Verdence Capital Advisors LLC Sells 241 Shares of Snap-on Inc

July 11, 2023

☀️Trending News

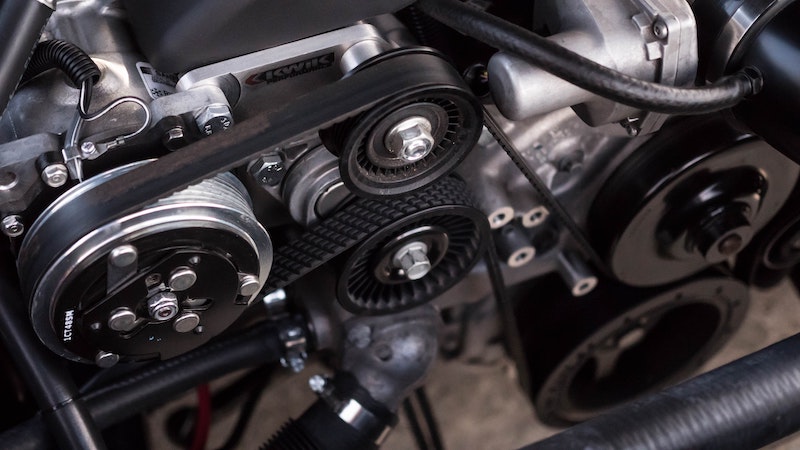

Verdence Capital Advisors LLC recently sold 241 shares of Snap-on Incorporated ($NYSE:SNA) at the Defense World market. Snap-on Incorporated is a publically traded company that specializes in providing high-end tools, equipment, and diagnostic software to professional technicians, industrial businesses, and the general public. They have also developed a wide range of software solutions that allow technicians to quickly and efficiently diagnose complex automotive systems. Snap-on Incorporated also offers technical training programs and services to ensure customers are up to date with the latest technology.

Additionally, the company provides financing options to customers looking to purchase large purchases. With their commitment to quality products and services, Snap-on Incorporated is well positioned to continue its growth as a leader in the tool and equipment industry.

Price History

The stock opened the day at $281.4 and closed at $285.4, up by 1.7% from its last closing price of 280.7. This marked another positive day for Snap-on Inc, which has seen its stock continually rise in recent months. Snap-on Inc continues to be a trusted name in the production of quality tools and accessories, and the company is expected to continue to see strong growth going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Snap-on Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 4.58k | 943 | 20.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Snap-on Incorporated. More…

| Operations | Investing | Financing |

| 782.9 | -272.5 | -530.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Snap-on Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.13k | 2.49k | 87.1 |

Key Ratios Snapshot

Some of the financial key ratios for Snap-on Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.7% | 10.9% | 28.2% |

| FCF Margin | ROE | ROA |

| 15.2% | 17.7% | 11.3% |

Analysis

We at GoodWhale recently performed an analysis of SNAP-ON INCORPORATED‘s wellbeing. According to our Star Chart assessment, SNAP-ON INCORPORATED has a high health score of 10/10 with regard to its cashflows and debt. This means that the company is capable to pay off debt and fund future operations. In addition to this, SNAP-ON INCORPORATED is strong in asset, dividend, and profitability, and medium in growth. Of these factors, we conclude that SNAP-ON INCORPORATED is classified as ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. Given these highly positive indicators, investors of all types may be interested in SNAP-ON INCORPORATED. Long-term investors may be attracted to the company’s cashflow strength and ability to pay off debt. Value investors may be drawn to the company’s strong assets and dividends. Finally, growth investors may be intrigued by SNAP-ON INCORPORATED’s moderate but consistent growth profile. In any case, we believe that there is something for every investor in SNAP-ON INCORPORATED. More…

Peers

The company’s products are used by professionals in the automotive, aerospace, and industrial sectors. Snap-on’s products are also used by hobbyists and do-it-yourselfers. The company has a wide range of products that compete with those of its competitors.

– DMG Mori Aktiengesellschaft ($LTS:0OP0)

DMG Mori Aktiengesellschaft is a German machine tool manufacturer. The company is headquartered in Bielefeld, Germany. DMG Mori Aktiengesellschaft is the parent company of DMG Mori Seiki Co., Ltd., a Japanese machine tool manufacturer. The company is listed on the Frankfurt Stock Exchange and Tokyo Stock Exchange.

DMG Mori Aktiengesellschaft has a market cap of 3.24B as of 2022 and a Return on Equity of 8.55%. The company is a leading manufacturer of machine tools and has a strong presence in both the German and Japanese markets.

– Hangzhou Great Star Industrial Co Ltd ($SZSE:002444)

Hangzhou Great Star Industrial Co., Ltd. is engaged in the manufacture and sale of tools and hardware products. The Company’s products include hand tools, power tools, air tools, garden tools, automobile maintenance tools, and others. It sells its products under the brand names of Greatstar, GPS, and others. The Company operates its business in China and internationally.

– Jainex Aamcol Ltd ($BSE:505212)

Jainex Aamcol Ltd is an Indian company that is engaged in the business of manufacturing and marketing of chemicals. The company has a market capitalization of 184.87 million as of 2022 and a return on equity of 33.37%. The company’s products include dyes, pigments, and other chemicals. The company has a strong presence in the Indian market and is one of the leading manufacturers of chemicals in the country.

Summary

Verdence Capital Advisors LLC recently sold 241 shares of Snap-on Incorporated, providing insight into their current investment strategy. Snap-on Incorporated is a manufacturer of professional tools and equipment used in the automotive repair, industrial, and government and military markets. This growth has been driven by strong demand in the automotive repair market, and increased government and military spending. Investors should closely monitor this stock to capitalize on future growth opportunities, as Snap-on Incorporated is likely to remain a strong performer in the market.

Recent Posts