Norwegian Cruise Line Holdings Ltd. Stock Soars 3.52% to $16.75 on Tuesday

June 12, 2023

🌥️Trending News

Norwegian Cruise Line ($NYSE:NCLH) Holdings Ltd. (NCLH) shares were in the spotlight on Tuesday, as they rose 3.52% to $16.75 – making it a successful day of trading for the stock. NCLH is a leading global cruise company that operates the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. In addition to cruises, NCLH also owns and operates private islands in the Caribbean – Great Stirrup Cay in the Bahamas and Harvest Caye in Belize.

The company is committed to providing an exceptional guest experience and has continued to innovate the cruising industry with its award-winning culinary, entertainment, and onboard activities. With an impressive fleet of ships and destinations, Norwegian Cruise Line Holdings Ltd. is an ideal choice for an unforgettable cruising experience.

Analysis

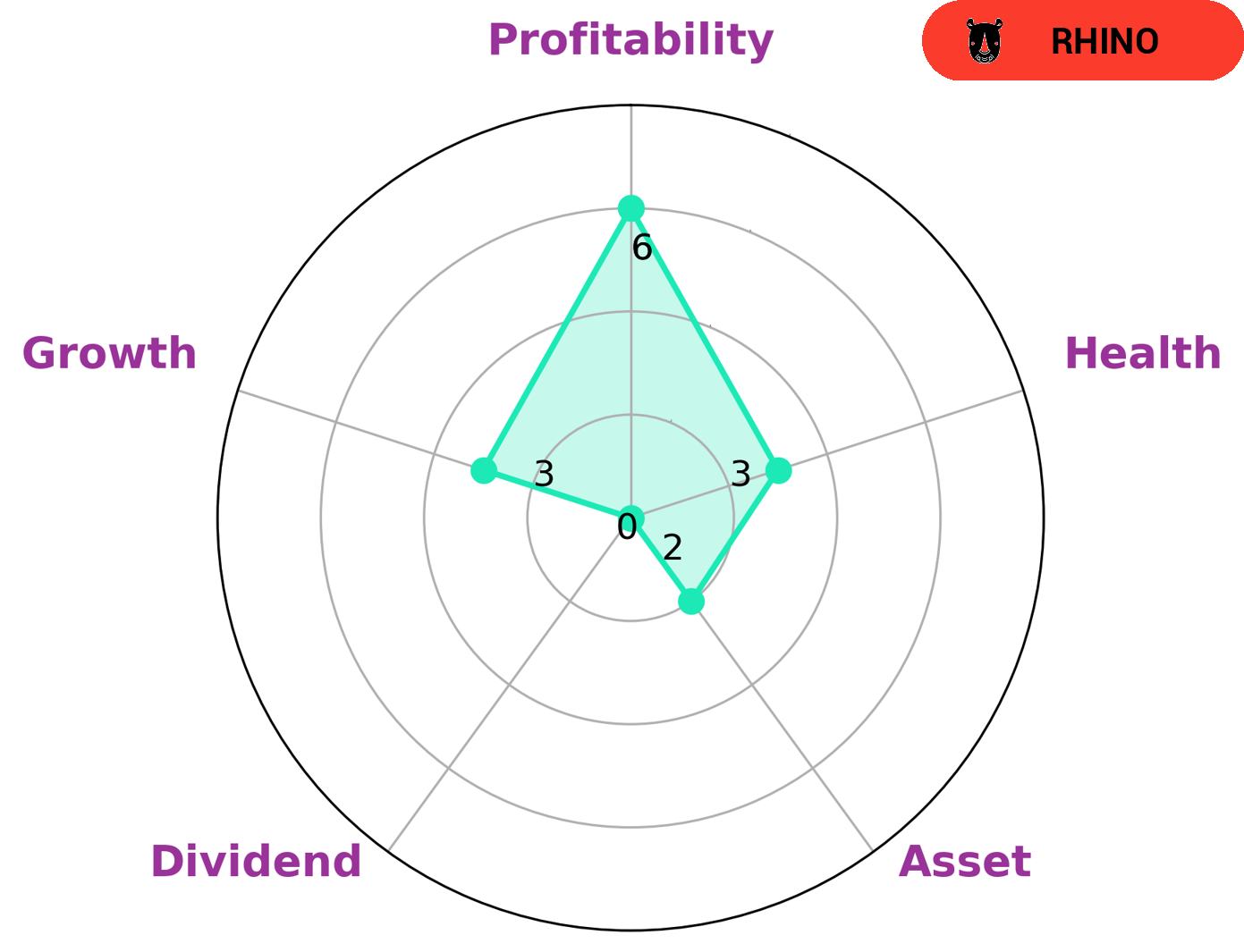

At GoodWhale, we recently conducted an analysis of NORWEGIAN CRUISE LINE’s financials. Based on our Star Chart, NORWEGIAN CRUISE LINE has a low health score of 3/10 due to its cashflows and debt, indicating that it is less likely to sustain future operations in times of crisis. Furthermore, we classify NORWEGIAN CRUISE LINE as ‘rhino’, meaning that the company has achieved moderate revenue or earnings growth. Given this assessment, investors interested in NORWEGIAN CRUISE LINE should consider its strengths and weaknesses. While NORWEGIAN CRUISE LINE is strong in terms of profitability, it is weak in asset management, dividend payments, and overall growth. Therefore, investors should carefully consider these factors before investing in the company. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NCLH. More…

| Total Revenues | Net Income | Net Margin |

| 6.14k | -1.45k | -23.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NCLH. More…

| Operations | Investing | Financing |

| 1.08k | -2.07k | -448.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NCLH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.35k | 18.45k | -0.23 |

Key Ratios Snapshot

Some of the financial key ratios for NCLH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.9% | 8.4% | -13.4% |

| FCF Margin | ROE | ROA |

| -12.6% | 3322.3% | -2.8% |

Peers

The company operates through three segments: Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. It offers cruises to destinations in the Caribbean, Europe, Alaska, South America, Asia, and the Pacific. The company was founded in 1966 and is headquartered in Miami, Florida. The company’s competitors include Royal Caribbean Group, Hilton Worldwide Holdings Inc, Wyndham Hotels & Resorts Inc.

– Royal Caribbean Group ($NYSE:RCL)

Royal Caribbean Group is a cruise company that operates Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises brands. The company has a market cap of 12.55B as of 2022 and a Return on Equity of -53.73%. Royal Caribbean Group is headquartered in Miami, Florida.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. It has a market cap of 35.99B as of 2022 and a Return on Equity of -148.2%. The company was founded in 1919 and is headquartered in McLean, Virginia.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts Inc is a hotel and resort company that operates globally. As of 2022, the company has a market capitalization of 6.34 billion dollars and a return on equity of 30.65%. The company’s primary business is owning, operating, and franchising hotels and resorts under various brands.

Summary

Norwegian Cruise Line Holdings Ltd. (NCLH) experienced strong gains in share price on Tuesday, with a 3.52% increase to $16.75. Analysts suggest this may be an attractive entry point for investors, with its strong track record of consistent growth and potential for further gains. With steady earnings and healthy profit margins, NCLH appears to be a promising long-term investment in the cruise line industry.

Recent Posts