Hillman Solutions Reports Strong Non-GAAP EPS, Despite Revenue Miss

May 10, 2023

Trending News ☀️

Hillman Solutions ($NASDAQ:HLMN), a leading provider of technology services and solutions, reported strong non-GAAP EPS of $0.06 for the second quarter, surpassing analyst estimates by $0.04. Despite this success, the company experienced a revenue miss of $7.15M, falling short of expectations with a total of $349.7M. Hillman Solutions is a publicly traded company that provides technology services and solutions for its customers. Hillman Solutions offers an extensive portfolio of products and services, from cloud-based solutions to cybersecurity solutions to IT consulting and professional services. The company’s mission is to help its customers succeed by providing the most reliable and effective technology solutions.

In the second quarter, Hillman Solutions was able to report strong non-GAAP EPS despite the revenue miss. This demonstrates the company’s commitment to providing quality services and solutions while managing costs efficiently. Going forward, Hillman Solutions will strive to continue offering innovative products and services while maintaining financial discipline.

Earnings

Hillman Solutions recently reported their fourth quarter earnings ending December 31 of 2022. The results revealed total revenue of 350.66M USD, a 1.8% increase from the previous year. Unfortunately, the net income was 13.9M USD in losses, a 312.2% decrease from the previous year.

The total revenue of HILLMAN SOLUTIONS has grown from 327.07M USD to 350.66M USD in the last 3 years, indicating a positive trend for the company despite the recent losses. While the net income decreased in this quarter, the stability of the total revenue and strong non-GAAP EPS are encouraging signs that the company is on the right track to achieving long-term success.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hillman Solutions. More…

| Total Revenues | Net Income | Net Margin |

| 1.49k | -16.44 | -1.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hillman Solutions. More…

| Operations | Investing | Financing |

| 119.01 | -72.82 | -28.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hillman Solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.47k | 1.31k | 5.95 |

Key Ratios Snapshot

Some of the financial key ratios for Hillman Solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.0% | 73.1% | 2.7% |

| FCF Margin | ROE | ROA |

| 3.3% | 2.1% | 1.0% |

Market Price

On Tuesday, HILLMAN SOLUTIONS reported strong non-GAAP earnings per share (EPS) in spite of missing their revenue projections. HILLMAN SOLUTIONS stock opened at $8.5 and closed at $8.1, a modest 0.1% increase from its previous closing price of 8.1. Despite the missed revenue target, their non-GAAP EPS exceeded expectations, allowing investors to remain optimistic about the company’s future performance.

The performance of HILLMAN SOLUTIONS was impressive, given the challenging market conditions that have been present over the past few months. Going forward, investors will be watching to see if HILLMAN SOLUTIONS can continue to deliver strong non-GAAP EPS despite any potential revenue shortfalls. Live Quote…

Analysis

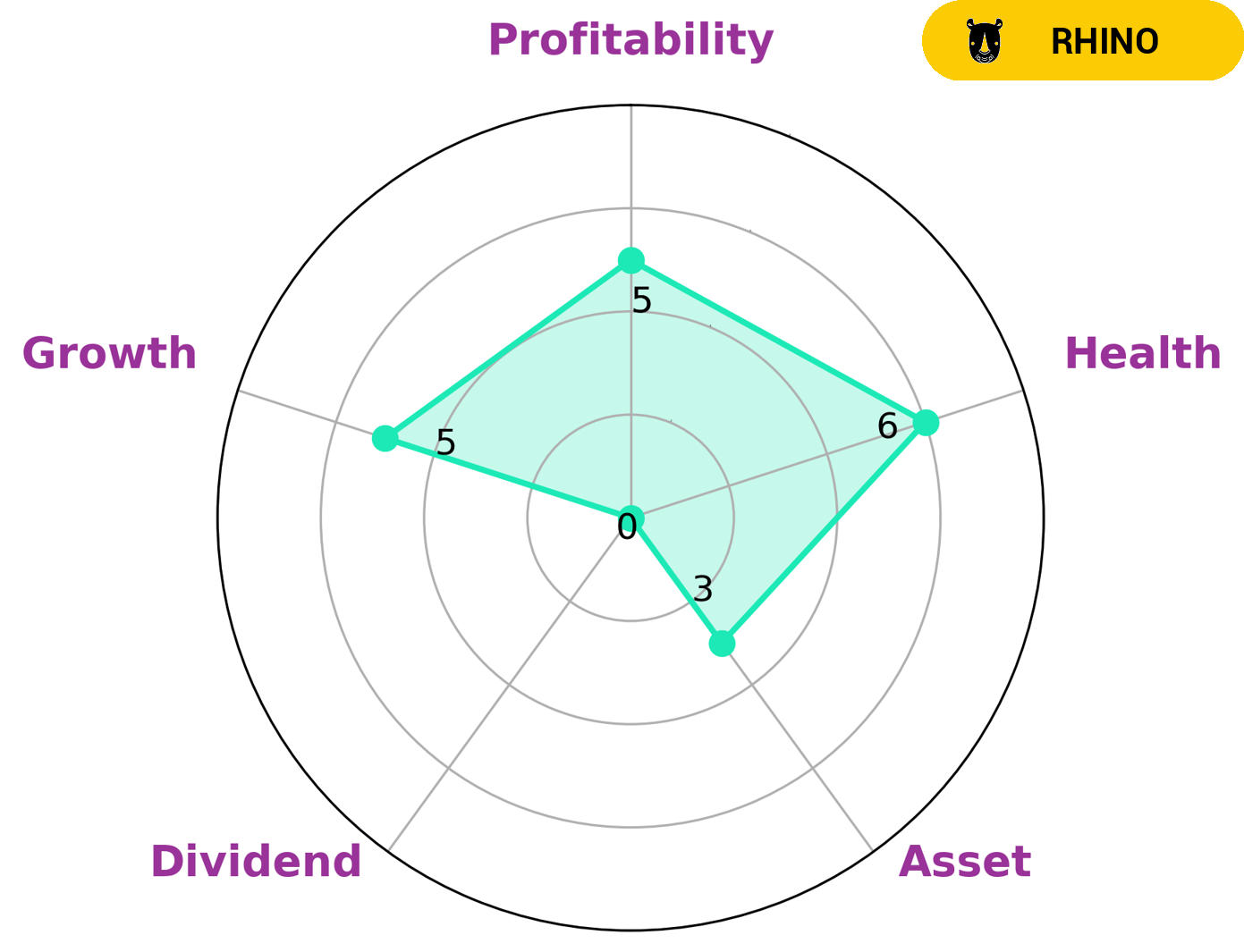

GoodWhale conducted an analysis of HILLMAN SOLUTIONS‘ wellbeing. According to the Star Chart, HILLMAN SOLUTIONS has an intermediate health score of 6/10. The assessment was based on cashflows and debt, and concluded that HILLMAN SOLUTIONS is likely to have enough to pay off debt and fund future operations. HILLMAN SOLUTIONS was identified as having a ‘rhino’ profile, meaning the company has achieved moderate revenue or earnings growth. When it comes to specific metrics, HILLMAN SOLUTIONS is strong in growth, medium in profitability and weak in asset, dividend. This combination of strengths and weaknesses means that HILLMAN SOLUTIONS may be of interest to a range of investors. Specifically, those looking for companies that have reasonably strong growth, but may still be able to offer attractive returns. More…

Peers

Its competitors are Q.E.P. Co Inc, Shinvest Holding Ltd, and StrongPoint ASA.

– Q.E.P. Co Inc ($OTCPK:QEPC)

Q.E.P. Co., Inc. engages in the manufacture and sale of flooring and flooring-related products. The company operates through three segments: Wood, Laminate, and Tools. It offers engineered hardwood, bamboo, cork, and laminate flooring products; ceramic and porcelain tiles; adhesives, grouts, underlayments, tools, and trims for flooring installation and finishing; and products for concrete surface preparation, including concrete saws, grinders, polishers, scarifiers, shot blasters, and floor scrapers. The company sells its products through distributors to specialty retail stores, home centers, hardware stores, and other retailers. Q.E.P. Co., Inc. was founded in 1979 and is based in Boca Raton, Florida.

– Shinvest Holding Ltd ($LTS:0JEZ)

StrongPoint ASA is a technology company that provides retail and logistics solutions. The company has a market cap of 846.68M as of 2022 and a return on equity of 4.23%. StrongPoint ASA’s solutions are used by retailers and logistics providers to increase efficiency, optimize operations and improve the customer experience.

Summary

Hillman Solutions reported its first quarter earnings, with non-GAAP earnings per share (EPS) of $0.06 exceeding estimates by $0.04 and revenue of $349.7M falling short of expectations by $7.15M. Analysts have reacted positively to the news, with the stock up 4% in after-hours trading. Investors should still be cautious when investing in Hillman Solutions due to its recent volatile earnings history and poor revenue growth.

Recent Posts