Aberdeen PLC Increases Holdings in Norwegian Cruise Line Holdings Ltd. by 9.1% in Q4

June 3, 2023

🌥️Trending News

NORWEGIAN ($NYSE:NCLH): (NCLH). The records show that Aberdeen PLC increased its ownership of the stock by 9.1%. NCLH also owns and operates various private island destinations, such as Great Stirrup Cay in the Bahamas.

Additionally, the company offers onboard entertainment, dining, and other amenities. In addition to its cruise operations, NCLH provides support services to its subsidiary companies, such as shore excursions and private cruise experiences. The company is also investing heavily in technological innovations such as virtual reality, artificial intelligence, and augmented reality, to enhance its customers’ experience. The company aims to continually increase its customer base and provide a superior cruise experience that caters to a wide variety of travelers. As one of the world’s largest cruise companies, NCLH offers a variety of experiences and amenities that make it an attractive option for investors. With its strong presence in the industry and plans to continue investing in technological breakthroughs, it is no wonder that Aberdeen PLC is confident enough to increase its ownership in NCLH.

Analysis

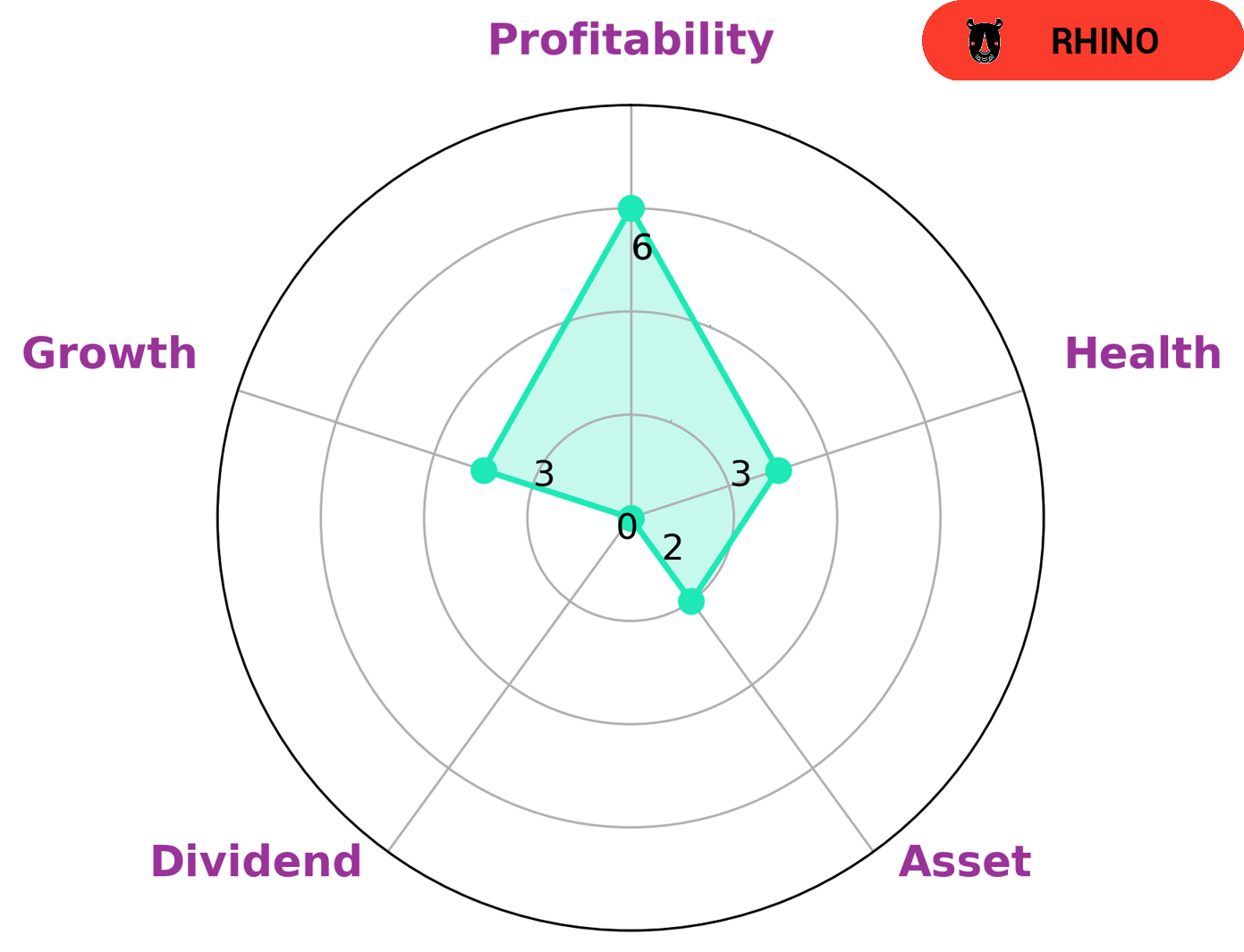

GoodWhale has performed an analysis of NORWEGIAN CRUISE LINE’s fundamentals and found that its Star Chart places the company in the ‘rhino’ category. This means that NORWEGIAN CRUISE LINE has achieved moderate revenue or earnings growth or is in a transitional stage. The company has a low health score of 3/10, indicating that it is less likely to sustain future operations in times of crisis. GoodWhale has assessed NORWEGIAN CRUISE LINE to be strong in liquidity, medium in profitability, and weak in assets, dividend, and growth. Given the company’s fundamentals, we believe that value investors may be interested in NORWEGIAN CRUISE LINE as the company is at a transitional stage with moderate growth potential. Risk-averse investors should consider staying away from the company due to its poor health score. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NCLH. More…

| Total Revenues | Net Income | Net Margin |

| 6.14k | -1.45k | -23.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NCLH. More…

| Operations | Investing | Financing |

| 1.08k | -2.07k | -448.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NCLH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.35k | 18.45k | -0.23 |

Key Ratios Snapshot

Some of the financial key ratios for NCLH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.9% | 8.4% | -13.4% |

| FCF Margin | ROE | ROA |

| -12.6% | 3322.3% | -2.8% |

Peers

The company operates through three segments: Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. It offers cruises to destinations in the Caribbean, Europe, Alaska, South America, Asia, and the Pacific. The company was founded in 1966 and is headquartered in Miami, Florida. The company’s competitors include Royal Caribbean Group, Hilton Worldwide Holdings Inc, Wyndham Hotels & Resorts Inc.

– Royal Caribbean Group ($NYSE:RCL)

Royal Caribbean Group is a cruise company that operates Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises brands. The company has a market cap of 12.55B as of 2022 and a Return on Equity of -53.73%. Royal Caribbean Group is headquartered in Miami, Florida.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. It has a market cap of 35.99B as of 2022 and a Return on Equity of -148.2%. The company was founded in 1919 and is headquartered in McLean, Virginia.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts Inc is a hotel and resort company that operates globally. As of 2022, the company has a market capitalization of 6.34 billion dollars and a return on equity of 30.65%. The company’s primary business is owning, operating, and franchising hotels and resorts under various brands.

Summary

Norwegian Cruise Line Holdings Ltd. This suggests confidence in the company’s performance and future prospects. Analysts had a largely positive outlook on NCLH prior to this move, based on its strong financials, good customer service, and technological advantages.

Going forward, investors should keep an eye on the company’s economic performance and its ability to navigate the ongoing pandemic crisis. With a consistent dividend policy and a resilient balance sheet, NCLH looks like a strong long-term investment opportunity.

Recent Posts