Swiss National Bank Trims Stanley Black & Decker Holdings, Raising Questions Among Financial Experts.

May 16, 2023

Trending News 🌥️

The Swiss National Bank recently announced that it had trimmed its holdings in Stanley Black & Decker ($NYSE:SWK), a leading provider of tools and storage solutions. This move has left analysts questioning their motives, while financial experts have speculated that the bank might be looking to diversify its investments. Stanley Black & Decker is a well-known company in the industrial and construction markets. It supplies power tools, hand tools, and storage solutions to professional customers. With a strong presence in Europe, Asia, and North America, the company has become a leader in its sector. It is also a publicly traded company on the New York Stock Exchange, so its stock is widely followed by investors.

The Swiss National Bank’s decision to trim its Stanley Black & Decker holdings has raised some eyebrows among financial experts. It could be an indication that the bank is looking to diversify its investments, as Stanley Black & Decker’s stock has been underperforming in recent weeks. It might also be a sign that the bank is expecting an upcoming dip in the market, and is looking to mitigate any potential losses. Whatever the Swiss National Bank’s reasoning may be, this trimming of its Stanley Black & Decker holdings has certainly attracted attention from financial experts and analysts. It will be interesting to see how the market reacts in the coming weeks, and if this move will have any effect on the company’s stock price.

Share Price

The stock opened at $78.9 and closed at $79.1, up 0.4% from the previous closing price of 78.8. This move makes the Swiss National Bank the fourth-largest institution to reduce its ownership stakes in the company over the last year. This recent activity has left some analysts scratching their heads and wondering what this could mean for the future of the company. The decline in ownership stakes has come at a time when Stanley Black & Decker is on track to report its first quarterly profit since the pandemic began. While the company has seen its sales decline due to store closures, it has managed to stabilize its business, resulting in higher profits.

Despite this encouraging news, the banking giant’s reduced holdings raise questions about their long-term outlook for the business. For now, analysts are keeping a close eye on Stanley Black & Decker’s stock price as well as its overall performance. The company’s performance over the next few quarters will be a key indicator of how stable their business is and whether or not it is a good investment for investors. If they are able to continue to perform well, then the Swiss National Bank’s recent decision may be seen in a different light. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SWK. More…

| Total Revenues | Net Income | Net Margin |

| 16.43k | 699.4 | -0.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SWK. More…

| Operations | Investing | Financing |

| -504.7 | 3.67k | -3.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SWK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.07k | 15.58k | 61.97 |

Key Ratios Snapshot

Some of the financial key ratios for SWK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | -40.8% | 0.5% |

| FCF Margin | ROE | ROA |

| -5.9% | 0.6% | 0.2% |

Analysis

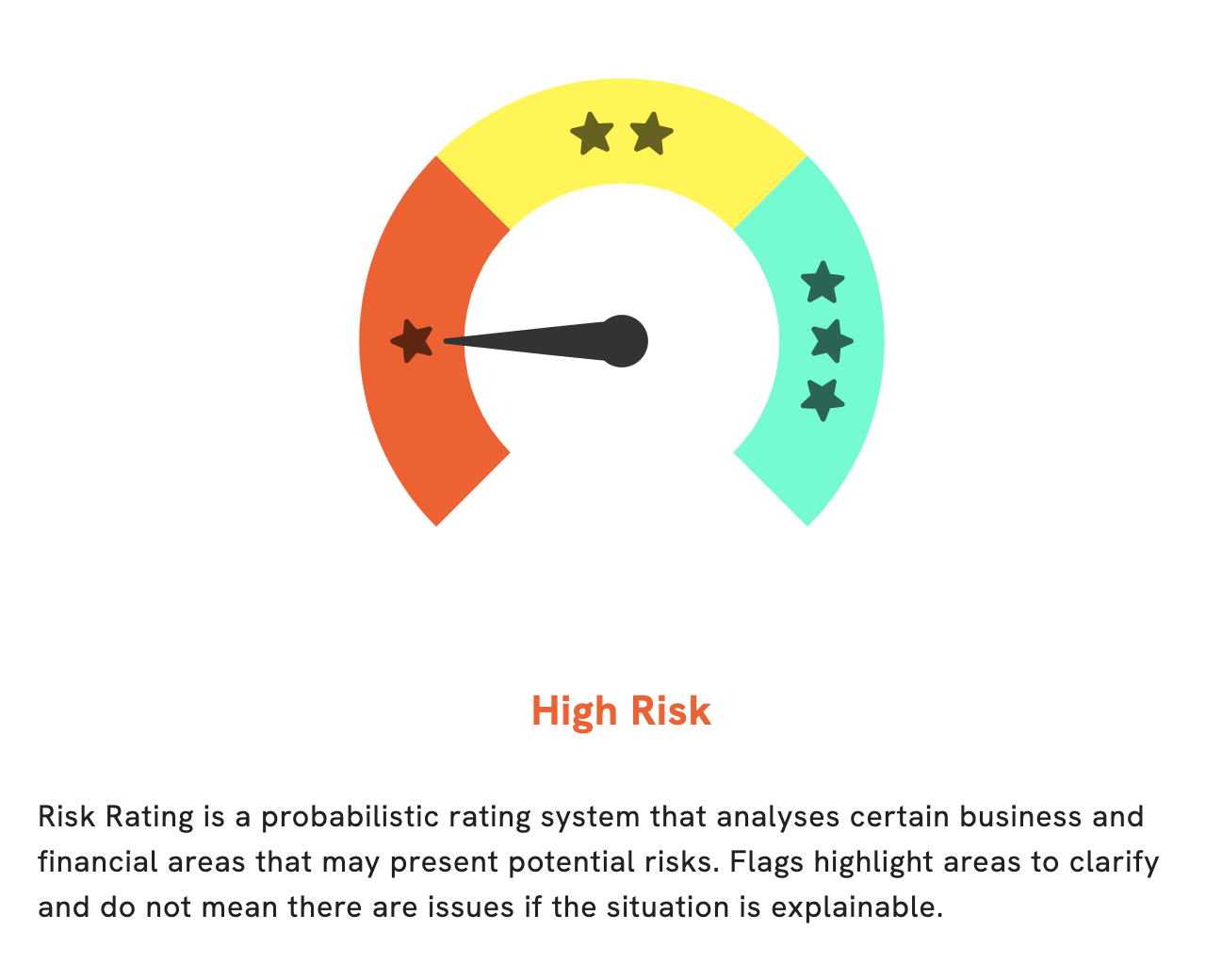

GoodWhale recently conducted an analysis of STANLEY BLACK & DECKER’s wellbeing, and the results were not encouraging. According to our Risk Rating, STANLEY BLACK & DECKER is a high risk investment with significant financial and business risks. Our research found two risk warnings in the company’s income sheet and balance sheet. To learn more about these risks and how to mitigate them, please become a registered user of GoodWhale. Our data-driven insights will help you identify potential pitfalls and gain confidence in your investments. More…

Peers

In the business world, competition is inevitable. Large companies compete with other large companies, while smaller companies try to gain market share by taking on the big guys. Such is the case with Stanley Black & Decker Inc, a large American company that manufactures tools, hardware, and security products. Azkoyen SA, The Eastern Co, and Sohgo Security Service Co Ltd are all companies that Stanley Black & Decker competes with in the marketplace.

– Azkoyen SA ($LTS:0DOG)

Azkoyen SA is a Spanish company that manufactures vending machines and other related products. The company has a market cap of 142.86 million as of 2022 and a return on equity of 11.63%. Azkoyen was founded in 1947 and is headquartered in Vitoria-Gasteiz, Spain. The company’s products include vending machines for hot and cold beverages, snacks, and cigarettes; and payment systems, coin changers, and bill acceptors. Azkoyen also offers maintenance and repair services for its products.

– The Eastern Co ($NASDAQ:EML)

The Eastern Co is a publicly traded company with a market capitalization of 133.23M as of 2022. The company has a return on equity of 9.56%. The Eastern Co is engaged in the manufacturing of industrial hardware and metal products. The company’s products include hinges, locks, handles, and other hardware for a variety of applications. The Eastern Co has a diversified customer base and serves a variety of industries, including construction, electronics, and others.

– Sohgo Security Service Co Ltd ($TSE:2331)

Sohgo Security Service Co Ltd is a Japanese security company that provides security services to businesses and households. The company has a market cap of 366.47B as of 2022 and a return on equity of 9.44%. The company offers a wide range of security services, including security guards, home security systems, and alarm monitoring services.

Summary

Investors have been analyzing the recent move by the Swiss National Bank to reduce its holdings in Stanley Black & Decker. Investors are carefully examining the company’s long-term prospects, its competitive advantages, and its performance in the market, to gain insights into whether it is a wise investment. In order to make an informed decision, investors should keep an eye on the company’s financials and key performance indicators, while also considering other factors such as macroeconomic conditions, industry trends, and political developments.

Recent Posts