46.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NCLH. More…

| Operations | Investing | Financing |

| 210.02 | -1.76k | 986.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NCLH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.56k | 18.49k | 0.16 |

Key Ratios Snapshot

Some of the financial key ratios for NCLH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.2% | 8.4% | -30.5% |

| FCF Margin | ROE | ROA |

| -32.5% | -393.7% | -5.0% |

Analysis

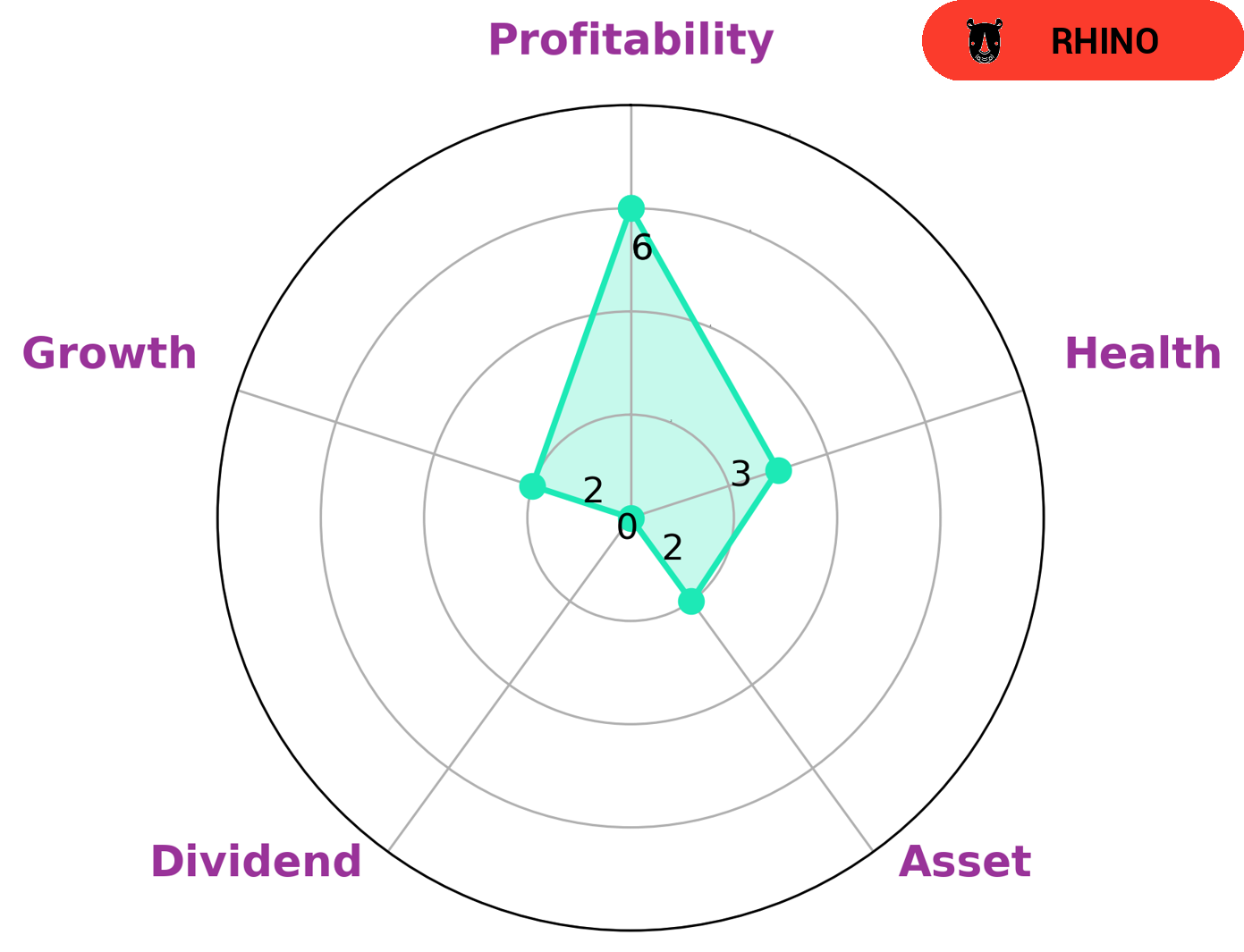

At GoodWhale, we rate companies based on their overall wellbeing. Our Star Chart shows that Norwegian Cruise Line (NCL) is classified as a ‘rhino’, which is a company that has achieved moderate revenue or earnings growth. This type of company may be of interest to various investors looking for sustainable growth or steady returns within a given industry. When looking at the specific factors that make up NCL’s wellbeing, we can see that the company is strong in cashflow, medium in profitability and weak in asset, dividend and growth. Overall, this gives NCL a low health score of 3/10, indicating that it is less likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company operates through three segments: Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. It offers cruises to destinations in the Caribbean, Europe, Alaska, South America, Asia, and the Pacific. The company was founded in 1966 and is headquartered in Miami, Florida. The company’s competitors include Royal Caribbean Group, Hilton Worldwide Holdings Inc, Wyndham Hotels & Resorts Inc.

– Royal Caribbean Group ($NYSE:RCL)

Royal Caribbean Group is a cruise company that operates Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises brands. The company has a market cap of 12.55B as of 2022 and a Return on Equity of -53.73%. Royal Caribbean Group is headquartered in Miami, Florida.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. It has a market cap of 35.99B as of 2022 and a Return on Equity of -148.2%. The company was founded in 1919 and is headquartered in McLean, Virginia.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts Inc is a hotel and resort company that operates globally. As of 2022, the company has a market capitalization of 6.34 billion dollars and a return on equity of 30.65%. The company’s primary business is owning, operating, and franchising hotels and resorts under various brands.

Summary

As a result, the stock price moved up the same day. This is a positive sign for investors, indicating that the company is recovering from the pandemic-induced downturn. Investors should monitor the company’s financial performance and relative valuation when considering investing in the stock. However, given the current market conditions, investors should also consider the potential for volatility when making investment decisions.

Recent Posts