LSV Asset Management Divests 10342 Shares of The Eastern Company.

February 10, 2023

Trending News ☀️

LSV Asset Management recently disposed of 10342 shares of The Eastern Company ($NASDAQ:EML), an industrial products and services company based in Connecticut. The Eastern Company is a holding company whose operating subsidiaries design and produce a range of mechanical locks, electro-mechanical locks, and other security products. The company also manufactures metal castings and industrial hardware, among other products. The company has also diversified into markets such as military, healthcare, and hospitality. The Eastern Company has achieved success by leveraging its strong customer base and strong engineering capabilities.

Its corporate structure allows for a diversified approach to research and development, which has led to new products and services that meet customer needs. Its commitment to innovation has enabled The Eastern Company to stay ahead of the competition and continue to be a leader in the industrial goods and services industry. The Eastern Company has a strong financial profile, with a low debt-to-equity ratio, positive cash flow, and a market capitalization of over $1 billion. With its strong financials, diversified product offerings, and commitment to innovation, The Eastern Company is well-positioned for continued growth and success.

Stock Price

The stock opened at $21.9 and closed at $21.9, which was 1.8% lower than the previous closing price of 22.4. Despite the slight dip in stock prices, the overall response to the news has been mostly positive. The company currently operates in four segments: Industrial Hardware and Equipment, Locks and Security Products, Automotive Products, and Metal Products. This move is likely to bolster investor confidence and help push the stock price higher in the coming days.

The divestment could be a sign of confidence in the company and its future prospects, which could lead to further gains in stock prices. Investors should keep an eye on The Eastern Company‘s stock price in the near future and make their own decisions based on their own research and analysis. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eastern Company. More…

| Total Revenues | Net Income | Net Margin |

| 269.82 | 13.93 | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eastern Company. More…

| Operations | Investing | Financing |

| -3.19 | 13.61 | -14.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eastern Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 275.95 | 151.96 | 19.95 |

Key Ratios Snapshot

Some of the financial key ratios for Eastern Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | -1.5% | 7.2% |

| FCF Margin | ROE | ROA |

| -2.4% | 10.0% | 4.4% |

Analysis

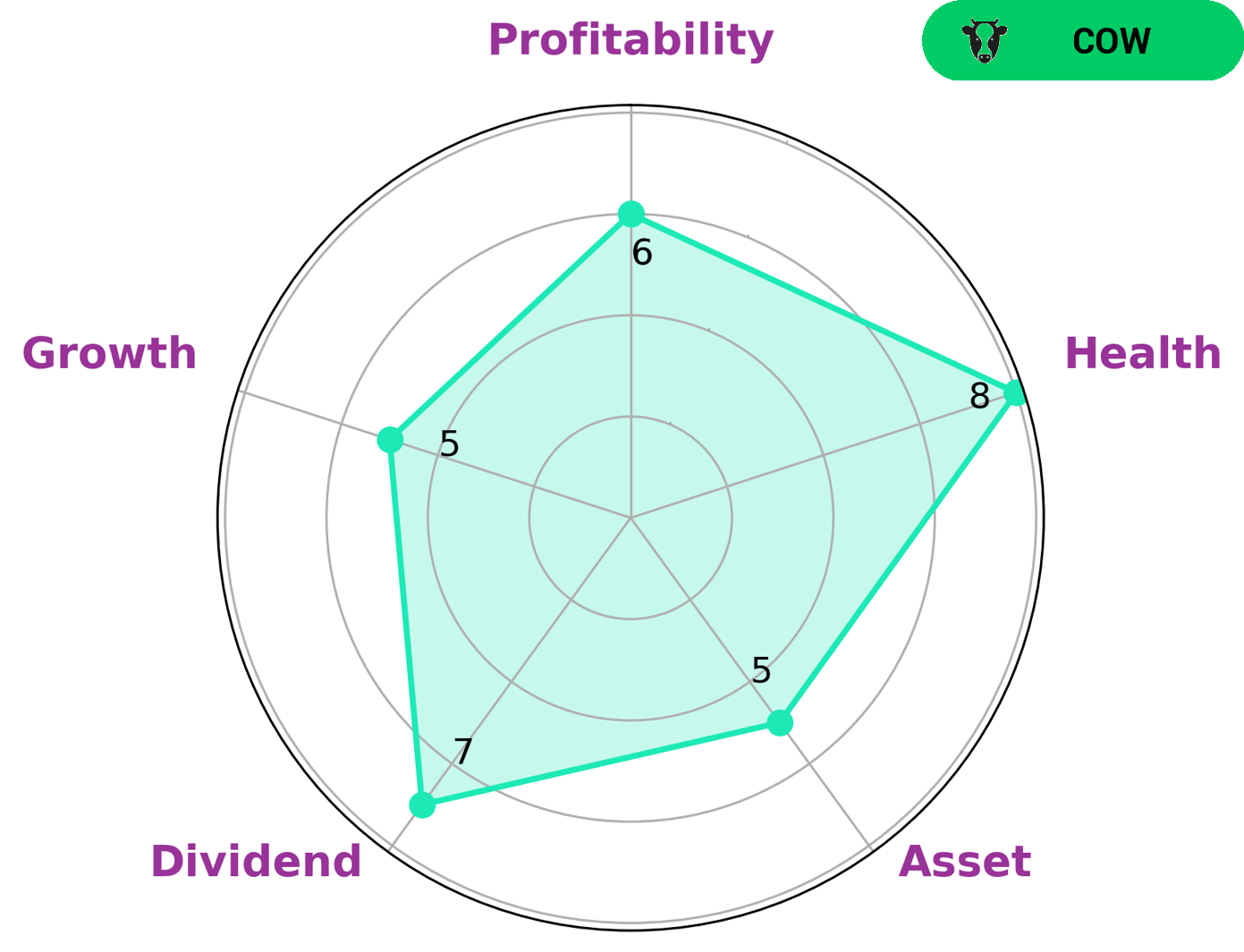

GoodWhale’s analysis of EASTERN COMPANY‘s financials reveals that the company has a strong dividend record and medium scores for asset growth, profitability, and cash flow. In terms of overall financial health, EASTERN COMPANY boasts an impressive 8/10 score. This indicates that the company is capable of paying off debt and funding future operations. EASTERN COMPANY is classified as a ‘cow’, which means that it has a solid track record of paying out consistent and sustainable dividends. This makes EASTERN COMPANY an ideal investment for investors who are looking for a steady and reliable source of income. These investors include retirees, income investors, and those who are looking for a steady stream of passive income. In addition, EASTERN COMPANY’s strong dividend and reliable cash flows make it an attractive option for value investors. These investors are looking to purchase stocks at a discount in order to generate long-term capital gains. They may view EASTERN COMPANY as an opportunity to buy a stock with a high dividend yield at a bargain price. Finally, EASTERN COMPANY offers short-term traders an opportunity to capitalize on quick price movements. These traders may be attracted to the company due to its strong dividend record and healthy financials. Overall, EASTERN COMPANY’s strong dividend record, reliable cash flows, and healthy financials make it an attractive option for a variety of investors. Retirees, income investors, value investors, and short-term traders may all find something to like about this company. More…

Peers

The Eastern Co and its competitors, Stanley Black & Decker Inc, Azkoyen SA, and Jiangsu Tongrun Equipment Technology Co Ltd, are all vying for a share of the market in the manufacturing industry. The Eastern Co has been in business for over 100 years and has a well-established reputation.

However, the other companies are all relatively new and are looking to make a name for themselves.

– Stanley Black & Decker Inc ($NYSE:SWK)

Stanley Black & Decker Inc is a leading global provider of tools and storage, commercial electronic security and engineered fastening systems. It has a market cap of 12.46B as of 2022 and a ROE of 4.45%. The company’s products are used in a variety of end markets, including construction, manufacturing, distribution, retail, food and beverage, healthcare, and government.

– Azkoyen SA ($LTS:0DOG)

Azkoyen SA is a Spanish company that manufactures vending machines and other related products. The company has a market cap of 153.59M as of 2022 and a Return on Equity of 11.63%. Azkoyen SA’s products are used in a variety of industries, including food and beverage, retail, and healthcare. The company has a strong presence in Europe and South America, and is expanding its operations into Asia and North America.

– Jiangsu Tongrun Equipment Technology Co Ltd ($SZSE:002150)

Jiangsu Tongrun Equipment Technology Co., Ltd. is engaged in the research, development, production and sale of metallurgical equipment and materials. The Company’s products include electric arc furnace (EAF), ladle refining furnace (LF), vacuum degassing furnace (VD), continuous casting machine (CCM), plate mill, hot rolling mill and cold rolling mill, among others. The Company operates its business in domestic market and overseas market.

Summary

Analysts have been positive on the stock, pointing to the company’s strong fundamentals and its ability to weather economic downturns. The company has a diversified portfolio of products and services, as well as a presence in a number of different industries. Investors can also benefit from its strong dividend yields and low-risk profile. While Eastern Company may not be the most exciting stock out there, it is a solid choice for conservative investors looking for a safe bet.

Recent Posts